What is a W-9 Form?

The W-9, or Request for Taxpayer Identification Number and Certification form, provides a business with relevant personal information about an independent contractor (IC) or freelancer for tax purposes in the United States. The form asks for information such as the IC's name, address, social security number (SSN), and more. The data is used to generate a 1099-NEC. The W-9 Form is an essential tool for employers to gather information about contractors for income tax purposes. Verifying the information on this form and keeping it up-to-date ensures you collected accurate personal information.

Form W-9 should be reviewed and updated yearly. However, if a contractor provides you with an updated address or a name change, those changes may be recorded for use. The business should retain the information on this form for several years. It should not be sent to the Internal Revenue Service. Remember that it is a tool to gather specific information that a business needs to complete a 1099-NEC if the contractor earns more than a certain amount during the tax year.

Click here to get started now!

How To Fill Out A W-9 Form

Overview of fields

You've already learned a little about the information requested on a W-9. There's one more essential thing you should know. The IRS W-9 Form certifies that the TIN (taxpayer identification number) given is correct (or that the person is waiting for an amount to be issued), that the person is not subject to backup withholding, or that the person is exempt from backup withholding because they are an exempt payee. This tax document may be found online on the IRS website: www.irs.gov.

When you're asked to fill in a W-9, you should complete the required fields. You may find that not all of the grounds apply to you and your situation. For example, if you're self-employed and haven't incorporated your business, you wouldn't provide a business name. Let's get familiar with the fields (fillable parts) contained in IRS W-9 Form. Although you can provide the required information to the requesting party without a W-9, there's no reason to forgo the IRS form since it is free and easy to find online. We're going to use that form to cover the fields of the requested information.

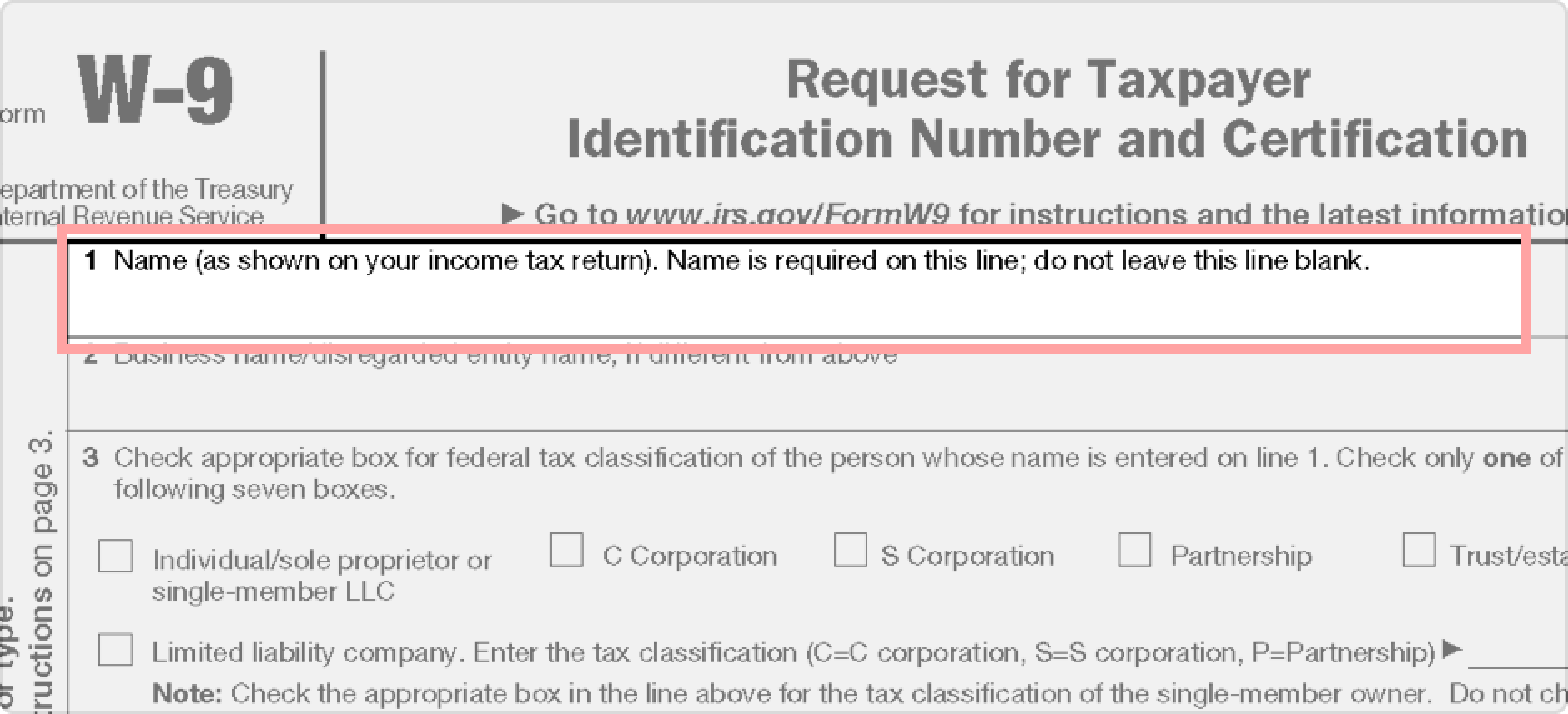

Box 1

In Box 1, enter your name as it appears on your income tax return. Do not leave this line blank. It is not optional, even if you're a business entity.

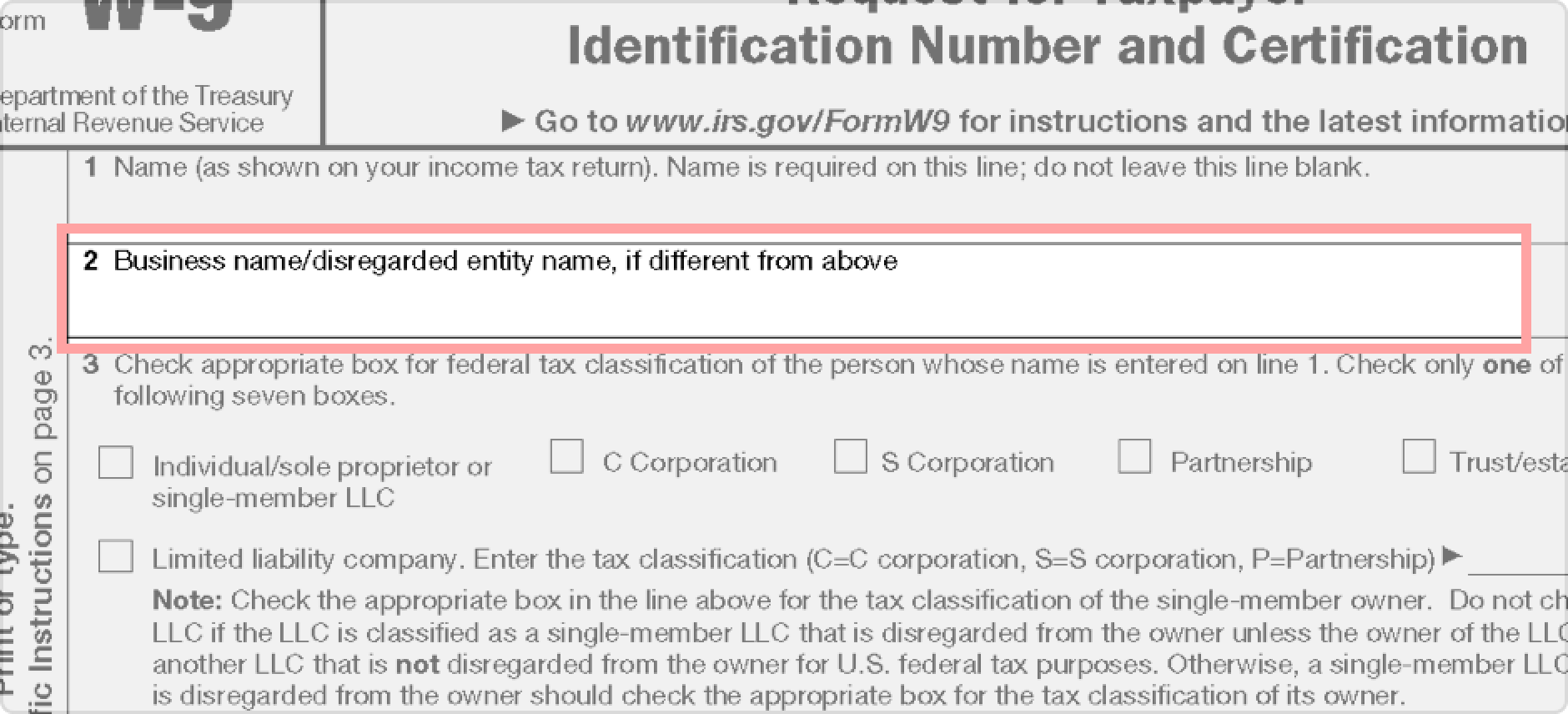

Box 2

Enter your business name if it is different from what you entered in Box 1. For example, if your name is Joe Smith, and you don't have a separate business entity, you would leave it blank. However, if your business name were Smith Content Creation Services, Inc., you'd place that name in Box 2.

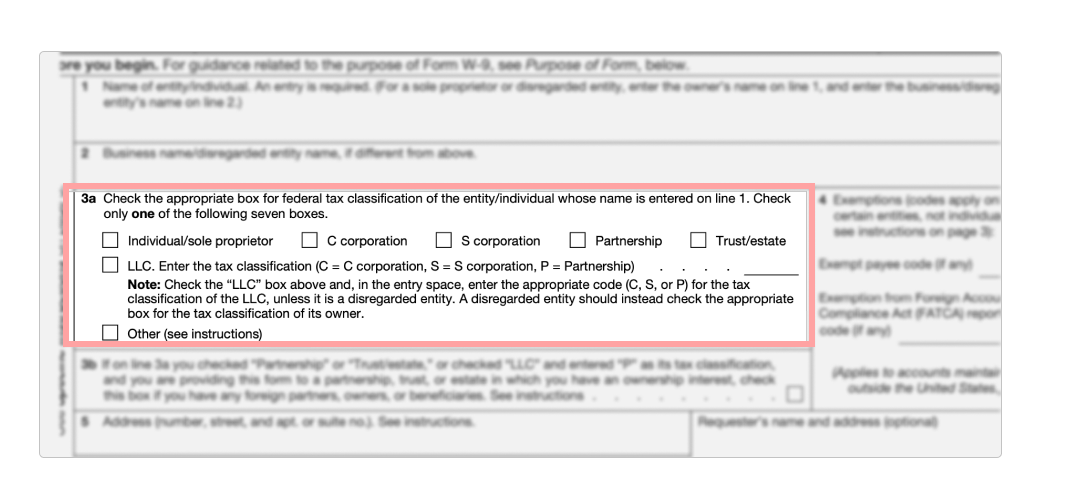

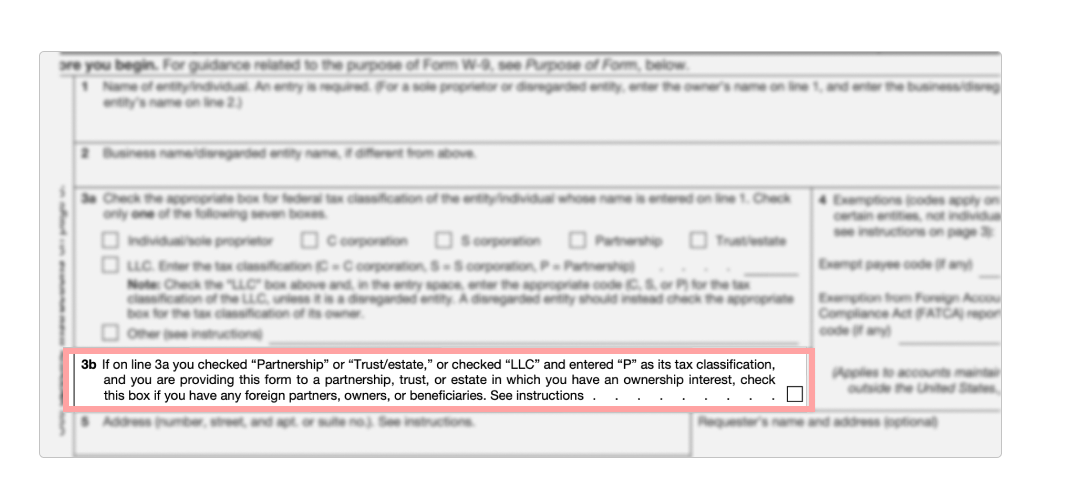

Box 3

If you are an individual without a legally formed business, a sole proprietor, or a single-member LLC, place a checkmark in the first box. If you're a C Corporation, check the second box. If you're an S Corporation, check the appropriate box. If you're part of a Partnership or Trust / Estate, choose the proper receptacle.

You'll also notice that there's another checkbox for LLC. It is used if you have a special designation associated with your LLC, such as C Corp, S-Corp, or partnership tax status. Do not use this box if you are a single-member LLC.

Finally, you'll see a checkbox for Others. The instructions provided by the IRS should be consulted. This box won't apply to most individuals as long as they can identify their status through one of the other checkboxes.

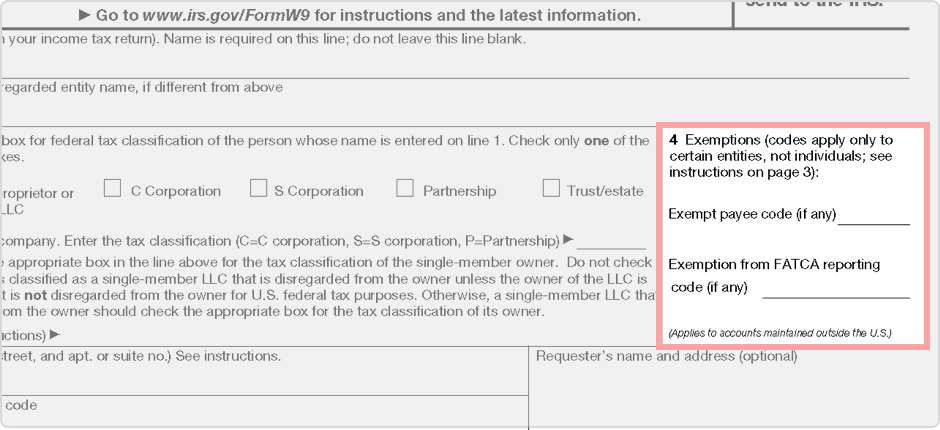

Box 4

In Box 4, you'll list the proper code (found in the instructions) to use if you're exempt from backup withholding or subject to FATCA. For example, a U.S. government agency is exempt as a payee, as are corporations and dealers in securities.

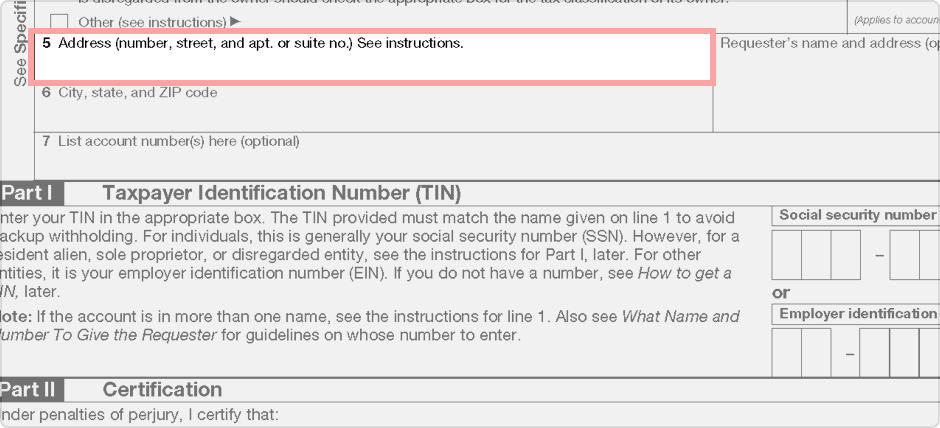

Box 5

In Box 5, enter your address. This includes any apartment number, lot number, or suite number.

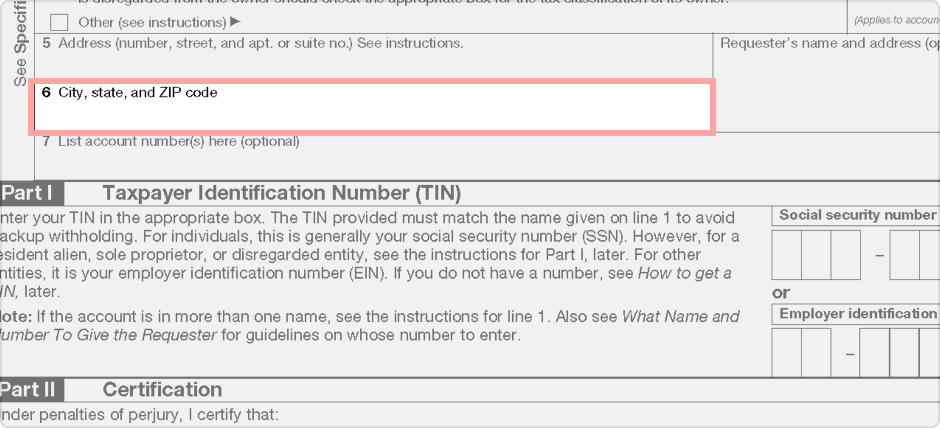

Box 6

In Box 6, fill in the city, state, and zip code for the address from Box 5.

Box 7 is an optional field below for an account number(s) that helps the two parties identify the purpose of the W-9.

To the right of those boxes, you'll find an unnumbered box. It is a space to place the requester's name and address. It, too, is an optional box.

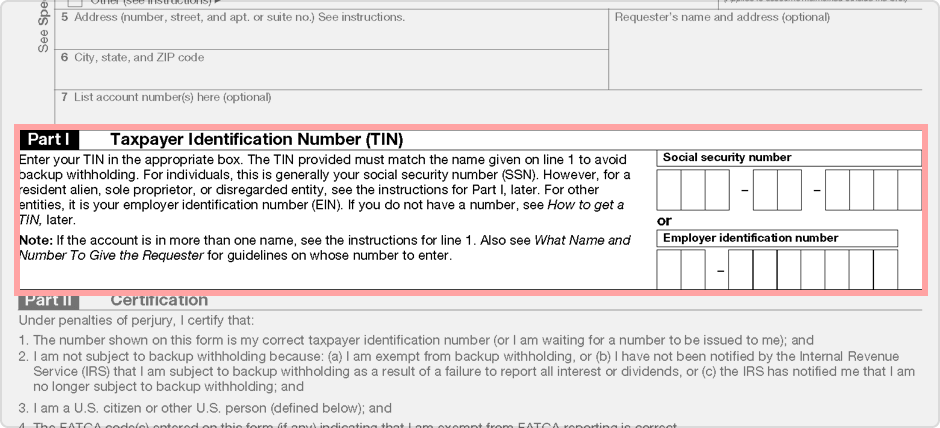

Part I Taxpayer Identification Number (TIN)

The final fields are the taxpayer identification number (TIN) field and the certification field. You can either use your SSN, an assigned tax number, or an employer identification number (EIN) if you have one.

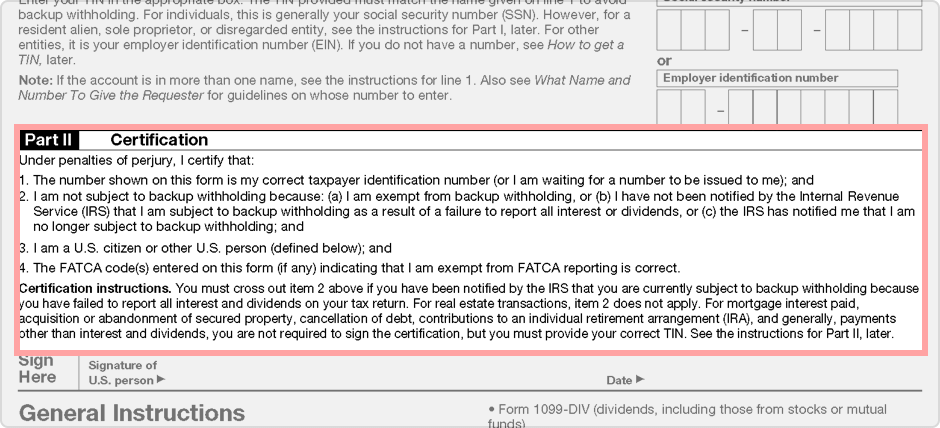

Part II Certification

Carefully read the certification before you sign it. Your signature promises the government that everything listed on the form is true to your knowledge. If you provide false information, you could face serious legal ramifications.

Remember, the form should not be sent to the IRS.

Who needs a W-9 Form?

It is a popular myth that contractors and freelancers don't have to pay taxes. Self-employment does not erase the requirement of filing a tax return. In fact, taxes for contractors are usually more complicated than the taxes of an employee. This is because employers withhold the proper taxes on behalf of the employee. ICs and freelancers are responsible for withholding (and paying) their own taxes. This guide addresses the first step of this process: the W-9.

For Independent Contractors (and Freelancers) and the Clients They Work With

Here's a run-down of how it works for both the contractor and the business.

Your client will ask you to complete and return a W-9 Form. On it, you will need to provide your full legal name, address, and TIN. Your TIN may be your social security number. If you have an EIN, you may use it provided that you also include the name of your business that's associated with it. Be sure and double-check all the information you provide for accuracy. One very important note: submit the finished W-9 to your client. Do not submit it to the IRS.

If you earn over $600 from a client during the tax year, they use the W-9 information to complete a 1099-NEC. The 1099-NEC is essentially a simplified W-2. It reports gross income earned from the named client. Remember, though, it is your responsibility to actually set the money aside for your taxes and for you to file them. It is ultimately your responsibility to determine through your records if you need a 1099-NEC and to ask for one, if necessary. If you earn less than $600 during the tax year from a client, you won't need a 1099-NEC. However, you must still complete your taxes.

For Those Who Hire Independent Contractors (or Freelancers)

Have each independent contractor or freelancer complete a W-9. This should be done as early as possible, ideally during the time of hire. If someone takes a long time to return the W-9, follow up with them. It's important that you get the form completed by the contractor every tax year you work with them so that the IRS doesn't have a missing form to use as a flag for auditing you.

If you've hired someone who has little or no previous experience as an IC or freelancer, be sure that you explain the necessity of returning the completed form to you and not to the IRS. It can be confusing for those who are newly self-employed to handle tax forms. It's easy to understand why someone with little or no experience would think the IRS should receive the form. That's why it is important to remind the contractor to return the form to you. The IRS will not keep it on file on your behalf.

If a contractor earns more than $600 from you during the tax year, you'll need to report their income using a 1099-NEC Form. You can download one of these from the IRS website and fill out the 1099-NEC using the information provided in the W-9. This is not optional.

Submit one copy of the 1099-NEC to the IRS and one copy to the contractor. The contractor needs the 1099-NEC so that they may complete their taxes.

Employer and Employee

W-9s are not used by individuals involved in an employer-employee relationship. Instead, a form W-4 and W-2 should be used. The W-4 is completed at the beginning of the relationship. It can also be updated, if necessary. Then, at the end of each tax year, the employer will use the information from the W-4, along with records related to payroll, to assemble a W-2. The W-2 is then provided to the employee for their taxes.

Financial Institutions and Their Customers

A W-9 may be used by a financial institution to gather specific information about their customers. This is done when the institution will pay out dividends or interest to the customer. Remember that a W-9 requests certain information, including their legal name and / or business name, TIN, specific exemptions, an address, and the recipient's tax classification (i.e., individual or a legal entity status). Much of this information is requested when customers open an account. A customer may check with the institution to find out exactly which piece of information needed that wasn't provided at the time their account was opened and provide the missing information.

Avoid Backup Withholding

The final use of a W-9 is to avoid backup withholding. If the business, client, or financial institution asking for the W-9 to be completed must report certain payments to the IRS (generally, this is certain withholding taxes), a W-9 may be used by the self-employed individual as a certification that they are not subject to backup withholding.

IRS Form W-9 Resources

Related W-9 Tax Documents

FormSwift also offers a complete suite of tax forms for businesses, including W-2, 1099-MISC, 1099-INT, W-9, and pay stubs. These tax forms can be filled out with our easy to use pdf editor, and are updated to the latest version every year.