Business

Formation

Guide

Incorporation Basics

Advantages

Legal Protection

Corporations protect their owners from personal liability pertaining to company debts and financial obligations. Incorporated businesses, in other words, become their own entities, wholly separate from their owners.

Greater Potential to Raise Capital

Incorporation offers owners the most direct and attractive path to eventually become a publicly traded entity, because corporations can more easily raise capital and transfer ownership.

Transparency

Corporations are required to put in place a legal framework that informs the behaviors and actions of their management structures, creating transparency and consistency in business operations.

Tax Advantages

Depending on how you incorporate your business, incorporation can yield lower taxes.

Disadvantages

Bureaucracy

Incorporating requires filing a substantial amount of paperwork both during the initial stage of incorporation and periodically thereafter due to annual state filing requirements.

Fees

Initial incorporation and legal fees can be costly. Annual subsequent fees are also not insignificant costs depending on a business’ revenue.

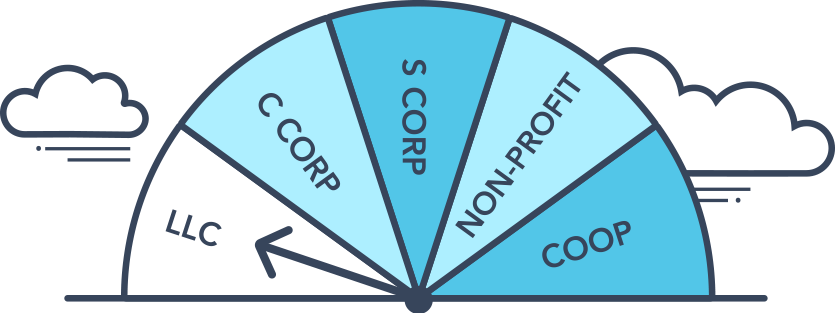

Business Formation Types

The most common choice for small businesses like restaurants, boutiques, and hair salons, as well as for landlords.

Example

The Chan Zuckerberg Initiative, the philanthropic organization set up by Facebook founder Mark Zuckerberg and his wife, Dr. Priscilla Chan, was set up as an LLC. Although it is somewhat atypical for charitable organizations, which are usually incorporated as non-profits, Chan and Zuckerberg went the LLC route in order to afford their organization the flexibility to invest in for-profit ventures and political causes, in addition to the simplified tax structure an LLC provides compared to a non-profit.

LLCs are most advantageous for smaller, self-run business enterprises, since membership is limited to business partners (no shareholders) and there are less requirements from an administrative standpoint due to the lack of shareholders.

In terms of management and organizational structure, are relatively flexible.. The management of an LLC is limited only to members who have been asked to join as business partners, as opposed to a wide-ranging group of shareholders in a corporation, permitting LLC owners to enjoy much more day-to-day and administrative flexibility in terms of organization and management. Moreover, there are no requirements for member boards and shareholder meetings, and their attendant annual reports and recordkeeping requirements. Therefore, LLCs are overall much more preferable for people who wish to set up small businesses that will have a limited amount of business partners, fewer administrative tasks, and less annual reporting requirements.

LLCs rank excellently in terms of liability protection: LLCs offer limited liability protection, so their owners are not held directly liable for their businesses.

LLCs also rank relatively well in terms of their flexibility in raising capital, the primary means of which are through bank loans; however, they cannot raise funds by selling stocks, like corporations.

Separate business and personal filing - YES

Separate state and federal filing - NO

Exempt from double taxation - YES

Members of an LLC are taxed on their personal returns, since the LLC as an entity is not taxed itself.

Double taxation is a rule that requires income taxes to be paid twice on the same source of income. In more practical terms, this means that corporations pay taxes on their annual earnings. When those earnings are distributed to shareholders via dividends, those investors must pay income taxes on those dividend payments.

If you are conducting business operations as an individual, you may already be operating as a sole proprietorship. Sole proprietorships ARE NOT corporations. This means that there is no legal distinction between you and your business. Your tax liabilities are paid via your personal filing, for example. More importantly, as a sole-proprietor you have no personal legal protection in the event that your business is sued. In that case, you are personally liable.

Example

Many of the world’s largest corporations began as sole proprietorships. Wal-Mart, for example, began as a sole proprietorship owned by the late Sam Walton.

From an organizational structure standpoint, a sole proprietorship is the most manageable and least complex, because you are the sole owner and authority figure within your proprietorship. Nonetheless, from a liability protection standpoint, it is the worst possible business formation because you are directly responsible for all of your business activities as an individual. In addition, in terms of raising capital, there isn’t much flexibility because people have to directly invest in you as an individual.

Separate business and personal filing - NO

Separate state and federal filing - NO

Exempt from double taxation - YES

Double taxation is a rule that requires income taxes to be paid twice on the same source of income. In more practical terms, this means that corporations pay taxes on their annual earnings. When those earnings are distributed to shareholders via dividends, those investors must pay income taxes on those dividend payments.

All publicly traded companies are C Corps.

Example

All publicly traded companies—e.g. Apple, Google (Alphabet), Coca-Cola, Wells Fargo, and Disney—are C Corporations.

Double taxation is a rule that requires income taxes to be paid twice on the same source of income. In more practical terms, this means that corporations pay taxes on their annual earnings. When those earnings are distributed to shareholders via dividends, those investors must pay income taxes on those dividend payments. Hence, double-taxation.

The ideal form of incorporation for larger businesses, since there are no limits on the amount of shareholders, and it provides a great amount of flexibility in raising capital.

Although various state and federal laws dictate differing terms of management structure for C Corporations across the country, C Corporations do offer limited liability protection for their shareholders. Also, C Corporations are the most preferable form of incorporation in regards to raising capital, because there is no limit on how many people can own stock.

Separate business and personal filing - YES

Separate state and federal filing - YES

Exempt from double taxation - NO

C Corporations are technically subject to possible double taxation, because C Corporations pay corporate taxes on their profits, then the shareholders of C Corporations are taxed again when those profits are funneled to them in the forms of dividends.

Example

Certified Public Accounting firms (CPAs), Real Estate Agencies, law practices, and construction companies are all business models that, depending on their size, commonly incorporate as S Corporations.

The ideal form of incorporation for small businesses, because S Corporations can offer shares to raise capital but they have a hard cap of shareholders at 100.

S Corporations offer a little less managerial complexity than C Corporations, because there is a limit on the amount of shareholder. Nevertheless, they offer less flexibility in raising capital because of the 100-person shareholder limit.

Separate business and personal filing - YES

Separate state and federal filing - YES

Exempt from double taxation - YES

S Corporations are not subject to double taxation. They file an informational federal return, but their earnings are reported on their owners’ and/or shareholder's individual tax return.

Example

All charities are non-profits. These include: UNICEF, Doctors Without Borders, The American Red Cross, Teach For America, and The Sierra Club. Additionally, organizations that offer services for the public interest, such as National Public Radio (NPR) and Planned Parenthood, are also non-profits.

Example

Berkeley, California’s iconic Cheeseboard Collective has operated as a worker-owned cooperative business since 1971. The collective’s services includes a cheese shop, bakery, and pizza shop.

A Closer Comparison

Still not sure which is best for your business? Take a

closer look with these more in-depth comparisons.

LLC vs. Corporation

LLCs and Corporations share some features. They are both, for example, established through the filing of state formation documents. Each also shields owners from personal liability. Despite their similarities, though, there are also important differences between LLCs and Corporations. Those include:

-

Ownership

Members vs. Shareholders: “Members” own LLCs. “Shareholders” own corporations. The difference lies in the flexibility to transfer ownership. It is much easier to buy shares in a corporation than it is to become a “member” of an LLC. LLC membership is typically highly restricted.

What’s right for me? Ask yourself the following question: “How do I imagine the growth of my business?” If you intend to raise capital through outside investors or venture capitalists, offer shares to employees, or want the flexibility to sell shares of your company to whomever you desire, a corporation is for you.

If, on the other hand, you want to choose your business partners and have more control over who invests in your company as it expands, an LLC probably makes the most sense.

-

Management Structure

When it comes to management structures, the difference between LLCs and corporations boils down to flexibility. Corporations have established guidelines informing its operational structure. These include a Board of Directors that oversees the evolution of the company, a management structure that runs the daily operations, annual reports and shareholder meetings.

LLCs, on the other hand, offer substantially more flexibility to set up their management structures and daily operations as they see fit. Additionally, LLCs do not have as many annual reporting or recordkeeping requirements.

What’s right for me? Consider the role the owner(s) and/or partners wish to play in the company. If your business consists of a small group of owners/partners who are hands-on with the daily operations of the business, an LLC likely makes more sense. If, however, you have or seek investors who do little more than put up capital in exchange for an ownership stake in the company, a corporation is likely a more appropriate path.

C Corp vs. S Corp

If you decide to pursue incorporation as a corporation, rather than as an LLC, you’ll have to choose between a C Corp and an S Corp. What’s the difference? While there are many similarities, there are also crucial differences. Those include:

-

Size

C Corporations are large; S Corporations are small. S Corporations must have less than 100 shareholders.

-

Taxation

C Corporations may be subject to double taxation if their revenues are distributed in the form of dividends to shareholders. Put another way, C Corporations pay corporate taxes on profits, and then investors are taxed again when those profits are paid in the form of dividends.

S Corporations are not, however, subject to double taxation. S Corporations file an informational federal return, but their earnings are reported on their owners’ and/or shareholders’ individual tax returns.

Non-Profit vs. Cooperative

People often conflate or confuse non-profits with cooperatives. In fact, they are quite distinct. There are several key differences between non-profits and co-ops. They include:

-

Profit

The primary distinction is that co-ops do not have to be non-profit. Co-ops are merely required (legally) to distribute their profits among their members.

-

Accountability

Non-profits are ultimately beholden both to their board of directors and their benefactors. Co-ops, on the other hand, are accountable only to their members, who, again, are their owners.

-

Permissible Economic Sectors

There are a limited number of economic sectors in which non-profits can operate. Co-ops, on the other hand, can exist in any economic sector.

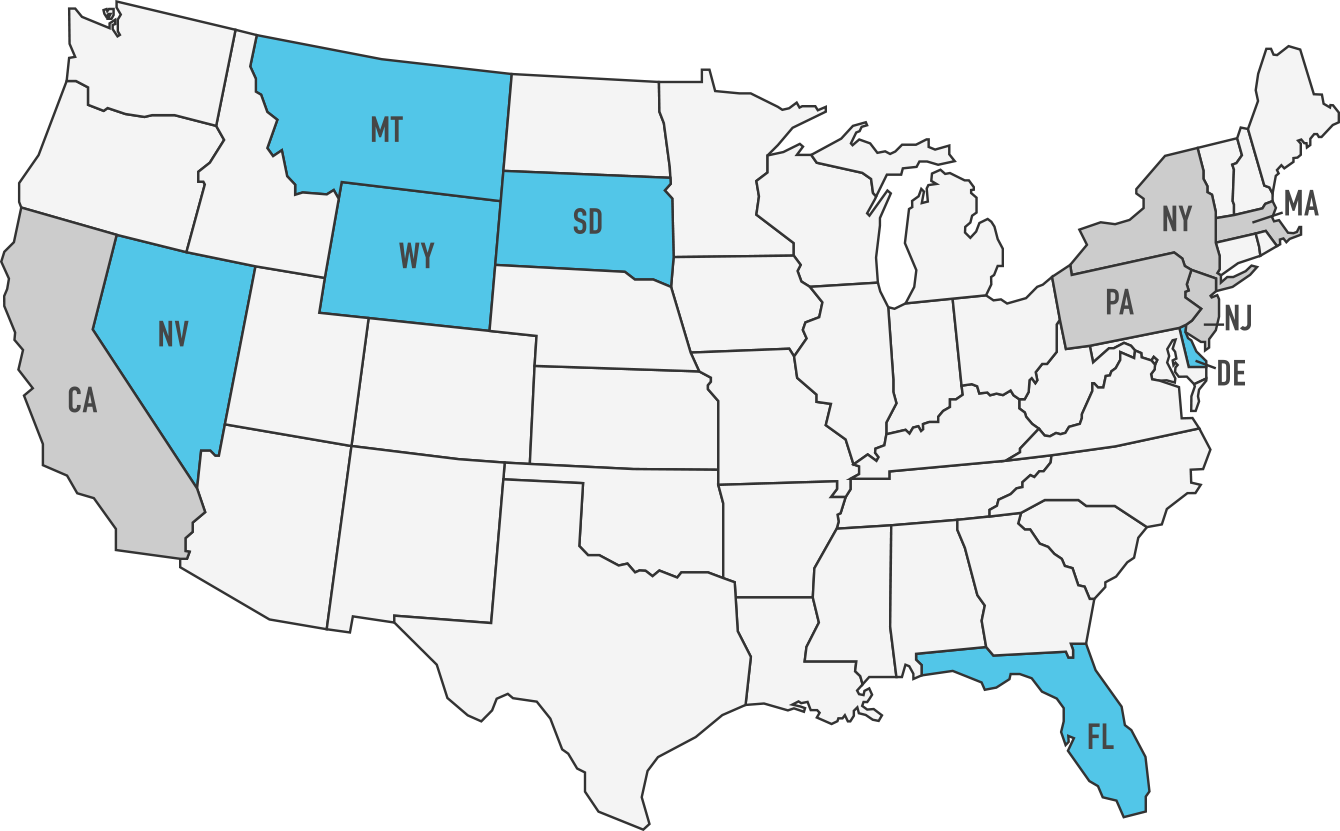

Where to Form a Business

For more information, check these out:

http://www.gimmelaw.com/best-state-for-incorporation

https://wallethub.com/edu/best-cities-to-start-a-business/2281/

How to Form a Business

Generally, the process for incorporation works as follows:

-

Choose a name for your corporation and reserve it with the state.

-

Choose your corporation type (LLC, C Corp, etc.)

-

Identify a “Registered Agent.” Generally speaking, this is a resident of the state in which you wish to incorporate and is affiliated with your company. The Registered Agent must be authorized to do business in that state. If your business is located in the state in which you plan to incorporate, the business itself may serve as the Registered Agent.

-

Complete articles of incorporation.

-

Create company structure (Board of Directors, Members, Partners, etc.) and bylaws.

-

Obtain Federal Employer Identification Number (FEIN) and open a bank account.

-

Obtain business license.

Once you’ve obtained your business license, remember to mark your calendar for yearly license renewal dates. Finally, from the team at FormSwift, good luck with your business endeavors!