What is a W-2 Form?

A W-2 Form, also known as a Wage and Tax Statement, is a form that an employer completes and provides to the employee to complete their tax return. Form W-2 must contain certain information, including wages earned and state, federal, and other taxes withheld from an employee's earnings. The Form W-2 must be provided to employees by February 2, 2026. Employers must also file a copy with the Social Security Administration by February 2, 2026 (paper or electronic).

If you need to complete it, make sure you include all the required information. You will also need the employee's personal information, such as their full legal name, address, social security number, and employee ID. Check for accuracy. Using the wrong information could cause problems for both the employer and the employee when they file their income tax return.

Please note: this form is only used for employees and not self-employed independent contractors or freelancers. Small businesses must also provide W-2 forms to all qualifying employees, regardless of company size.

Frequently Asked Questions

What is the W-2 deadline for employers?

By law, employers must distribute W-2 forms to their employees no later than February 2, 2026 for the 2025 tax year. If you haven't received your form by mid-February, reach out to your company's HR or payroll department for assistance.

How do I correct mistakes on my W-2?

If you discover errors on your W-2, notify your employer right away to request a corrected version (Form W-2c). Avoid filing your tax return until you have the accurate form, as mistakes can cause processing delays and affect your refund.

Should I expect a W-2 or 1099 form?

You'll receive a W-2 if you're a company employee with taxes automatically deducted from your paychecks. Independent contractors and freelancers who earned $600+ receive 1099 forms instead, as they handle their own tax payments.

What should I do if my W-2 is missing?

Start by requesting a replacement from your employer's payroll department. If that's not possible, you can obtain a wage transcript directly from the IRS by submitting Form 4506-T, though processing typically takes several weeks.

How do I read Box 1 vs Box 3 on my W-2?

Box 1 shows total taxable wages for federal income tax. Box 3 shows wages subject to Social Security tax (capped at $176,100 for 2025). Box 3 may be lower if you have pre-tax deductions.

What does Box 12 on my W-2 mean?

Box 12 contains codes for various benefits and deductions like 401(k) contributions (Code D), employer health coverage (Code DD), or life insurance premiums (Code C). Each code represents different pre-tax or post-tax benefits.

Is it possible to file taxes before receiving my W-2?

It's best practice to wait for your official W-2 before submitting your tax return. In exceptional cases where the form is significantly delayed, you may estimate using your final pay stub, but you'll need to file an amended return once the actual W-2 arrives.

Components of a W-2 Form

As far as tax documents go, the W-2 is simple. However, it does ask for a lot of information, most of which can be pulled from your payroll information and other personnel records. You need:

Information about the Employer:

-

Full legal business name

-

Full address, including zip code, of the business

-

Employer Identification Number (EIN)

-

State ID number

-

Control number; this is the number your payroll processing software assigns the W-2 for record-keeping purposes

Compensation Information:

-

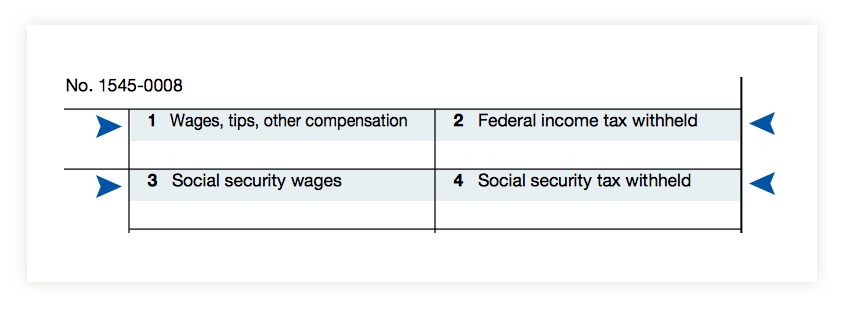

Box 1 - Total taxable wages: This includes wages or salary, bonuses, reported tips, and other miscellaneous compensation.

-

Box 2 - Federal income tax withheld: This Box records the federal tax amount that the employer kept and paid on behalf of the employee.

-

Box 3 - Social security wages: This is the amount of money subject to social security withholding. For most people, it is the same amount as Box 1.

-

Box 4 - Social security tax withheld: This is the amount of money that the employer paid to SSA on behalf of the employee.

-

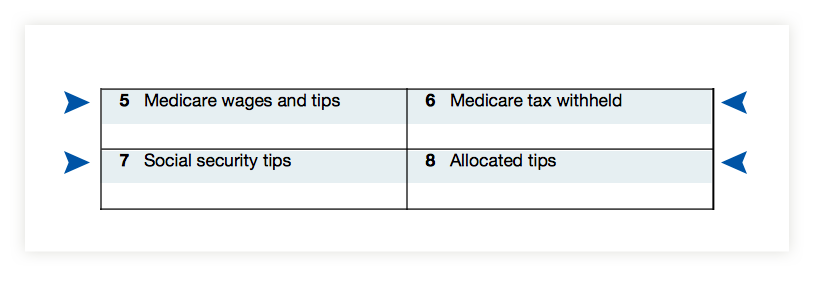

Box 5 - Medicare wages and tips: This is sometimes a bigger number than what's listed in Box 1. It includes an employee's total taxable compensation and fringe benefits, such as 401K contributions while they are nontaxable, that aren't subject to regular income tax.

-

Box 6 - Medicare tax withheld: This box documents the amount of Medicare tax the employer paid in on behalf of the employee.

-

Box 7 - Social security tips: This Box lists the total tips reported by your employee throughout the tax year.

-

Box 8 - Allocated tips: This only applies if you run a restaurant or other "tip-centric" establishment. It's customary to set aside a percentage of gross sales (usually 8%) to be paid out as tips. This acted as insurance for waitstaff on slow days and included in tax preparation. To calculate allocated tips, subtract the number of tips the employee reported for that year from the set percentage. Fill in the Box only if the difference is a positive number. This will ensure that the employee pays at least the established percentage.

-

Box 9 - No longer in use since 2010.

-

Box 10 - Dependent care benefits: Record the total amount of dependent care benefits paid (if applicable) for a qualified dependent care assistance program. This money could be paid directly to the assistance program or the employee. It should reflect the fair market value of the care according to the instructions given by the IRS.

-

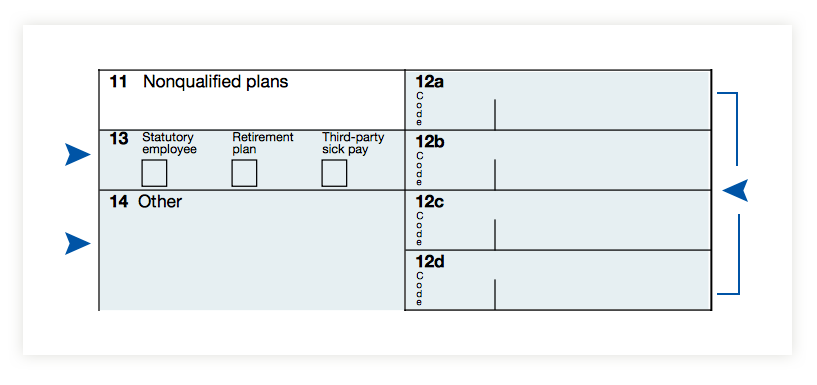

Box 11 - Non-qualified plans: This Box helps the SSA decide if any of the money reported in Boxes 1, 3, or 5 was earned the previous year. The SSA uses this information to ensure that it properly applied social security earnings.

-

Box 12: Box 12 has four individual spaces labeled 12a, 12b, 12c, and 12d. There is no official title. According to the instructions, these fields are for different codes. An employer may need to use more than one of the boxes. 12a reflects uncollected social security or RRTA tax on tops. 12b reflects uncollected tax for Medicare on tips. 12c reflects the taxable cost of group-term life insurance over $50,000. 12d reflects elective deferrals and designated Roth contributions made to H, S, Y, AA, BB, and EE plans. You can learn about the codes and when to use them, in the General Instructions.

-

Box 13 - Checkboxes: This Box has three checkboxes: statutory employee, retirement plan, and third-party sick pay. Employers should check all boxes that apply. A statutory employee is an employee whose earnings are subject to social security and Medicare taxes, but they aren't subject to withholding at the federal level. This is not the same as a common-law employee. To learn more, please consult the General Instructions through the link above. If the employee is an active participant in a retirement plan, check this Box. The third-party sick pay box should be checked if you are a third-party sick payer filing a W-2 for an insured's employee or employer reporting sick pay payments made by a third party.

-

Box 14 - Other: If you include 100% of the amount of a vehicle's annual lease in the employee's income, it is reported in this Box.

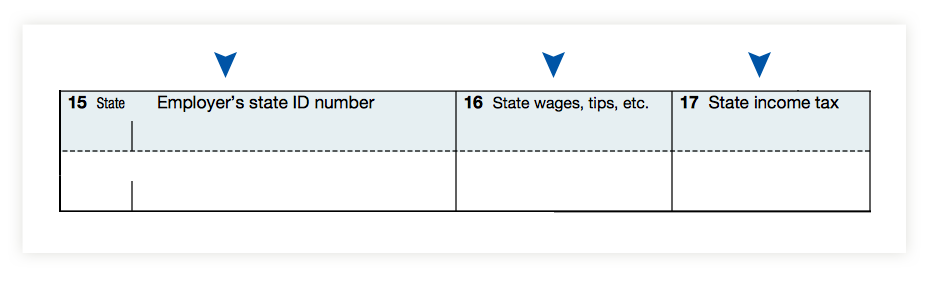

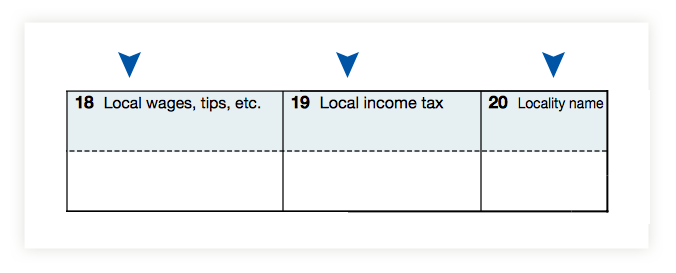

Boxes 15 through 20 are used to record state information. You'll notice that there are two lines under each Box. This is for employees who work in two separate states for the business issuing the W-2. If the employee only works in one country, the employer would only fill out the top line for each Box. Box 15 includes the state abbreviation and the employer's state ID number. Box 16 records state wages and tips. It usually matches Box 1. Box 17 documents the amount of state tax withheld by the employer. Plates 18 and 19 generally match Boxes 16 and 17. Box 20 isn't explicitly mentioned in the General Instructions.

Information about Taxes Withheld

Instructions for calculating the following are included with the W-2. Your bookkeeping software should automatically calculate this based on information about your company, its location, and the withholding allowance selected by your employee. Also, remember that tax laws can change every year.

Your bookkeeping software may or may not automatically update to reflect the newest information. It's vital that you stay on top of the yearly changes and, if necessary, consult a tax expert on behalf of your business. Small businesses should particularly pay attention to software updates and compliance requirements, as manual tracking can become complex with multiple employees.

-

Federal income tax: Use Publication 15 as your guide when calculating this.

-

State income tax: Total state taxes withheld from an employee's wages throughout the year; more information can be found on your state website.

-

Local income tax: Total local taxes withheld from an employee's wages throughout the year.

-

Locality name: A short description of the state or local tax being paid.

-

Social security tax: Usually a 12.4% deduction, with 6.2% coming out of the employee's wages and 6.2% coming out of your own. There is a maximum amount that can be taxed, but it changes by year. Up to date, information on these tax rates can be found on the IRS website.

-

Medicare tax: Typically, a 2.9% tax in total, with 1.45% coming from the employee and 1.45% coming from you.

A Few Things to Remember

Double-check your work; this means double-checking the math if you're calculating taxes by hand, spelling all the names and street addresses, and ID codes such as the SSN. Meet your deadlines. There are specific deadlines that you must meet as an employer when it comes to providing tax forms to your employees and to the tax agencies that need the information. Periods can vary by year or circumstance. Check this section of the IRS website for details.

There are six copies in total. Distribute them as follows:

-

Copy A goes to the SSA.

-

Text 1 goes to your state, city, or local tax department (you can learn more about your area's requirements on its official website).

-

Copies B, C, and the W-2 go to the employee.

-

You should retain copy D for four years.

W-2 vs 1099-NEC: Understanding the Difference

One of the most common questions about tax forms is when to expect a W-2 versus a 1099-NEC. Understanding this distinction is crucial for proper tax filing:

W-2 Form Recipients

- Company employees with regular wages or salary

- Workers with taxes automatically deducted from paychecks

- Employees who receive benefits like health insurance or 401(k)

- Workers classified as statutory employees in specific situations

1099-NEC Form Recipients

- Independent contractors and freelancers

- Workers who handle their own tax payments

- Consultants, gig workers, and business owners

- Anyone who earned $600 or more from non-employee compensation

Key Tax Implications

| Aspect | W-2 Employee | 1099-NEC Contractor |

|---|---|---|

| Tax Withholding | Automatic from each paycheck | Self-managed quarterly payments |

| Social Security/Medicare | Split 50/50 with employer | Pay full 15.3% self-employment tax |

| Business Deductions | Limited deductions available | Extensive business expense deductions |

Even small business employees require proper W-2 documentation. Misclassifying employees as contractors can result in significant penalties and back-tax obligations for both parties.

How Do I Fill Out a W-2?

The W-2 is probably one of the most common tax forms used by people. The myriad of boxes and blanks can seem frustrating at first glance, but now that you understand them from reading about them earlier in this guide, filling out the form should be easy for you if you must do it by hand.

However, check your bookkeeping and payroll software to determine if the way can be automatically generated for each employee by the deadline.

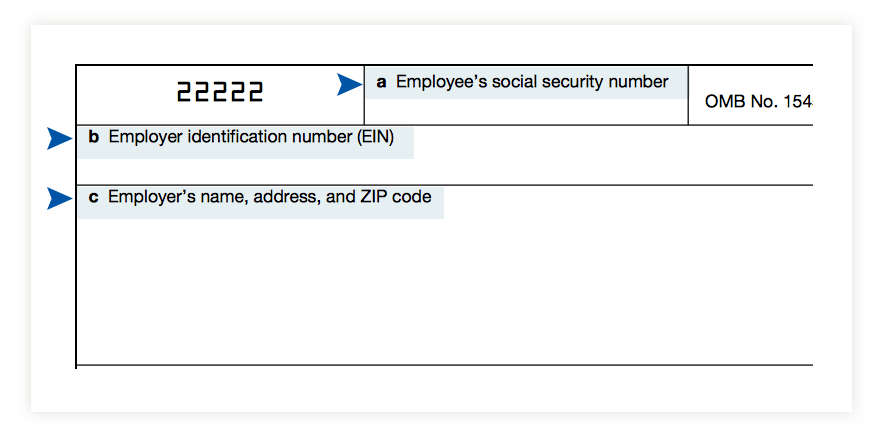

In Box A, list the employee's SSN. If it is not on the form, or incorrect, it could prevent the employee from filing their taxes on time.

In Box B, you'll list the EIN for the business.

In Box C, you'll add the employer's name, address, and zip code.

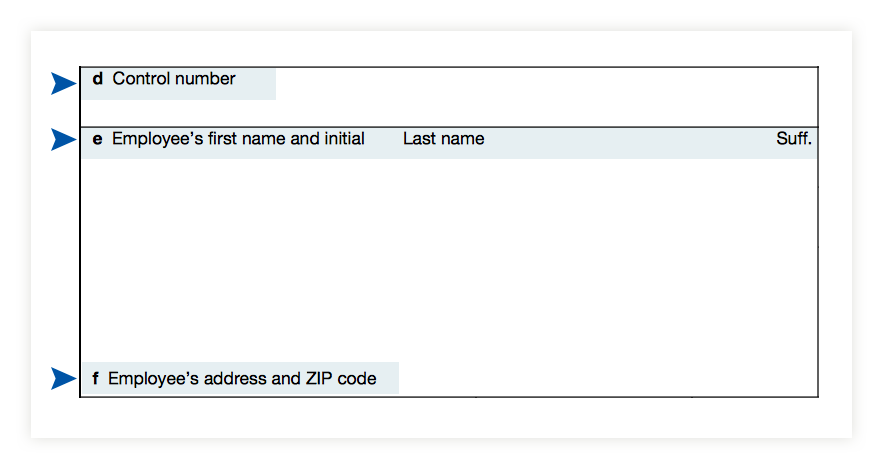

In Box D, enter the control number assigned by the company's payroll processing system.

Next, use Box E to list the full name of the employee. The first Box is for the employee's first name and middle initial. The second Box is for the last name. The small Box is to list a suffix.

Record the employee's address (including city, state, and zip code) in Box F.

Next, address the boxes with numbers. Start with Box 1. List the wages, tips, and other compensation paid to the employee. This number should include hourly wages or salary, tips, and bonuses.

In Box 2, list the amount of money withheld for federal income taxes.

Box 3 lists the individual's social security wages.

Box 4 documents how much Social Security tax was withheld on behalf of the employee.

In Box 5, you'll list the amount of income eligible for the Medicare tax.

In Box 6, you'll document: the amount of the Medicare tax withheld.

Use Box 7 to record tip income that was reported by the employee to the employer.

Use Box 8 for any tip income that was assigned to the employee by the employer.

Use Box 10 to list any amount of money for dependent care reimbursed through a flex spending account, paid directly to a provider by the employer, or paid to the employee to reimburse dependent care expenses.

Most businesses don't use Box 11. However, if necessary, you'd use it to report money paid to an employee as part of an on-qualified compensation plan or non-government pension plan.

In Box 12, you'll list deferred compensation. This usually involves savings or retirement plans.

You'll check the appropriate boxes in Box 13.

In Box 14, you'll list any additional information that must be reported.

Box 15 marks the beginning of state information. The employer's state employer tax identification number will be listed here. There's room for you to record data for two states for one employee.

Box 16 lists the total number of taxable wages earned in the state.

In Box 17, you'll list the amount of state income tax withheld.

Use Box 18 to record the number of an employee's wages that are subject to local, city, or other taxes.

In Box 19, you'll list the amount of local income tax withheld.

Box 20 lists the locality or city being paid locally.

Common Mistakes

Common errors on the W-2 Form when completing it by hand include making entries using ink that is too light or making entries that are too small or too large. Make sure to use black ink and clear writing if you complete it by hand. If generated by a computer, use a clear font, such as Courier, that is easy to read. Also, make sure not to add dollar signs to the boxes that list dollar amounts. Do not omit decimal points and cents from entries.

Most importantly, do not incorrectly format the employee's name in Box E. There are stringent penalties for employers who fail to complete the W-2 Form by the deadline. Small businesses should be especially cautious about compliance deadlines, as penalties can be proportionally more impactful on smaller operations.

Important W-2 Deadlines for the 2025 Tax Year

- February 2, 2026: Employers must provide W-2s to employees

- February 2, 2026: Employers must file W-2s with Social Security Administration (paper or electronic)

- April 15: Employee tax filing deadline

Common W-2 Scenarios

- Multiple jobs: You'll receive separate W-2s from each employer

- Job changes: Former employers must still provide W-2s for work performed during the tax year

- Small businesses: Even small business employees require proper W-2 documentation for tax compliance