What is a Power of Attorney (POA)?

A Power Of Attorney allows another person (the agent) to take specific legal actions on your behalf. There are different types of power of attorney, depending on your circumstances. You should select one of the following POAs:

General (Financial) Power of Attorney

With a general power of attorney, one person (known as the principal) permits another person (usually referred to as the agent or attorney in fact) to manage their assets and financial affairs while the principal is still alive.

Because this legal document grants the agent substantial power, the POA needs to list out clear instructions about what the agent can and cannot do. A clause can be added to terminate the power of attorney within a certain time frame.

The difference between a durable power of attorney and other powers of attorney is that if the principal becomes disabled or incapacitated in some way, the agent would still hold power--it doesn’t end. However, if you want your agent to continue to have power if you become disabled or incapacitated, make sure that your power of attorney explicitly states that it is durable.

IRS Limited Power of Attorney (Form 2848)

This form should be used when you require an individual to represent before the IRS. If you have ongoing legal proceedings with the IRS, it is best to use Form 2848 to allow an experienced tax attorney and/or accountant to present and negotiate the case on your behalf.

A limited power of attorney involves the principal granting specific powers to the agent. These powers are explicitly mentioned in the limited power of attorney.

For example, while the agent may be permitted to access a checking account to pay the monthly expenses of the principal, they may not have permission to make decisions related to medical care or retirement accounts.

Medical or Healthcare Power of Attorney

A medical power of attorney is more commonly referred to as a health care power of attorney (HCPOA). With a medical power of attorney, you’re creating a legal document that gives someone permission to make medical decisions on your behalf if you’re unable to do so. Your agent will have the ability to consent, refuse, or withdraw medical treatment, services, or procedures on your behalf.

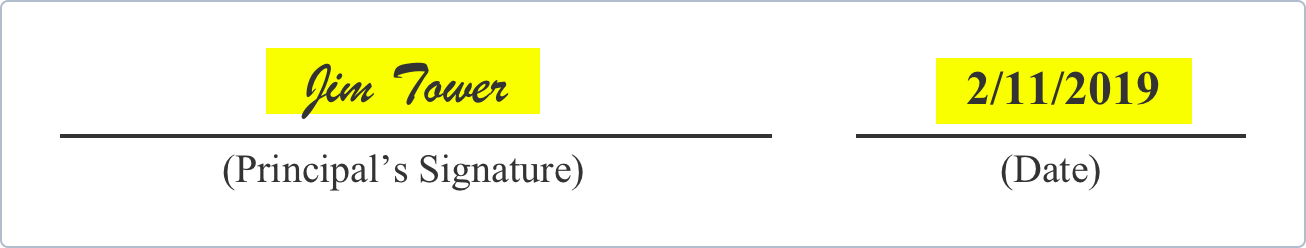

Step 1 - Sign and Date

After reading and understanding the aforementioned clauses, sign and date the agreement, certifying that you are granting permission to your Agent to make financial decisions and handle legal affairs on your behalf should you become unable or incapacitated.

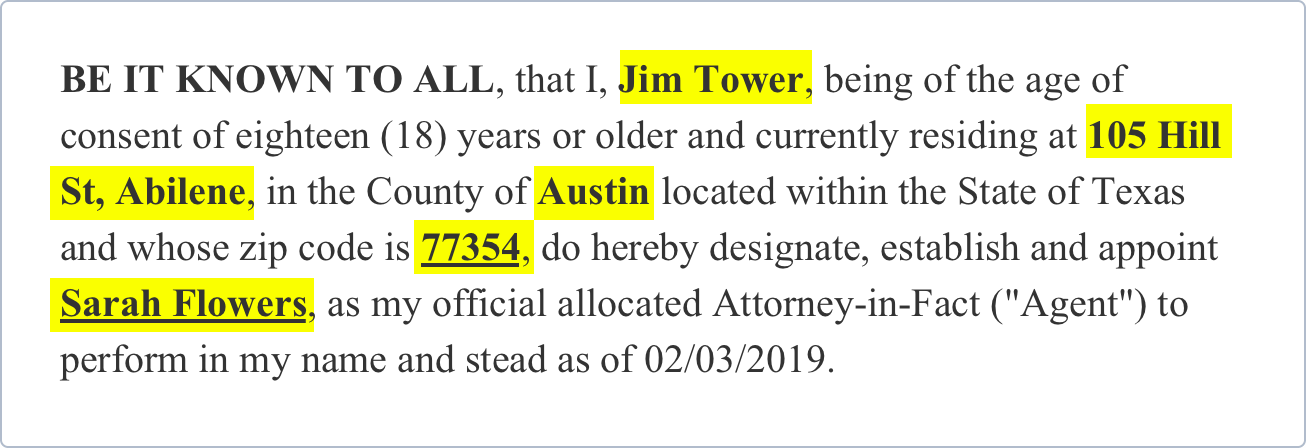

Step 2 - Provide your Contact Information

Provide your name, and the name and contact information of your Agent. This should include your Agent’s full name, address, and county where he or she lives. Keep in mind that your Agent must be at least 18 years of age and be of sound mind.

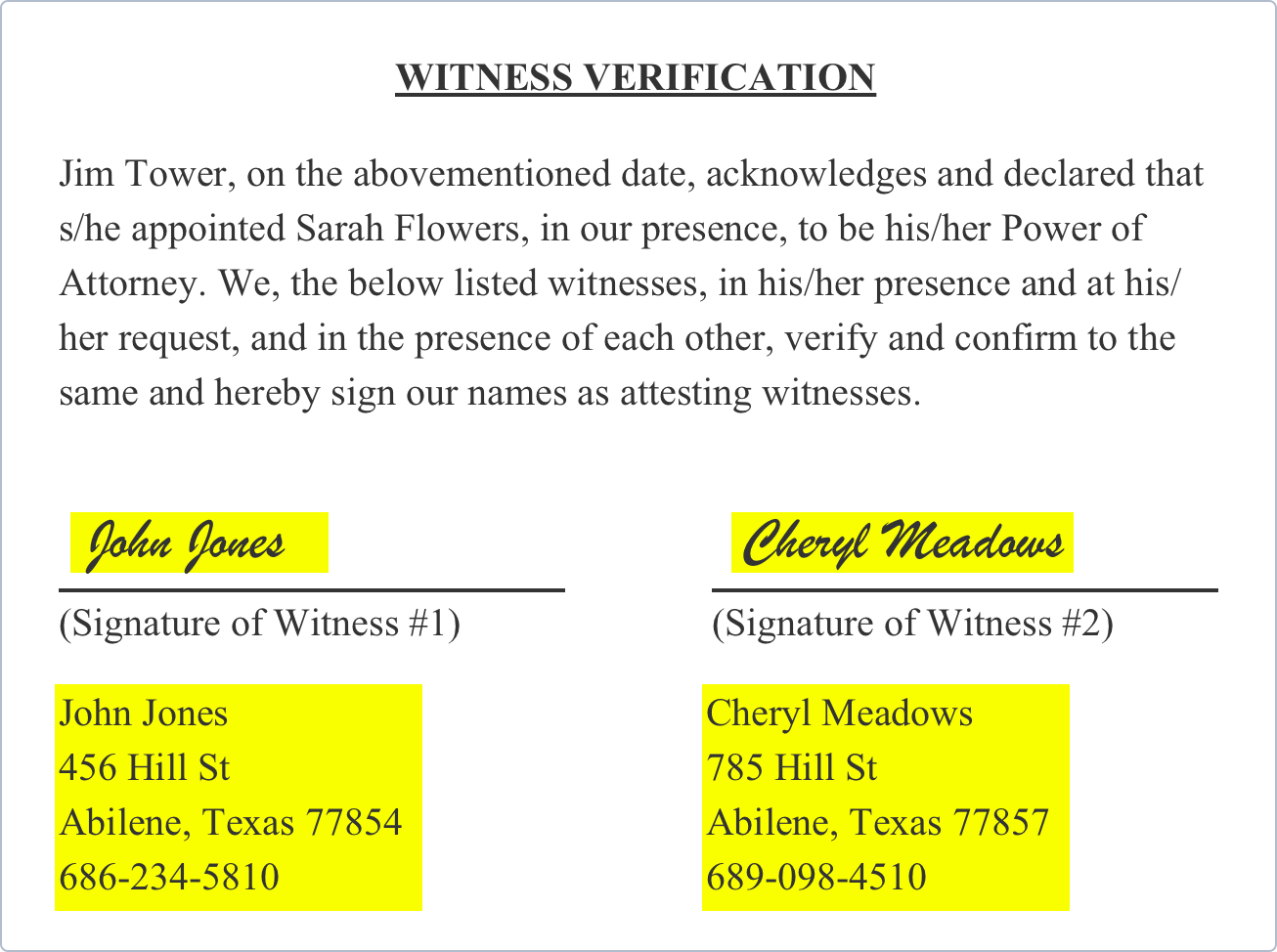

Step 3 - Witness Information

After indicating the powers given to your Agent, provide your Witnesses. Most states require that your Durable Power of Attorney document be notarized and witnessed by two attesting individuals. Be sure that the following information is provided for each witness:

-

Full Name

-

Full Address (including city, state and zip code)

-

Telephone Number

-

Signature

What Is the Procedure for Signing a Power of Attorney?

The procedure and requirements for signing a power of attorney vary slightly in every state. Generally, your named agent must be at least 18 years old. Your agent may not act as a witness during the signing process. In most states, there’s a requirement for the signature of the Principal (you) to be witnessed by at least two witnesses. Some states require that the document be signed in front of a notary public.

What Are The Limitations Of A Power Of Attorney?

- Transferring Money—A POA cannot typically transfer power of attorney to another person, allow an agent to break fiduciary duties, or make any decisions after a principal’s death, including but not limited to their last will and testament.

- Financial Institutions Reject a POA—Some financial institutions may refuse to recognize a power of attorney. For example, some state laws allow banks to require additional documentation, such as an affidavit. Banks may object the POA if it isn't durable, meaning the person who made the POA becomes incapacitated and the POA was not made to last during incapacitation. POAs are durable by default, but some states require an explicit statement with the document.

- Springing Power of Attorney—A springing power of attorney takes place some time in the future after signing. It does not take effect immediately, but "springs" into action should the principal become incapacitated.

Download a PDF or Word Template

Power of Attorney

A Power of Attorney is a legal form. It can be used in many situations. This document is used to name another person who has your permission to handle your legal, business, and personal affairs because you are either out of the country or you are unable, mentally or physically, to make those decisions.

Read More

Read More

Last Will and Testament

A Last Will and Testament is a legally enforceable document that sets out how a person wishes their assets to be distributed after death. Without this document or signature, property and wealth will be distributed by the courts and may be contested by interested parties, such as family, business colleagues, or other acquaintances.

Read More

Read More

Living Will

A Living Will legally enforces health care providers to carry out your specific wishes in relation to medical treatments, surgery, or withdrawal of treatment in the event of your incapacitation. It can include values and quality of life decisions. This protects loved ones from second guessing your wishes and the potential for disputes to arise at a difficult time.

Read More

Read More

Health Care Proxy

A Health Care Proxy is also known as 'Medical Power of Attorney'. It empowers you to appoint a trusted representative to make decisions about your health treatments in the event of your being unable to do so. It also allows you the added protection of discussing your wishes and values in advance with someone you can rely on.

Read More

Read More

California Power of Attorney

California Power of Attorney

New York Power of Attorney

New York Power of Attorney

Florida Power of Attorney

Florida Power of Attorney