What is a Durable Power of Attorney?

A durable power of attorney is a legal document that delegates to someone you choose, the power to act on your behalf. It covers circumstances where a person delegating their power of attorney (the Principal) is preparing for potentially becoming incapacitated. Durable powers of attorney cover medical care and finances for the duration of incapacitation and inability of a person signing such an agreement to manage their own affairs alone.

Power of attorney means a specified person (Attorney-in-fact) is legally permitted to manage important matters for another named person. It allows this trusted person to continue acting on the principal's behalf if they become too ill to manage their affairs or unable to communicate. The agreed powers can cover: bill payments, investment management, or medical care. Without it, if unfortunate circumstances befall a person, their family or friends may need to go to court to obtain authority to handle their affairs.

Durable power of attorney can involve separate documents pertaining to different matters of concern to the principal, such as health care issues or finances.

This arrangement differs from 'ordinary', or 'nondurable', powers of attorney, which automatically cease should the person who makes this agreement lose their mental capacity.

Extent of The Durable Power of Attorney:

A Principal may appoint one single attorney, or more, to act as follows:

- "jointly" i.e. all delegated decisions must be made together by appointed attorneys

- "jointly and severally" i.e. Attorneys have to make some decisions together and others individually

- "jointly" on some matters, and "jointly and severally" on others

The scope for durable powers of attorney can vary between state jurisdictions. Thus the Principal can only agree to the purposes delineated by state statutes in which they are to be used. Durable Power of Attorney may also involve the use of specific language as specified in the relevant state statute.

Limited powers of attorney are exactly as they are described, outlining restrictions on the attorney-in-fact's powers to act on behalf of the Principal. Specific powers will outline the circumstances in which they are entitled to act, such as signing a contract, when the principal may be unavailable.

The lawyer acting for the Principal and the Attorney-in-fact should keep a copy of the signed agreement for their records.

What You Can Use This Power of Attorney For

You can exercise this legal power for managing any type of financial, domestic or medical resources, including:

- Home

- Business

- Money

- Assets

Who Needs Durable Power of Attorney?

People who may find this legal tool useful are:

- principal, who authorizes another person, (their designated attorney-in-fact)

- an attorney-in-fact, or agent, or attorneys who have power of attorney delegated to them

Durable Versus Regular Power of Attorney

Limitations: Ordinary powers delegated to the attorney-in-fact can be general or specific and apply when the principal has the capacity to give authority to the attorney-in-fact to manage their specified legal issues on their behalf. Should the principal subsequently become incapacitated, a durable power of attorney is applicable if the principal has made such preparations.

Incapacity includes when the principal is injured, sick or disabled such that they are not able to communicate. Durable power of attorney continues to endure legally after the principal becomes unable to express their own wishes.

Pre-Arrangement: The document authorising durable power of attorney can be drafted in advance of incapacity, so that this power of attorney becomes immediately effective upon the principal becoming incapacitated, or it can be in place throughout a person's disability, regardless of capacity to communicate.

Power to Revoke. A principal has the power to revoke ordinary power of attorney any time while they still have legal capacity to act. It is also revoked automatically when the principle becomes incapacitated. Also, durable power of attorney can be revoked by the principal any time while they still have the legal capacity to act. Following their incapacitation, however, a person 'of interest' to the principal, such as a family member or a business colleague, can petition a local probate court to become the principal's appointed 'conservator' and if successful, they can then petition the probate court to revoke any pre-existing durable power of attorney.

Health Care Directives: Most U.S. states authorize an attorney-in-fact to decide on appropriate medicals for the principal when the principal becomes unable to communicate their wishes. However, some states also have their own health care surrogate appointment laws in place to allow any medical patient to appoint someone they trust to make medical treatment decisions on their behalf without the necessity of filling out a durable power of attorney form. This may exclude decisions on monetary transactions during incapacitation however.

Frequently Asked Questions

-

Is it possible for an Agent to steal my money and property?

-

Yes. A power of attorney can be abused. A principal's assets can be transferred to the Attorney or others. It is vital to appoint a highly recommended and trustworthy agent to act on your behalf. Look for professional credentials.

-

-

How many copies of a Power of Attorney need to be signed?

-

You are only required to sign only a single copy. However, in some cases several original copies may be applicable, e.g. where banks and brokerage companies use their own forms. To ease administration for your attorney-in-fact, prepare two (or more) durable powers of attorney with your own form and forms provided by any relevant parties with whom you do business.

-

-

After I sign a Power of Attorney, can I still make legal and financial decisions for myself?

-

Yes. Your named attorney-in-fact is only your representative. As long as you are capable, you can instruct them to only deal with specific matters.

-

Download a PDF or Word Template

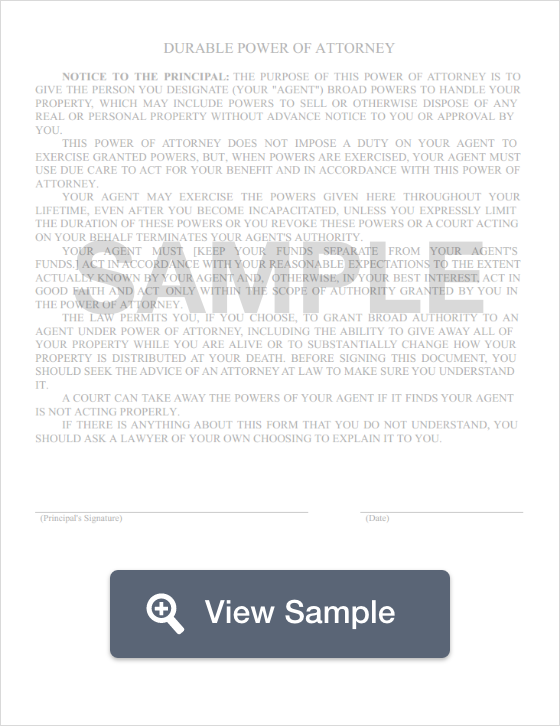

Durable Power of Attorney

This is a legal document that delegates the power to act on your behalf by someone else. It prepares for the possibility of becoming incapacitated or unable to express their wishes and covers a variety of areas of life. It specifies a named attorney-in-fact and details their delegated areas of authority.

Read More

Read More

Contract for Deed

A Contract For Deed involves the sale of land, whereby the seller finances the deal such that the buyer pays the purchase price of the owner's property in installments.

Read More

Read More

Last Will and Testament

One of the most important documents that every adult needs is a Last Will and Testament. This is a legal document that lists how you want your belongings and money distributed to others in the event of your death. These documents are often state specific.

Read More

Read More

Living Will

A living will is a legal document that enables you to tell medical professionals how you want your end-of-life care to be handled. This document is utilized in the event that you are no longer able to make your own medical decisions. It takes the stress off of your family because your wishes are clearly stated.

Read More

Read More