1099-MISC Document Information

What is a 1099-MISC Form?

The 1099-MISC is used to report certain types of non-employee income. As of the 2020 tax year, the 1099-MISC is now only used to report the following types of income worth at least $600:

-

Rents

-

Prizes and awards

-

Other income payments

-

Cash paid from a notional principal contract made to an individual, partnership, or an estate

-

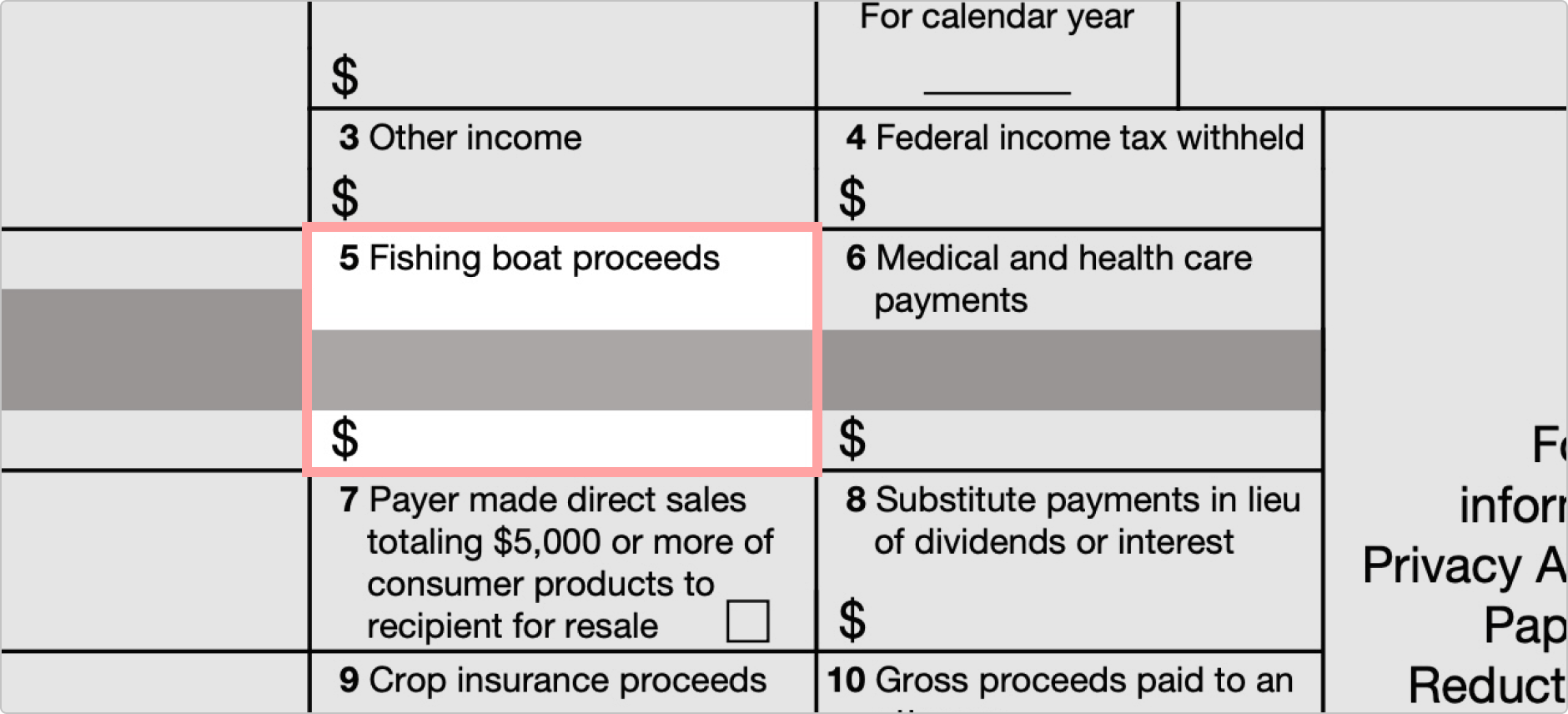

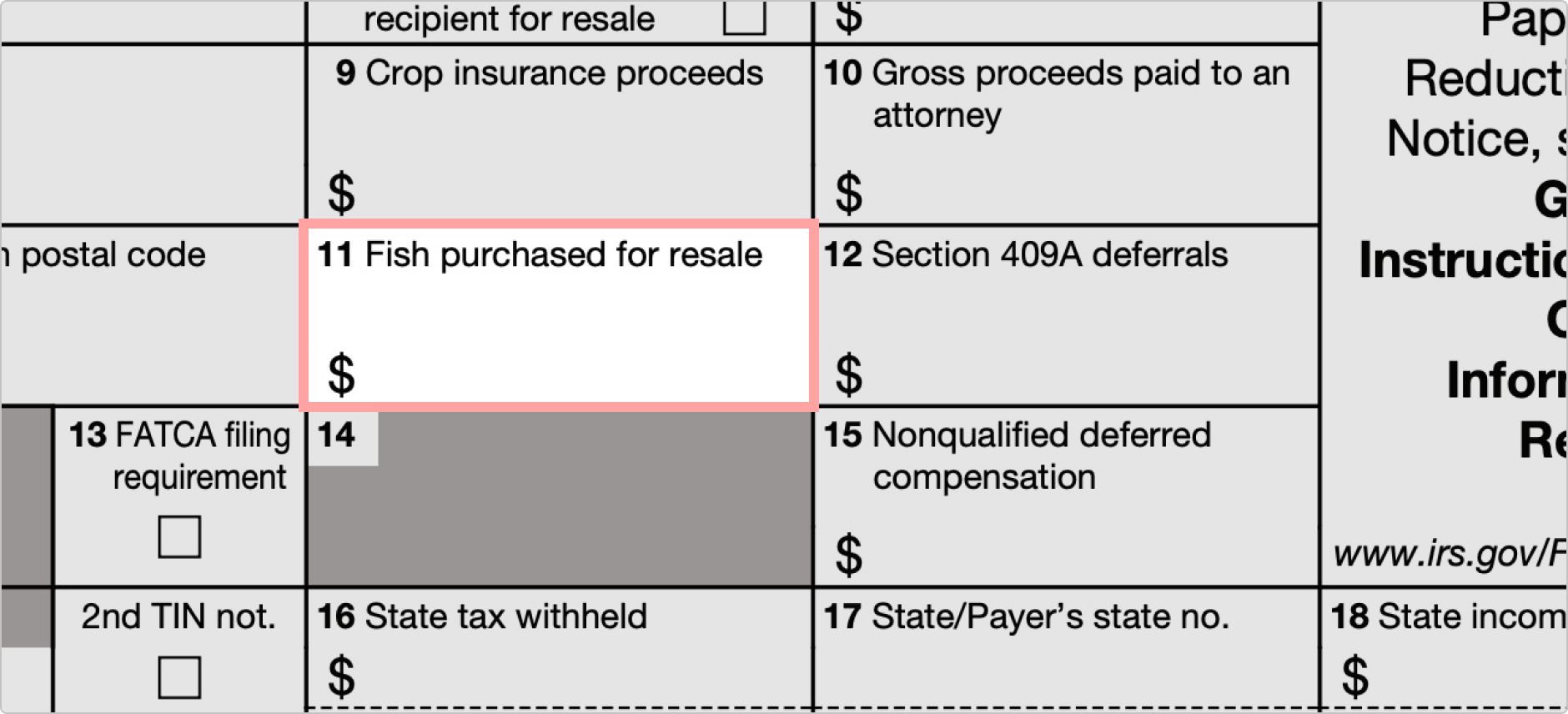

Fishing boat proceeds

-

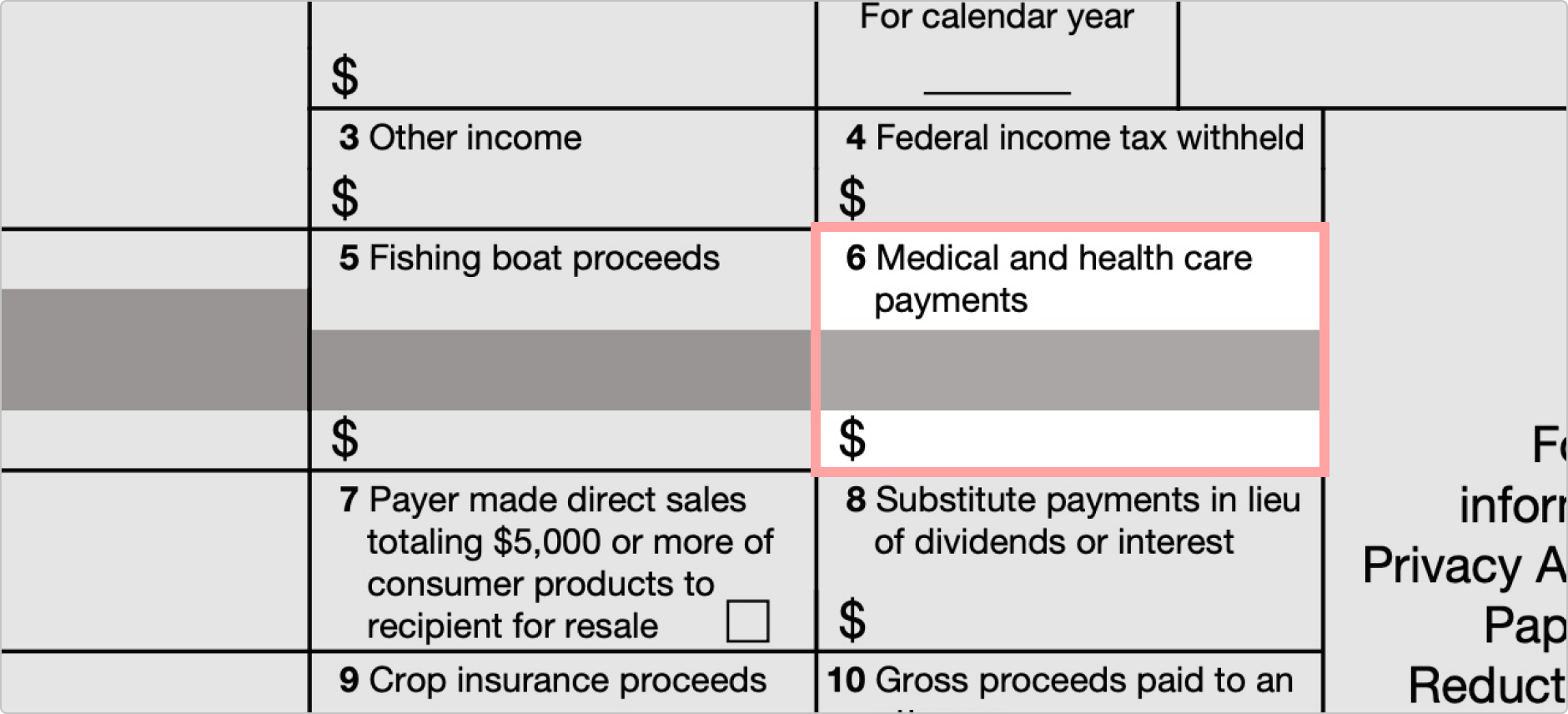

Medical and health care payments

-

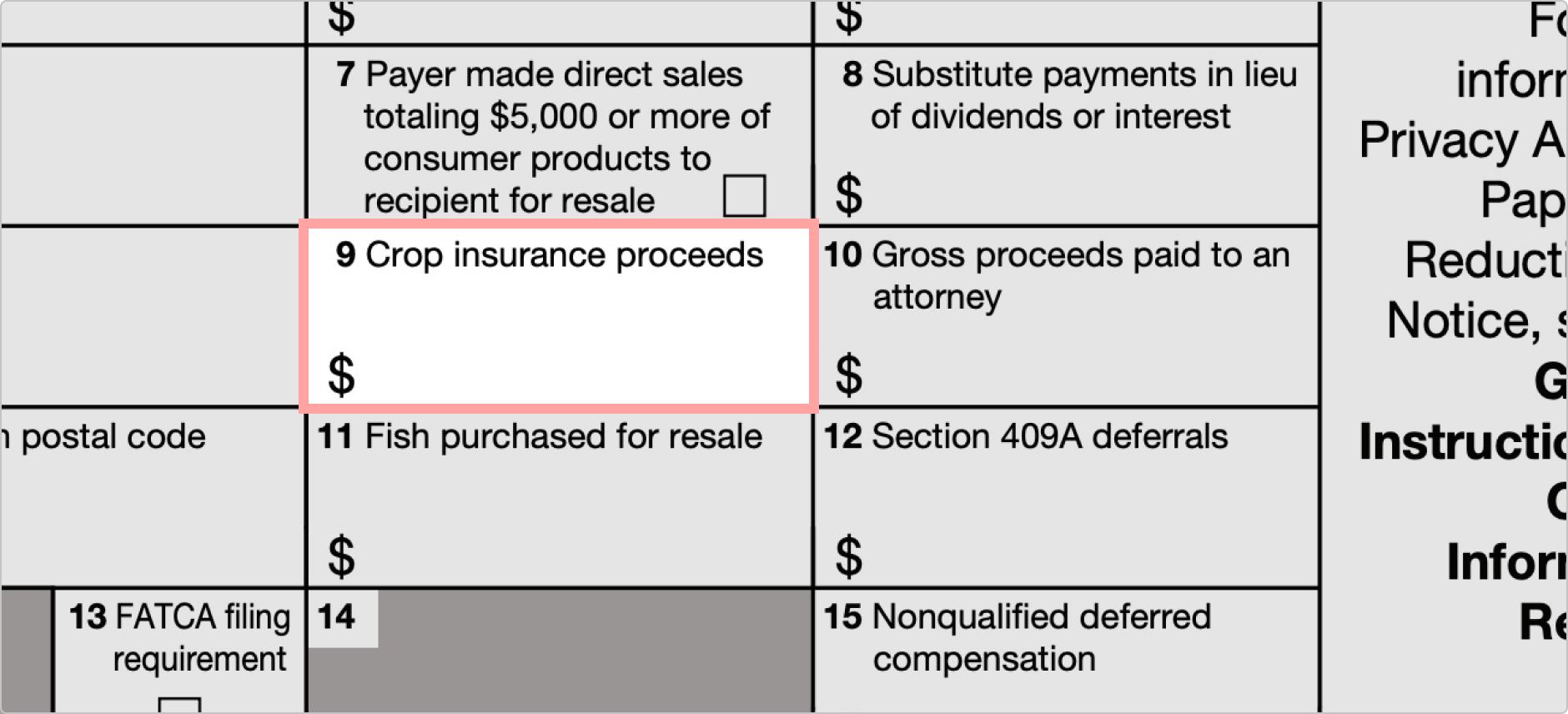

Crop insurance proceeds

-

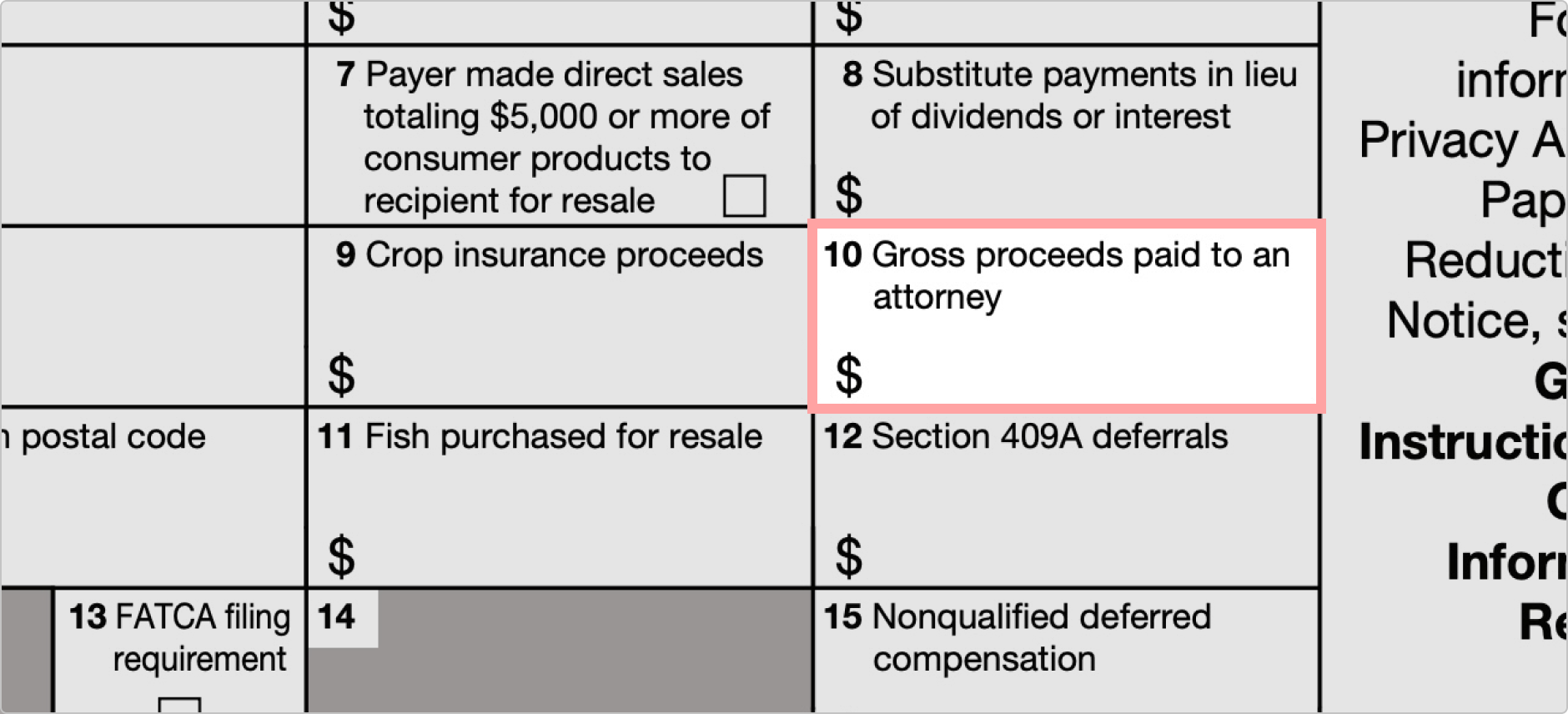

Gross proceeds paid to a lawyer

-

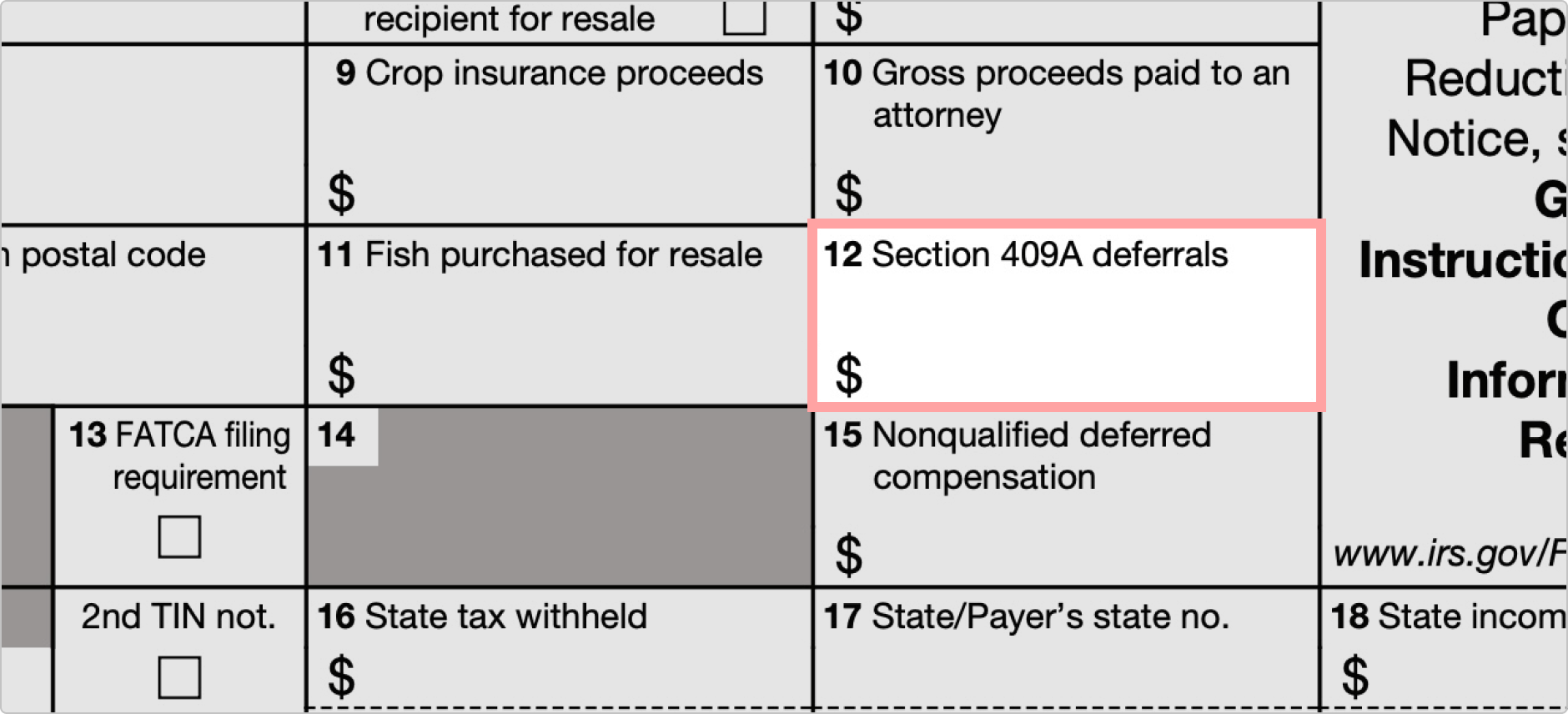

Section 409A deferrals

-

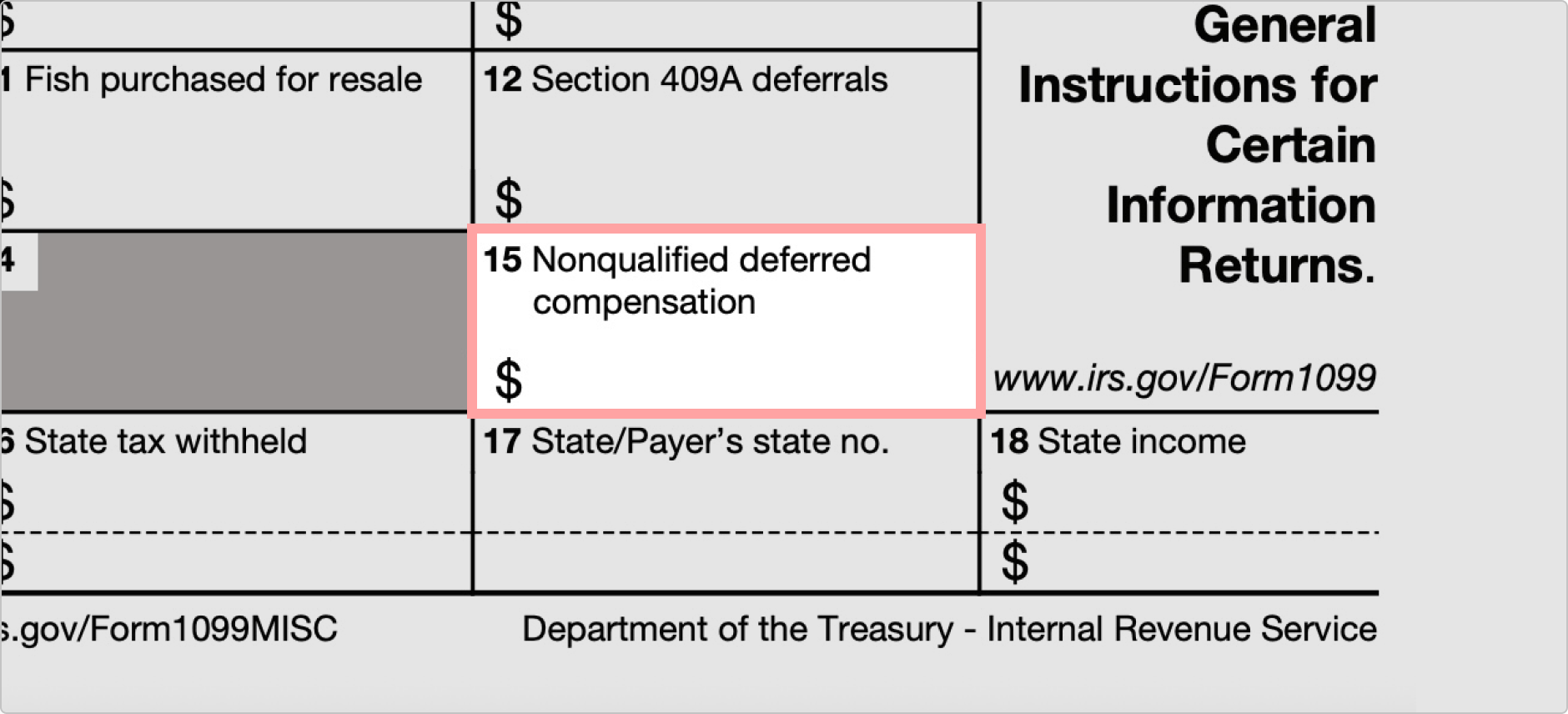

Nonqualified deferral compensation.

Additionally, use a a Form 1099-MISC for:

-

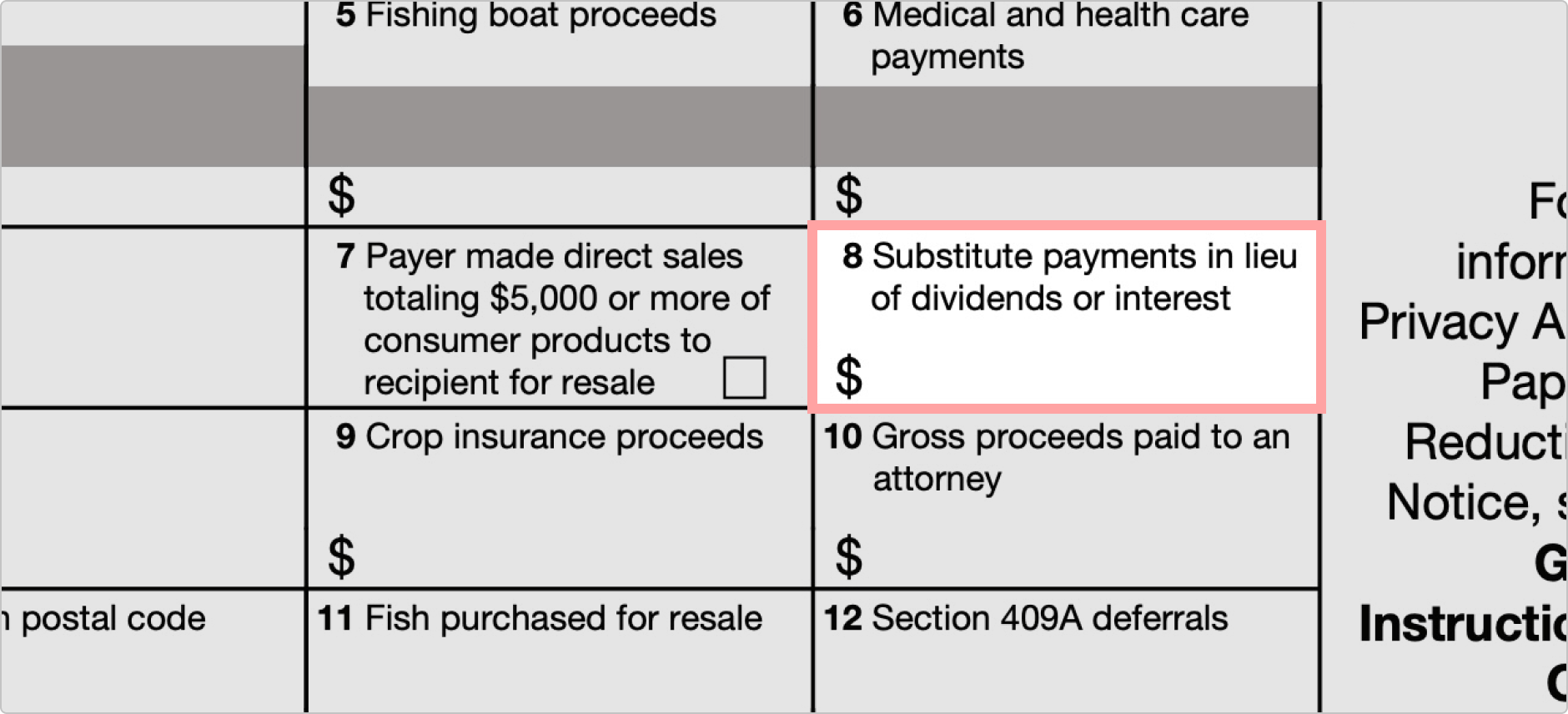

At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

-

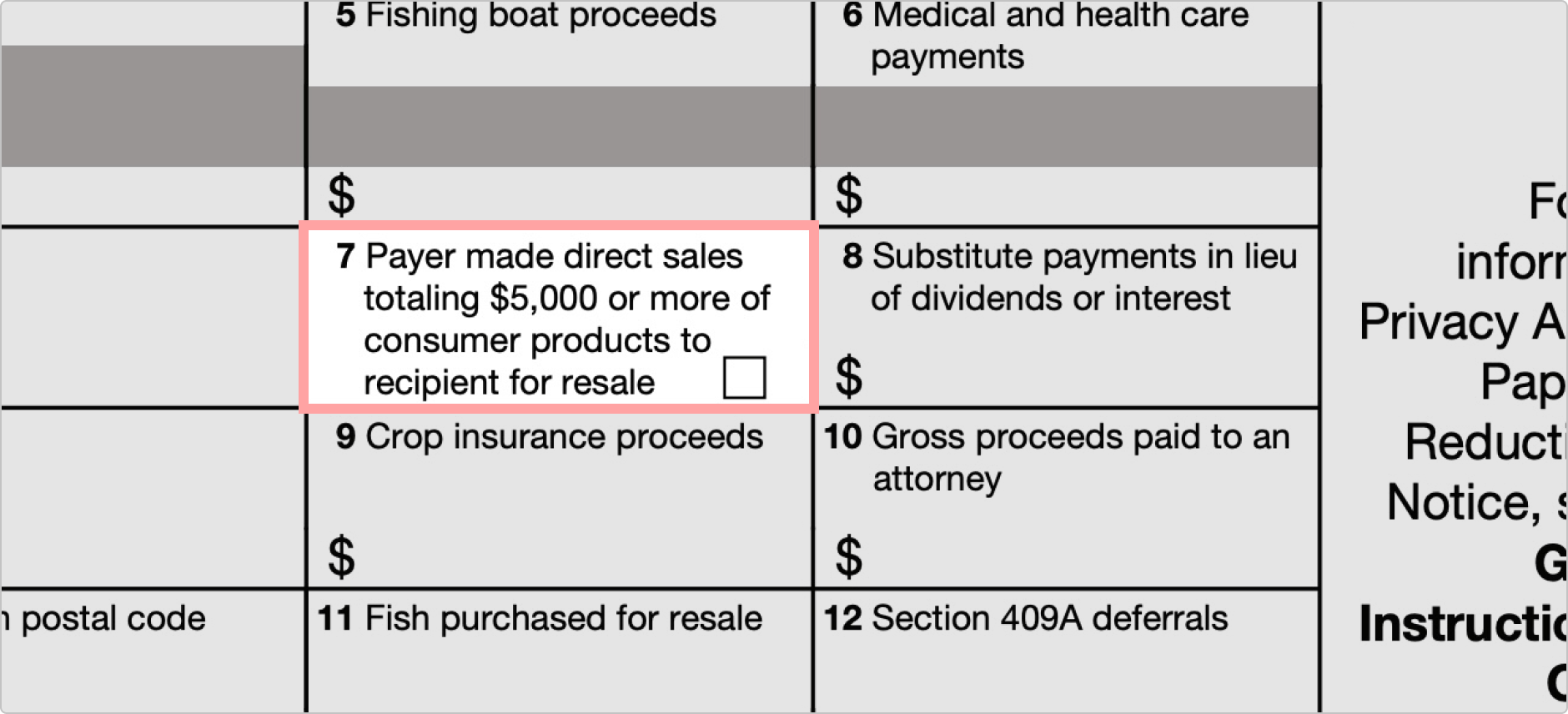

To report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

Compensation for freelancers and independent contractors are no longer reported using a 1099-MISC. Instead, they are reported using a 1099-NEC.

What you need to know

This document, technically known as the 1099-MISC Form, is a tax document that confuses. Who gets one? Who doesn't? Do I need to send them out? Many a bewildered business owner just decides not to bother with it because they just don't know what to do. Fortunately, this form is relatively simple to understand and easy to fill out once you grasp the basics of completing the form and who needs to receive one.

The IRS provides specific and clear instructions on when a 1099-MISC must be used. For example, if you received at least $600 in rental income, you would use a 1099-MISC. If you paid a lawyer at least $600 for legal services of some kind for your business, you can send them a 1099-MISC. If you received a prize or an award worth at least $600 or if you give out a prize worth at least $600, a 1099-MISC is required. If you were paying an independent contractor or freelancer for at least $600 in services, you would use a 1099-NEC.

The individual or business receiving a 1099-MISC can use it in addition to or in place of the W-2 that they would win in a standard employment arrangement.

As previously mentioned, it is also used to report a prize or award from a business. It reminds the recipient that they must pay taxes on that item or income (if they haven't done so already). It provides documentation that tells them exactly how much they've received from your business.

Don't delay or skip sending out the document by the end of January for the previous tax year. Failing to send it out as required can be punishable by fines of $60.00 to $330.00 per form.

If the IRS proves that a business intentionally disregarded the law when they failed to send out the proper form, the penalty starts at $660.00 per missed statement and with no maximum.

There are quite a few exceptions for which you do not need to send out a 1099-MISC (although this does not mean that the income is not taxable for the recipient). You're not required to send one to real estate agents or sellers of merchandise, storage, freight, etc. However, you are required to send one to any lawyer that you paid more than $600 to in a calendar year, even if they work with a law firm.

Components of a 1099-MISC

Overview of fields in a 1099-misc

Those who need to send out a 1099-MISC can acquire a free fillable form by navigating the website of the IRS, which is located at www.irs.gov.

Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed.

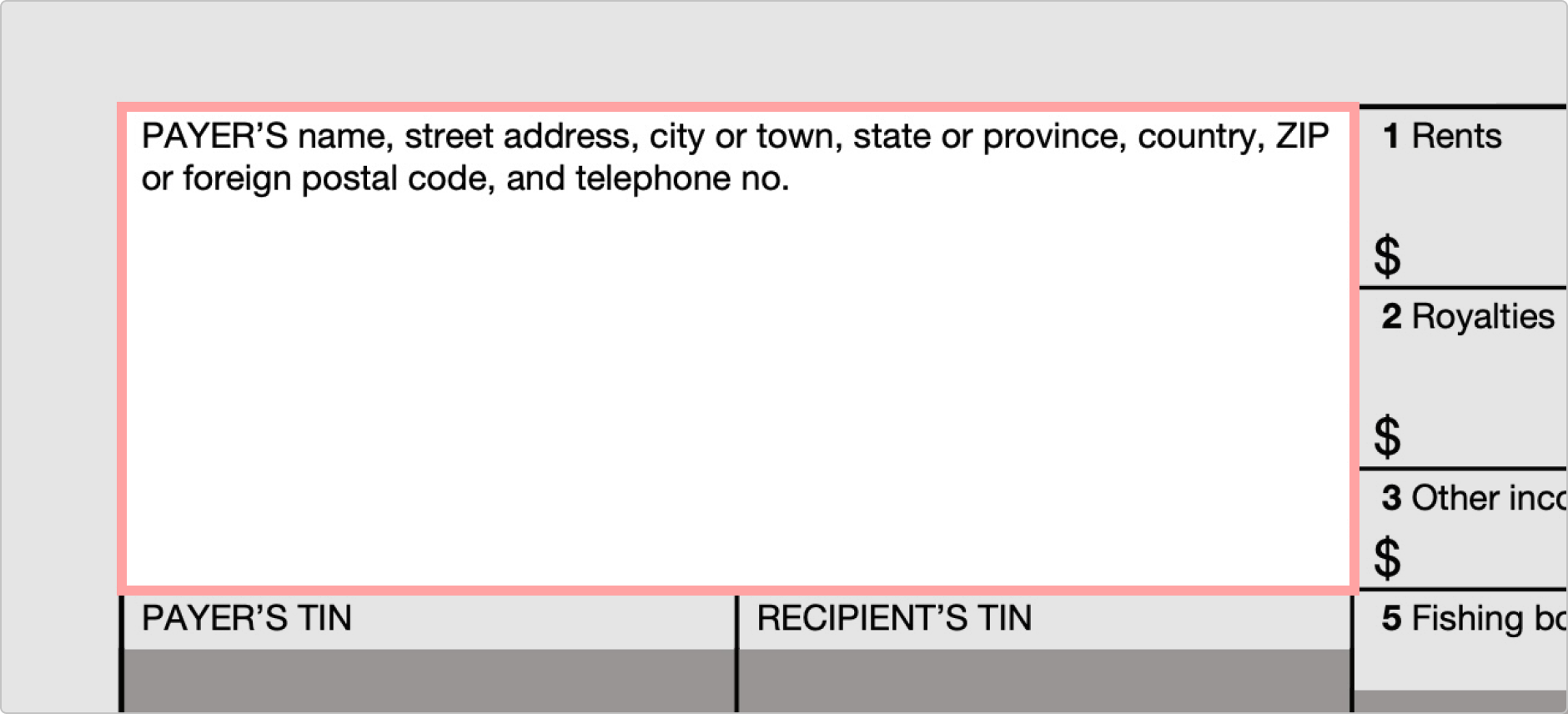

Under the checkboxes that say "VOID" and "CORRECTED" (which are only to be used in exceptional circumstances), you'll find in the upper left corner a relatively large field for the payer's name and necessary contact information.

Payer’s and Recipient’s Information

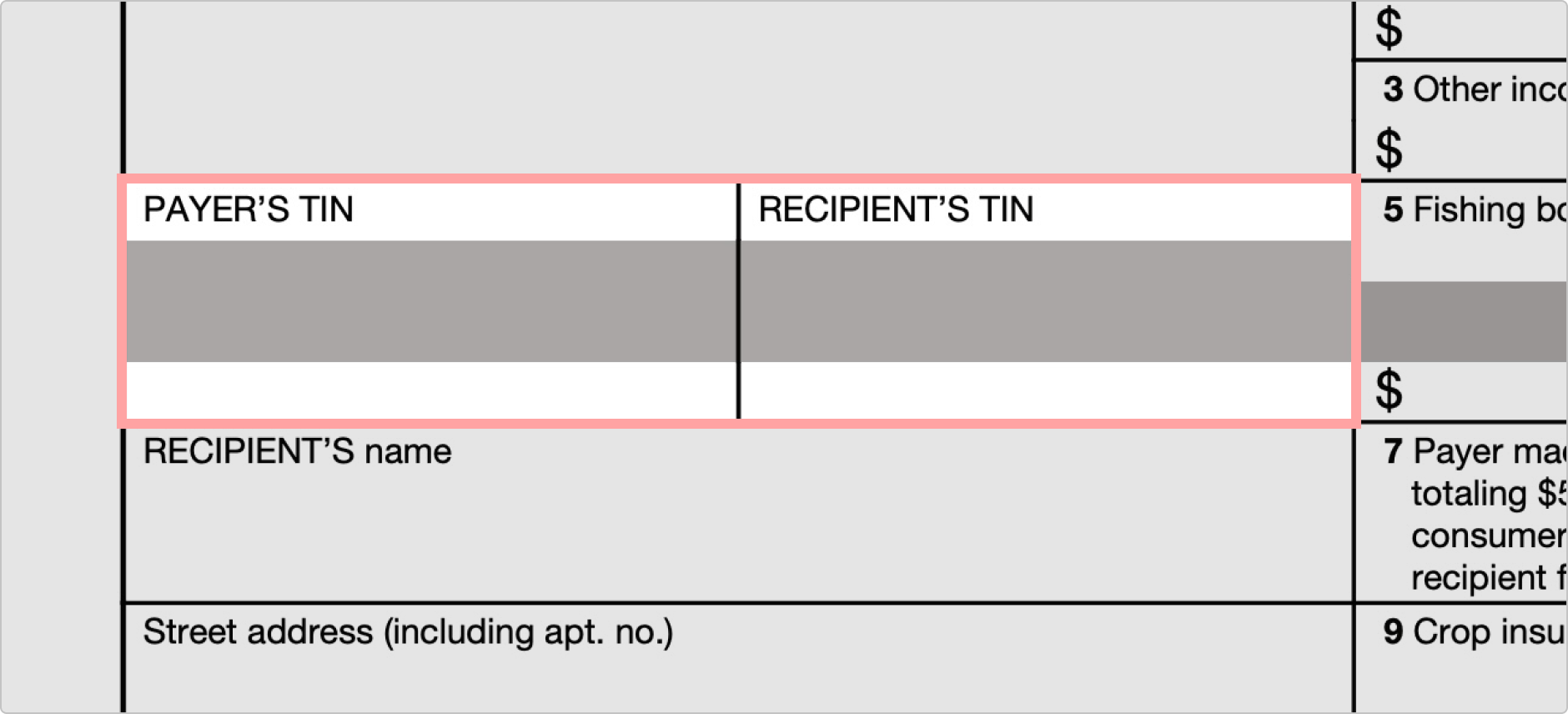

Under that large box will be two smaller fields: one on the left for the payer's federal identification number (F-EIN) and one on the right for the recipient's identification number (that's a fancy way of referring to their social security number, their taxpayer identification number (TIN), their adoption taxpayer identification number (ATIN), or their F-EIN. One thing to keep in mind is that a Box number doesn't designate this information as you'll notice on the right side of the page and other tax return documents.

Interestingly, even though the contact information for the payer was just one large box, the fields for the recipient's name, street address, city, state, and zip code are separate. These separated fields are located under the boxes for the federal identification numbers of the payer and recipient of this IRS form.

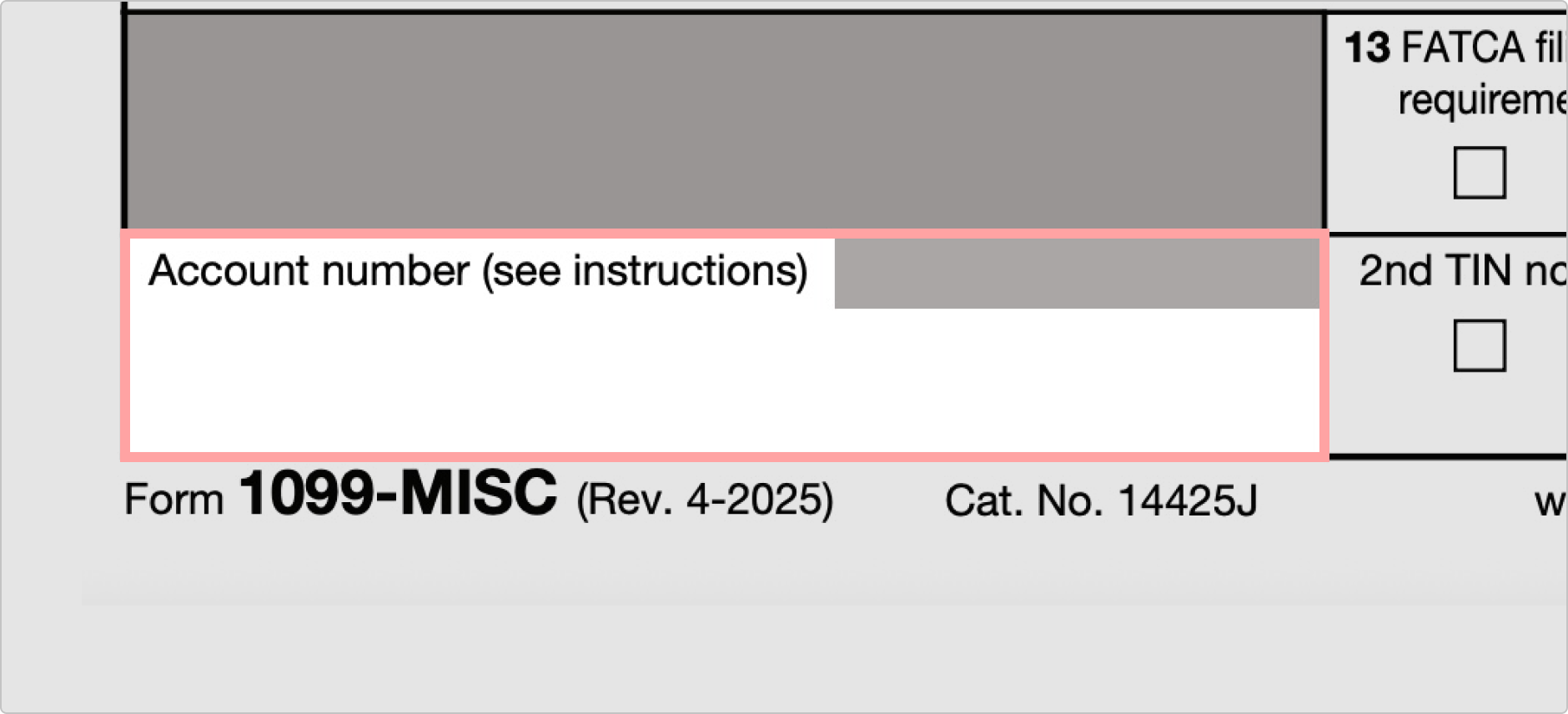

Account Number

Next, you'll see the account number field. It is located on the left side of the form, and it does not have its Box number. The account number is generally filled if the payer has multiple accounts for a recipient for whom they file more than one 1099-MISC Form.

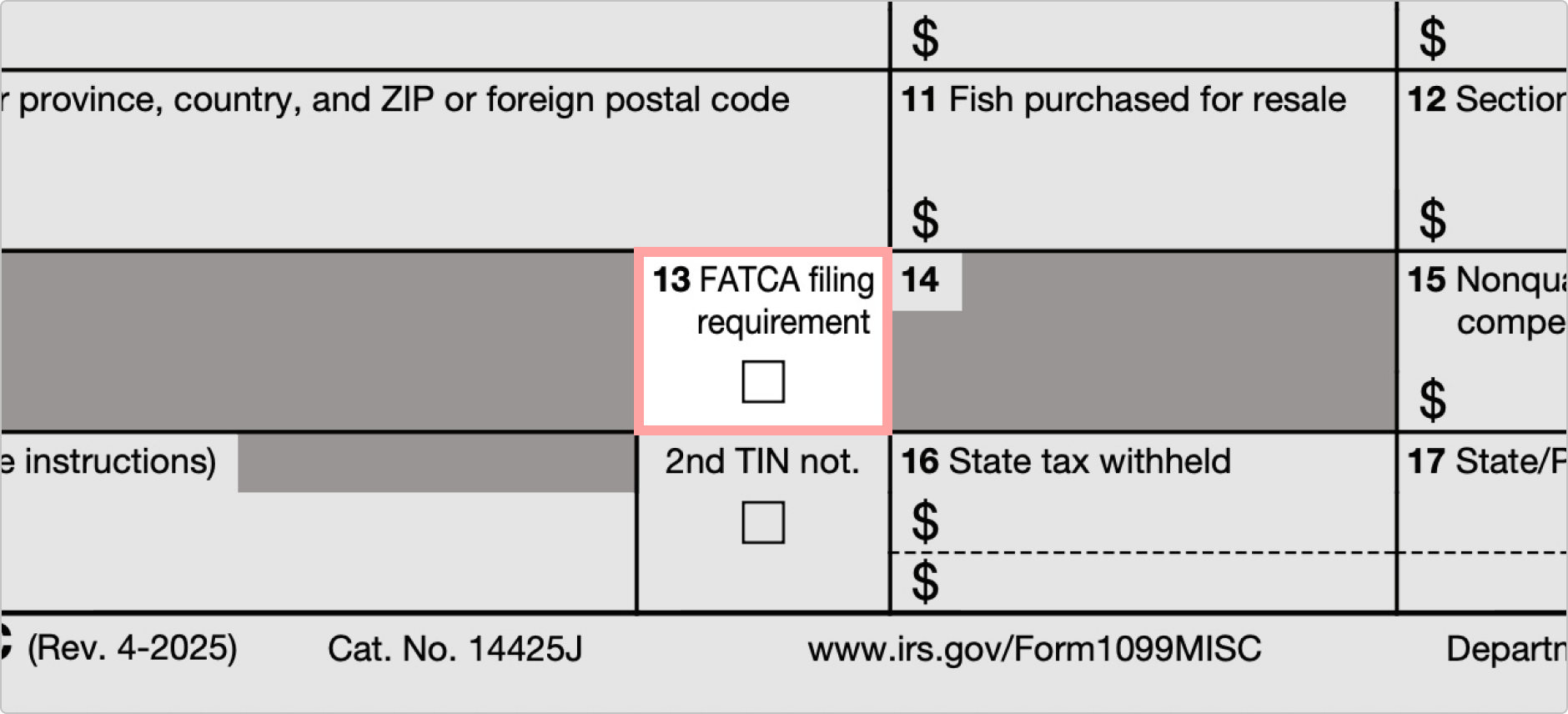

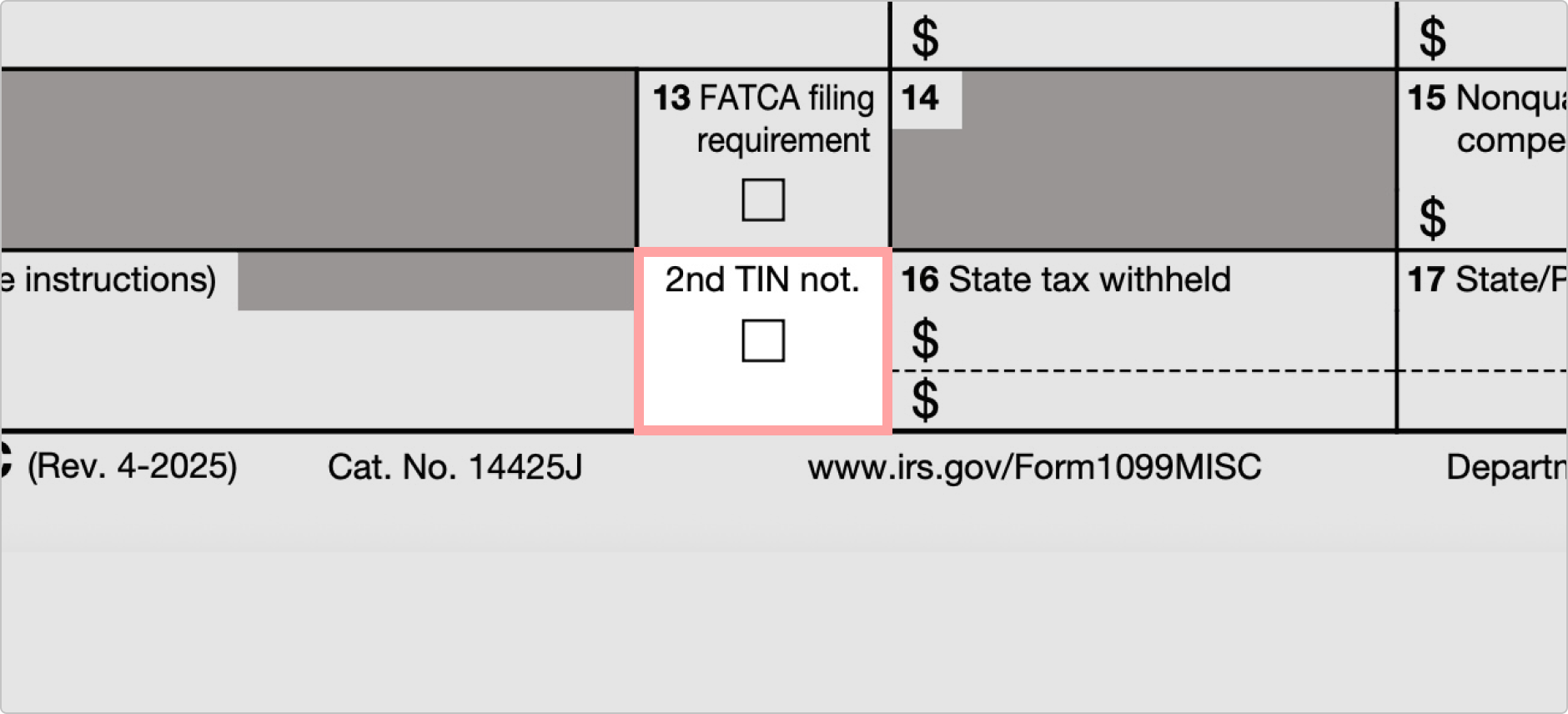

FATCA Filing Requirement Checkbox

You'll see a little checkbox for FATCA Filing Requirement. This refers to the Foreign Account Tax Compliance Act filing. You, as the payer, must be a U.S. citizen required to report specified foreign tax payments. This box has no identifying number. It is located directly to the right of the Account Number Box.

2nd TIN No.

Next to the FATCA Filing Requirement checkbox, you'll see another checkbox for 2nd TIN No. Check this box if you, as the payer, were notified twice by the IRS that the recipient's TIN was incorrect. This notification takes place over three years.

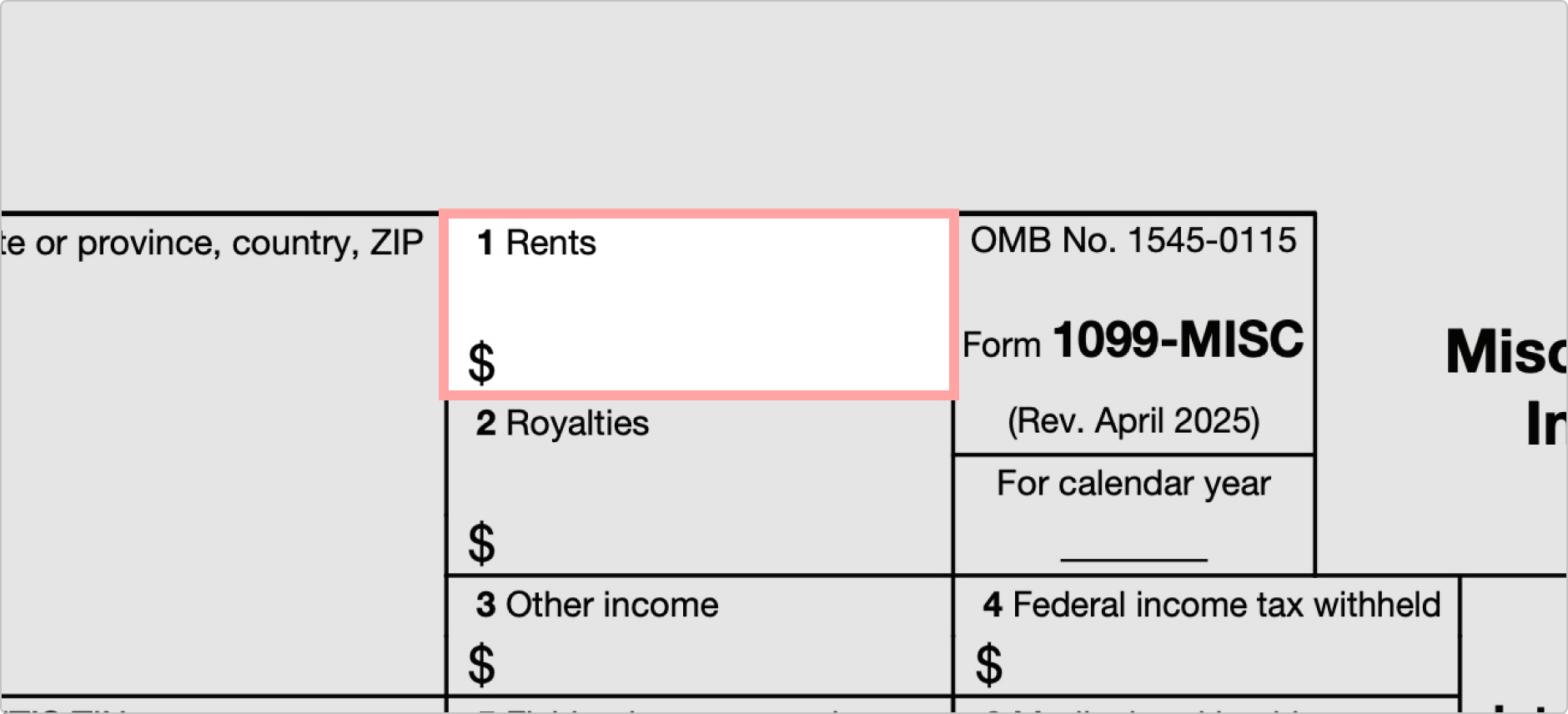

Box 1

Box 1 is located on the right side of the page. It is designated as Rents. You would report rents from real estate listed on Schedule E or Schedule C (depending on your circumstances). You can learn more about this box in the IRS instructions for the 1099-MISC Form.

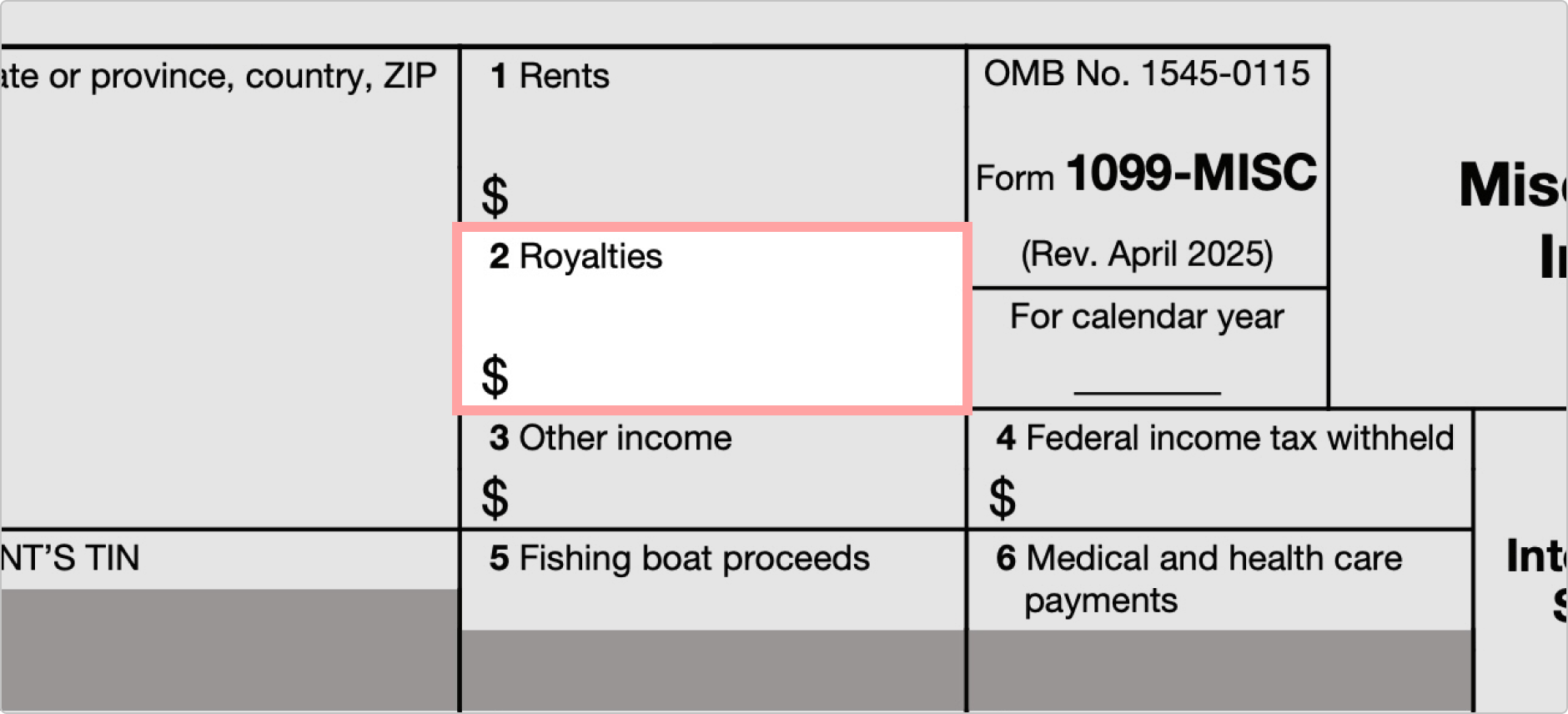

Box 2

Box 2 is designated as royalties for oil, gas, mineral properties, copyrights, and patents from Schedule E. You'd also use this box to report payments for working interest. If you receive royalties on timber, coal, or iron ore, you should consult IRS Pub. 527.

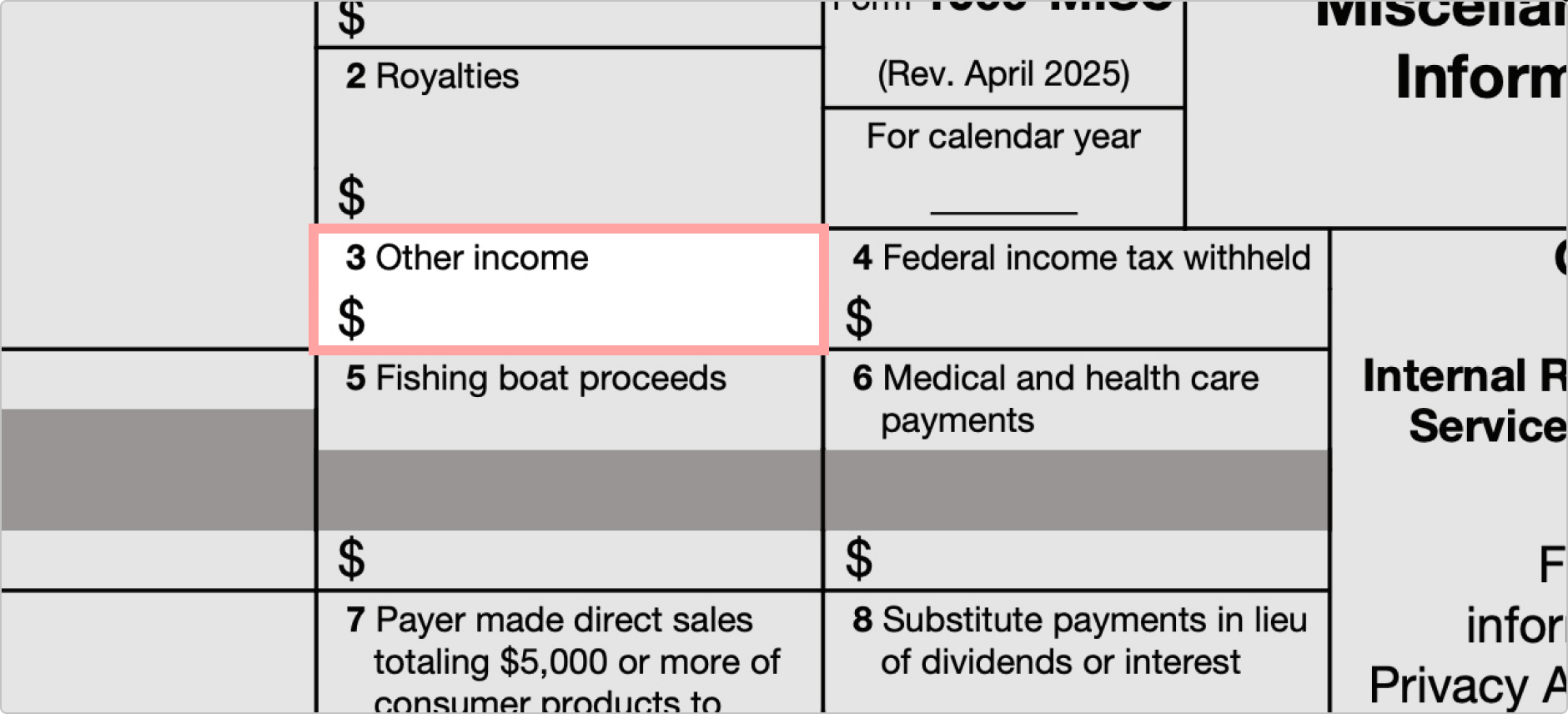

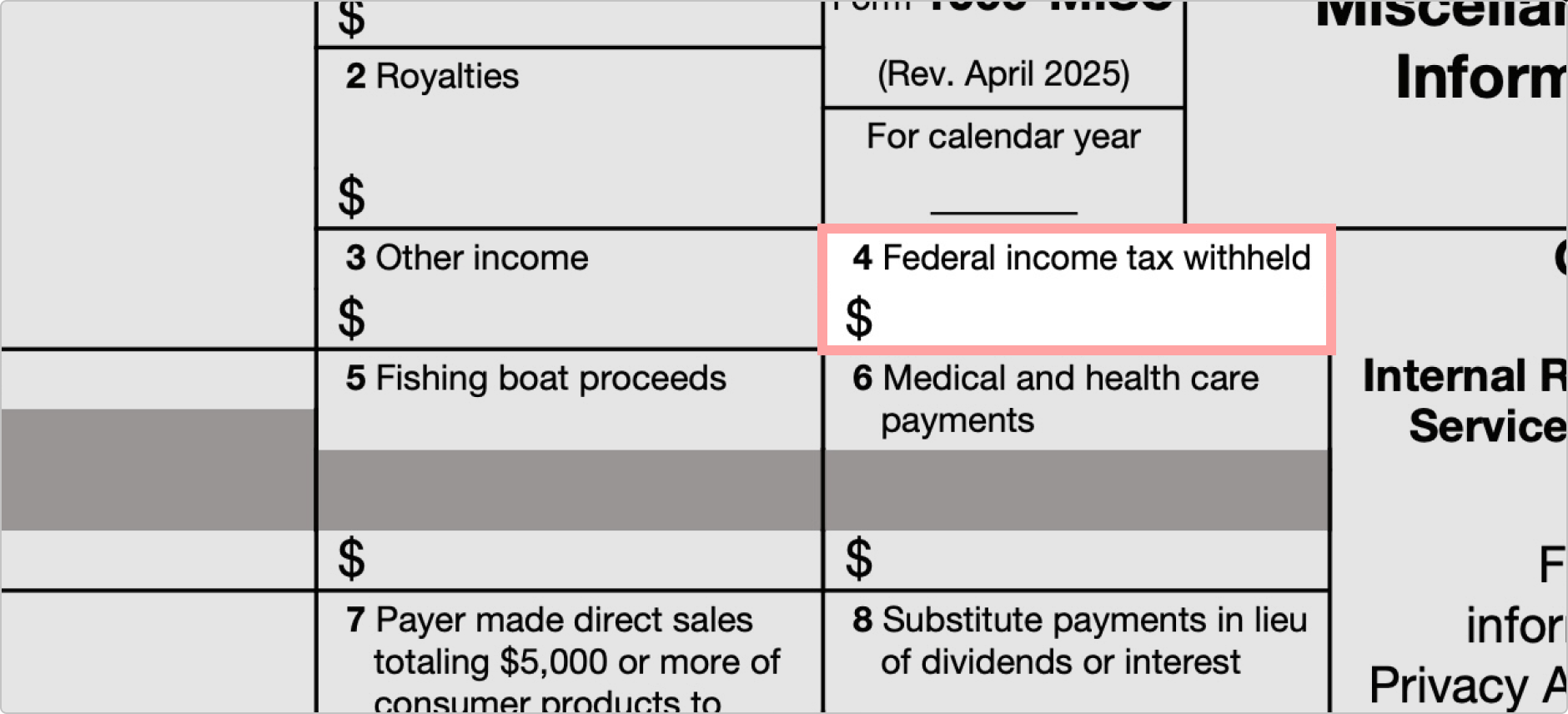

Box 3

Box 3 is used to report other income from Form 1040. You'll also identify the type of payment. For example, if you won a prize worth $650, the amount would be reported in this box, and you'd designate that as a prize. If the money is trade or business income, it is published on Schedule C or F, but will still be listed here.

Box 7

This box holds a checkbox that you will use if you made direct sales totaling $5,000 or more of consumer products to the recipient for resale. Remember that freelancers and independent contractors now have their payments reported via 1099-NEC.

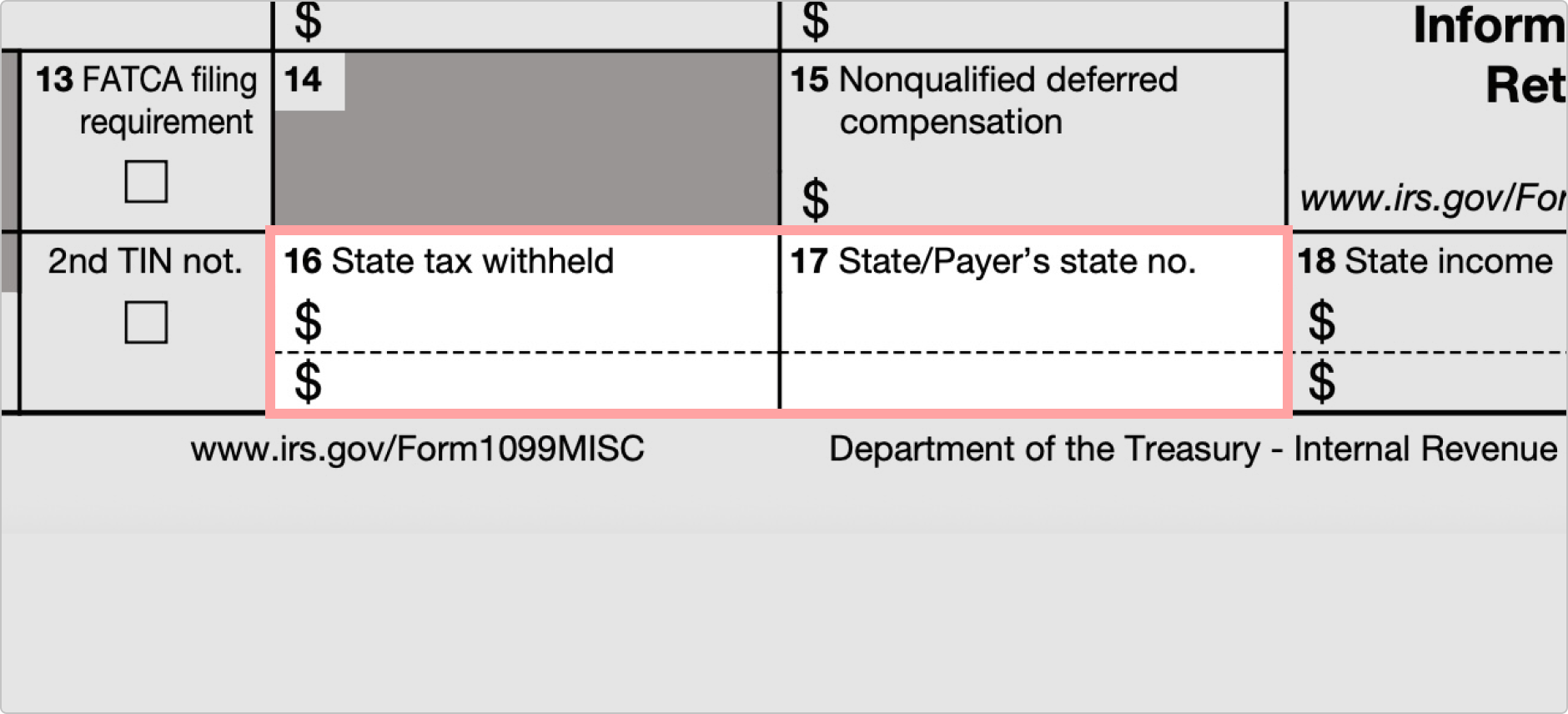

Boxes 16 & 17

Box 16 holds information for state tax withheld. There is space for two states. Box 17 records the state or payer's state numbers. You will notice that there is enough room to list information for two states.

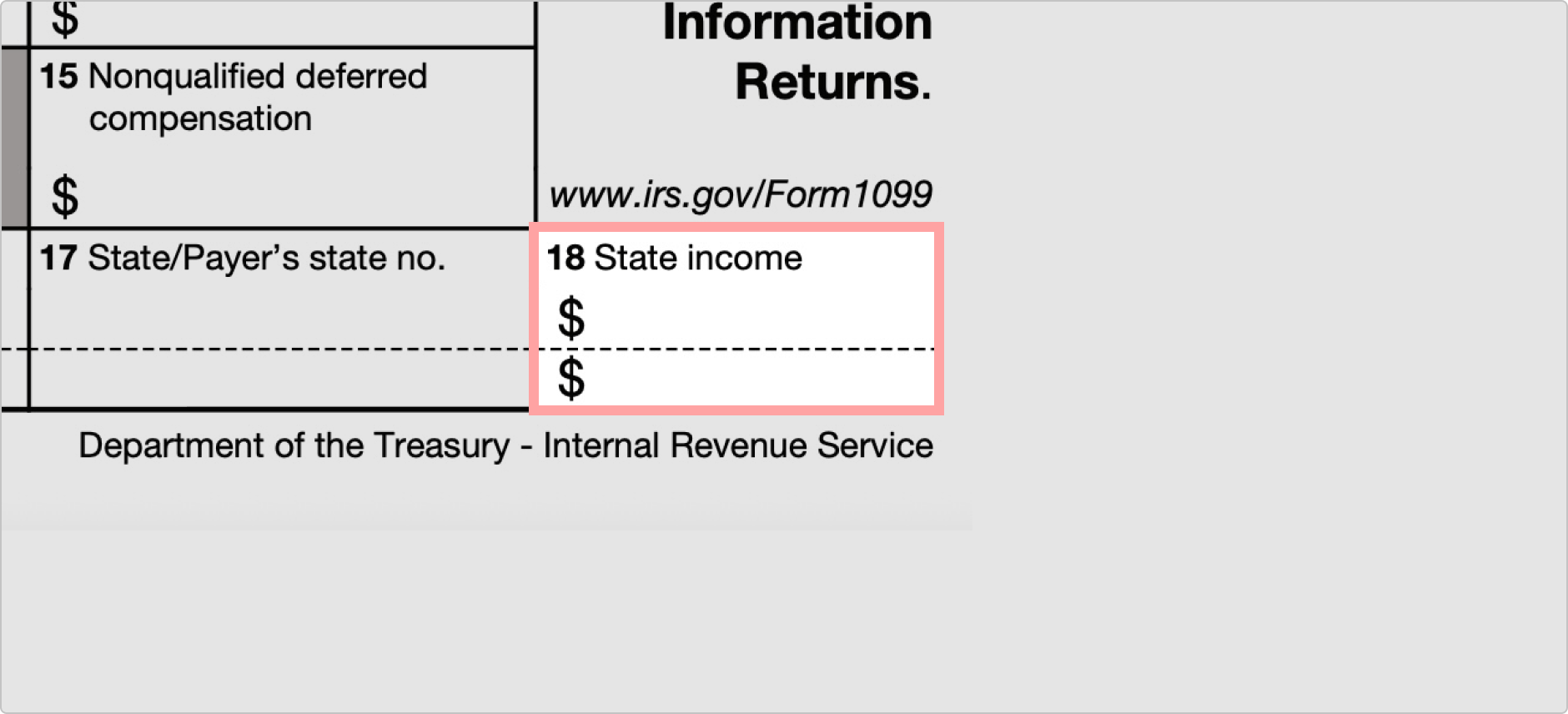

Box 18

Box 18 is used to record state income. Like the two previous boxes, there is enough room to list income for two states.

Boxes 16 through 18 track state information, and they are only provided for the payer's convenience. They do not need to be filled by the payer. Payers who familiarize themselves with these boxes will discover that it isn't so complicated after all. Once completed, the payer must send a copy of it to the Internal Revenue Service and a copy to the paid individual.

Distribution of Form Copies

1099 has several "copies." Here's the right way to distribute those:

- Copy A must be sent to the IRS. You may also need to send Copy 1 to your state's tax department.

- Copy B must be sent to the recipient.

- Copy 2 may also need to be used by the recipient for their state taxes, so make sure you give that to them.

- Copy C is for you, the payer, to retain for your records.

Important 2025 Tax Year Deadlines

For Recipients (Individuals/Businesses Receiving 1099-MISC):

- February 2, 2026: Deadline to receive 1099-MISC from payers

- April 15, 2026: Individual tax return filing deadline

For Payers (Businesses Issuing 1099-MISC):

- February 2, 2026: Deadline to provide copies to recipients

- March 2, 2026: Deadline to file with IRS (paper filing)

- March 31, 2026: Deadline to file with IRS (electronic filing)

Penalty Information:

Failing to file required 1099-MISC forms can result in penalties ranging from $60 to $340 per form, depending on how late the filing is. Intentional disregard of filing requirements can result in penalties starting at $680 per form with no maximum limit.

1099-MISC vs 1099-NEC vs W-2: Understanding the Differences

The tax landscape changed significantly in 2020 when the IRS reintroduced Form 1099-NEC and separated nonemployee compensation from Form 1099-MISC. Understanding these differences is crucial for proper tax compliance.

1099-MISC: Miscellaneous Income

- Use for: Rent, royalties, prizes, awards, legal fees, medical payments

- Threshold: $600 for most payments, $10 for royalties

- Recipients: Individuals and businesses receiving miscellaneous payments

- Tax Responsibility: Recipients handle their own tax payments

1099-NEC: Nonemployee Compensation

- Use for: Independent contractor and freelancer payments

- Threshold: $600 or more in compensation

- Recipients: Contractors, freelancers, consultants

- Tax Responsibility: Recipients pay self-employment taxes

Key Changes Since 2020

Before 2020, contractor payments were reported in Box 7 of Form 1099-MISC. The IRS separated this into Form 1099-NEC to streamline reporting and reduce confusion. This change affects millions of businesses and contractors who must now use the correct form for proper tax compliance.

Frequently Asked Questions

What is the 1099-MISC filing deadline for 2025?

For the 2025 tax year, 1099-MISC forms must be provided to recipients by February 2, 2026. For filing with the IRS: March 2, 2026 if filing on paper, or March 31, 2026 if filing electronically.

What's the difference between 1099-MISC and 1099-NEC?

Starting in 2020, the IRS separated nonemployee compensation from Form 1099-MISC into the dedicated 1099-NEC form. Use 1099-NEC for contractor and freelancer payments of $600+, while 1099-MISC is now used for rent, prizes, awards, royalties, and other miscellaneous income types.

What's the difference between 1099-MISC and W-2?

W-2 forms are for employees with taxes automatically withheld by employers, while 1099-MISC forms report miscellaneous income where no taxes are typically withheld. Recipients of 1099-MISC forms are responsible for paying their own taxes on the reported income.

Who needs to receive a 1099-MISC form?

Businesses must send 1099-MISC forms to individuals or entities who received $600 or more in miscellaneous income during the tax year. This includes rental payments, prizes and awards, royalties ($10 minimum), medical payments, legal fees, and other miscellaneous business payments.

Do I need to send a 1099-MISC for payments under $600?

No, you're not required to send a 1099-MISC for payments under $600 (except royalties which have a $10 threshold). However, recipients must still report all income on their tax returns regardless of whether they receive a 1099-MISC form.

What types of income are reported on 1099-MISC?

1099-MISC reports various types of miscellaneous income including: rents ($600+), royalties ($10+), prizes and awards ($600+), medical and healthcare payments, legal services payments, crop insurance proceeds, and fishing boat proceeds.

Can I use 1099-MISC for contractor payments?

No, since 2020, contractor and freelancer payments are reported on Form 1099-NEC, not 1099-MISC. Only use 1099-MISC for the specific types of miscellaneous income listed in the current IRS guidelines.

Common 1099-MISC Issues and Solutions

For Recipients:

Issue: I didn't receive my 1099-MISC

- Contact the payer by February 2nd if you haven't received your form

- You must still report all income even without receiving the form

- Keep records of all payments received during the tax year

Issue: The amount on my 1099-MISC is incorrect

- Contact the payer immediately to request a corrected form

- The payer must issue a corrected 1099-MISC marked "CORRECTED"

- Do not file your taxes until you receive the corrected form

Issue: I received a 1099-MISC but shouldn't have

- This may happen if you were misclassified as an independent contractor

- Contact the payer to discuss your employment classification

- The payer may need to issue a corrected form with $0 amounts

For Payers:

Issue: I'm not sure if I need to issue a 1099-MISC

- Issue for miscellaneous payments of $600+ (except royalties at $10+)

- Not required for payments to corporations (with some exceptions)

- Not required for employee payments (use W-2 instead)

Issue: The recipient won't provide their Tax ID number

- You may need to implement backup withholding at 24%

- Request Form W-9 from all potential recipients before making payments

- Consult IRS Publication 1281 for backup withholding procedures

More resources