What is a 1099-INT?

The 1099-INT Form is used for tax filing purposes. It is used to report interest earned. Interest earned must be notified if the amount received is more significant than $10. This interest is usually paid from a bank or government agency. Interest earned must be included as part of your earned income when you file your taxes. If you think you should have received one from your financial institution, contact them.

Generally, the form must be issued by the end of January or February. The information on this tax form will then be placed in the appropriate spot on your tax return forms. If your income tax return reports $1,500 or more in taxable interest, you should also file a Schedule B.

If you are self-employed, this is not the form that is used to report your income. You need a 1099-NEC.

How To Fill Out A 1099-INT Form Step By Step

A 1099-INT Form is a relatively simple tax document. Its purpose is to report to the Internal Revenue Service how much interest income you accrued over the tax year. Remember that this form is required if you earn $10 or more in interest income. As with many tax forms, even a brief document like the 1099-INT can be intimidating. To help you out, we've broken down the material into parts and provided a basic 1099-INT template to help you understand the reporting requirements.

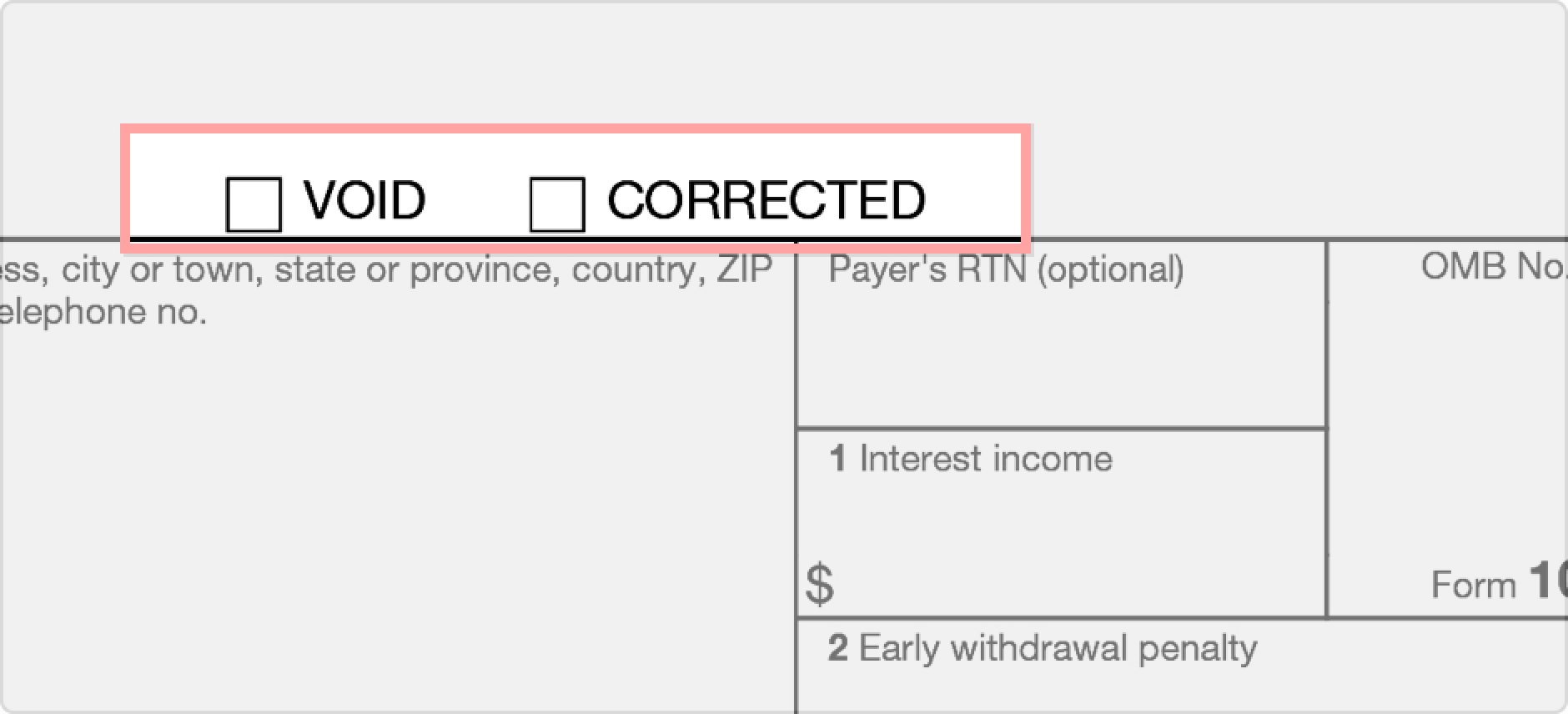

Check Boxes

Before anything else on the 1099-INT, you'll see two checkboxes at the top of the form: Void and Corrected. If you're filling out the 1099-INT to correct inaccurate information, you'll choose Corrected. You will use Void if you need to cancel a previous 1099-INT. This is very important to maintain the accuracy of your tax information.

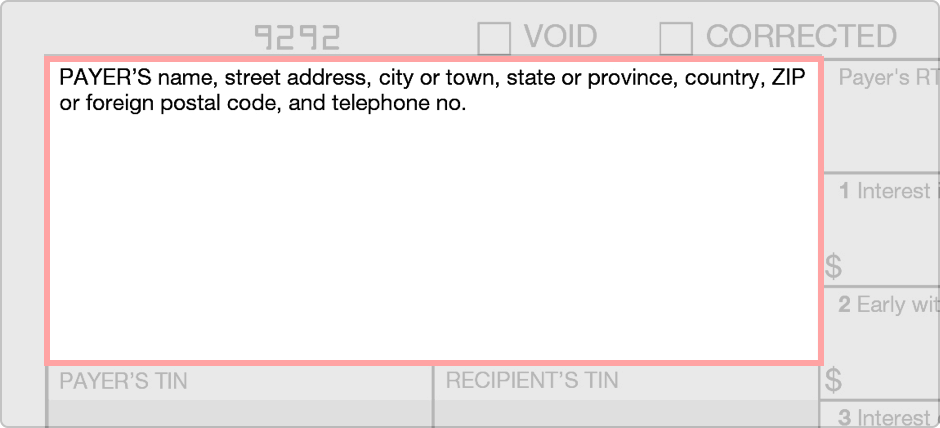

Payer Information

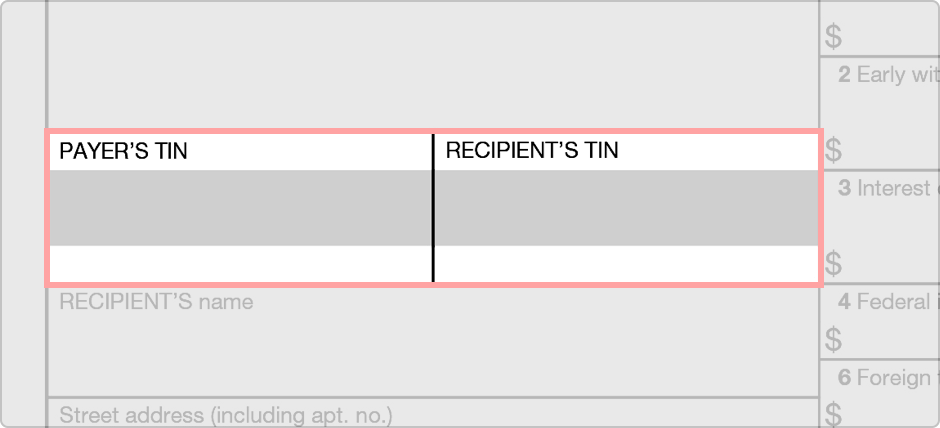

This includes full legal name, address, and contact information. This form can also be used if you're receiving interest from a foreign entity. Directly under that massive box, you'll see a small box that requests the payer's TIN. A TIN is a tax identification number.

Above the box that requests the recipient's name, you'll see a smaller box labeled as Recipient's TIN. If you are the named recipient, your tax identification number (TIN) goes in that box. It could be your social security number. If you're a business, it could list your federal EIN.

Next, you'll enter the recipient's full legal name, address, city, state, or zip code.

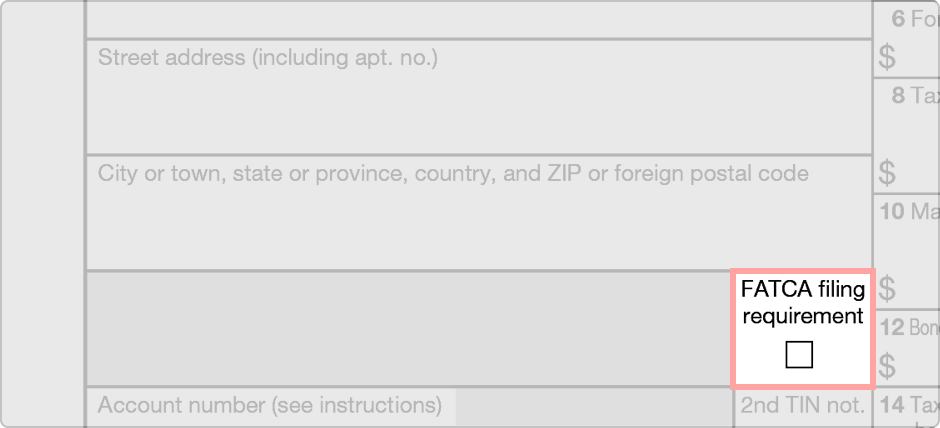

FATCA Filing Requirement Check Box

This box will be checked if a U.S. taxpayer uses the form to satisfy their requirement to report a U.S. account. Recipients aren't generally the ones who must worry about this box. This box is checked (or not reviewed!) by the institution that sends out the form.

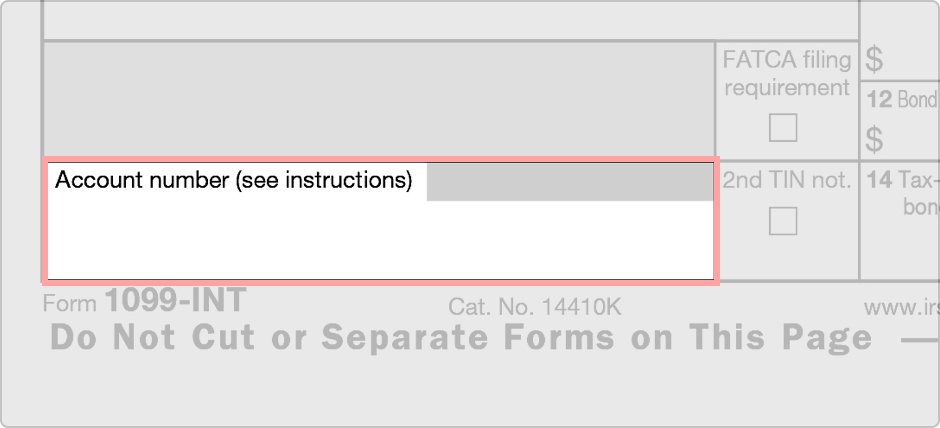

Account Number

On the left side of the form, you'll see a box labeled Account Number. This is a box completed by the sender. It is used only if you have more than one account and need more than one 1099-INT. The other time this box is filled out is if the sender checks the FATCA filing requirement box.

As the recipient, you can put account information in the box if it is empty. It is not required, but according to the instructions for completing this IRS form, it is good. As you can probably imagine, writing the one on the way can help you determine which account you received for if you have more than one account or if you're audited.

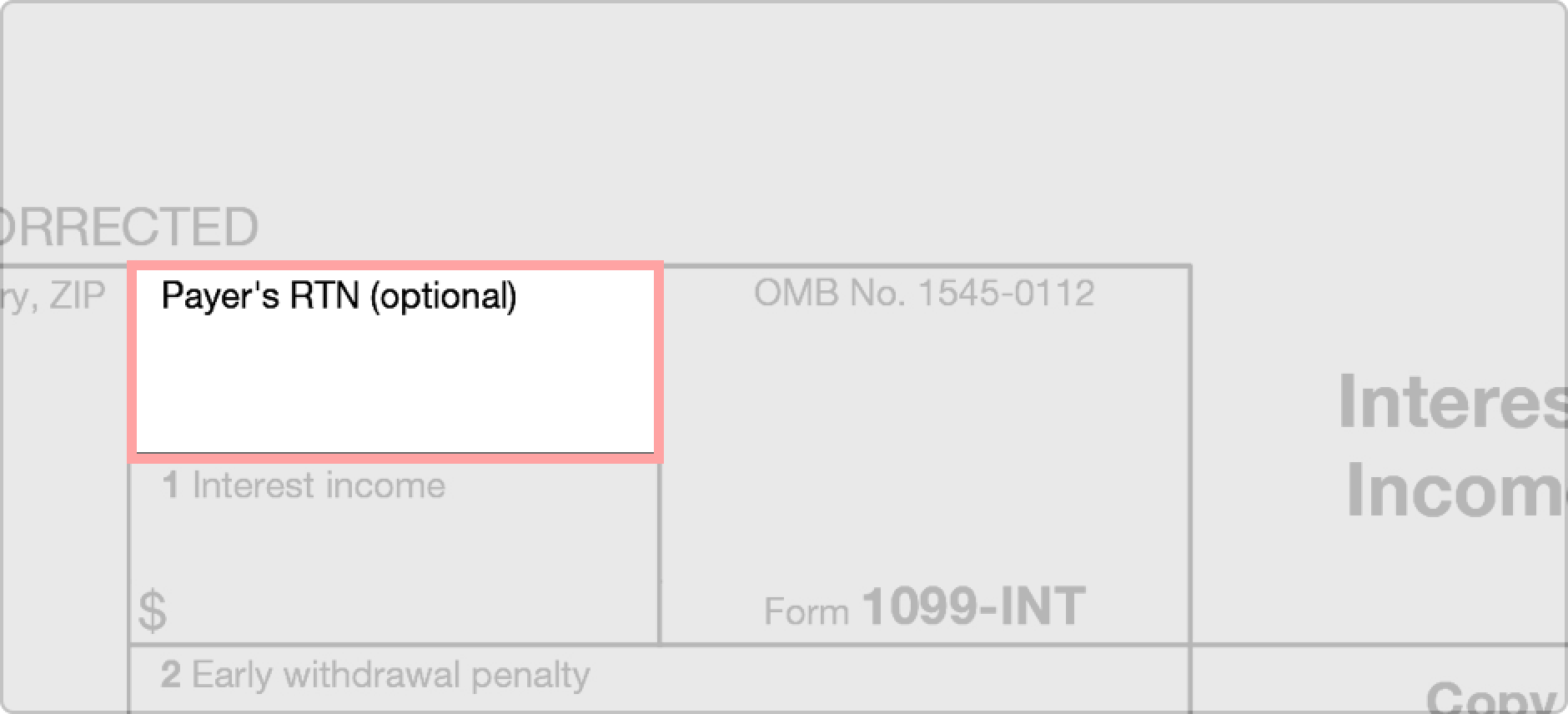

Payer’s RTN (Optional)

On the right side of the payer's and the recipient's information, you'll see a box labeled as Payer's RTN (optional). If the payer participates in a program that provides a direct deposit of refunds, they could enter their routing and transit number in that box.

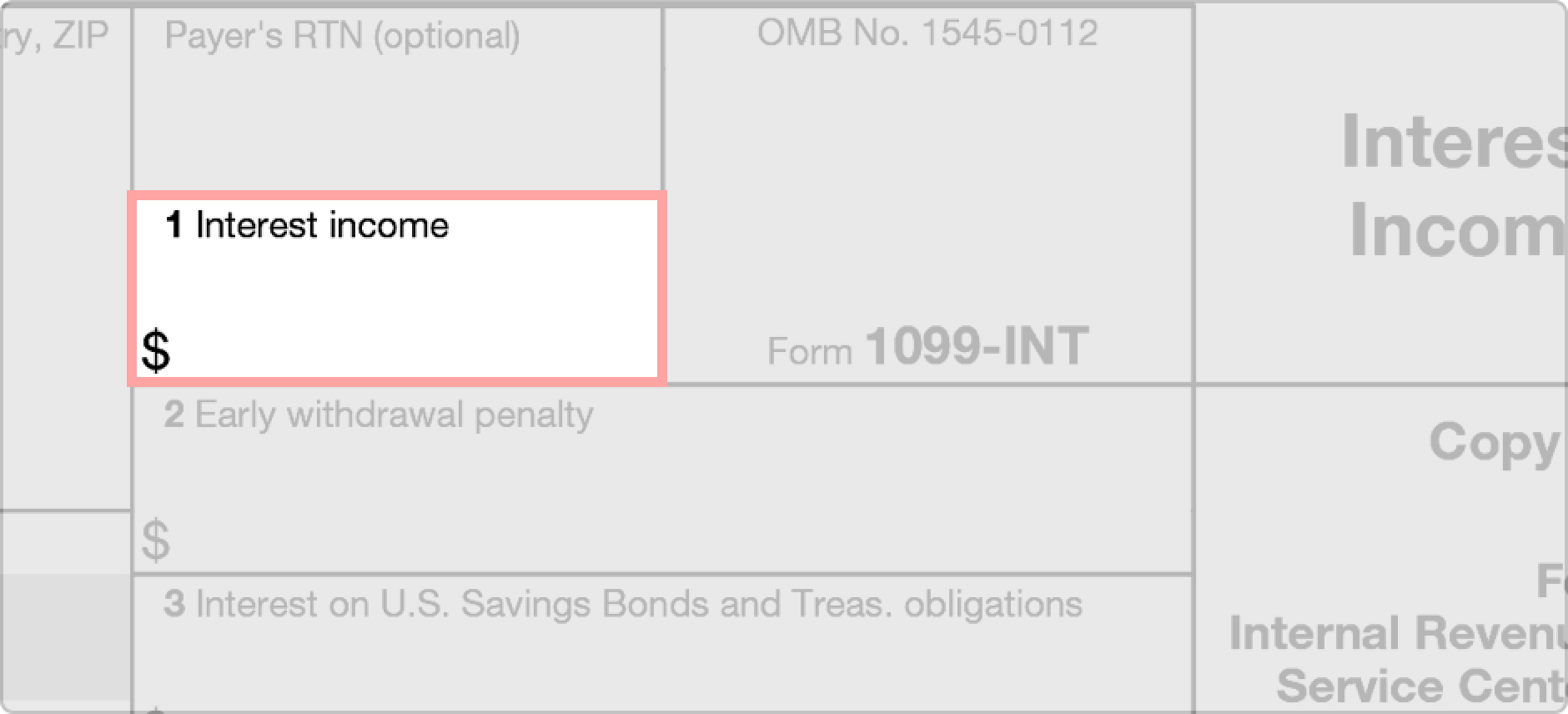

Box 1 - Interest Income

This box lists the amount of taxable interest accrued that is $10 or more. It doesn't necessarily have to be designated as interest. It just needs to be paid or credited toward the recipient's account by a savings and loan association, mutual savings bank without capital stock, shares, building and loan associations, credit union, or a similar organization.

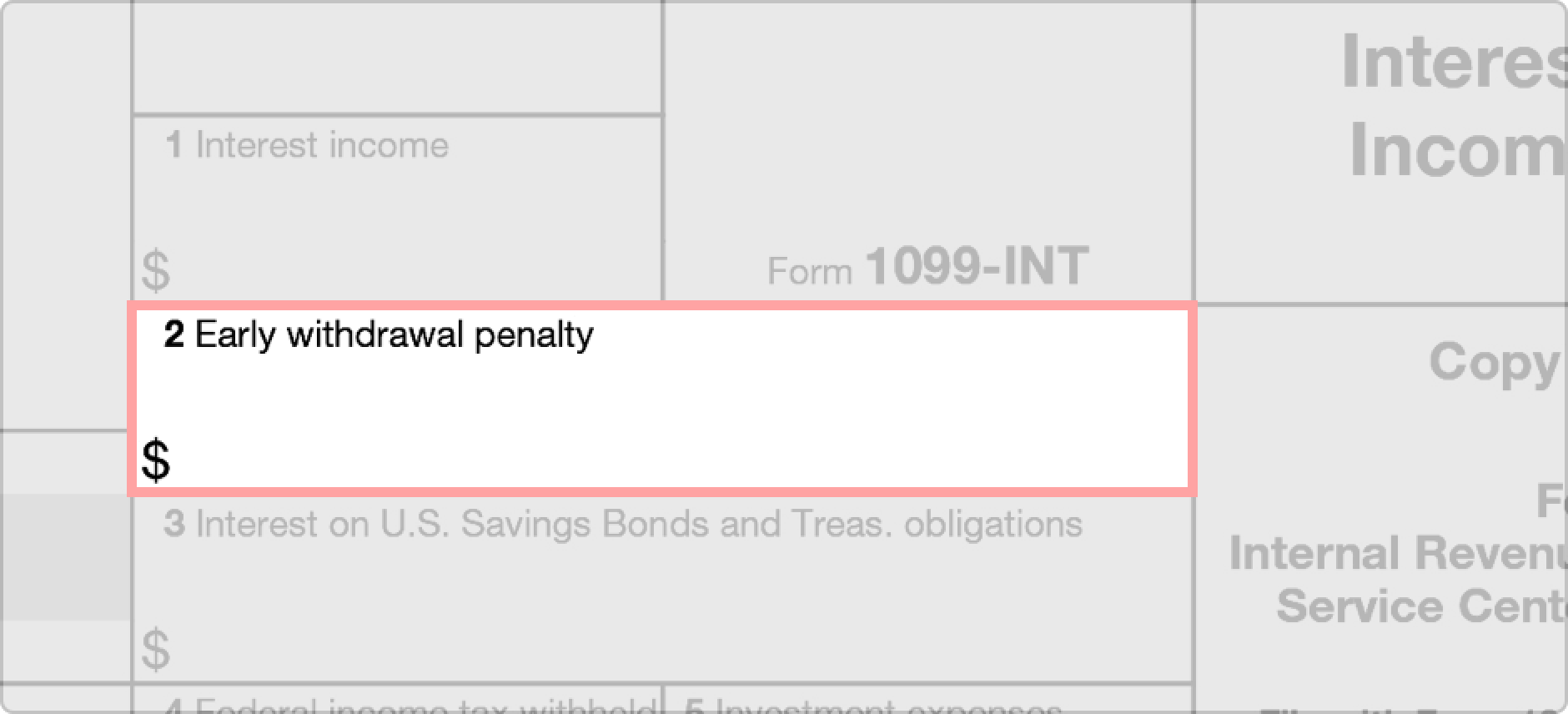

Box 2 - Early Withdrawal Penalty

If the recipient forfeited interest or principal because of an early withdrawal on certain items, such as on a deposit certificate, that amount would be listed here. According to the IRS' instructions for the 1099-INT, this amount is deductible from your gross income. However, this amount is NOT deducted (and should NOT be deducted) from the amount in Box 1.

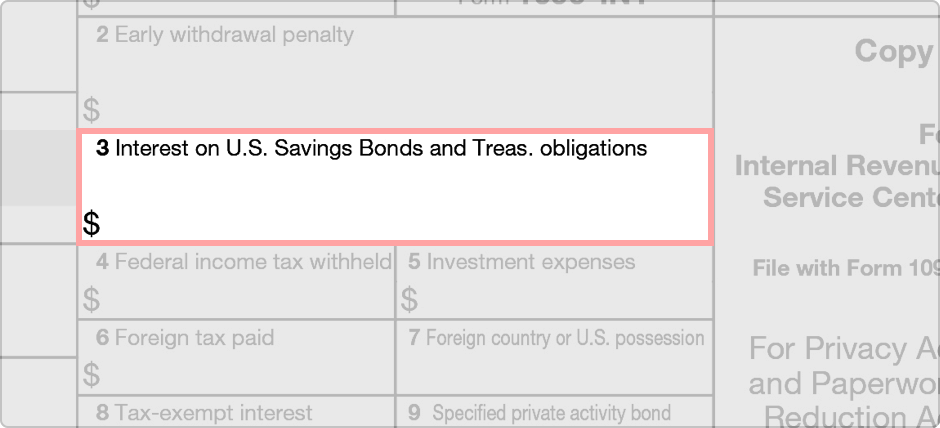

Box 3 - Interest on U.S. Savings Bonds and Treas. Obligations

Interest for U.S. Savings Bonds, Treasury bills, Treasury notes, and Treasury bonds are recorded here, but the amount is NOT included in Box 1.

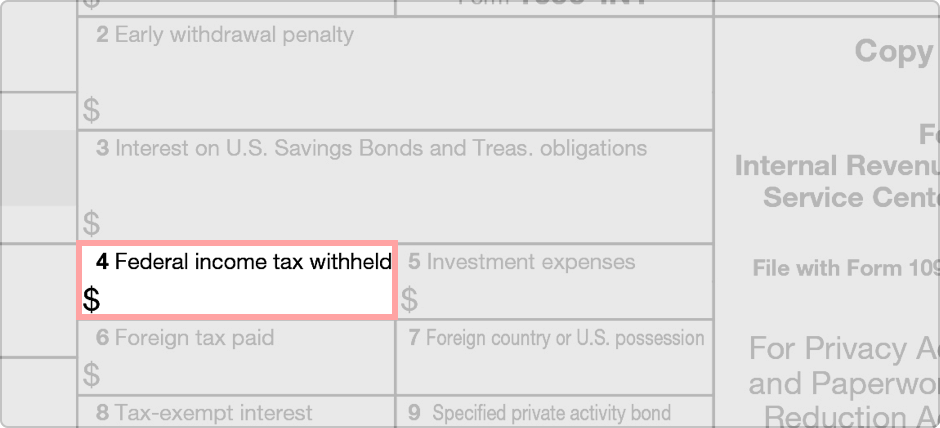

Box 4 - Federal Income Tax Withheld

The payer uses this box to record the amount of backup withholding it performed. This is usually done if the payer doesn't have the recipient's TIN on file. The amount withheld is 28% according to the IRS's instructions for form 1099-INT. This information may be quite useful for your federal tax return.

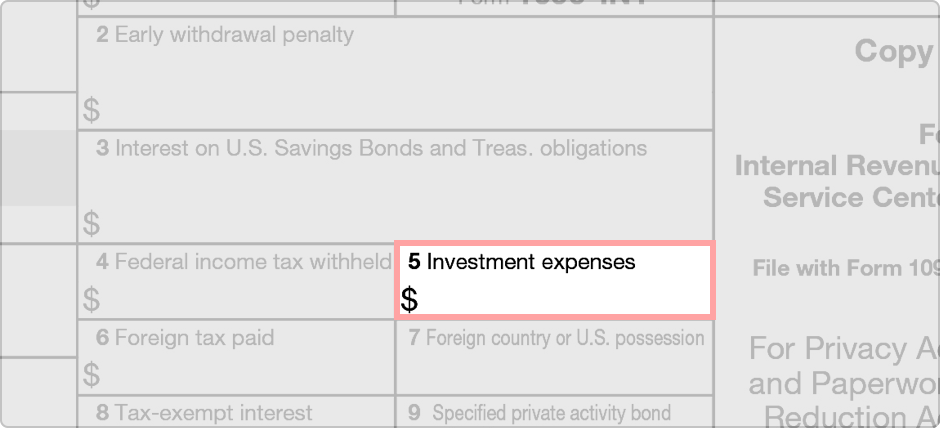

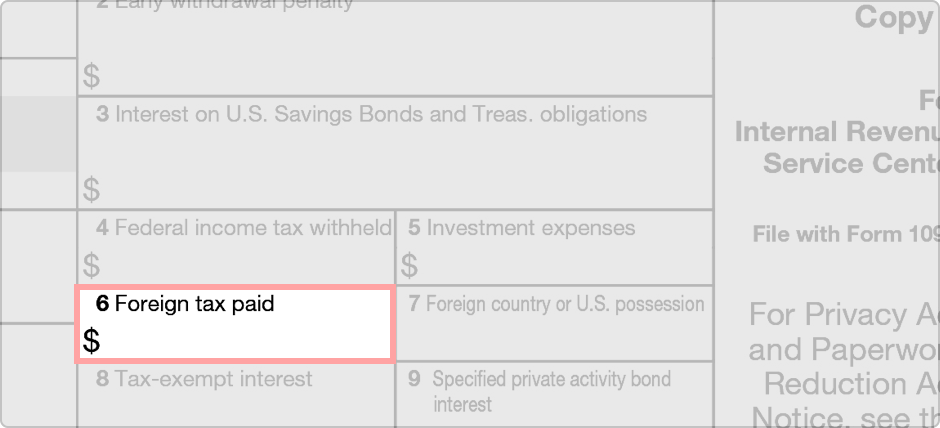

Box 6 - Foreign Tax Paid

If foreign tax was paid on the interest, that amount is listed here in U.S. dollars.

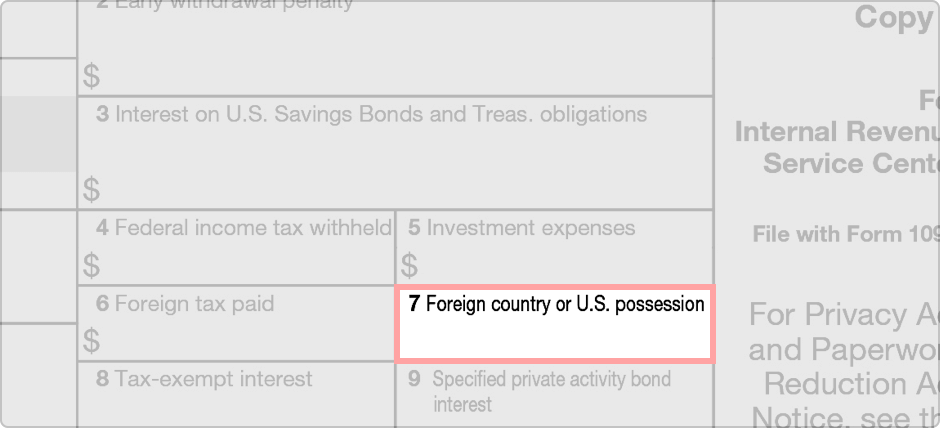

Box 7 - Foreign Country or U.S. Possession

The name of the foreign country or U.S. possession to which the tax was paid in Box 6 is listed here.

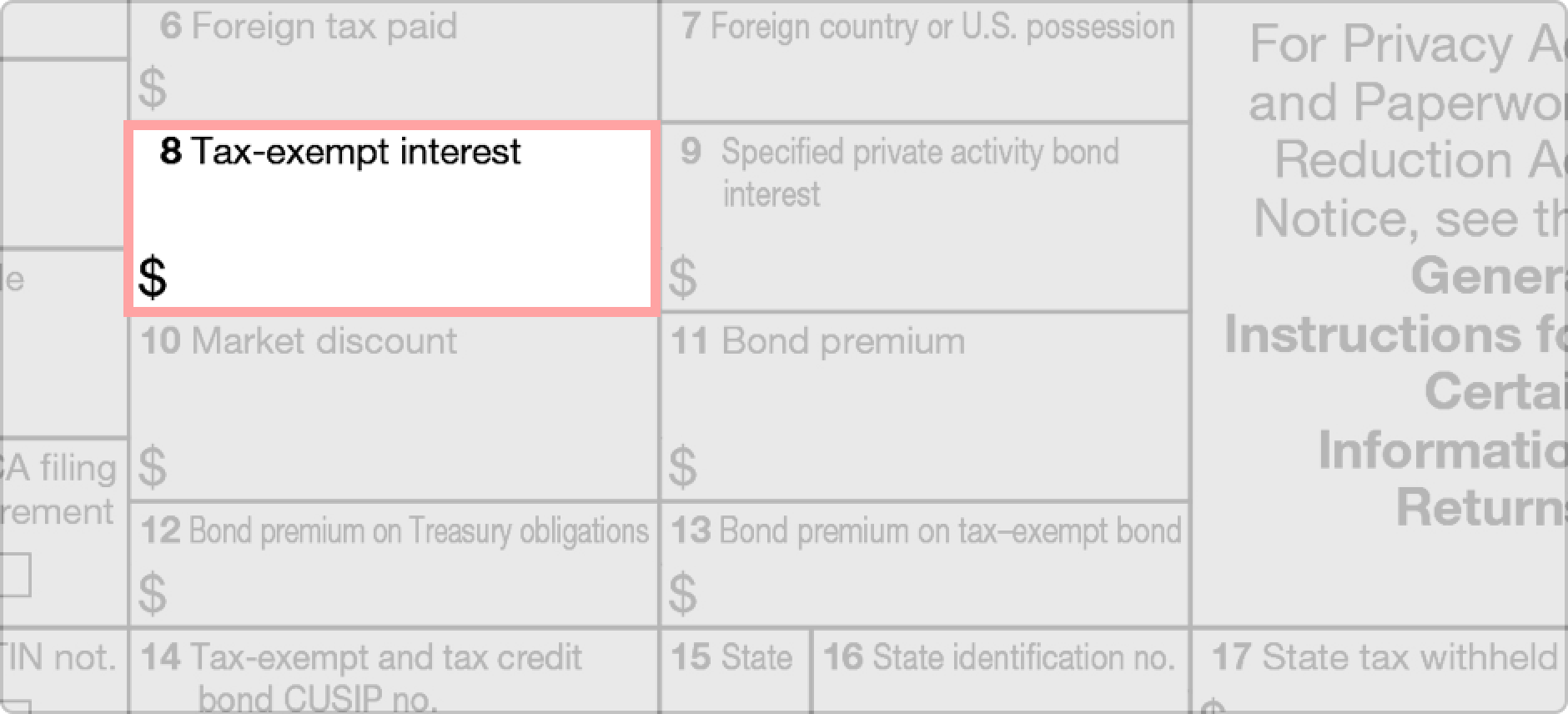

Box 8 - Tax-exempt Interest

Any amount of tax-exempt interest credited or paid to the recipient's account is listed here if, and only if, that interest is used to finance government operations and was issued by a state, D.C., a U.S. possession, a tribal government, specific political subdivisions, and individual qualified volunteer fire departments.

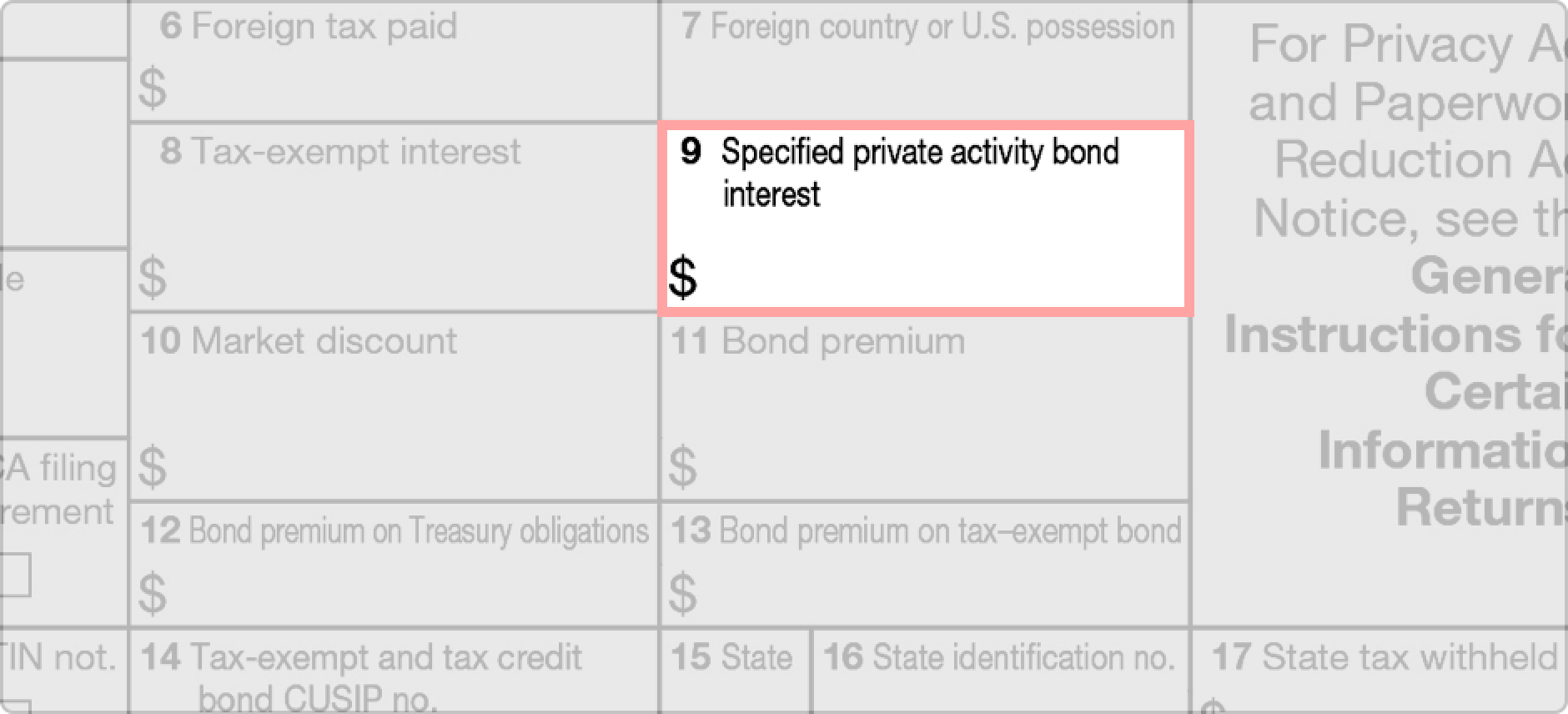

Box 9 - Specified Private Activity Bond Interest

Any interest of $10 or higher from specified private activity bonds will be reported in this box.

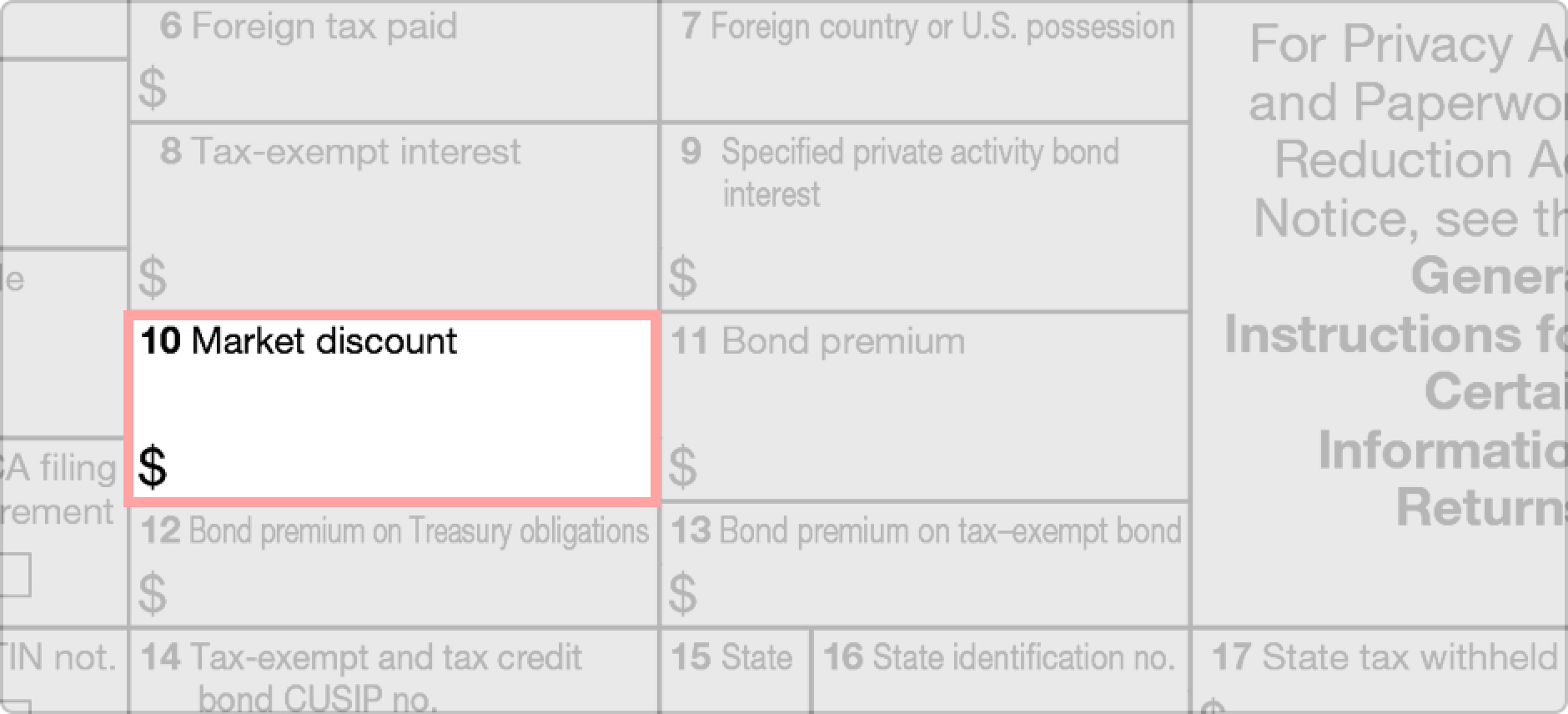

Box 10 - Market Discount

This applies to covered securities that were acquired with a market discount. If you're a recipient and there's a dollar amount in this box, and you don't believe it should apply to you, contact the payer to discuss it.

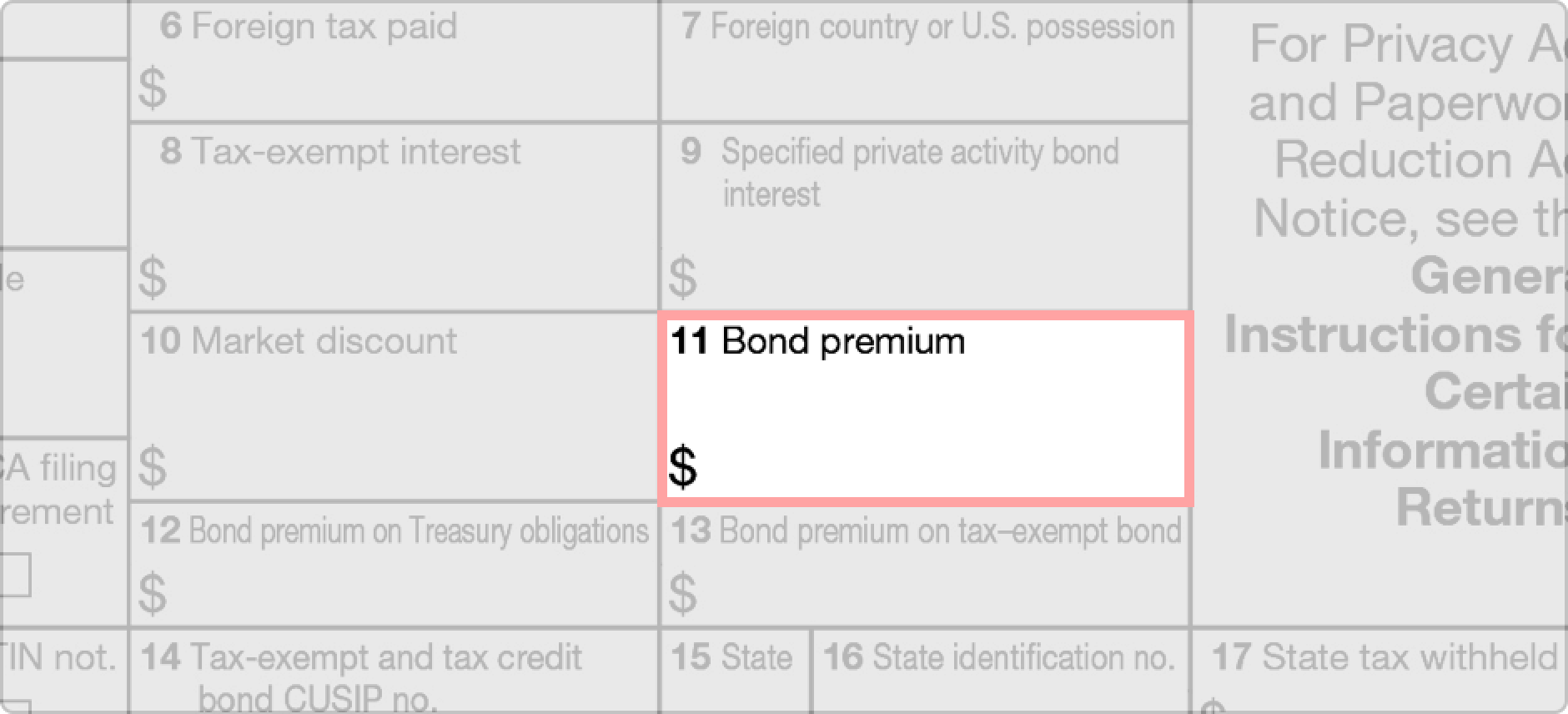

Box 11 - Bond Premium

This box records the taxable covered security that was acquired at a premium amortization. If you're a recipient and there's a dollar amount in this box, and you don't believe it should apply to you, contact the payer to discuss the issue.

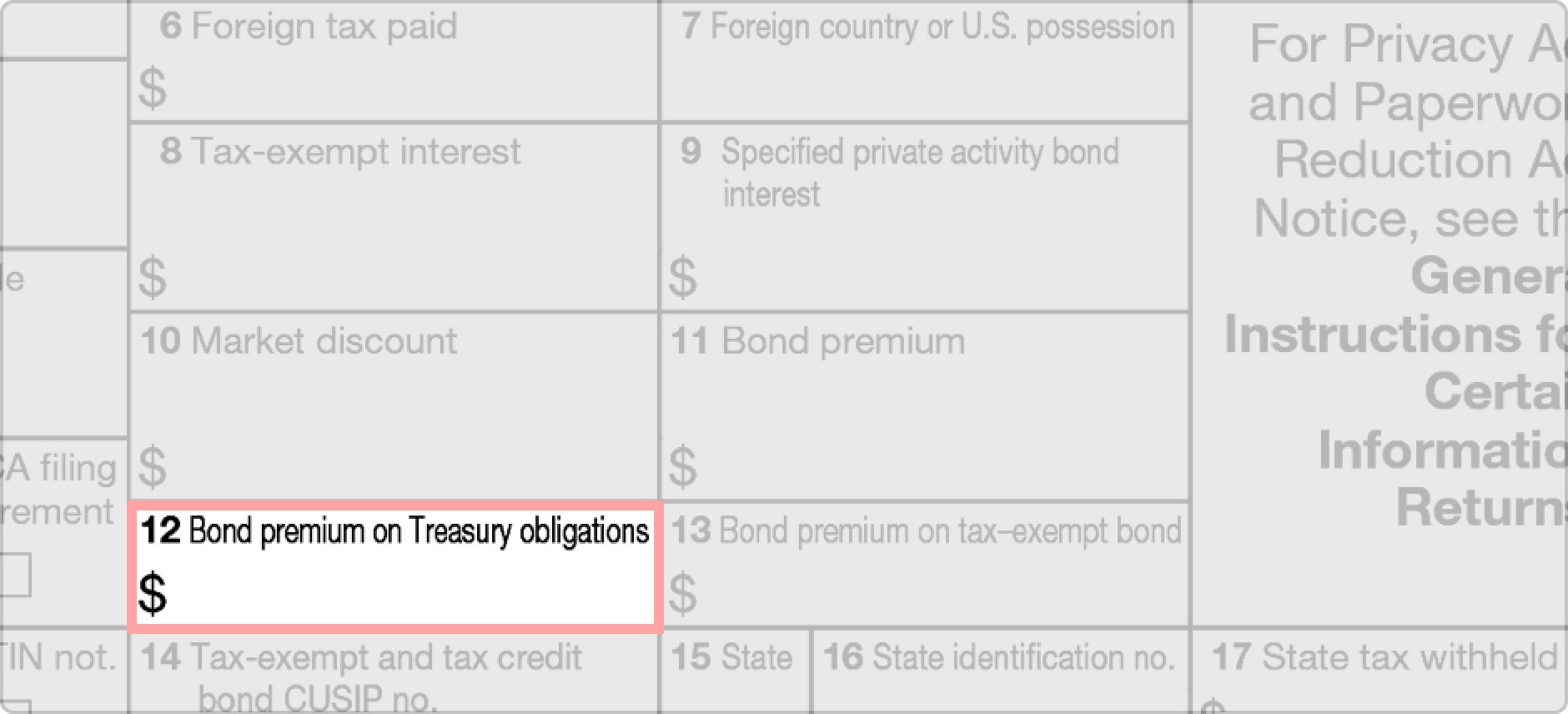

Box 12 - Bond Premium on Treasury Obligations

Covered securities that are a U.S. Treasury obligation have interest payments $10 or higher are listed here. The amount of the bond premium was amortized. If you believe that your bond premium shouldn't have been amortized, you should contact the payer. However, for it to not be depreciated, you must notify the payer in writing.

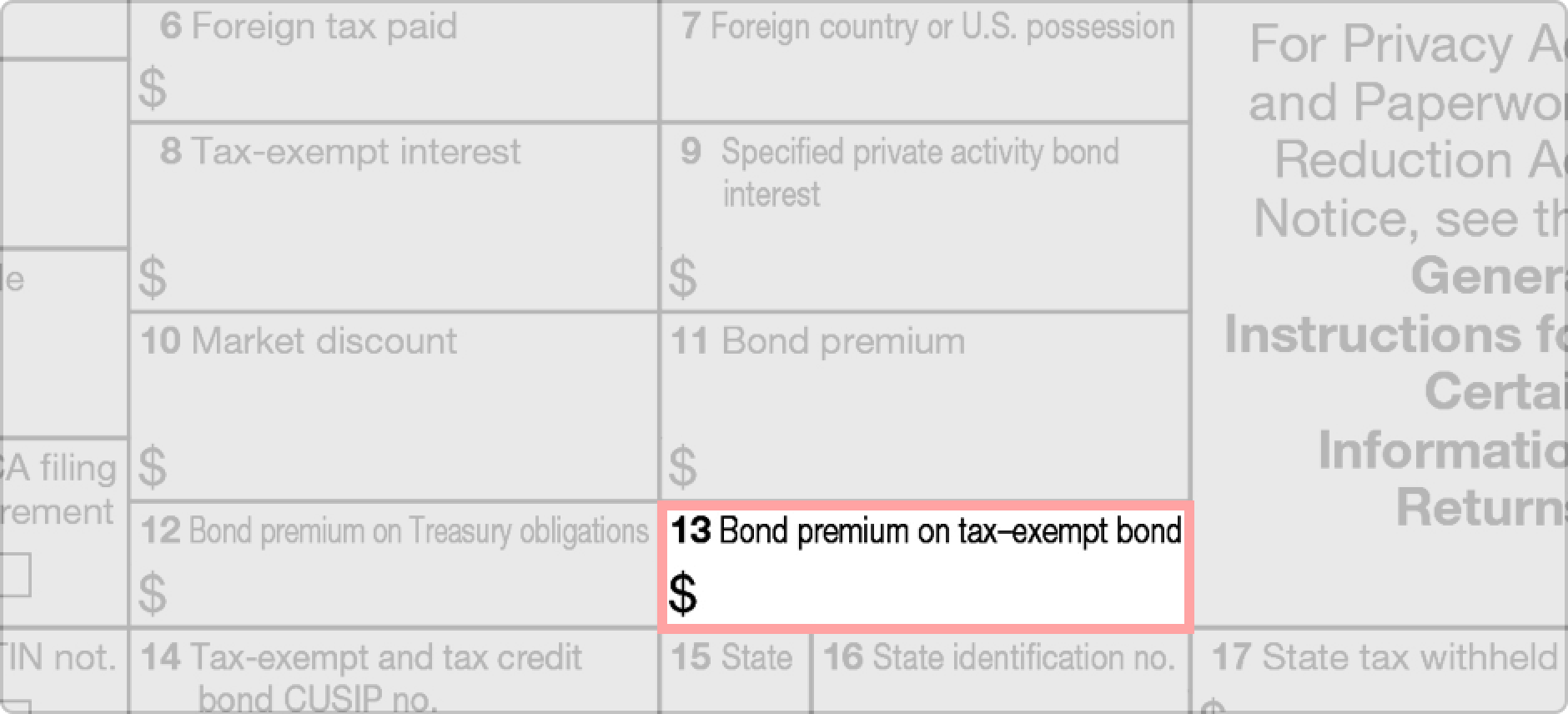

Box 13 - Bond Premium on Tax-Exempt Bond

This box records interest for tax-exempt covered securities that were acquired at a premium. If Boxes 8 or 9 are completed, this box is left blank.

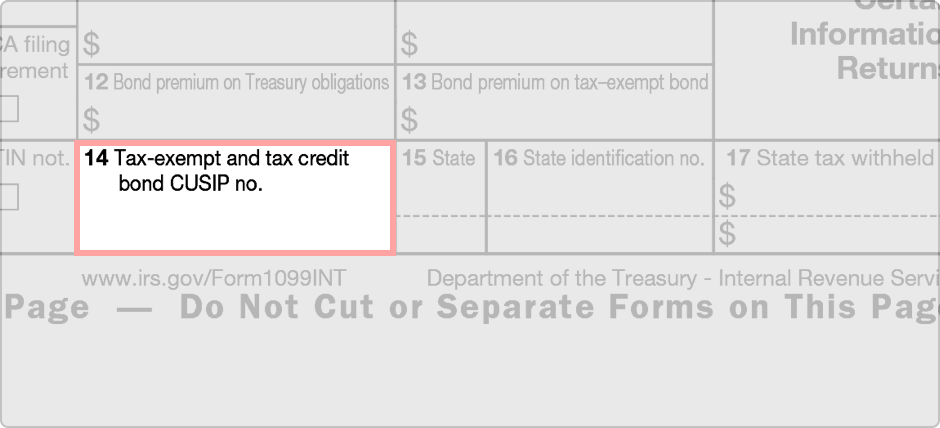

Box 14 - Tax-Exempt and Tax Credit Bond CUSIP No.

If there is a single bond or if a unique relationship covers multiple accounts, the CUSIP number is entered here if it is tax-exempt. The interest is reported in Box 8.

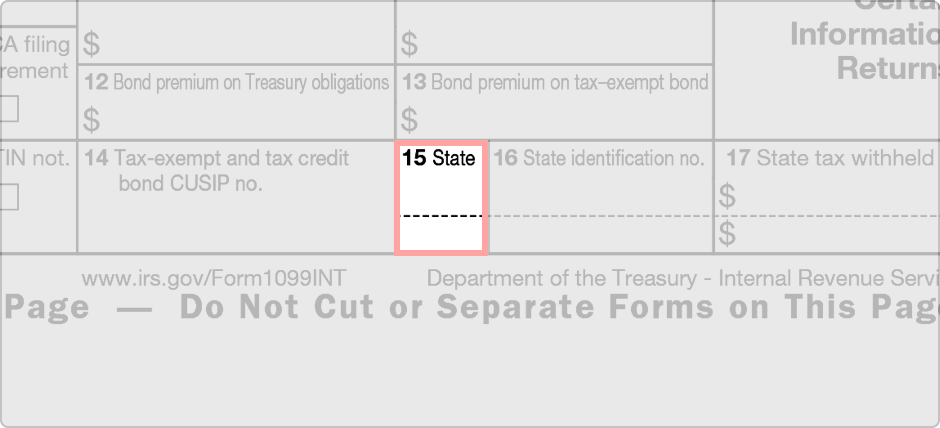

Box 15 - State

This box is used by a payer who participates in the Combined Federal/State Filing Program and is required to file paper copies of a 1099-INT with their state. The state information can hold up to two state abbreviations, one on each side of the dashed line.

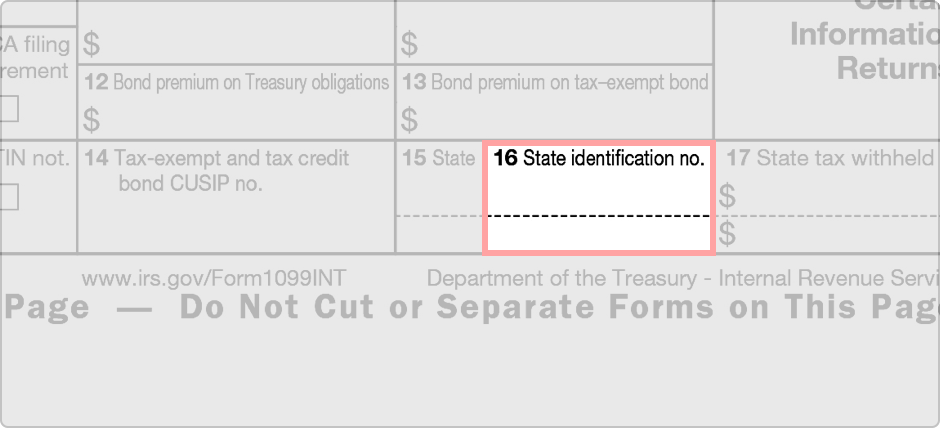

Box 16 - State Identification No.

The payer completes this box. It is a particular number that identifies the state or states listed in Box 16.

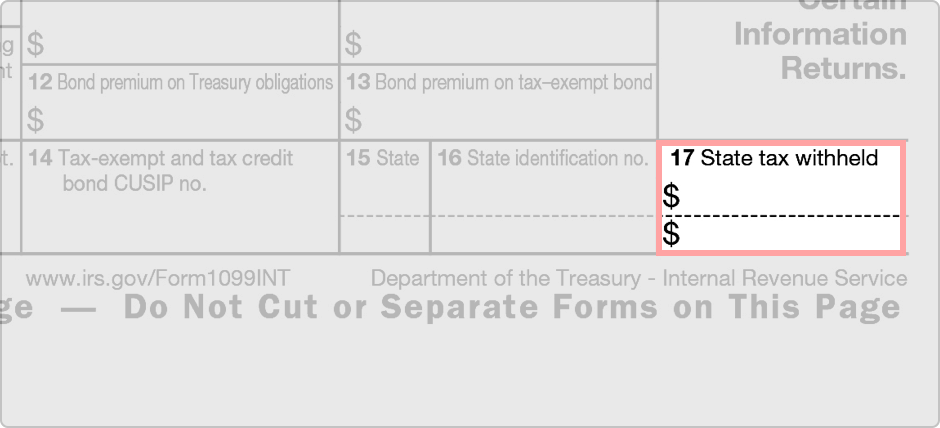

Box 17 - State Tax Withheld

This box lists the amount of state tax that was withheld. This information may be useful for your state income tax filing.

Taxable Interest

Taxable interest is income generated from an interest-bearing account. When an account earns a certain amount of interest, referred to as the minimum threshold for reporting, the payer of the interest (such as a bank or credit union) will mail out a 1099-INT to the owner of the account.

Minimum Threshold for Reporting

According to the 2025 Instructions for Forms 1099-INT and 1099-OID, taxable interest for the 1099-INT is $10 or more of interest paid out. This interest can be garnered from a U.S. account or a foreign account.

Exempt Account Holders and Accounts

Individual account holders are exempt from receiving a 1099-INT. The 2025 Instructions for Forms 1099-INT and 1099-OID list exempted recipients as:

- A corporation

- A tax-exempt organization

- Archer medical savings account (MSA)

- Medicare Advantage MSA

- Health savings account (HSA)

- Individual states

- The District of Columbia

- A U.S. possession

- Registered securities or commodities dealer, nominees, and custodians

- Brokers

- Notional principal contract dealers