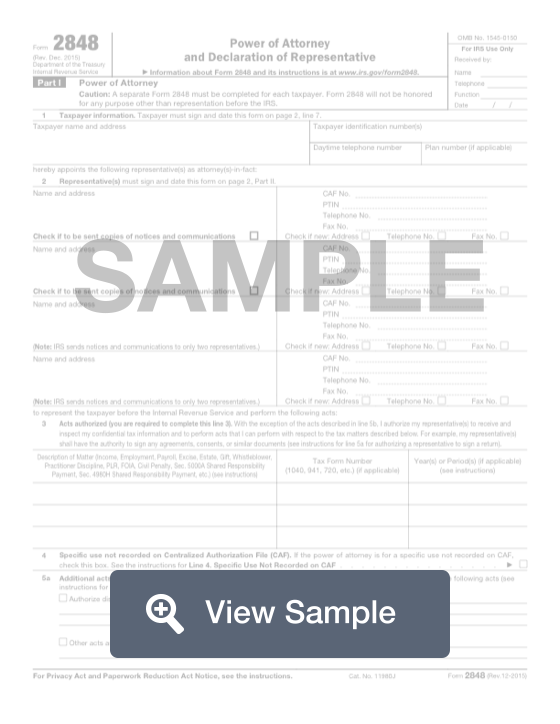

What is a Form 2848?

A Form 2848 is also known as a Power of Attorney and Declaration of Representative form. This form will be used in various situations related to tax filing or tax audits. The form will authorize someone to represent the filer before the United States Internal Revenue Service. This person will also be authorized to view all of the filer’s confidential tax information.

A qualified representative can help a taxpayer navigate a dispute related to taxes. For the attorney or representative to qualify, the filer needs to have their information. This may include their name, qualifications, and license number. The taxpayer and the representative will both need to sign and date the form in order for it to be recognized by the IRS.

Details of the dispute should also be included on this form. This will ensure that everyone is on the same page regarding the matter. Identifying information such as the tax form number and date of the situation should be included so the information regarding the dispute can be found.

Most Common Uses

A Form 2848 is commonly used to authorize an agent such as a CPA or attorney to take specific actions on your behalf, including:

- Receive confidential tax information

- Perfem acts that you are able to do

- Sign a tax return in limited circumstances

Components of a Form 2848

A Form 2848 contains the following sections:

- Part I - Power of Attorney

- Part II - Declaration of Representative

How to complete a Form 2848 (Step by Step)

To complete a Form 2848, you will have to provide the following information:

- Part I - Power of Attorney

- Taxpayer information:

- Name and address

- TIN

- Phone number

- Plan number

- Representative information

- Name and address

- CAF number

- PTIN

- Telephone number

- Fax number

- Acts authorized

- Description of matter

- Tax form number

- Applicable time period

- Specific use not recorded on Centralized Authorization File

- Additional acts authorized

- Specific acts not authorized

- Retention/revocation of prior power of attorney (attach a copy of any power of attorney you want to remain in effect)

- Signature of taxpayer

- Taxpayer information:

- Part II - Declaration of Representative

- Designation (attorney, CPA, enrolled agent, officer, full-time employee, family member, enrolled actuary, unenrolled return preparer, qualifying student, enrolled retirement plan agent

- Licensing jurisdiction

- Bar, license, certification, registration, enrollment number

- Signature

- Date

Filing

If you checked the box on the form indicating that the power of attorney is for a specific use not recorded on Centralized Authorization File (CAF), you should mail or fax the form to the IRS office handling the matter.

If special circumstances do not apply, you should mail or fax Form 2848 directly to:

Internal Revenue Service, 5333 Getwell Road, Stop 8423, Memphis, TN 38118, Fax: 855-214-7519 (If you live in Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, or West Virginia)

Internal Revenue Service, 1973 Rulon White Blvd., MS 6737, Ogden, UT 84201, Fax: 855-214-7522 (If you live in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, or Wyoming)

Internal Revenue Service, International CAF Team, 2970 Market Street, MS: 4-H14.123., Philadelphia, PA 19104, Fax: 855-772-3156 or 304-707-9785 if outside the United States (All APO and FPO addresses, American Samoa, nonpermanent residents of Guam or the U.S. Virgin Islands, Puerto Rico (or if excluding income under Internal Revenue Code section 933), a foreign country: U.S. citizens and those filing Form 2555, 2555-EZ, or 4563.)

Permanent residents of Guam should use Guam Department of Revenue and Taxation, P.O. Box 23607, GMF, GU 96921; permanent residents of the U.S. Virgin Islands should use V.I. Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, V.I. 00802.