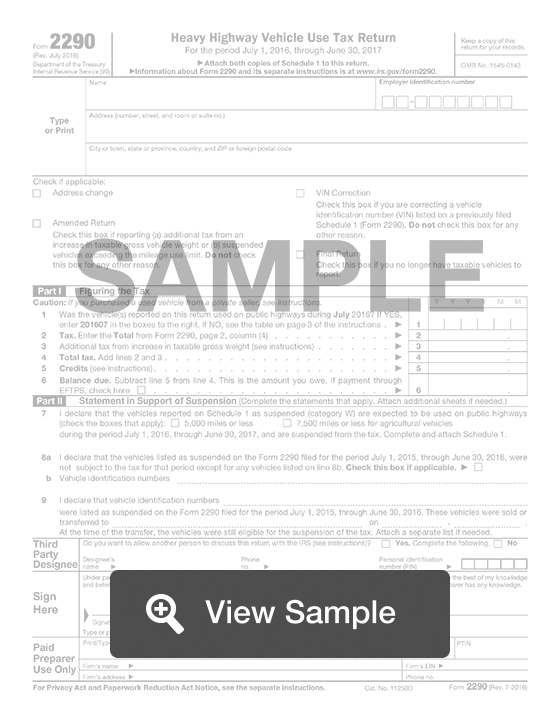

What is a Form 2290?

A Form 2290 is also known as a Heavy Highway Vehicle Use Tax Return. This form will be recorded by the U.S. Internal Revenue Service for tax filing and calculating purposes. The Form 2290 will allow the filer to calculate and pay any taxes due on highway motor vehicles with a gross weight of 55,000 pounds or more.

Like all tax forms, this form requires personal information about the filer. This will allow the IRS to identify the taxpayer. Information about the vehicle will also be necessary. This may include details about the mileage, the weight of the highway motor vehicle, and any credits there may be towards the taxes due. This information will be used to calculate whether you owe taxes or not, and how much taxes are due.

How to Complete a Form 2290 (Step by Step)

To complete a Form 2290, you need to provide the following information:

- Personal Information

- Name

- Address

- Employer identification number

- Indication if: address change, amended return, VIN correction, final return

- Part I - Figuring the Tax

- Whether vehicle was used on public highways during July 2023

- Tax

- Additional tax from increase in taxable gross weight

- Total tax

- Credits

- Balance due

- Payment by: EFTPS, credit or debit card

- Part II - Statement in Support of Suspension

- Declaration that vehicles reported on Schedule 1 as suspended are expected to be used on public highways: 5,000 miles or less, 7,500 or less for agricultural vehicles from July 1, 2023 to June 30, 2024 and are suspended from tax (attach Schedule 1)

- Declaration vehicles listed as suspended on the Form 2290 filed for the period July 1, 2023, through June 30, 2024, were not subject to the tax for that period except for any vehicles listed

- List vehicle identification numbers of vehicles listed as suspended on Form 2290 filed for the period July 1, 2023 to June 30, 2024.

- List party that vehicles were sold or transferred to

- List date that vehicles were sold or transferred

- Declaration that vehicles were still eligible for the suspension of the tax at time of the transfer

- Third Party Designee

- Authorization for IRS to discuss return with third-party designee

- Designeeâs name

- Phone number

- Personal identification number

- Signature

- Certification that form and attachments are correct

- Signature

- Date

- Name

- Phone number

- Paid Preparer Information

- Name

- Signature

- Dater

- PTIN

- Firmâs name

- Firmâs EIN

- Firmâs address

- Phone number

- Tax Computation

- Taxable gross weight

- Annual tax: vehicles except logging, logging vehicles

- Partial-period tax: vehicles except logging, logging vehicles

- Number of vehicles: vehicles except logging, logging vehicles

- Amount of tax

- Totals

- Tax-suspended vehicles

- Schedule 1 - Schedule of Heavy Highway Vehicles

- Name

- Address

- Employer identification number

- Month of first use

- Part I - Vehicles you are reporting

- VIN

- Category

- Part II - Summary of Reported Vehicles

- Total number of reported vehicles

- Total number of taxable vehicles on which tax is suspended (category W)

- Total number of taxable vehicles

- Consent to Disclosure of Tax Information

- Consent for IRS to disclose information about my payment of the heavy highway vehicle use tax (HVUT) for the tax period listed above to the federal Department of Transportation (DOT), U.S. Customs and Border Protection (CBP), and to state Departments of Motor Vehicles (DMV).

- Signature

- Date

- Name

- EIN

- Payment Voucher

- EIN

- Amount of payment payable to âUnited States Treasuryâ

- Date shown on line 1 of Form 2290

- Name

- Address