What is a Form 1120-S?

A Form 1120-S is also known as an U.S. Income Tax Return for an S Corporation. An S Corporation is a corporation that elects to pass corporate income, losses, deductions, and credits through to their shareholders. This will allow the corporation to avoid double taxation. To be considered an S Corporation, a corporation must be domestic, have no more than 100 shareholders, have only one stock class, and not be an ineligible form of corporation.

A company must already be considered an S Corporation before they use this tax return for its yearly tax filing. Like other types of tax returns, this form will require information about the corporation’s earnings, losses, deductions, and credits. This will ensure that the amount of taxes owed or refunded will be accurate. Other information may be required depending on the type of corporation and the number of employees at the company during the tax year.

Form 1120-S and S corporations

S Corporations are a form of corporate structure that allows a business to pass its income, losses, deductions, and credits through to shareholders for federal tax purposes. This allows for limited liability and prevents double taxation.

To form an S Corporation, there cannot be 100 or more shareholders. If the corporation does not have significant inventory, then it is able to use the cash method of accounting under S corporation terms.

S corporations are subject to many of the same rules that C corporations must follow. Both S corporations and C corporations must file articles of incorporation and hold regular meetings for directors and shareholders. Both types of corporations are subject to high legal, accounting, and tax service fees.

Most Common Uses

The IRS Form 1120-S is the annual tax form that S corps and LLCs that are taxed as S corps must complete to report net earnings to the IRS.

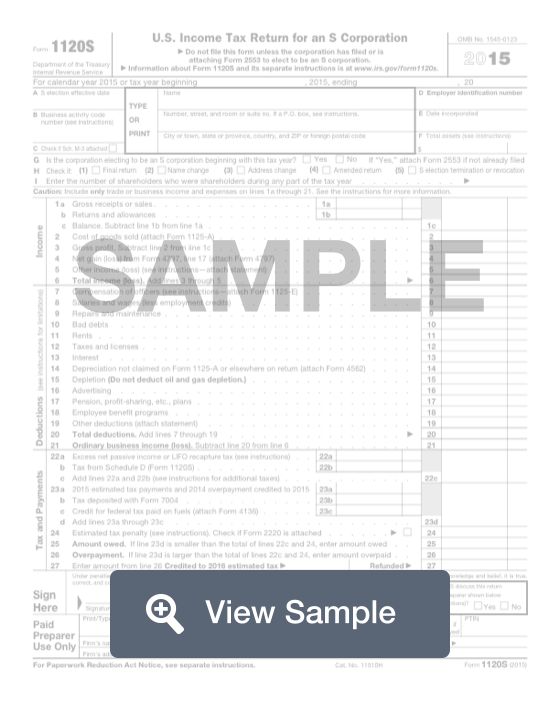

Components of a Form 1120S

The Form 1120-S contains the following components:

- Corporate Information

- Income

- Deductions

- Tax and Payments

- Signature

- Paid Preparer Information

- Schedule B

- Schedule K

- Schedule K-2

- Schedule K-3

- Schedule L

- Schedule M-1

- Schedule M-2

How to complete a Form 1120-S (Step by Step)

To complete a Form 1120-S, you need to provide the following information:

- Corporate Information

- Tax year

- Selection effective date

- Business activity code

- Schedule M-3

- Name

- Address

- Employer identification number

- Date of incorporation

- Total assets

- Indication if this is the first year filing as an S corporation (attach Form 2553)

- Indication if: final return, name change, address change, amended return, selection termination or revocation

- Number of shareholders who were shareholders during any part of year

- Income

- Gross receipts or sales

- Returns and allowances

- Balance

- Cost of goods sold (attach Form 1125-A)

- Gross profit

- Net gain or loss from Form 4797

- Other income or loss

- Total income or loss

- Deductions

- Compensation of officers (attach Form 1125-E)

- Salaries and wages

- Repairs and maintenance

- Bad debts

- Rents

- Taxes and licenses

- Interest

- Depreciation not claimed on Form 1125-A or elsewhere on return (attach Form 4562)

- Depletion

- Advertising

- Pension, profit-sharing, etc.

- Employee benefit programs

- Other deductions

- Total deductions

- Ordinary business income or loss

- Tax and Payments

- Excess net passive income or LIFO recapture tax

- Tax form Schedule D (Form 1120S)

- Current year’s estimated tax payments plus any credited overpayment from past fiscal year

- Tax deposited with Form 7044

- Credit for federal tax paid on fuels (attach Form 4136)

- Estimated tax penalty (Form 2220)

- Amount owed

- Overpayment

- Amount credited to next year’s estimated tax

- Refunded

- Signature

- Signature of officer

- Date

- Title

- Paid Preparer Information

- Authorization for IRS to discuss return with paid preparer

- Preparer’s name

- Preparer’s signature

- Date

- PTIN

- Firm’s name

- Firm’s EIN

- Firm’s address

- Phone number

- Schedule B - Other Information

- Accounting method: cash, accrual, other

- Business activity

- Product or service

- Whether any shareholder was a disregarded entity, trust, estate, nominee, or similar person (attach Schedule B-1)

- Whether corporation owned 20% or more or directly or indirectly 50% or more of the total stock issued and outstanding in any foreign or domestic corporation

- Whether corporation owned directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership

- Whether corporation had any outstanding shares of restricted stock

- Whether corporation had any outstanding stock options, warrants, or similar instruments

- Whether corporation filed or is required to file Form 8918

- Whether corporation issued publicly offered debt instruments with original issue discount (Form 8281)

- Whether corporation was a C corporation before it elected to be an S corporation or the corporation acquired an asset with a basis determined by reference to the basis of the asset in the hands of a C corporation and has a net unrealized built-in gain in excess of the net recognized built-in gain from prior years

- Accumulated earnings and profits

- Total receipts less than $250,000 and total assets less than $250,000

- Any non-shareholder debt canceled, forgiven, or terms modified to reduce principal

- Any qualified subchapter S subsidiary election terminated or revoked

- Any payments made requiring Forms 1099

- Schedule K - Shareholders’ Pro Rata Share Items

- Income

- Ordinary business income

- Net rental real estate income

- Expenses from other rental activities

- Other net rental income

- Interest income

- Dividends

- Royalties

- Net short-term capital gain (attach Schedule D (Form 1120-S))

- Net long-term capital gain (attach Schedule D (Form 1120-S))

- Collectibles

- Unrecaptured section 1250 gain

- Net section 1231 gain (attach Form 4797)

- Other income

- Deductions

- Section 179 deduction (attach Form 4562)

- Charitable contributions

- Investment interest expense

- Section 59(e) expenditures

- Other deductions

- Credits

- Low-income housing credit

- Qualified rehabilitation expenditures (attach Form 3468)

- Other rental real estate credits

- Other rental credits

- Biofuel producer credit

- Other credits

- Foreign transactions

- Name of country or U.S. possession

- Gross income from all sources

- Gross income sourced at shareholder level

- Passive category

- General category

- Other deductions allocated and appropriated at shareholder level

- Interest expense

- Other

- Deductions allocated and apportioned at corporate level to foreign source income

- Passive category

- General category

- Other information

- Total foreign taxes: paid, accrued

- Reduction in taxes available for credit

- Other foreign tax information

- Alternative minimum tax items

- Post-1986 depreciation adjustment

- Adjusted gain or loss

- Depletion

- Oil, gas, and geothermal properties - gross income

- Oil, gas, and geothermal properties - deductions

- Other AMT items

- Items affecting shareholder basis

- Tax-exempt interest income

- Other tax-exempt income

- Nondeductible expenses

- Distributions

- Repayment of loans from shareholders

- Other information

- Investment income

- Investment expenses

- Dividend distributions paid from accumulated earnings and profits

- Other items and amounts

- Reconciliation

- Income/loss reconciliation

- Income

- Schedule L - Balance Sheets per Books

- Assets

- Cash

- Trade notes and accounts receivable

- Less allowance for bad debts

- Inventories

- U.S. government obligations

- Tax-exempt securities (see instructions)

- Other current assets (attach statement)

- Loans to shareholders

- Mortgage and real estate loans

- Other investments (attach statement)

- Buildings and other depreciable assets

- Less accumulated depreciation

- Depletable assets

- Less accumulated depletion

- Land (net of any amortization)

- Intangible assets (amortizable only)

- Less accumulated amortization .

- Other assets (attach statement)

- Total assets

- Liabilities and Shareholders’ Equity

- Accounts payable

- Mortgages, notes, bonds payable in less than 1 year

- Other current liabilities (attach statement)

- Loans from shareholders

- Mortgages, notes, bonds payable in 1 year or more

- Other liabilities (attach statement)

- Capital stock

- Additional paid-in capital

- Retained earnings

- Adjustments to shareholders’ equity (attach statement)

- Less cost of treasury stock

- Total liabilities and shareholders’ equity

- Assets

- Schedule M-1 - Reconciliation of Income (Loss) per Books With Income (Loss) per Return

- Net income (loss) per books

- Income included on Schedule K not recorded on books

- Expenses recorded on books not included on Schedule K

- Income recorded on books not included on Schedule K

- Deductions included on Schedule K not charged against book income

- Income (Schedule K)

- Schedule M-2

- Balance at beginning of tax year

- Ordinary income

- Other additions

- Loss

- Other reductions

- Distributions other than dividend distributions

- Balance at end of tax year