What is a 1099-B?

This form will be used for tax filing purposes by the Internal Revenue Service in the United States. The Form 1099-B is also known as a Proceeds from Broker and Barter Exchange Transactions form. It is used to report the proceeds from these types of transactions on the yearly tax return forms. This form is required in order to provide an accurate estimate of your yearly earnings and deductions.

The form will require information about the specific transaction. This includes the date of the sale or exchange, the date of the acquisition, the type of sale, and the quantity sold. The amount from each sale must be included, whether it is from stocks or bonds. Then more financial information will be needed, such as the tax withheld, profits and losses, bartering earnings, and more. This information will be used to determine tax withholdings or refunds.

Most Common Uses

The IRS requires the submission of Form 1099-B to record a taxpayer’s gains or losses associated with the brokered sale or trade of certain securities. Brokers submit this form for each person who sold stocks, options, commodities, or similar trading vehicles. This form is also used to report barter exchange transactions.

Components of a 1099-B

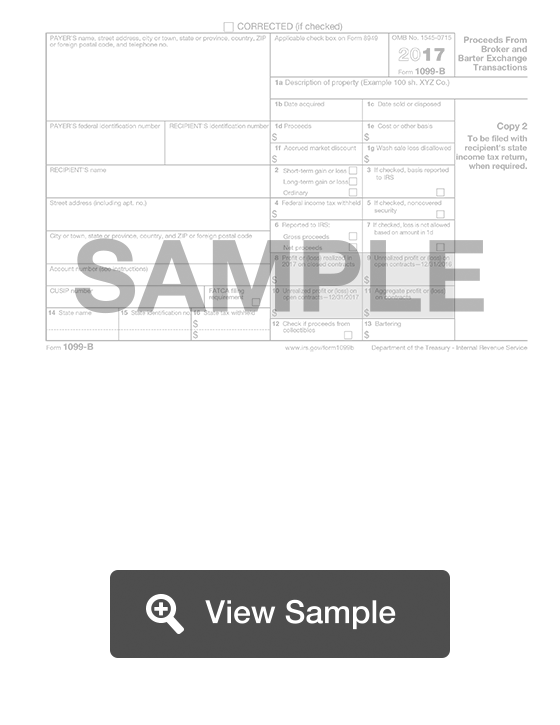

A Form 1099-B contains the following sections:

- Payer’s information

- Recipient’s information

- Description of property

- Financial details of transaction

How to complete a 1099-B (Step by Step)

To complete a 1099-B, you need to provide the following information:

- Payer’s name, street address, phone number

- Payer’s TIN

- Recipient’s TIN

- Recipient’s name

- Street address

- Account number

- CUSIP number

- FATCA filing requirement

- Applicable check box on Form 8949

- Description of property

- Date acquired

- Date sold or disposed

- Proceeds

- Cost or other basis

- Accrued market discount

- Wash sale loss disallowed

- Short-term gain or loss, long-term gain or loss, or ordinary

- Reported to IRS

- Federal income tax withheld

- Noncovered security

- Reported to IRS: gross proceeds, net proceeds

- Whether loss is not allowed based on proceeds

- Profit or loss realized in current year on closed contracts

- Unrealized profit or loss on open contracts for past year

- Unrealized profit or loss on open contracts for current year

- Aggregate profit or loss on contracts

- Proceeds from collectibles

- Bartering

- State name

- State identification number

- State tax withheld