What is a 1099 DIV?

This form is used for tax filing purposes, and will be recorded by the United States Internal Revenue Service. A Form 1099-DIV is also known as a Dividends and Distributions form. This form will be given to taxpayers by their bank or other financial institution. It will list the amount of taxable dividends and other distributions that person got during the tax year. This will ensure that the filer pays the appropriate amount of taxes.

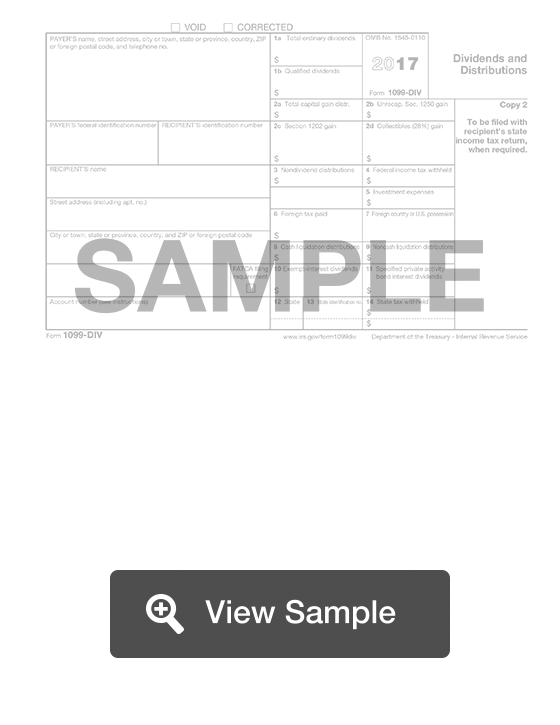

The form will include information about the person who is paying taxes. This includes their tax identification number. The financial information regarding dividends and other distributions will also be listed. The total amount for the tax year will be included, as well as any taxes already withheld. This provided information can be copied to the taxpayer’s tax filing forms in order to ensure they get an accurate estimate of taxes due or taxes refunded.

Most Common Uses

A Form 1099-DIV is commonly sent to a taxpayer who owns stocks that paid dividends or mutual funds that made a capital gains distribution. A 1099-DIV does not need to be filed with the IRS, but the information that it contains is necessary to prepare a tax return.

Components of a 1099 DIV

A 1099-DIV contains the following sections:

- Payer’s information

- Recipient’s information

- Dividend information

- Capital gain distribution information

- Tax information

Types of Dividends

There are three main categories of dividends:

- Ordinary dividends - paid from a company’s earnings and profits, taxed at normal income tax rates

- Qualified dividends - paid by a U.S. corporation or qualified foreign corporation you’ve met the holding period for the underlying stock, taxed at long-term capital gains rates

- Capital gains distributions - generally from mutual funds, subject to long-term capital gains rates

How to complete a 1099 DIV (Step by Step)

To complete a 1099-DIV, you need to provide the following information:

- Payer’s name, street address, telephone number

- Payer’s TIN

- Recipient’s TIN

- Recipient’s name

- Street address

- FATCA filing requirement

- Account number

- 2nd TIN

- Total ordinary dividends

- Qualified dividends

- Total capital gain distributions

- Unrecaptured section 1250 gain from certain depreciable real property

- Section 1202 gain

- Collectibles (28%) gain

- Nondividend contributions

- Federal income tax withheld

- Section 199A dividends

- Investment expenses

- Foreign tax paid

- Foreign country or U.S. possession

- Cash liquidation distributions

- Noncash liquidation distributions

- Exempt-interest dividends

- Specified private activity bond interest dividends

- State

- State identification number

- State tax withheld

Legal Considerations

Tax Filing

Investors need to report the amounts on each 1099-DIV that they receive on their annual tax form. This may be done on Schedule B or on Form 1040. Ordinary dividends are generally taxed at an investor’s income tax rate.

US Tax Reform

U.S. tax reform legislation enacted many changes for both individuals and corporations. The 2018 tax legislation did not include major changes to taxation of capital gains and dividends.