What is a Form 1040 V?

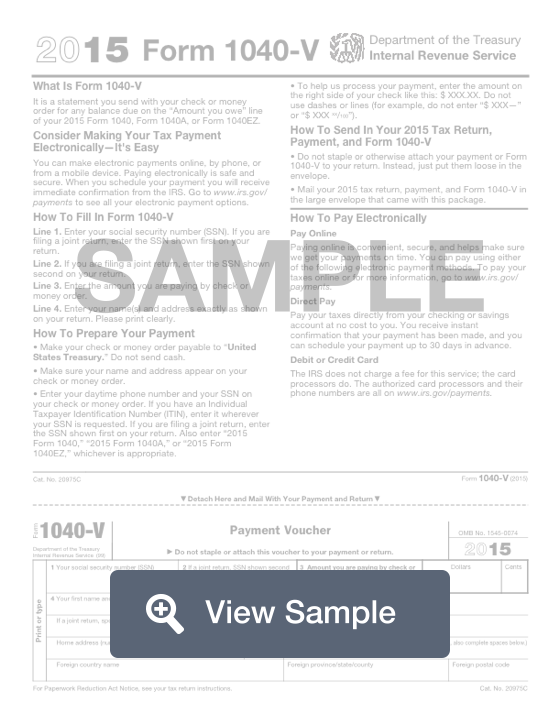

A Form 1040-V will be used by the Internal Revenue Service for tax filing and recording purposes. This form is known as a Payment Voucher, and it will be used by someone who needs to make a payment in order to pay their owed taxes for the tax year. It can only be used with the 1040 tax filing forms.

To fill out this form, you must have already completed a 1040 tax filing form and determined how much in taxes you either owe or will get refunded. You will only use this form if you owe taxes and need to make a payment to the IRS. You will need to include the exact amount you owe on this form for it to be processed.

This form should be included with your payment. Be sure you have filled it out completely, indicating your personal information, address, and payment amount.

Most Common Uses

Form 1040-V is a payment voucher that is commonly used with Forms 1040, 1040A, and 1040EZ. Payments sent in with a 1040-V voucher facilitate payment processing.

Components of a Form 1040 V

A Form 1040-V contains sections for you to provide:

- Social security number

- Amount you are paying

- Name

- Address

How to complete a Form 1040 V (Step by Step)

To complete a Form 1040-V, you will need to provide the following information:

- Social security number (SSN)

- SSN shown second on joint return

- Amount you are paying by check or money order payable to “United States Treasury”

- First name and middle initial

- Last name

- Spouse’s first name, middle initial, last name

- Home address

- Foreign country name, province/state/county, foreign postal code

Where to mail your Form 1040-V

IRS Branch Residents of

Internal Revenue Service Florida, Louisiana, Mississippi, Texas

P.O. Box 1214

Charlotte, NC 28201-1214

Internal Revenue Service Alaska, Arizona, California, Colorado,

P.O. Box 7704 Hawaii, Idaho, Nevada, New Mexico,

San Francisco, CA 94120-7704 Oregon, Utah, Washington, Wyoming

Internal Revenue Service Arkansas, Illinois, Indiana, Iowa, Kansas,

P.O. Box 802501 Michigan, Minnesota, Montana, Nebraska,

Cincinnati, OH 45280-2501 North Dakota, Ohio, Oklahoma, South

Dakota, Wisconsin

Internal Revenue Service Alabama, Georgia, Kentucky, New Jersey,

P.O. Box 931000 North Carolina, South Carolina, Tennessee,

Louisville, KY 40293-1000 Virginia

Internal Revenue Service Delaware, Maine, Massachusetts, Missouri,

P.O. Box 37008 New Hampshire, New York, Vermont

Hartford, CT 06176-7008

Internal Revenue Service Connecticut, District of Columbia,

P.O. Box 37910 Maryland, Pennsylvania, Rhode Island,

Hartford, CT 06176-7910 West Virginia

Internal Revenue Service A foreign country, American Samoa, or P.O. Box 1303 Puerto Rico (or are excluding income under

Charlotte, NC 28201-1303 Internal Revenue Code 933), or use an APO

or FPO address, or file Form 2555,

2555-EZ, or 4563, or are a dual-status alien

or non permanent resident of Guam or the

U.S. Virgin Islands.