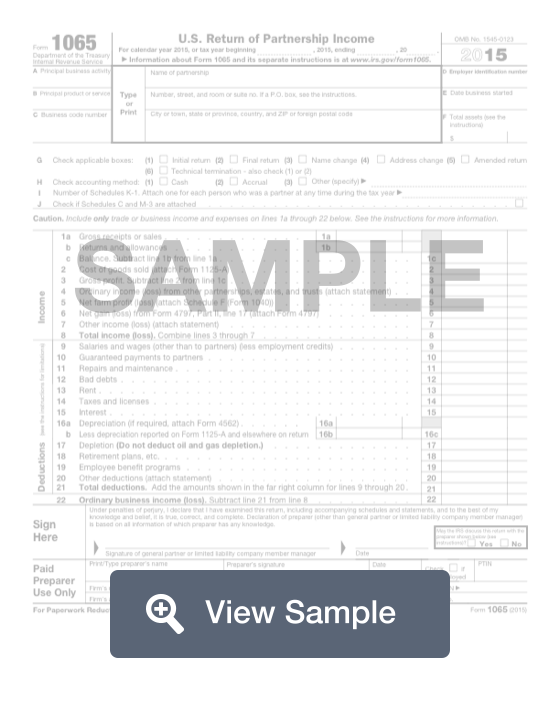

What is a Form 1065?

A Form 1065 is used for tax filing purposes in the United States. It will be reviewed by the Internal Revenue Service. The form is known as a U.S. Return of Partnership Income form. It will be used by businesses in order to report profits, losses, credits, and deductions from their business partners. A form will need to be completed for each individual partner.

Anyone with business partnerships will need to fill out a Form 1065. This is true even for non-profit companies that don’t get taxed. Various information about the tax year’s finances will be required, including profits from sales, returns, and other income. It will also need to list expenses, including salaries, rents, debts, interest, and other expenses. These numbers will be used to determine the ordinary business income. This will determine the amount of owed taxes.

Most Common Uses

Form 1065 is commonly used by general partnerships, limited partnerships, and limited liability partnerships. It is also used when a company is an LLC and has decided not to be taxed as a corporation this year. Foreign partnerships with more than $20,000 in annual income in the United States or those who earn more than 1% of their income in the United States must file Form 1065.

Components of a Form 1065

Form 1065 contains the following sections:

- Partnership information

- Income

- Deductions

- Signature

- Paid preparer information

- Schedule B

- Schedule K

- Schedule K-2

- Schedule K-3

- Schedule L

- Schedule M-1

- Schedule M-2

How to complete a Form 1065 (Step by Step)

To complete a Form 1065, you will have to provide the following information:

- Partnership information

- Principal business activity

- Principal product or service

- Business code number

- Name of partnership

- Address

- Employer identification number

- Date business started

- Total assets

- Special circumstances: initial return, final return, name change, address change, amended return, technical termination

- Accounting method

- Number of Schedules K-1

- Schedule C and M-3

- Income

- Gross receipts or sales

- Returns and allowances

- Balance

- Costs of goods sold

- Gross profit

- Ordinary income from other partnerships, estates, and trusts

- Net farm profit or loss (attach Schedule F)

- Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797)

- Other income or loss

- Total income (loss)

- Deductions

- Salaries and wages

- Guaranteed payments to partners

- Repairs and maintenance

- Bad debts

- Rent

- Taxes and licenses

- Interest

- Depreciation (Form 4562)

- Less depreciation reported on Form 1125-A and elsewhere on return

- Depletion

- Retirement plans

- Employee benefit programs

- Other deductions

- Total deductions

- Ordinary business income

- Signature

- Signature

- Date

- Authorization for IRS to discuss return with preparer below

- Paid preparer information

- Preparer’s name

- Preparer’s signature

- Date

- PTIN

- Firm’s name

- Firm’s EIN

- Firm’s address

- Phone number

- Schedule B - Other Information

- Type of entity filing this return

- Whether any partner in the partnership was a disregarded entity, a partnership (including an entity treated as a partnership), a trust, an S corporation, an estate (other than an estate of a deceased partner), or a nominee or similar person

- Whether any foreign or domestic corporation, partnership (including any entity treated as a partnership), trust, or tax-exempt organization, or any foreign government own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership (attach Schedule B-1)

- Whether any individual or estate owns an interest of 50% or more in the profit, loss, or capital of the partnership (attach Schedule B-1)

- Whether the partnership owned directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of stock entitled to vote of any foreign or domestic corporation

- Whether the partnership owns directly an interest of 20% or more, or owns, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust

- Whether the partnership filed Form 8893, Election of Partnership Level Tax Treatment, or an election statement under section 6231(a)(1)(B)(ii) for partnership-level tax treatment, that is in effect for this tax year

- Whether the partnership satisfies all of the following:

- Total receipts for the tax year were less than $250,000

- Total assets at the end of the tax year were less than $1 million

- Schedules K-1 are filed with the return and furnished to the partners on or before the due date for the partnership return

- Partnership is not filing and not required to file Schedule M-3

- Whether partnership is a publicly traded partnership under section 469(k)(2)

- Whether the partnership had any debt cancelled, forgiven or modified to reduce principal during tax year

- Whether partnership filed or is required to file Form 8918 Material Advisor Disclosure Statement

- Whether partnership had an interest in or a signature or other authority over a financial account in a foreign country

- Whether partnership received distribution from or was grantor of or transferor of foreign trust (Form 3250)

- Whether the partnership is making a section 754 election; whether it made an optional basis adjustment under section 743(b) or 734(b); and whether the partnership is required to adjust the basis of its assets under 743(b) or 734(b) because of a substantial built-in loss under 743(d) or substantial basis reduction under section 734(d)

- Whether the partnership distributed any property in like-kind exchange or contributed such property to another entity

- Whether the partnership distributed to any partner a tenancy-in-common or other undivided interest in partnership property

- Whether partnership is required to file Form 8858 Information Return of U.S. Persons With Respect To Foreign Disregarded Entities

- Whether partnership has any foreign partners (Form 8805)

- Number of Forms 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, attached to this return

- Whether partnership made any payments this year that would require it to file Form(s) 1099

- Number of Form(s) 5471 Information Return of U.S. Persons With Respect to Certain Foreign Corporations attached to return

- Number of partners that are foreign governments

- Whether partnership made any payments that would require it to file Form 1042 and 1042-S

- Whether partnership was a specified domestic entity required to file Form 8938 for the tax year

- Name of designated Partnership Representative, phone number, address

- Schedule K - Partner's' Distributive Share Items

- Income (Loss)

- Deductions

- Self-Employment

- Credits

- Foreign Transactions

- Alternative Minimum Tax items

- Other information

- Analysis of Net Income (Loss)

- Schedule L - Balance Sheets per Books

- Assets

- Liabilities and Capital

- Schedule M-1 - Reconciliation of Income (Loss) per Books with Income (Loss) per Return

- Schedule M-2 - Analysis of Partners’ Capital Accounts

Filing

How to File

To file Form 1065, you will need all of your partnership’s important year-end financial statements, including a profit and loss statement that shows net income and revenues, a list of the partnership’s deductible expenses, and a balance sheet for the beginning and end of the year.

Partnerships the sell physical goods will also need to provide information for costs of goods sold.

You will also need to provide your Employer Identification number, business code number, start dates for business, and information about your company’s accounting methods.

You can file online or by mail.

Filing Deadlines

Form 1065 must be filed by March 15 in the year following the fiscal year that it applies to.