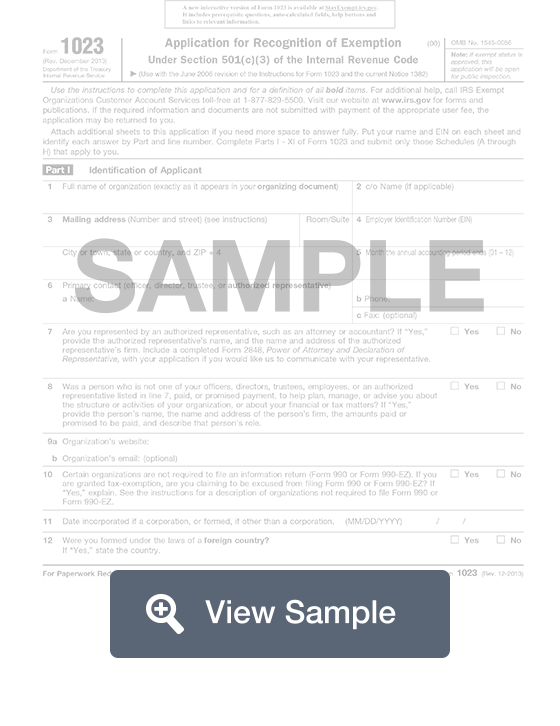

What is a Form 1023?

A Form 1023 will be used by the Internal Revenue Service in the United States for tax filing purposes. This form is known as an Application for Recognition of Exemption Under Section 501(3) of the Internal Revenue Code. This form is used by charities or other non-profit organizations who want to become a tax-exempt organization.

This form requires a substantial amount of information in order for the organization to be considered. This includes information about the organization, such as where it is located, what kind of organization it is, and who the representative is. One thing that should never be included on this form is personal social security numbers. These should not be included because the Form 1023 form is publicly disclosed.

Eligibility

Section 501(c)(3) of the Internal Revenue Code permits the following organizations to file Form 1023:

- Religious or charitable organizations

- Scientific organizations

- Organizations that test for public safety

- Educational or literary organizations

- National or international amateur sports competitors

- Organizations that prevent cruelty to children or animals

To qualify for tax-exempt status, an organization must also be:

- Organized as a corporation, LLC, trust, or unincorporated association that limits its reach to the purpose of its filing

- Operated to further the purposes in its organization documents and refrain from participating in political campaigns and promoting legislative activity; ensure its assets and earnings do not unjustly benefit board members, officers, or other key members of the organization; refrain from promoting private or non-tax-exempt purposes more than insubstantially; not engage in illegal activities or violate fundamental public policy

Components of a Form 1023

A Form 1023 contains the following sections:

- Identification of Applicant

- Organizational Structure

- Required Provisions in Your Organizing Document

- Narrative Description of Your Activities

- Compensation and Other Financial Arrangements With Your Officers, Directors, Trustees, Employees, and Independent Contractors

- Members and Other Individuals That Receive Benefits From You

- History

- Specific Activities

- Financial Data

- Public Charity Status

- User Fee Information and Signature

- Schedule A: Churches

- Schedule B: Schools, Colleges, and Universities

- Schedule C: Hospitals and Medical Research Organizations

- Schedule D: Section 509(a)(3) Supporting Organizations

- Schedule E: Organizations Not Filing Form 1023 Within 27 Months of Formation

- Schedule F: Home for the Elderly or Handicapped and Low-Income Housing

- Schedule G: Successors to Other Organizations

- Schedule H: Organizations Providing Scholarships, Fellowships, Educational Loans, or Other Educational Grants to Individuals and Private Foundations Requesting Advance Approval of Individual Grant Procedures

How to complete a Form 1023 (Step by Step)

To complete a Form 1023, you will need to provide the following information:

- Identification of Applicant

- Name or organization

- Mailing address

- Primary contact

- EIN

- Month annual accounting period ends

- Phone

- Fax

- Authorized representation (Form 2848 Power of Attorney and Declaration of Representative)

- Paid advisor for structure or activities or financial or tax matter

- Website, email

- Exempt from filing Form 990 or 990-EZ

- Date incorporated or formed

- Whether formed in foreign country

- Organizational Structure

- Corporation, limited liability company, unincorporated association or trust

- Adopted bylaws

- Required Provisions in Your Organizing Document

- Statement of exempt purpose

- Upon dissolution, remaining assets must be used exclusively for exempt purposes

- Narrative Description of Your Activities

- Describe past, present and planned activities

- Compensation and Other Financial Arrangements With Your Officers, Directors, Trustees, Employees, and Independent Contractors

- Officers, directors, trustees - name, title, mailing address, compensation amount, qualifications, average hours worked, duties

- Five highest paid employees - name, title, mailing address, compensation amount, qualifications, average hours worked, duties

- Five highest paid independent contractors - name, title, mailing address, compensation amount, qualifications, average hours worked, duties

- Whether any officers, directors, trustees related to each other through family or business relationship

- Whether any officers, directors, trustees, highest paid employees or contractors are paid from any other organization related to you by common control

- Whether compensation arrangements follow a conflict of interest policy, compensation arrangements are approved in advance of paying, date and terms of compensation are documented in writing, votes on compensation arrangements are recorded, compensation arrangements are based on information about compensation paid by similarly situated organizations, information about basis of decisions is recorded, or description of how reasonable compensation is set

- Conflict of interest policy description

- Whether any officers, directors, trustees, highest paid employees or contractors are paid through non-fixed payment

- Whether any officers, directors, trustees, highest paid employees or contractors are paid more than $50,000 per year though non-fixed payments

- Whether you have or will purchase or sell goods, services, assets from any officers, directors, trustees, highest paid employees or contractors and how you will determine that you pay no more than fair market value or are paid at least fair market value

- Whether you have or will have leases, contracts, loans, or other arrangements with officers, directors, trustees, highest paid employees or contractors

- Members and Other Individuals That Receive Benefits From You

- Whether you provide goods, services, or funds to individuals or organizations

- Whether any of your programs limit the provision of goods, services, or funds to a specific individual or group of individuals

- Whether any individuals who receive goods, services, or funds through your programs have a family or business relationship with any officers, directors, trustees, highest paid employees or contractors

- History

- Whether you are the successor to any organization

- Whether you are submitting this application more than 27 months after the month you were legally formed

- Specific Activities

- Whether you support or oppose candidates in political campaigns in any way

- Whether you attempt to influence legislation and whether you are making an election to have legislative activities monitored by Form 5768

- Whether you operate bingo or gaming activities, have contracts for other to conduct bingo or gaming for you, and list of states and jurisdictions where you will conduct these operations

- Fundraising program information

- Explanation of affiliation with any governmental unit

- Description of economic development activities

- Whether persons other than your employees or volunteers will develop or manage your facilities and explanation of any family or business relationship between the manager or developer and your officers, directors, trustees, highest paid employees or contractors

- Whether you will enter any joint ventures

- Whether you will apply for an exemption as a child care organization

- Whether you have rights in any intellectual property

- Whether you will accept contributions of real property; easements; intellectual property; licenses; royalties; automobiles; or collectibles

- Whether you have or will operate in any foreign country

- Whether you will make grants, loans, or distributions to foreign organizations

- Whether you have a close connection with any organization

- Whether you are applying for exemption as a cooperative hospital service organization

- Whether you are applying for an exemption as a cooperative service organization of operating educational organizations

- Whether you are applying for an exemption as a charitable risk pool

- Whether you have or will operate a school

- Whether your main function is to provide hospital or medical care

- Whether you will provide low-income housing for the elderly or handicapped

- Whether you provide scholarships, fellowships, educational loans, or other educational grants to individuals for travel, study, or other similar purposes (Schedule H)

- Financial Data

- If in existence less than 5 years, a statement for each year in existence and projections of likely revenues and expenses in future

- If in existence 5 or more years, provide data for past 5 years

- Revenues

- Expenses

- Balance sheet: assets, liabilities, fund balances or net assets

- Public Charity Status

- Classification as either a private foundation or public charity

- Private foundation status

- Private operating foundation status

- Existence for one or more years

- Affidavit or opinion of counsel or statement describing proposed operations

- Public charity status selection

- Confirmation of public support status

- Explanation of receipt of any unusual grants during years shown of Statement of Revenues and Expenses

- User Fee Information and Signature

- Amount of user fee paid

- Signature

- Name

- Title

- Date

- Schedule A: Churches

- Schedule B: Schools, Colleges, and Universities

- Schedule C: Hospitals and Medical Research Organizations

- Schedule D: Section 509(a)(3) Supporting Organizations

- Schedule E: Organizations Not Filing Form 1023 Within 27 Months of Formation

- Schedule F: Home for the Elderly or Handicapped and Low-Income Housing

- Schedule G: Successors to Other Organizations

- Schedule H: Organizations Providing Scholarships, Fellowships, Educational Loans, or Other Educational Grants to Individuals and Private Foundations Requesting Advance Approval of Individual Grant Procedures

Filing Requirements

Form 1023 requires an organization to provide the following information:

- Date of organization’s creation

- Organizational structure

- Organizing documents

- Description of past, present, and future activities

- Compensation of organization’s officers, directors, trustees, employees, and independent contractors

- Other members and individuals receiving benefits

- Organization’s history

- Specific activities conducted by the organization

- Financial data

Applications cost $400 if the charity has earned less than $10,000 annually for the past four years. Applications cast $850 if the charity has earned over $10,000 annually.