What is a Form 1120 H

This form is used for tax filing purposes. It will be filed by a homeowner’s association and recorded by the Internal Revenue Service. The Form 1120-H is also known as an U.S. Income Tax Return for Homeowners Associations. Using this form instead of a standard tax return will allow a homeowner’s association to take advantage of several tax benefits.

Like other tax return forms, this form will require information about income and deductibles. This is so the amount of tax can be calculated, whether it will be owed taxes or a refund. For homeowners associations, financial information regarding repairs, rents, and other specific deductibles should be included. This will ensure an association can get as many tax breaks as possible.

This form must be submitted by the end of tax season in April. Otherwise, there may be tax penalties and delays. Get the forms in early for a quicker processing time, and ask for financial advice if the year’s income and deductibles were overly complicated.

Most Common Uses

This form is commonly used by homeowners associations to take advantage of the tax benefits provided by section 528 of the Internal Revenue Code.

Components of a Form 1120 H

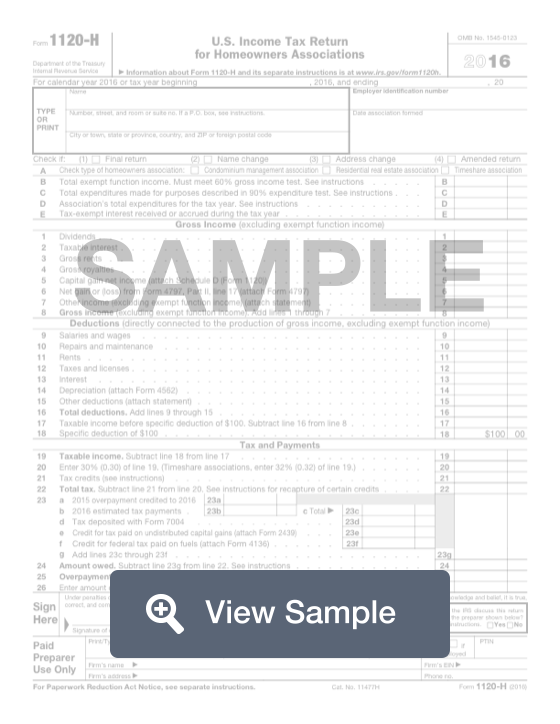

Form 1120-H contains sections for:

- Association information

- Gross Income

- Deductions

- Tax and Payments

- Signature

- Paid Preparer’s Information

How to complete a Form 1120 H (Step by Step)

To complete a Form 1120-H, you need to provide the following information:

- Association information

- Tax year

- Name

- Address

- Employer identification number

- Date association formed

- Special return status: final return, name change, address change, amended return

- Type of HOA: condominium management association, residential real estate association, timeshare association

- Total exempt function income

- Total expenditures made for the purposes described in 90% expenditure test

- Association’s total expenditures for tax year

- Tax-exempt interest received or accrued during the tax year

- Gross Income

- Dividends

- Taxable interest

- Gross rents

- Gross royalties

- Capital gain net income (attach Schedule D (Form 1120))

- Net gain or loss from Form 4797, line 17 (attach Form 4797)

- Other income

- Gross income

- Deductions

- Salaries and wages

- Repairs and maintenance

- Rents

- Taxes and licenses

- Interest

- Depreciation (attach Form 4562)

- Other deductions

- Total deductions

- Taxable income before specific deduction of $100

- Specific deduction of $100

- Tax and Payments

- Taxable income

- 30% of taxable income 32% for timeshare associations

- Tax credits

- Total tax

- Past fiscal year’s overpayment credited to current fiscal year

- Current year estimated tax payments

- Tax deposited with Form 7004

- Credit for tax paid on undistributed capital gains (attach Form 2439)

- Credit for federal tax paid on fuels (attach Form 4136)

- Amount owed

- Overpayment

- Credit to next year’s estimated tax

- Refund

- Signature

- Signature of officer

- Date

- Title

- Paid Preparer’s Information

- Authorization for IRS to discuss return with preparer

- Preparer’s name

- Preparer’s signature

- Date

- PTIN

- Firm’s name

- Firm’s address

- Firm’s EIN

- Phone number

Filing

An association must file Form 1120-H by the 15th day of the 4th month after the end of its tax year. Associations with fiscal years ending on June 30 must file by the 15th day after the 3rd month after the end of its tax year. Associations with short tax years ending anytime in June will be treated as if its short year ended on June 30.

If the due date falls on a Saturday, Sunday, or legal holiday, the association may file Form 1120-H on the next business day.