Why Create A Rental Application?

An effective rental application will protect the landlord by helping them to determine if a potential tenant will be a good tenant.

The application will ask the prospective tenant for a lot of personal information, such as full name, address, social security number, and more. A credit check may also be included with the application to screen candidates.

How To Run A Thorough Background Check

Step 1: Every Potential Tenant Must Complete a Rental Application

A rental application should be filled out after the potential tenant has viewed the property and shows interest in renting. If there are two or more adults who would be named on the rental agreement, each person should complete a basic rental application online or on paper. This document asks for basic information about the tenant, including their employment and rental history. It also asks about criminal convictions.

You should attach a copy of the Fair Credit Reporting Act that explains what rights the potential tenants have during the application process. The potential tenants should return the application along with the application fee. The application fee is typically used to pay for the second step, running a credit report.

Every state has fair housing laws that either meet or exceed the standards set by the Fair Housing Act. Landlords and tenants should know and understand their rights in each state. Race, religion, sex, national origin, color, familial status, and mental/physical disability are all protected classes under federal law. State laws must consist of these protected classes, but may add additional protections.

Step 2: Run a Credit and Criminal History Report on the Potential Tenant

Tenant screening services, including a credit report and a criminal history report (also known as a background check) can help you determine whether the potential tenant can afford to rent the property and the likelihood that your property will be properly cared for. There are numerous options available for you to run these reports. RentPrep.com charges $28 per application. ScreeningWorks.com and MyRental.com charge $30 per application. E-Renter.com charges $32 per application.

If there was a reason that the potential tenant could not complete the application and you’re both exploring the possibility of creating the landlord-tenant relationship, there are credit and background companies that the applicant can pay to use. LeaseRunner.com costs the applicant $32. MySmartMove.com is owned by TransUnion and it costs the applicant $35. Cozy.com costs the applicant $40.

Step 3: Verify Both Employment and Income for the Potential Tenant

Make sure that you call the potential tenant’s employer (you’ll most likely need to request to speak with someone in Human Resources) to ensure they’re employed as well as to verify their gross income. You can also ask the potential tenant for their last two pay stubs. If the potential tenant is self-employed, ask for the last two copies of their federal tax return to show their income.

For many landlords, it's common to ensure the potential tenant makes at least three times the monthly rent amount.

Step 4: Call Previous Landlords to Verify Rental History

Call the previous landlords or property management companies listed under “Rental History” on the rental application. Ask about:

-

Whether the potential tenant was ever late when paying their rent. If so, ask about how often this happened during the previous rental period.

-

Whether the potential tenant was served an eviction notice (or a notice to quit). If so, what was the reason?

-

Whether the tenant was loud.

-

How the potential tenant left the previous residence. For example, was it clean and in good repair (outside of normal wear and tear)?

-

How the potential tenant appeared to get along with others if the rental was a multi-tenant establishment such as an apartment complex.

Step 5: Decide Whether They’d Make a Good Tenant

Consider a tenant’s credit score, job history, income, criminal convictions (if any), and previous rental history. If you decide to move forward, send them an approval letter and collect the security deposit after signing a lease agreement. If you’re denying the application, send out a rejection letter. Keep a copy of the letter for future reference.

What Should You Include in the Background Check?

A background check is an important component when deciding if you want to rent to someone. You should look at the potential tenant’s credit (including their credit score), current employment status, their income, their previous rental history (including whether they’ve been evicted), and ask for references.

How To Write A Rental Application

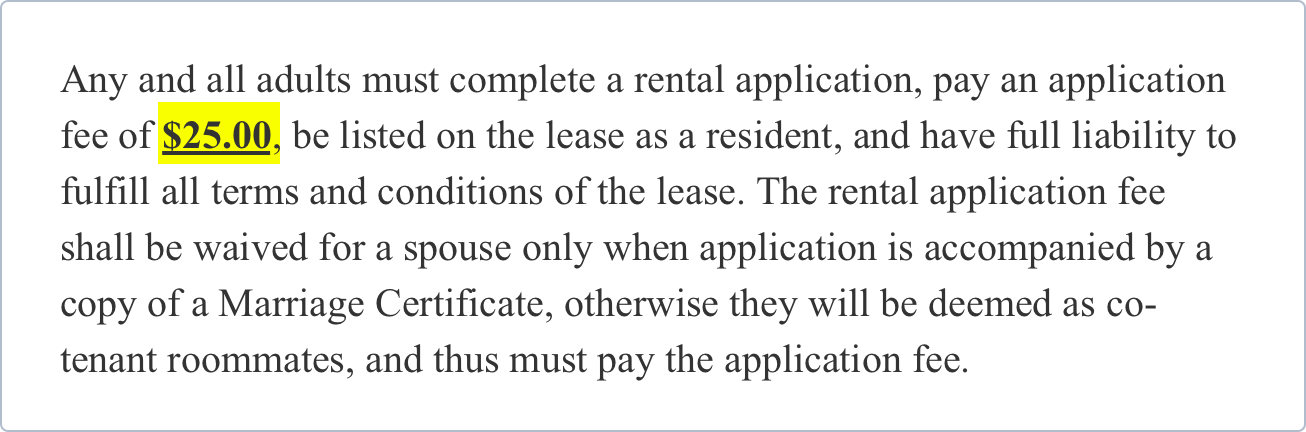

Step 1 - Application Fees and Background Checks:

This portion of the rental application will describe whether or not a fee will be charged for applying with the landlord. If an application fee will be charged, indicate the amount that will be charged to the applicant.

Step 2 - Pet Provisions (Optional):

If pets will be allowed in the rental, indicate the maximum number of pets allowed in the apartment. Besides, specify the amount required to cover the pet deposit. These figures will specify the deposit required for one pet and two pets. Also, specify the non-refundable deposit amount.

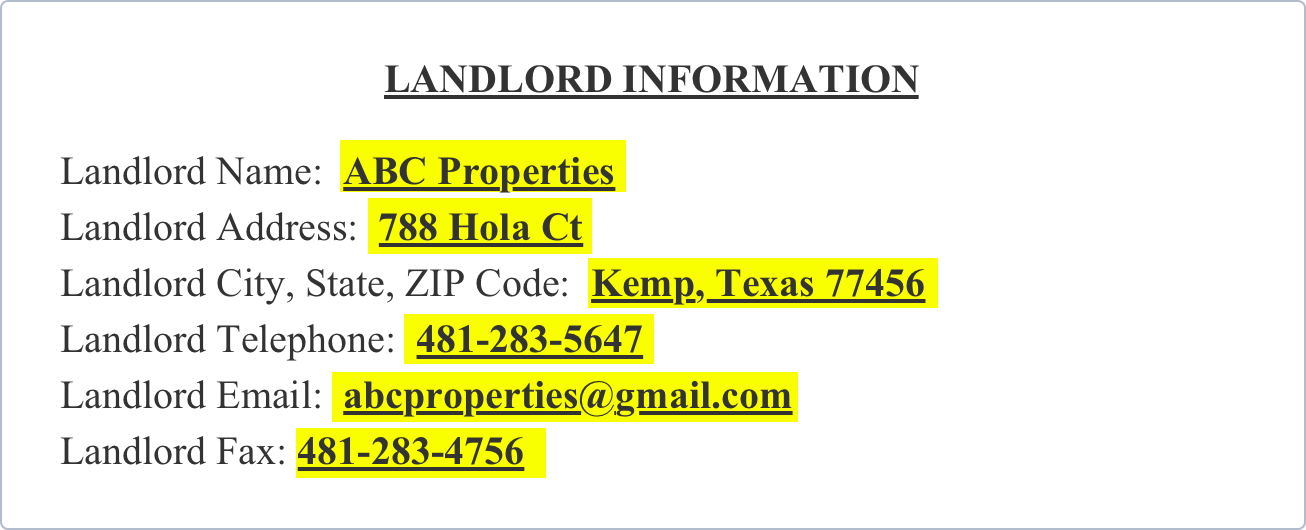

Step 3 - Landlord Information:

This section identifies the landlord and provides his or her contact information. When filling out this section, be sure to specify the following:

-

Landlord's Name

-

Full Address (Including city, state, and zip code)

-

Landlord’s Email Address

-

Landlord’s Telephone Number

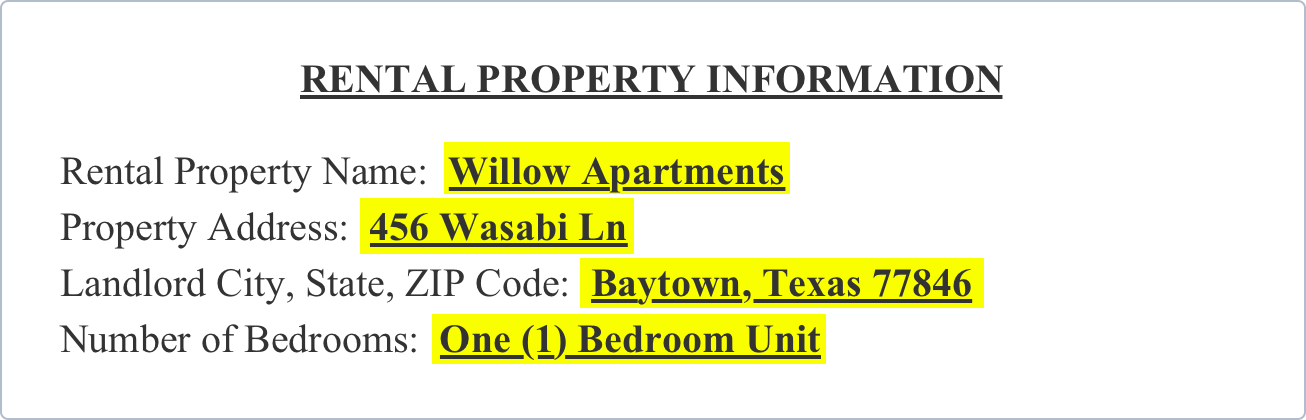

Step 4 - Rental Property Information:

In this section, the property is presented for rent is described, including the particular unit/rental information. Provide the following details about the rental property:

-

Property Address (including city, state, and zip code)

-

Number of Bedrooms

-

Rental Term

-

Amount of Rent Due and How Often

-

Security Deposit Amount

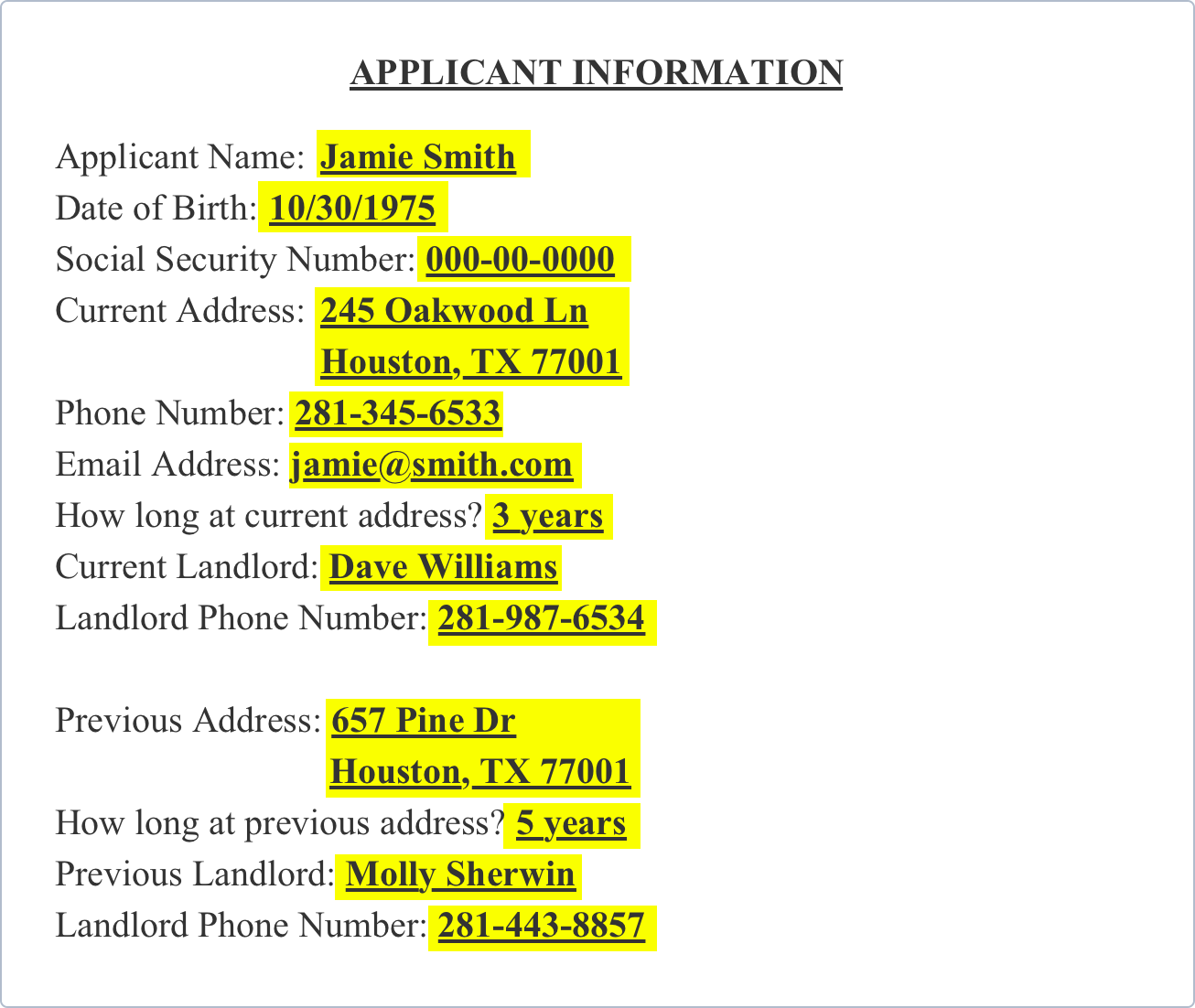

Step 5 - Applicant Information

In this section, the applicant’s details will be highlighted. These details include the applicants:

-

Date of Birth

-

Social Security Number

-

Date of Birth

-

Current Address

-

Phone Number

-

Email Address

-

Other personal information that will highlight their employment and rental history.

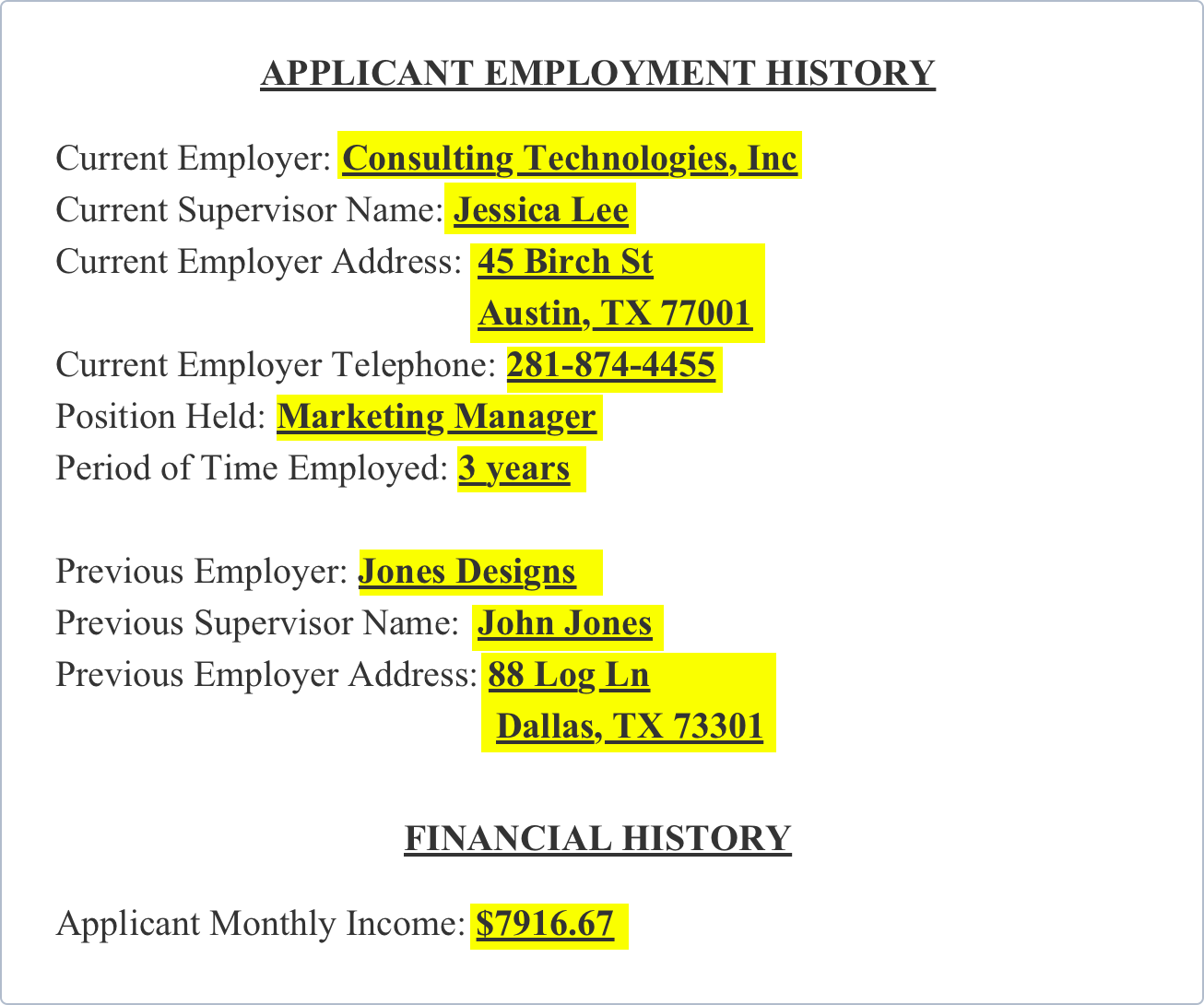

Step 6 - Employment and Financial History of Applicant:

This portion of the application highlights the employment and financial history of the applicant. This section gives the landlord an in-depth look into the applicant's life to help him or she determine whether or not the applicant will be a good candidate to rent the apartment or rental property. Information required includes current and past employers, positions held, and a period where the position was held.

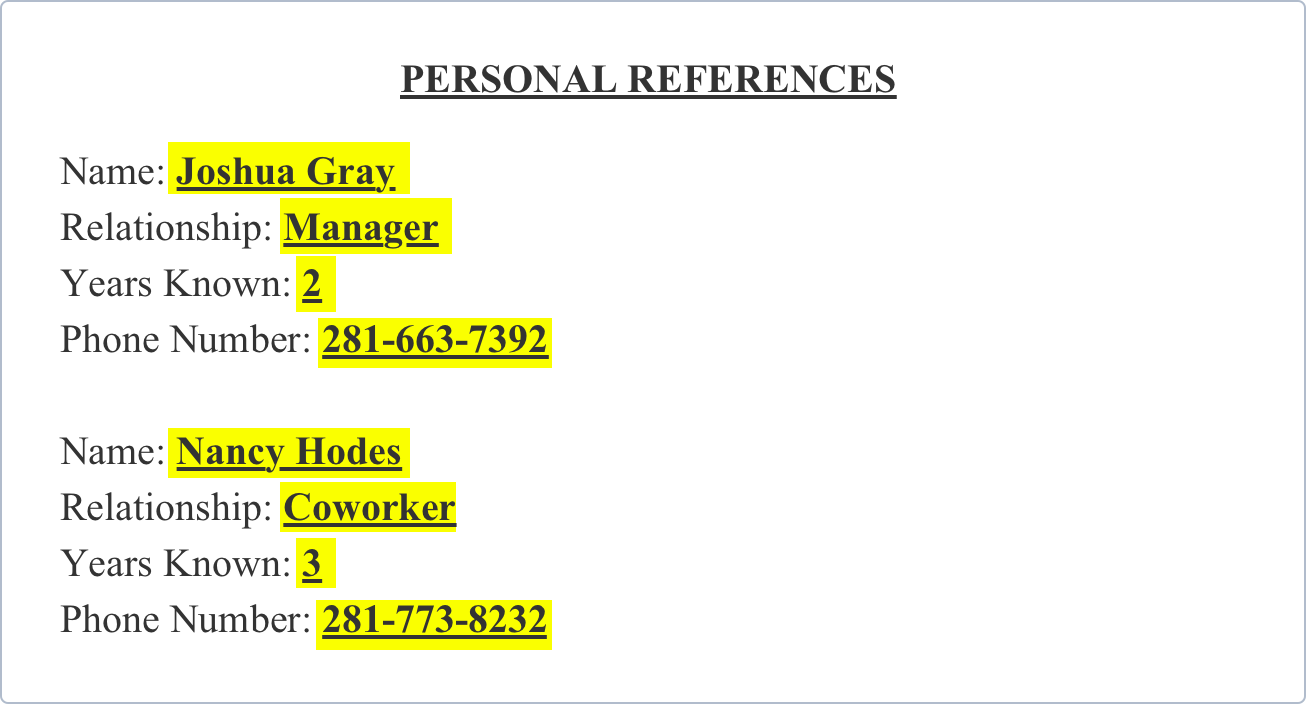

Step 7 - Reference Checks:

In this section, the applicant will provide personal references that will back up, or give further account to who they claim to be on paper. In this section, the applicant will provide the following information for each person that can support their claims, and give the landlord further insight on who they are as a person:

-

Reference’s Name

-

Relationship to Applicant

-

Years Known

-

Telephone Number

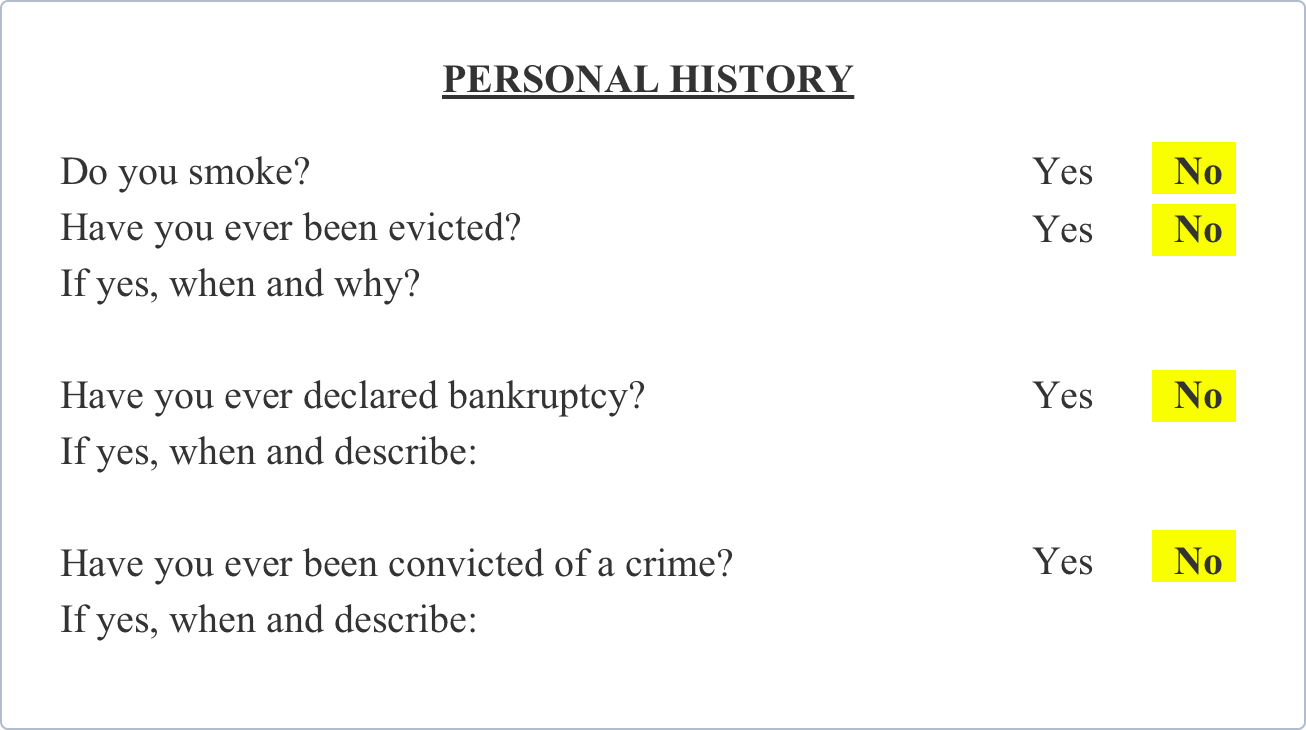

Step 8 - Personal History:

This section highlights some personal details of the applicant and helps the landlord determine whether or not he or she will be a promising tenant. These details include whether or not the tenant smokes, or has been evicted. Additional details include whether or not the applicant has been convicted of a crime, or declared bankruptcy.

Legal Forms Related to a Rental Application

-

Residential Lease Agreement: A document that sets out the legal terms by which a residential property is leased out from a landlord to a tenant.

-

Residential Sublease Agreement: If allowed by the original lease agreement, a sublease agreement allows a tenant to rent out the property to a subtenant, along with the same provisions of the main lease agreement.

-

Rent Receipt: A rent receipt is a form that provides proof of payment for rent by a tenant to a landlord.

Download a PDF or Word Template

Rental Application

A rental application is a tool to identify an ideal tenant who best fits the criteria of a rental agreement and helps the landlord find a tenant they can have the best relationship with.

Read More

Read More

Lease Agreement

A lease agreement is an agreement between two parties that enables one party to essentially borrow and use something that belongs to the other party. The lease agreement defines the terms and conditions of the lease.

Read More

Read More

Rent Receipt

A Rent Receipt is documented proof and protection for both landlords and tenants of rental payments having been made.

Read More

Read More

Month-to-Month Lease Agreement

Month to month lease agreements offer flexible rental arrangements for landlords and tenants. Each party is only contracted to comply with the negotiated and agreed terms on a monthly basis.

Read More

Read More