1099-NEC Document Information

What is a 1099-NEC Form?

The 1099-NEC Form is for employers to document non-employee compensation for independent contractors and freelancers. Independent contractors must receive Copy B of the 1099-NEC in order to include it with their tax returns. Employers, or payers, are required to file Copy A of the Form 1099-NEC with the IRS by February 2, 2026 for the 2025 tax year.

These conditions must be met to report payment for non-employee compensation:

-

The payment made are to someone (recipient) other than an employee, such as an independent contractor or freelancer who completes a temporary assignment.

-

The payment must be made for projects and services in the course of your (payer) trade or business.

-

The payments made to the payee (recipient) must be at least $600 during the year.

As aforementioned, payers are required to provide a Form 1099-NEC to the payee and file it with the IRS by February 2, 2026 for the 2025 tax year.

1099-NEC vs Other Tax Forms

1099-NEC vs W-2: Employee or Contractor?

Understanding the difference between employees and independent contractors is essential for proper tax reporting. Here are the key factors that determine whether someone receives a W-2 or 1099-NEC:

| Factor | W-2 (Employee) | 1099-NEC (Contractor) |

|---|---|---|

| Control | Employer controls how, when, and where work is done | Worker controls methods and timing of work completion |

| Tax Withholding | Employer automatically withholds federal, state, and payroll taxes | No taxes withheld - contractor handles their own tax payments |

| Equipment | Employer provides tools, equipment, and workspace | Contractor typically provides their own tools and equipment |

| Relationship | Ongoing employment relationship with benefits | Project-based or temporary work arrangement |

| Payment Schedule | Regular salary or hourly wage payments | Payment upon completion of specific projects or milestones |

1099-NEC vs 1099-MISC: What Changed in 2020?

The IRS brought back the 1099-NEC form in 2020 to separate nonemployee compensation from other miscellaneous income types. Here's what you need to know about this important change:

Historical Note: Before 2020, nonemployee compensation was reported in Box 7 of the 1099-MISC. The separate 1099-NEC form provides clearer distinction and helps ensure proper reporting of contractor payments.

How to Fill Out 1099-NEC

Completing a 1099-NEC form requires accurate information about both the payer (your business) and the recipient (contractor). Follow these steps for proper completion:

- Gather recipient information - Obtain completed Form W-9 from contractors before making payments

- Calculate total payments - Sum all nonemployee compensation paid during the tax year

- Complete form fields - Fill out payer and recipient information accurately

- Distribute copies - Provide Copy B to recipient by February 2, 2026

- File with IRS - Submit Copy A to the IRS by February 2, 2026

Form Components & Fields

Overview of fields in a 1099-NEC

Those who need to send out a 1099-NEC can create and customize their form using FormSwift's builder or acquire a free fillable form from www.irs.gov.

Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. When you fill out a Form 1099-NEC you will need:

-

Payer's and recipient's information, including name, address, and employee identification ID's/taxpayer ID's

-

Amounts paid to the recipient as a part of nonemployee compensation

-

State taxes withheld (if any) and in which states

-

Additional details (not common) such as “Account number” which identifies each individual 1099-NEC a payer is reporting, and “direct sales” information if the particular scenario involves direct sales between the payer and payee

Additional details for each section can be found below.

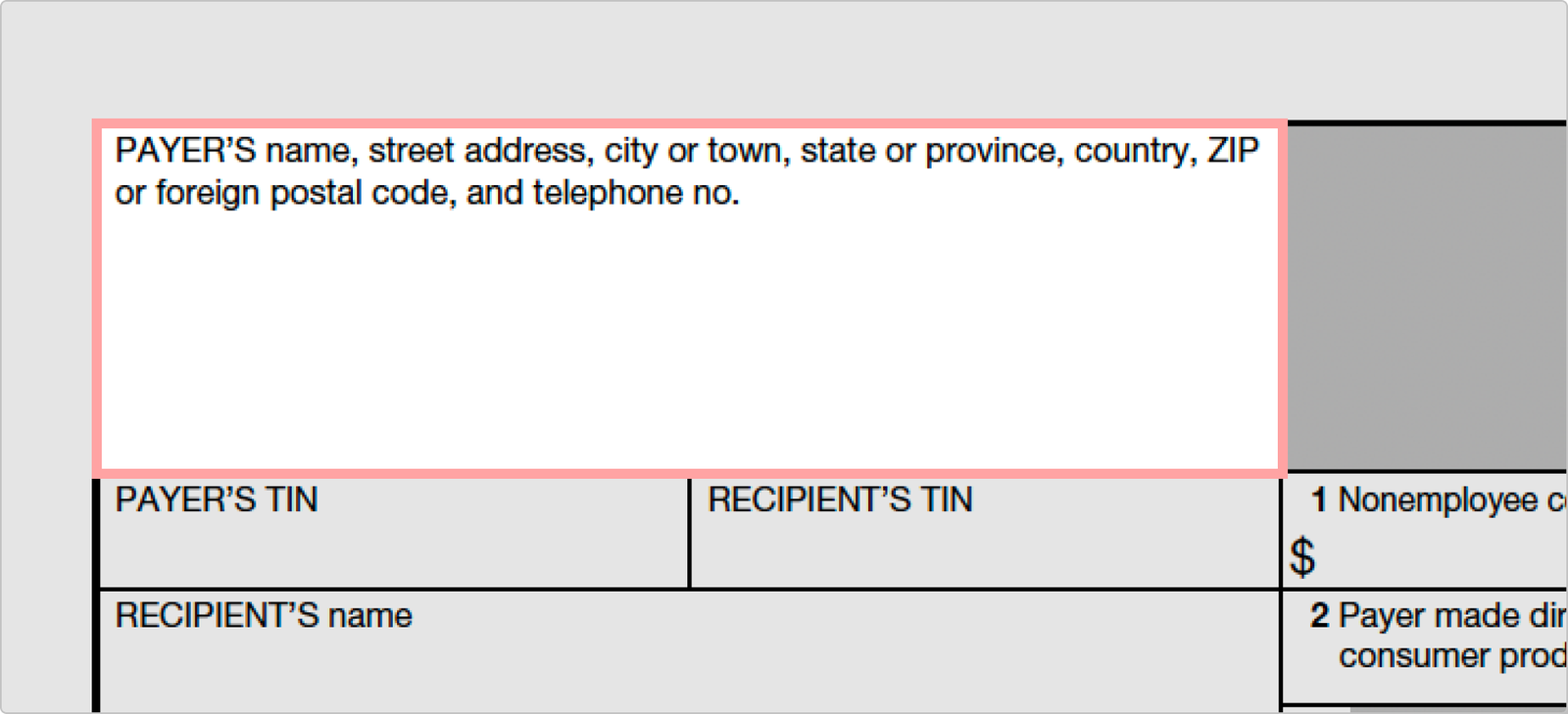

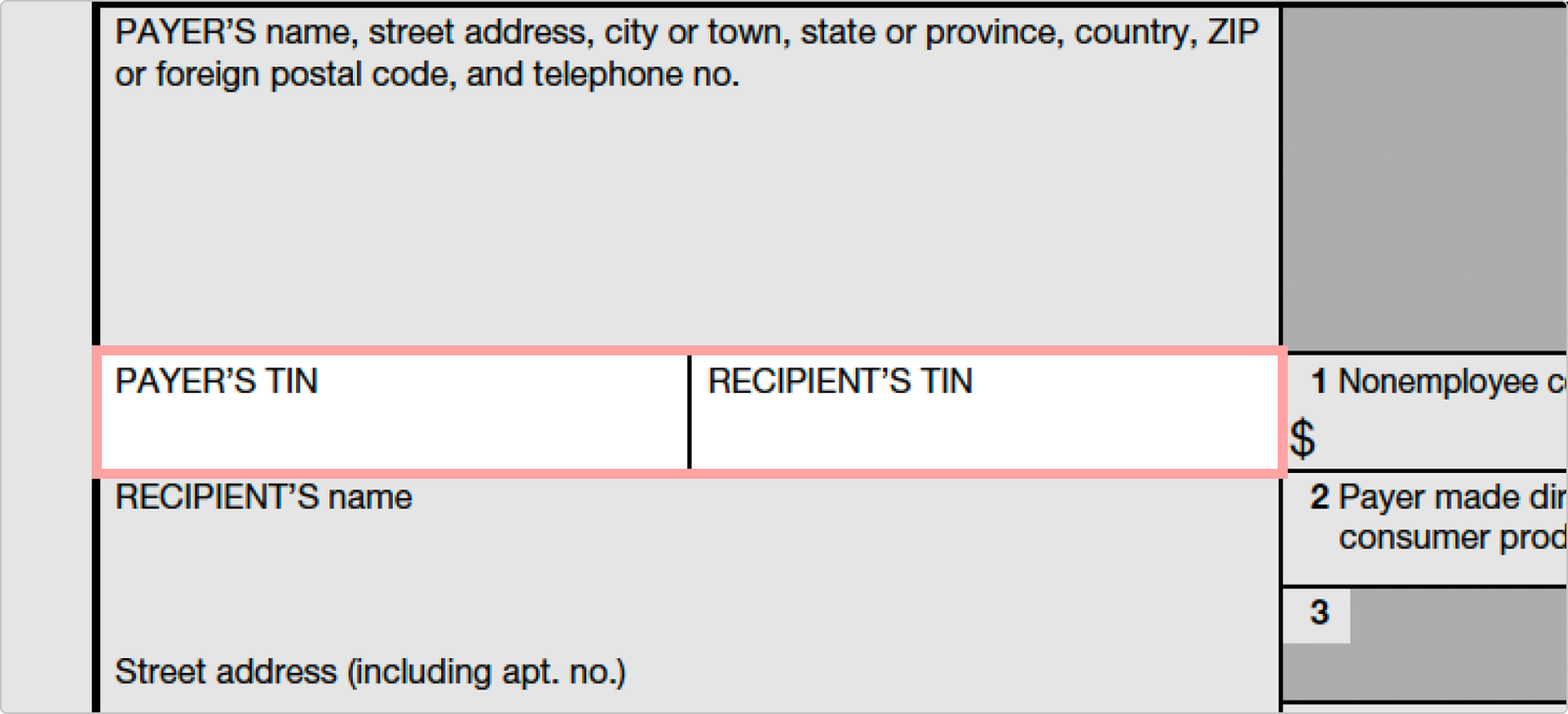

Payer's and Recipient's Information

Basic information such as payer's name and place of business should be listed in the large boxes on the top left.

Under that large box will be two smaller fields: one on the left for the payer's taxpayer identification number (TIN) and one on the right for the recipient's taxpayer identification number (for individuals, this is the same thing as their social security number).

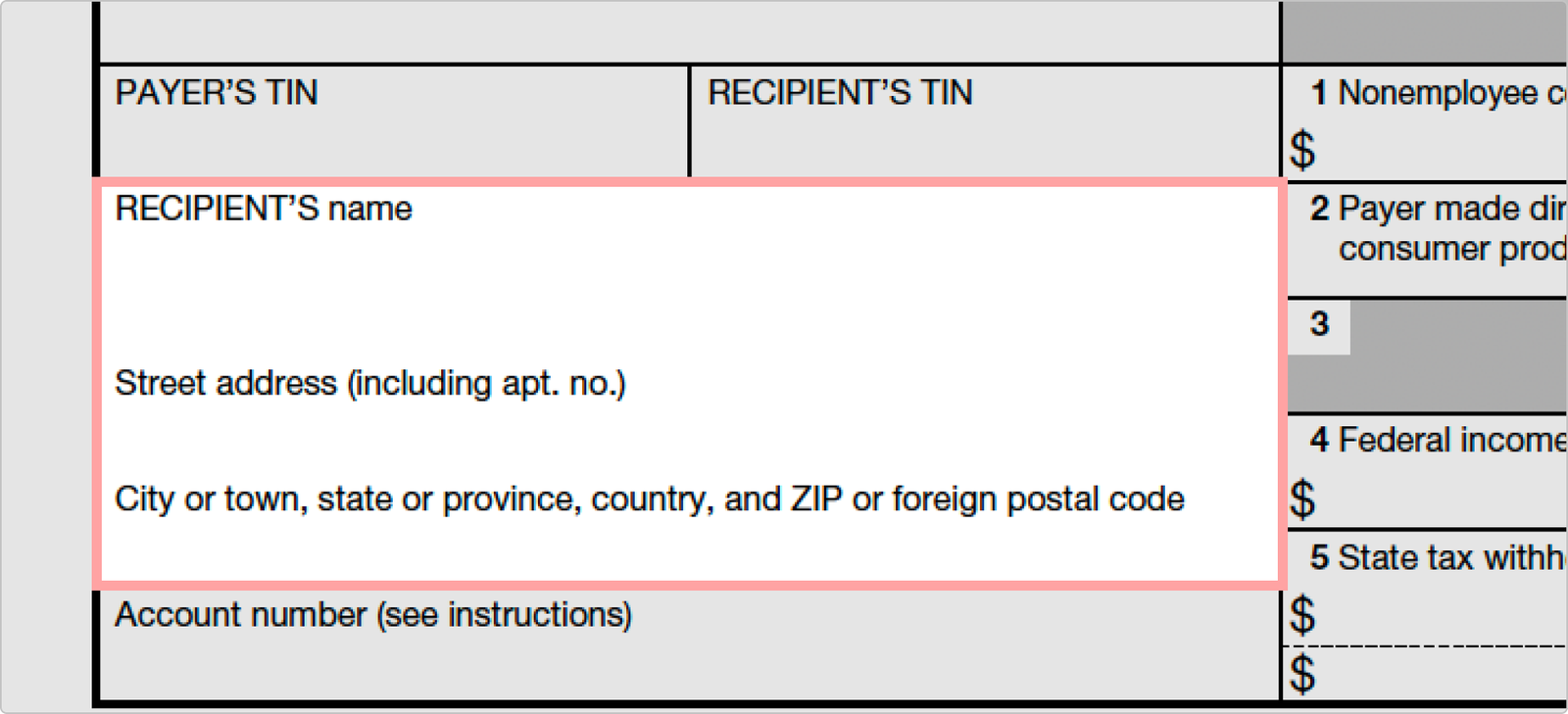

Recipient's name and address information will be requested below the above boxes.

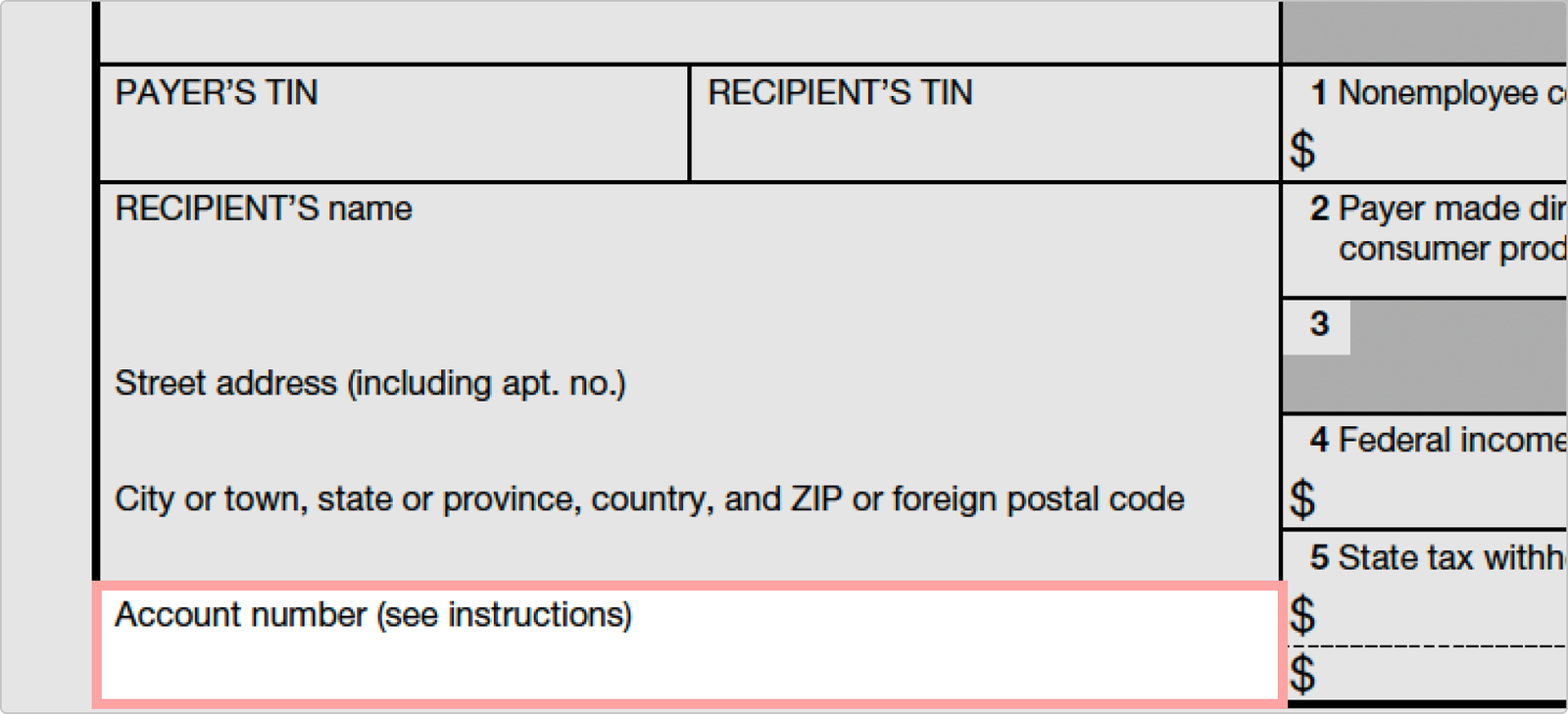

Account Information

Next, you'll see the account number field. It is located on the left side of the form, and it does not have its Box number. This is an optional field that is only used by the payer if they have multiple 1099-NEC’s for a single recipient. For example, if a payer need to provide two different 1099-NEC’s for separate services, each 1099-NEC will need a different account number in order to separate the two.

This section is generally used to help payers stay organized. However, if this section is filled out, and corrections will need to be made in the event of an error - this account information will need to be used to identify which 1099-NEC the payer is trying to correct.

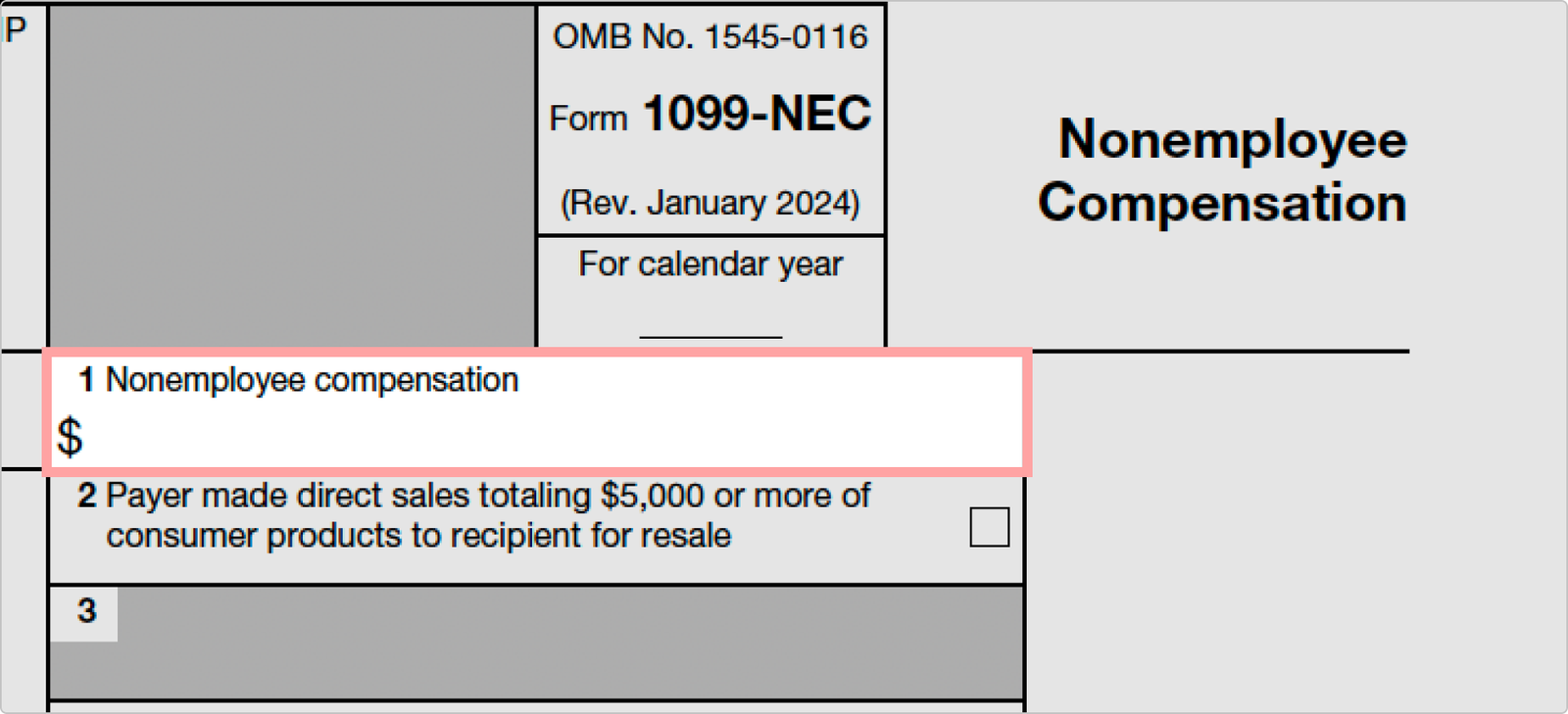

Box 1

Enter amounts of $600+ made to nonemployees. However, do not use the 1099-NEC to report gross proceeds to an attorney; use the 1099-MISC instead. Additionally, do not use the 1099-NEC to report payments of rent to real estate agents or property managers; use the 1099-MISC instead. Lastly, do not use the 1099-NEC to report cash payments for the purchase of fish for resale purposes; use the 1099-MISC instead.

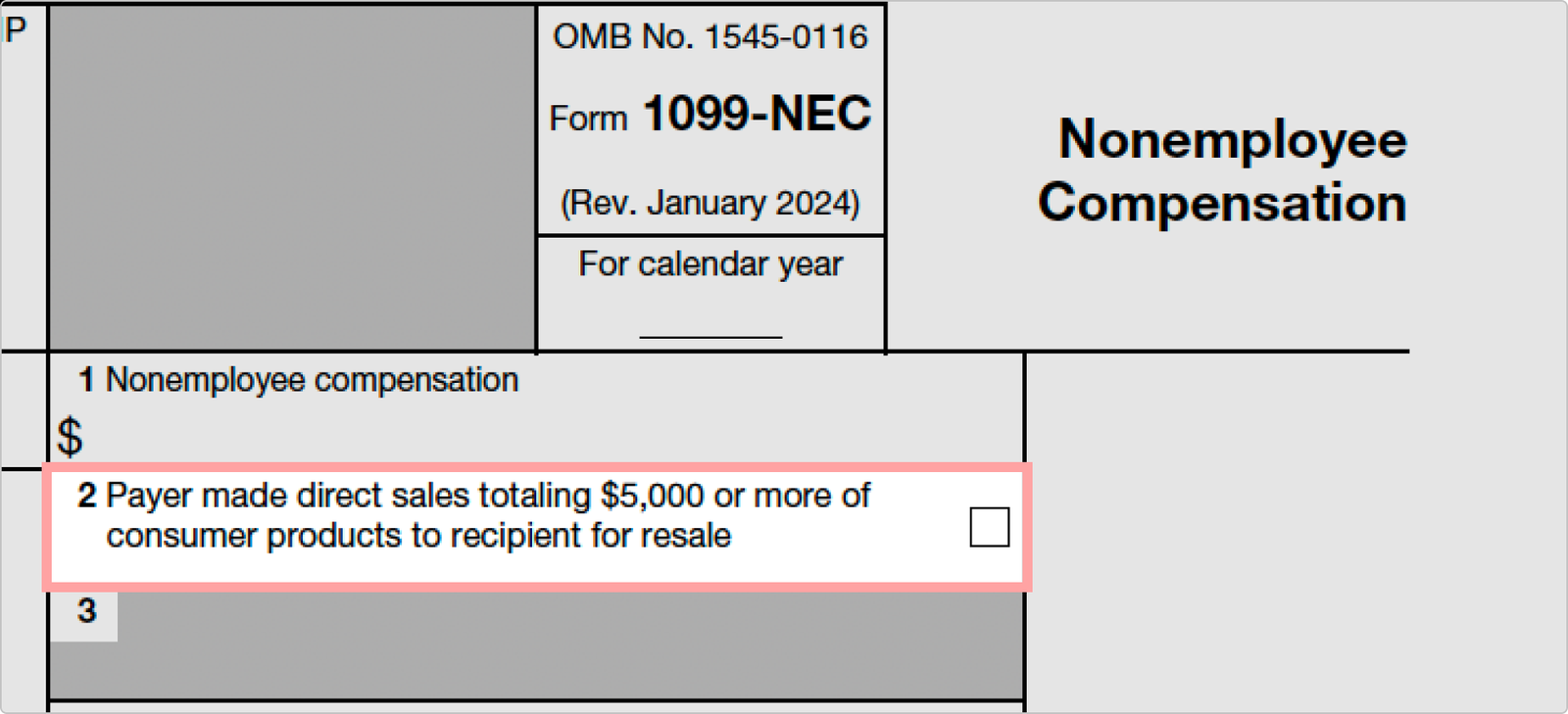

Box 2

Check this box if you made direct sales of $5000+ of consumer products to a recipient on a buy-sell, deposit-commission, or other commission basis anywhere other than a permanent retail establishment.

This is only checked if the arrangement between the payer and recipient involves resale goods. For example, if a business owner sold $5000 worth of pencils to a contractor, in which the contractor then sold to customers as a part of their services, this box would need to be checked.

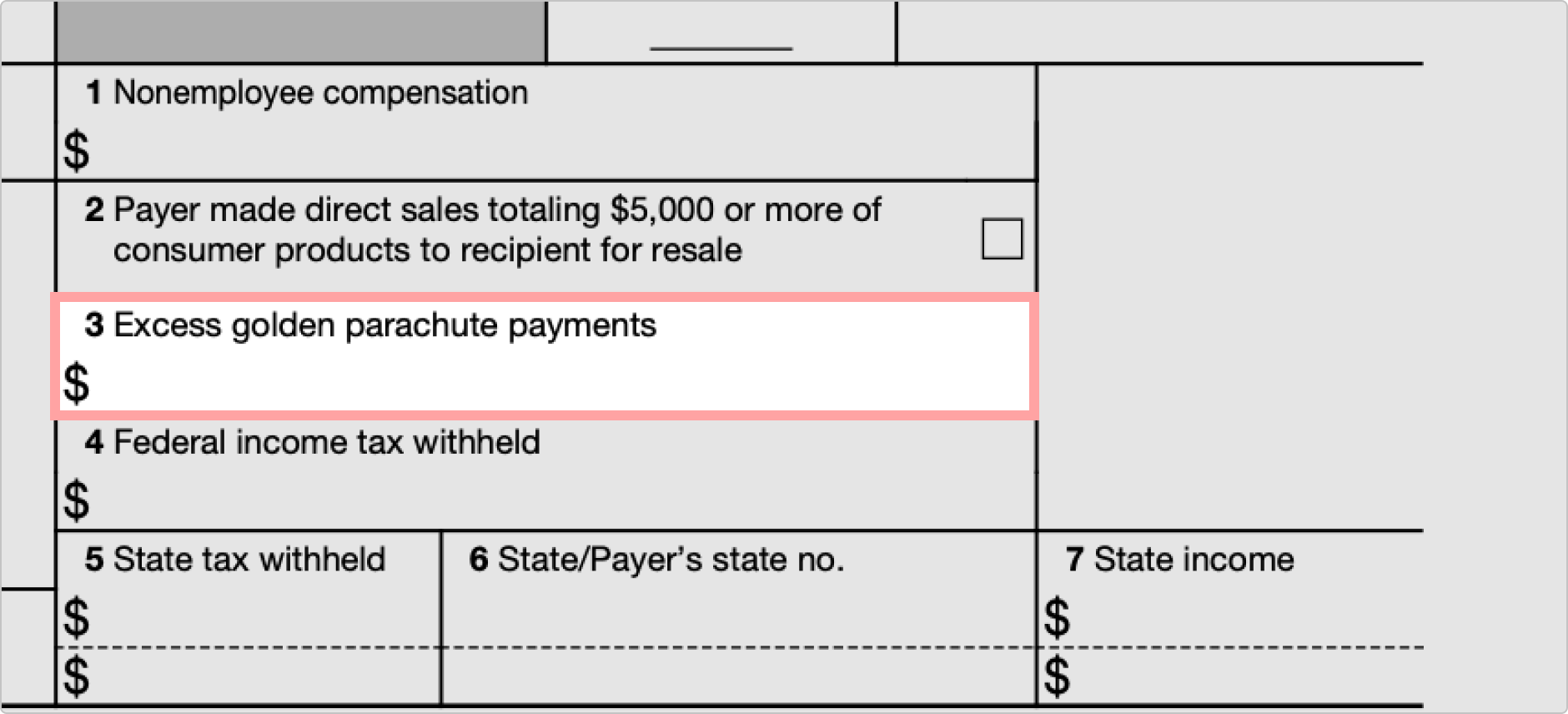

Box 3

Enter any excess golden parachute payments. These are special compensation payments made to executives during corporate ownership changes that exceed normal compensation levels.

This box is rarely used by most businesses. Golden parachute payments typically only apply to large corporations during mergers or acquisitions, not standard contractor payments.

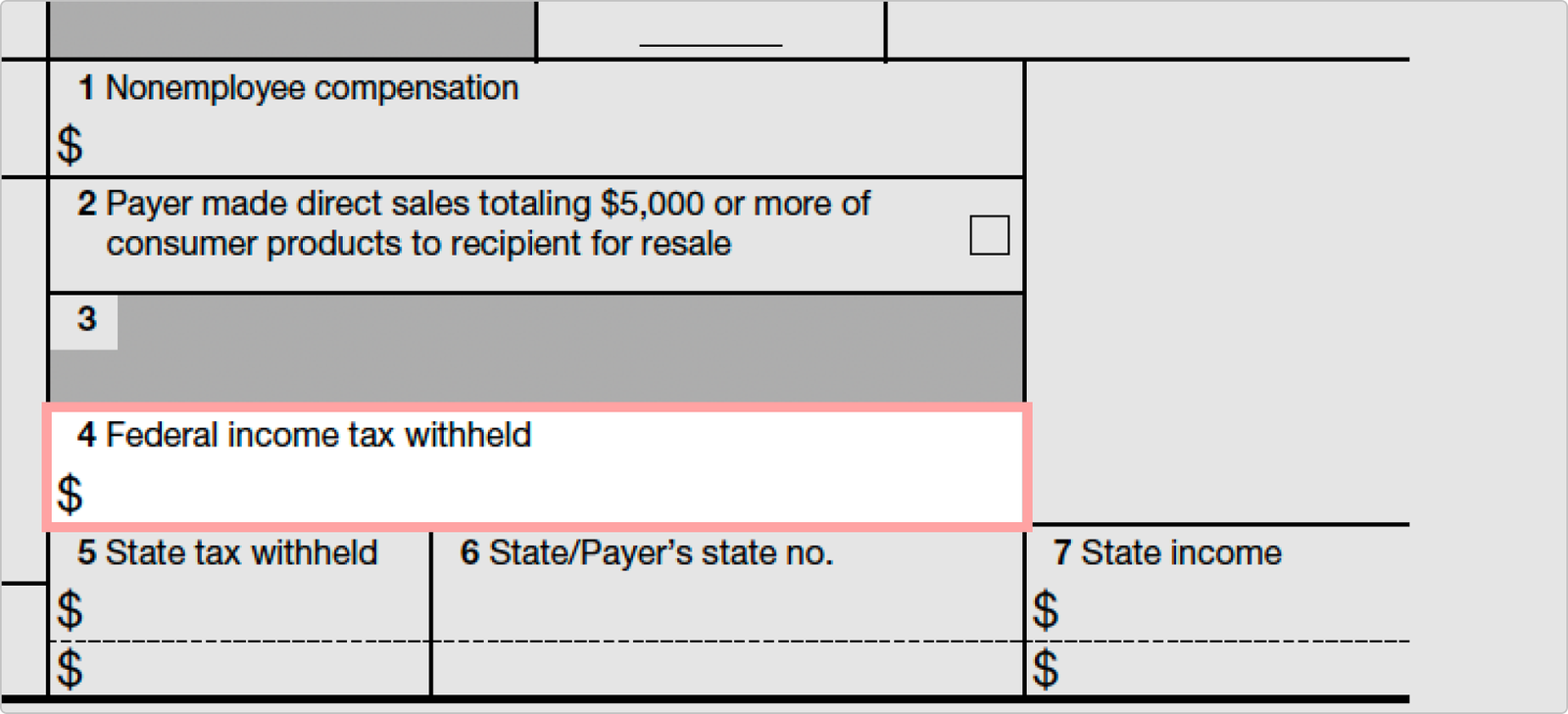

Box 4

List the amount of federal income tax withheld if any. When preparing tax forms for non-employees, federal income tax is often not withheld unless there is an order to do so by the court or the IRS.

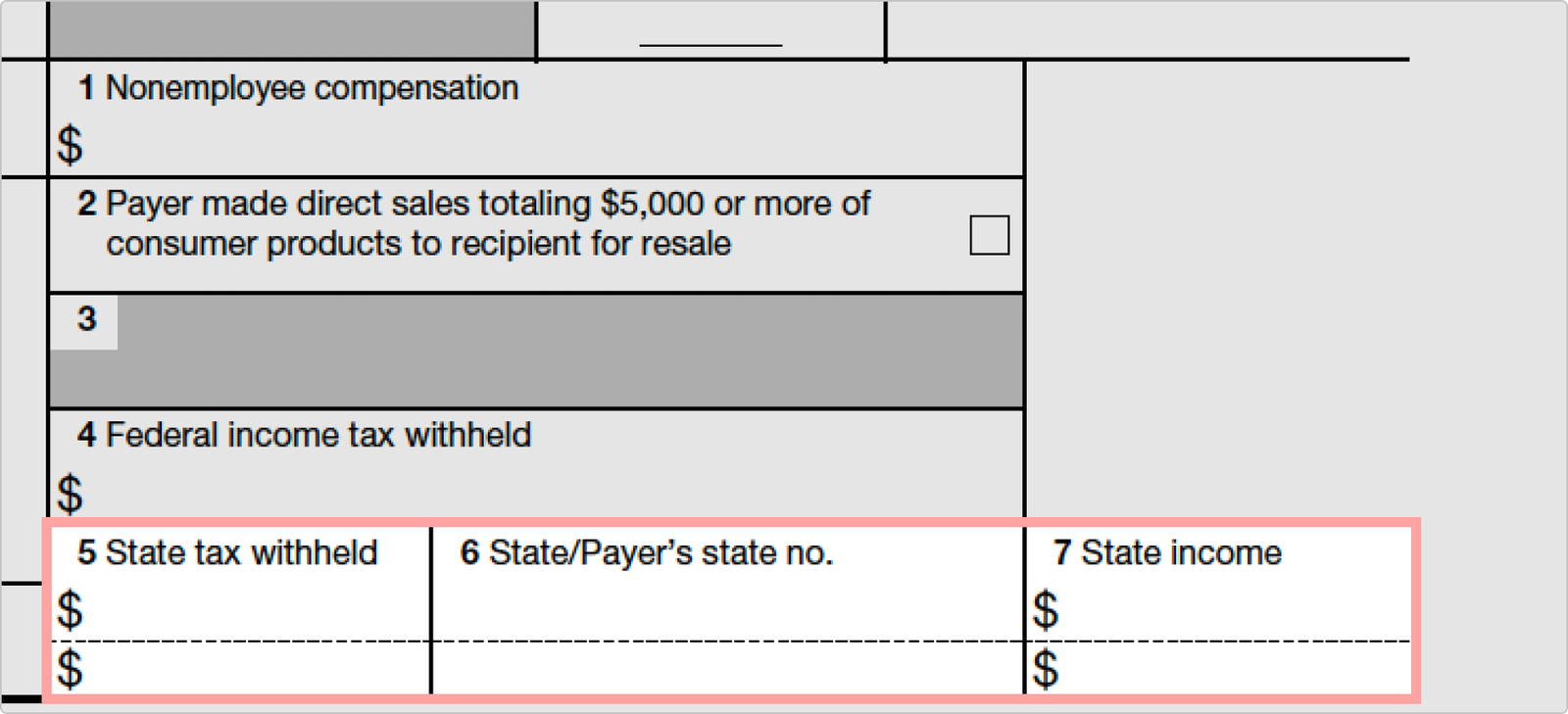

Box 5-7

Boxes 5, 6, and 7 are optional and are used to document state tax withheld from the non-employee compensation for up to two states.

Box 5 outlines the dollar amounts withheld.

Box 6 identifies the state via the two letter abbreviation and the payer's state ID number if applicable.

Box 7 outlines the amount of income paid in the respective state which nonemployee compensation was provided. In most case, if the services provided by the nonemployee reside in one state, there will be one state identified in boxes 5 and 6, and the amount listed in box 7 should equal to the number in box 1. If the services provided span across two states, box 7 should online which portion of the total amount paid to the nonemployee should attribute to state 1 vs state 2.

How do you fill out a 1099-NEC?

This document should not be confused with a W-2 form or with the 1099-MISC. The 1099-NEC is used to pay freelancers and independent contractors. This form is specifically for reporting payments to non-employees.

Completing and filing this tax form is easy. Simply fill in the appropriate boxes according to the definitions provided in the form's instructions. Remember that some fields are optional. Once the form is complete, distribute the copies of the 1099-NEC to the appropriate parties. Copy A will need to be filed with the IRS by February 2, 2026 for the 2025 tax year. Copy 1 will need to be filed with the appropriate state taxing authority, if applicable. Copy B is to be provided to the nonemployee by February 2, 2026. Copy C is for safekeeping for the payer's records.

The deadline for the 1099-NEC is the same regardless of whether you file by mail or electronically. This is the same deadline for when the payer will need to provide the recipient copy.

Essential 1099-NEC Form Elements

Understanding the core components of a 1099-NEC form ensures accurate completion and proper tax reporting. Here are the essential elements every 1099-NEC must include:

Important: All information must be accurate and complete before filing. Errors can result in processing delays and potential penalties. Consider consulting tax professionals for complex situations involving multiple contractors or unusual payment arrangements.

Frequently Asked Questions

What is the 1099-NEC filing deadline for 2025?

The 1099-NEC filing deadline is February 2, 2026 for the 2025 tax year. This deadline applies to both providing copies to recipients and filing with the IRS.

What's the difference between 1099-NEC and 1099-MISC?

Starting in 2020, the IRS separated nonemployee compensation from Form 1099-MISC into the dedicated 1099-NEC form. Use 1099-NEC for contractor and freelancer payments of $600+, while 1099-MISC is now used for rent, prizes, awards, and other miscellaneous income types.

What's the difference between 1099-NEC and W-2?

W-2 forms are for employees with taxes automatically withheld, while 1099-NEC forms are for independent contractors who handle their own tax payments. Contractors typically have more control over how and when work is completed and provide their own equipment.

Who needs to receive a 1099-NEC form?

Businesses must send 1099-NEC forms to independent contractors, freelancers, gig workers, and service providers who received $600 or more in nonemployee compensation during the tax year. This includes:

- Freelancers (writers, designers, consultants)

- Gig workers (rideshare drivers, delivery services)

- Service providers (cleaning, repair, maintenance)

- Professional services (accountants, lawyers, marketing)

Do I need to send a 1099-NEC for payments under $600?

No, you're not required to send a 1099-NEC for payments under $600. However, contractors must still report all income on their tax returns regardless of whether they receive a 1099-NEC form.

What are the different 1099-NEC copies for?

Each 1099-NEC form has multiple copies with specific purposes:

- Copy A - File with the IRS

- Copy B - Provide to the recipient (contractor)

- Copy C - Keep for your business records

- Copy 1 - File with state tax department (if required)

How do I correct errors on a filed 1099-NEC?

To correct a 1099-NEC, file a new Form 1099-NEC with the "CORRECTED" box checked. Provide corrected copies to both the recipient and the IRS. Include all correct information, not just the changes, and keep copies of both the original and corrected forms for your records.

What happens if I miss the 1099-NEC filing deadline?

Late filing penalties range from $60 to $680 per form depending on how late the filing is. File as soon as possible to minimize penalties. The penalty amounts increase the longer you wait, with the highest penalties for forms filed more than 60 days late.

Do I need to file 1099-NEC for corporations?

Generally no, you don't need to file 1099-NEC for payments to corporations. However, you must file for payments to attorneys (including corporate law firms) and for medical/healthcare payments to corporations. Always verify the business entity type before making this determination.

Important Filing Considerations

Tax laws and filing requirements can change every year. It's vital that you stay on top of the yearly changes and, if necessary, consult a tax expert on behalf of your business. Small businesses should particularly pay attention to compliance requirements, as 1099-NEC filing can become complex with multiple contractors.

Filing Compliance Requirements

Accuracy

Ensure all payer and recipient information is complete and accurate before filing. Double-check taxpayer identification numbers, addresses, and payment amounts to avoid processing delays.

Deadlines

File 1099-NEC forms by February 2, 2026 for the 2025 tax year to avoid penalties. This deadline applies to both providing copies to recipients and filing with the IRS. Mark your calendar well in advance.

Penalty Information

Failure to file required 1099-NEC forms or filing late can result in IRS penalties. The following penalty amounts apply to returns due in 2026 and vary based on how late the filing is and whether the failure was intentional:

- Filing 1-30 days late: $60 per form

- Filing 31 days to August 1: $130 per form

- Filing after August 1 or not filing: $340 per form

- Intentional disregard: $680 per form or higher

Consider consulting a tax professional for guidance on penalty abatement if you've missed filing deadlines. Professional guidance may help reduce or eliminate penalties in certain circumstances.

Professional Consultation Recommended: Tax law requirements vary by jurisdiction and can change annually. For complex contractor relationships, multi-state operations, or unusual payment arrangements, consider consulting with qualified tax professionals who can provide personalized guidance for your specific situation.