Professional Tax Builder

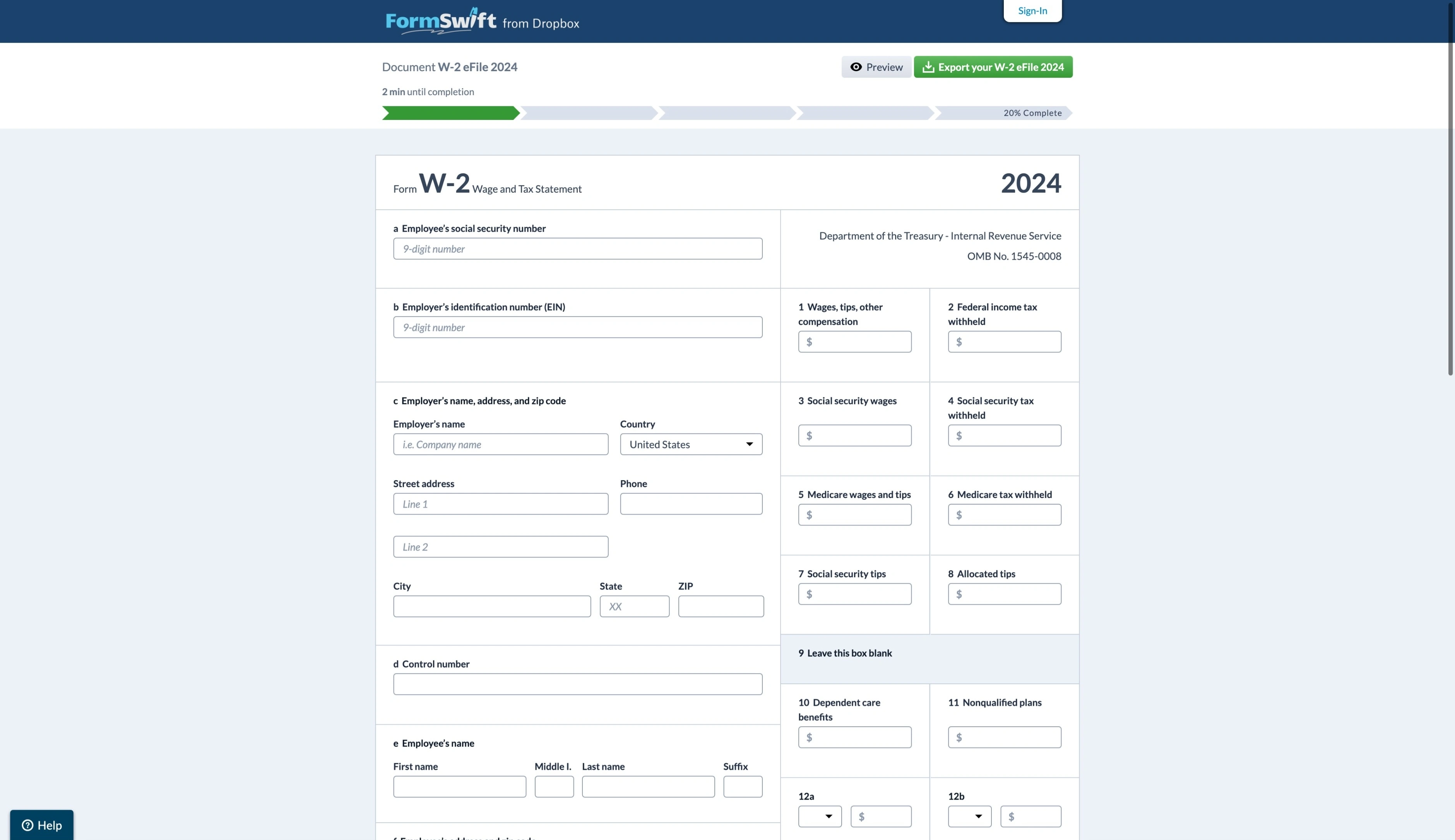

Create Any Tax Document with Ease. Build professional tax forms with our intuitive visual editor. Generate W-2s, 1099s, W-9s, and 50+ other tax documents without any technical skills required.

- 📋50+ Tax Forms - Complete library of federal and state tax documents for any situation

- 🎨Visual Tax Builder - Easy to use interface that anyone can use, no tax software experience needed

- ✅IRS Compliant - All forms meet current IRS specifications and are e-filing ready

Everything You Need to Build Tax Documents

Professional tax form creation tools that work in your browser - no software downloads required

Professional Tax Forms

Access 50+ tax forms including W-2, 1099-MISC, 1099-NEC, W-9, W-4, and more with automatic IRS compliance.

Visual Tax Builder

Create tax documents with intuitive form builder. They come pre-filled with the correct information for you to edit.

Business Tax Suite

Complete business tax document library including payroll forms, contractor payments, and year-end reporting documents.

Automatic Calculations

Built-in tax calculations and formulas ensure accuracy. Totals update automatically as you enter information.

Multi-State Support

Generate state-specific tax forms and handle multi-state tax situations with specialized templates and compliance.

Mobile Tax Builder

Create tax documents on any device. Our responsive builder works perfectly on desktop, tablet, and mobile.

Why Choose FormSwift's Tax Builder?

Professional tax documents without the complexity or expensive software

Faster Than Tax Software

Create tax documents in minutes, not hours. No complex setup or training required - start building immediately.

- ✓Generate tax forms in under 10 minutes

- ✓Pre-filled templates with smart defaults

- ✓Real-time validation and error checking

- ✓Instant preview of completed documents

Cost-Effective Solution

Get professional tax document capabilities at a fraction of the cost of traditional tax software or professional services.

- ✓Affordable filing fees

- ✓All 50+ tax forms included

- ✓Unlimited document creation

- ✓No expensive software licenses

Secure & Compliant

Bank-level security meets IRS compliance standards. Your tax documents are protected and professionally formatted.

- ✓256-bit SSL encryption

- ✓IRS-compliant document formatting

- ✓Secure document storage

- ✓HIPAA compliant for sensitive data

Perfect for Every Tax Document Need

Whether you're a tax professional, business owner, or managing personal taxes

Tax Professionals

Create custom tax documents and forms for diverse client needs

Perfect for:

- Client-specific W-2 and 1099 preparation

- Custom tax form modifications

- Multi-client document generation

- Professional tax document branding

Small Businesses

Handle payroll tax documents and contractor payments efficiently

Perfect for:

- Employee W-2 generation

- Contractor 1099 creation

- Quarterly tax form preparation

- Year-end tax document compilation

Property Managers

Manage rental income reporting and tenant tax documents

Perfect for:

- Rental income 1099 forms

- Property tax document preparation

- Tenant W-9 collection forms

- Multi-property tax reporting

Create Tax Documents in 3 Simple Steps

Professional tax document creation has never been easier - from form selection to filing-ready documents in under 10 minutes

Choose Your Tax Form

Select from 50+ professional tax form templates including W-2, 1099-MISC, 1099-NEC, W-9, and specialized business forms. Browse by category or search for specific forms needed for your tax situation.

Build & Customize

Use our visual tax builder to enter payer and recipient information, modify calculations, and customize document layouts. The system automatically validates data and applies current tax formulas as you type.

Generate & File

Download IRS-compliant tax documents ready for printing, electronic filing, or digital distribution to recipients. Export as PDF or submit directly through approved e-filing providers.

Frequently Asked Questions

Get answers to common questions about our tax builder and tax document creation features

Need help with tax document creation?

Our support team is here to help you get the most out of our Tax Builder

Ready to Build Professional Tax Documents?

Join thousands of tax professionals who trust FormSwift for tax document creation