2025 Tax Forms Made Simple

Create professional 2025 tax documents in minutes. Fill out 1099-MISC, 1099-NEC, W-2, and other essential tax forms with our intuitive online editor. IRS-compliant forms ready for electronic filing.

- ⚡Create Forms in Under 5 Minutes - Streamlined workflow gets your tax documents ready quickly

- 📄Professionally Formatted Documents - IRS-compliant forms that meet all 2025 tax year requirements

- 🔒Bank-Level Security & Compliance - Your tax information is encrypted and handled with HIPAA compliance

Everything You Need for 2025 Tax Filing

Complete suite of updated tax forms with built-in validation and professional formatting

1099-MISC 2025

Report miscellaneous income including rents, prizes, awards, and other payments to non-employees. Learn more about 1099-MISC requirements.

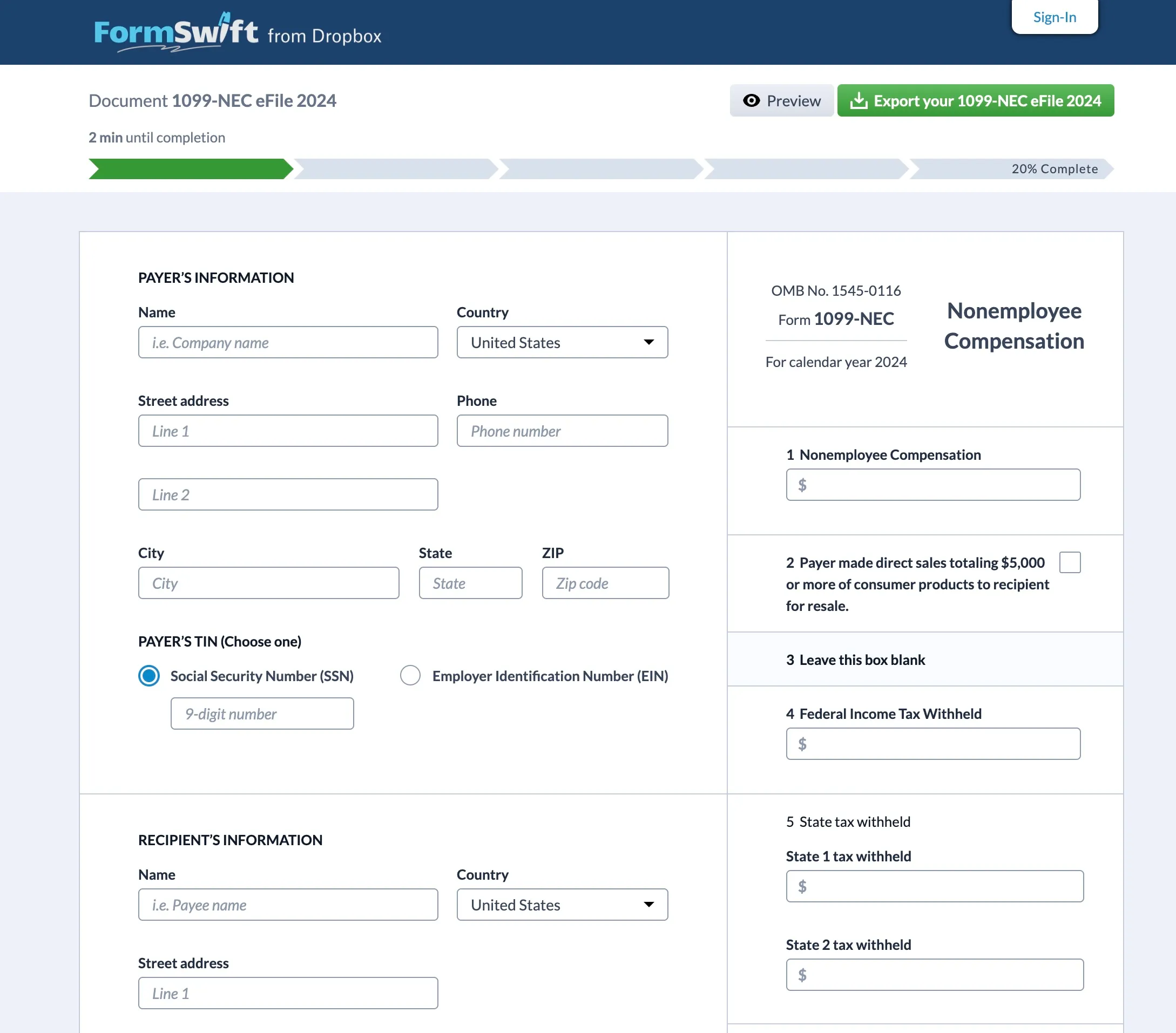

1099-NEC 2025

Document non-employee compensation for contractors, freelancers, and independent workers. Learn more about 1099-NEC requirements.

W-2 2025

Create employee wage and tax statements with automatic calculations and error checking. Learn more about W-2 requirements.

1099-INT 2025

Report interest income from banks, credit unions, and other financial institutions. Learn more about 1099-INT requirements.

Auto-Calculations

Built-in tax calculations and validation ensure accuracy and compliance with IRS requirements.

E-file Ready

Forms are formatted for electronic filing with the IRS or can be printed for manual submission.

Why Choose FormSwift for 2025 Tax Forms?

Professional tax document creation without the complexity or high costs

IRS-Compliant Forms

All forms are updated for the 2025 tax year with the latest IRS requirements and formatting standards.

- ✓Current 2025 tax year forms and schedules

- ✓Up-to-date with latest IRS requirements

- ✓Professional formatting that meets federal standards

- ✓Built-in validation rules prevent common errors

Streamlined Workflow

Complete your tax forms faster with guided step-by-step completion and smart data validation.

- ✓Step-by-step form completion guidance

- ✓Smart data validation catches errors instantly

- ✓Automatic calculations reduce manual work

- ✓Export in PDF, Word, or e-filing formats

Secure & Reliable

Bank-level security keeps your sensitive tax information safe throughout the entire process.

- ✓256-bit SSL encryption for all data transmission

- ✓HIPAA compliant document handling and storage

- ✓Secure cloud storage with privacy protection

- ✓Privacy-focused processing with no data mining

Perfect for Every Tax Filing Need

Whether you're managing business taxes, employee documentation, or contractor payments

Small Business Owners

Manage all your business tax documentation in one place

Perfect for:

- Create 1099 forms for contractors and vendors

- Generate W-2 forms for employees

- Organize business tax documentation

- Handle quarterly filing requirements

Freelancers & Contractors

Track and report your income with professional documentation

Perfect for:

- Organize 1099-NEC forms from multiple clients

- Prepare tax documentation for filing

- Create professional income reports

- Maintain records for tax preparation

HR Departments

Streamline employee tax document processing

Perfect for:

- Bulk generate W-2 forms for employees

- Process 1099 forms for contractors

- Manage year-end tax document distribution

- Ensure compliance with federal requirements

Start Filing 2025 Tax Forms in 3 Steps

Professional tax document creation has never been easier

Choose Your Form

Select from 1099-MISC, 1099-NEC, W-2, or other 2025 tax forms. All forms are updated with current IRS requirements.

Fill Out Details

Enter payer and payee information using our guided form builder. Smart validation catches errors as you type.

Download & File

Get IRS-ready documents formatted for electronic filing or printing. Export as PDF or Word documents.

2025 Tax Forms FAQ

Get answers to common questions about 2025 tax forms and filing requirements

Need help with tax form requirements?

Our support team can help you understand which forms you need and how to complete them properly

Ready to Complete Your 2025 Tax Forms?

Join thousands who trust FormSwift for professional tax document preparation