Pay Stub: What Is It?

A pay stub is a document related to an employee's paycheck. If an employee receives direct deposit, a pay stub is a separate document that is given to the employee to document their earning for that pay period and for the year-to-date. If an employee receives a paper paycheck for deposit, the pay stub will typically be attached to the check.

A pay stub will have several financial details about the employee's salary, taxes, and other contributions. This will include how much they earned for the current period and for the year so far. The stub will also list the federal and state taxes that have been withheld from the employee's earnings. Social security contributions as well as payments to employee benefits such as health insurance are also shown, ensuring the employee can see where their money is going.

Contents of a Pay Stub

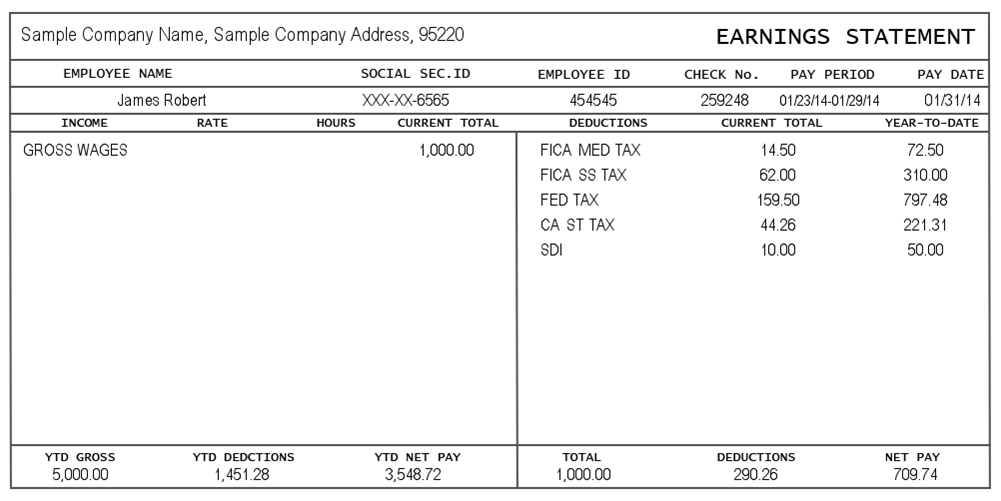

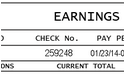

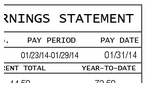

A pay stub is that little slip of paper that is attached to a paycheck. It allows employees to keep a record of payments received. Generally, it looks something like this:

When an employee receives a paycheck, he or she can free the pay stub from the check and file it away to use at the end of the tax year. A pay stub form should contain some basic information that can be divided into three components - company information, employee information and payment details. What follows is a summary of each component.

This is pretty basic. Company information includes the company's DBA name and address. It is generally listed either along the top or bottom of the pay stub.

Employee Information

This section must include an employee's full legal name and employee ID number. It may also include social security information. If you mail paychecks to your employees, this section should also include the employee's address. An easy way to organize this information is to list it along the top row of the pay stub.

Payment Details

This is the more extensive component of the pay stub. Basically, it should summarize how much money the employee has earned during the applicable pay period, as well as how much he or she has earned thus far this tax year. A pay stub template would consist of the following parts:

Check Number

This is the number of the check issued the employee. This comes in handy should the check need to be cancelled or tracked down.

Pay Period and Pay Date

These are pretty self-explanatory. The pay period section should list the beginning date (aka: 1/11/21) and end date (aka: 1/25/21) of the pay period in question. The pay date section should provide the date on which the check is issued. Generally, this is a few days after the end date of the pay period.

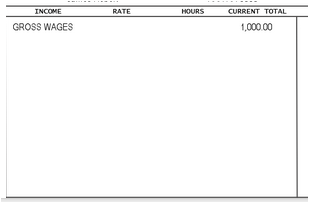

Amounts and Types of Income

This is the real meat of the pay stub. It must provide the number of hours worked, both regular and overtime. It should also specify the amounts earned for each type of income. Income types include gross wages or "regular" (in other words, hourly), as well as direct tips for food service workers and other tippable employees. Hours and amounts must be provided for both this particular pay period and the total tax year to date, often abbreviated as "YTD." This section should also include the hourly rate earned by the employee.

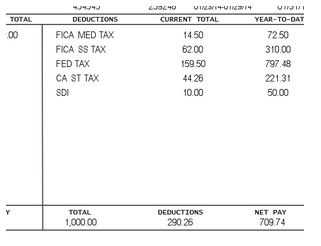

Deductions

A pay stub should also list deductions, for both this pay period and the YTD. Common deductions include federal tax, state tax, Medicare, and social security. The stub must provide both an itemized list of deducted amounts and the sum of all deductions.

Paycheck Stub

A paycheck stub, also known as a pay slip, wage slip, or pay stub, is a document a company provides to employees that details their income and deductions. It can be distributed as a hard copy or as an electronic pay stub. On a physical paycheck, a paycheck stub is generally attached to the same piece of paper. If employees are paid by direct deposit to their bank account, they can access printable paycheck stubs via the employer's online payroll system.

A paycheck stub should include the following information:

-

Employee information, including name, social security number, and address.

-

Employer information, including name and address.

-

The dates of the pay period.

-

Employee pay rate. The hourly rate should be listed for hourly employees.

-

Gross pay, earnings before taxes, deductions, and employee contributions are taken out. For hourly employees, the hours worked should be listed. For salaried employees, the default is 40 hours a week. The pay stub should also list vacation pay and any bonuses, as well as overtime if the employee is eligible and any overtime hours worked.

-

Taxes withheld, including federal income tax (based on an employee's W-4/exemptions), Social Security and Medicare (FICA), State Disability Insurance (SDI) and, if applicable, state or local taxes. States set their own income tax rates; some have bracketed tax rates, like the IRS, some have a flat rate, and some states have no state income tax whatsoever. Some cities require payment of local taxes, which pay for local government services.

-

Deductions, including deductions for health insurance and life insurance, and any deductions due to judgements rendered against the employee, including child support payments or another legal settlement.

-

Employee contributions, including contributions to retirement plans/pensions, the employee’s share of FICA tax, union dues, health insurance, and life insurance.

-

Net pay, the total amount the employee actually takes home in their paycheck after all taxes, contributions, and deductions are subtracted from gross earnings.

-

A year to date total of the employee’s gross salary, taxes, deductions, and net salary.

-

Additional information, such as accrued sick leave, as required by state law.

Additional Pay Stub Resources & Information:

https://www.thebalancecareers.com/what-is-included-on-a-pay-stub-2062766

https://smallbusiness.chron.com/create-pay-stub-excel-director-new-business-29227.html

https://www.zenefits.com/workest/what-does-a-pay-stub-look-like/

For the employer, a pay stub is useful for tax filing purposes and to resolve any issues regarding employee pay.

For the employee, a pay stub is a record of their wages, taxes/other deductions, and contributions that allows them to verify that they were paid correctly. A pay stub also serves as a proof of employment and/or income, often necessary information when applying for a loan/credit or applying for a job (if requiring salary history during a job interview is permitted by the state/locality).

Employers are not required by federal law to provide employees with a pay stub, but most states have laws that require some form of a written pay statement. In addition, employers are required by the Fair Labor Standards Act (FLSA) to keep a record of the hours their employees work. Employers should, therefore, provide employees with a pay stub with each paycheck.

The few states that do not require a pay stub are:

-

Alabama

-

Arkansas

-

Florida

-

Georgia

-

Louisiana

-

Mississippi

-

Ohio

-

South Dakota

-

Tennessee

The Fair Labor Standards Act (FLSA), however, does require information regarding employees, including payroll information/hours worked, to be recorded by employers. Employers should, therefore, provide employees with a pay stub with each payroll check.

In "opt-out" states, employers must obtain employees’ consent before changing the way they deliver paycheck stubs and must retain the previous method if an employee prefers. In "opt-in" states, employers must offer paper stubs unless an employee chooses to have the stub provided electronically.

Pay Stub Generator

There are several different ways an employer/business owner can create professional pay stubs, depending on their needs. If the design of the pay stub is not significant and the employer wants more control over the information that will be included on the pay stub, they should use software such as Microsoft Word or Microsoft Excel. No-cost web-based programs such as Google Docs and Google Sheets are also excellent options. If design is important, there are many online tools that will allow an employer to customize their pay stubs.

In the alternative, an employer can purchase payroll software or hire a payroll service. Payroll processing is a time and cost-saving process for a small business.

A pay stub generator creates a (blank) pay stub in four simple steps:

1. Enter the company, employee, and income information.

2. Enter any applicable deductions.

3. Click the “Create pay stub” button.

4. The pay stub will be sent to the employer's email inbox.

A pay stub generator should include the following features:

-

User-friendly.

-

The pay stub has a clean, simple design.

-

The process is instantaneous.

-

Pay stubs are exported in PDF form.

Pay Stub Generator:

The Guide to Best Utilizing Your Paycheck

By FormSwift Editorial Team

May 3, 2021

There’s a lot that goes into a paycheck- deductions, withholdings, taxes, benefits, flexible spending and savings accounts, exemptions, etc. This guide is designed to help you get the most out of your paycheck. Follow our step by step guide and make sure you’re receiving all the money you should out of each paycheck and taking advantage of the benefits your employer offers.

Step 1: Determine your income and expenditures

A thorough understanding of just how much money you bring in and how much you spend each month is the first, and perhaps most important, step towards financial responsibility. Therefore, before you consider taking on additional expenses--personal trainer, car payment, wine club membership, etc.--make sure you’ve calculated the following:

Income (A): how much money to you bring in each month, after taxes?

Expenditures (B): what are your monthly expenses? How much money, in other words, do you spend--i.e. rent/mortgage, utilities, car payments and transportation cost, student loan debt payment, groceries and food, insurance, other bills, miscellaneous* etc.

Note - you must also include non-monthly expenses. These include annual or semi-annual costs like property tax, income tax, car insurance and registration, home or auto maintenance, expected dental or health care costs, etc. To do this, calculate the expected annual cost of all of these items and then divide that number by twelve. The quotient is the monthly cost of those obligations. Take that number and add it to your monthly expenses as “miscellaneous” or some other label of your choosing.

Once you have tabulated both your income (A) and monthly expenditures (B), you can subtract B (expenditures) from A (income). The amount of money remaining is your disposable income, which you can invest, save, donate to charitable causes, or use for leisure activities, hobbies, and entertainment. If, however, B minus A gives you a negative sum, then you do not earn enough money to sustain your current lifestyle.

Track your discretionary spending

For 2-3 months, keep a detailed log on how much money you spend eating out, on concert and sports tickets, shopping, etc. After the 2-3 months, you’ll have extensive data on where you spend your discretionary income and where you can potentially save money by exercising financial restraint.

Pro tip: Use only cash for discretionary spending

Many people have trouble keeping their discretionary spending in check. With the convenience of credit cards and phone payment apps it is easy to overspend without knowing it. Therefore, when it comes to discretionary spending, the best way to stick to a budget is to withdraw a set amount of cash at the start of each week and make sure you pay for all of your discretionary items with that cash. Having actual money on you at all times will give you a constant reminder of what you can and cannot spend. If you find something you’d like to purchase (e.g. a new jacket) one week but do not have enough cash to do so, then it is up to you to save some money to roll over to the following week and make your purchase.

Take advantage of loyalty programs and coupons wherever possible, especially places you frequent.

These programs are almost always free to join and can help cut down on expenses.

Step 2: Saving

Monthly Saving: Assuming you earn more man than you spend (i.e. A>B), you should save a portion of each paycheck. Building robust savings will give you money to create a financial safety net (via traditional savings accounts, investments, etc.) that can secure your future or cover your monthly expenses if you happen to lose your job or confront other unforeseen financial burdens. A 6-month emergency fund (i.e. 6x your monthly expenses) is highly recommended.

401K & Retirement Accounts: Many employers offer matching funds for employees who contribute money to a retirement account. Additionally, the money you contribute to your 401K is taken from your pre-tax income, which allows you to save even more money without reducing your take home pay. It is highly recommended that you send a set percentage of your monthly paycheck towards a 401K. Ideally, that percentage would equal the amount your employer is willing to match, but even a fraction of that amount can start you on a path toward a comfortable retirement.

Savings Accounts: We also recommend you set up an automatic and recurring transfer from your checking to savings account on every payday. That money can be used to build your emergency fund and can also be used to save toward big-ticket expenditures like vacations.

Pro Tip: Save your raises, save your bonuses

Perhaps the best way you can save for and secure your financial future is to save as much of the money you don’t currently earn as possible. This means future raises and bonuses. If you’re spending money responsibly, you’re already living well within your means, setting aside money for retirement, and sending some cash to savings each month. Therefore, when you come into additional income, via raises or bonuses, consider saving most, if not all, of it.

Say, for example, you just earned a raise and expect to bring home an additional $500 each month after taxes. If you’re already living in a financially responsible manner, consider putting all of that raise into your 401K (which, in actuality, may amount to more than $500/month if its taken out of your pre-tax income and is matched by our employer). Doing so won’t impact your current financial situation since you’re already getting by without that money. It will, however, dramatically boost your retirement savings, speed up your timeline to buy a house, etc.

Or say you add all of that raise to your monthly auto-transfer to savings. Doing so would net you an additional $6000 dollars per year in savings. If, by chance, you lose your job eighteen months after your raise, you’ll have $9000 more in your emergency fund as you figure out your next steps.

The same goes for annual, or semi-annual bonuses. Consider saving or investing all of that money. The long term financial gains of doing so dramatically outweigh the short-term thrill of spending it irresponsibly.

Step 3: Mastering Withholdings

Fun Fact: In 2015, the average federal tax refund was over $3000. This means taxpayers typically give more to the government in withholdings than necessary. Additionally, extensive data compiled by the University of Chicago indicates that around 100 million taxpayers receive refunds each year as a result of over-withholding. Each taxpayer, the University of Chicago found, sends around 7% more of their adjusted gross income to the government than they should.

Think you may be overpaying? Check out the IRS withholding calculator.

Understanding your withholdings: Definitions

Regular pay: amount you were paid during your last pay period before any pre-tax deductions.

Other pay: overtime, holiday and sick-pay.

Federal taxable wages and withholding: amount of your paycheck taxed by the federal government.

Federal taxable wages and withholding: Regular pay minus pretax deductions (health insurance, retirement, flexible spending accounts).

State taxable wages and withholding: the amount your state will tax your net pay, not gross pay.

FICA/OASDI taxable wages and withholding: money taken out, matched by the employer, and then paid into social security fund.

Miscellaneous withholdings: other deductions that reduce taxable income.

How to prevent over-withholding

-

Consider filing a revised 2020 W4 with your employer. The W4 form determines the amount of federal income withheld from your paychecks.

-

Make sure you are claiming the proper number of allowances. The more “allowances” you claim on your W4, the less tax is withheld from your pay. How do I do it? Use either of the above withholding calculators to determine the proper number of allowances to claim.

Step 4: Maximize your paycheck

Roughly 20% of companies offer volunteer time off (VTO) for occasions when the office is overstaffed or on days where business is slow. VTO is common, for example, in call centers and other customer service industries and organizations. VTO functions like PTO (paid time off) except you are not paid; employees lose an hour of pay for each VTO hour they take.

Our advice is to avoid VTO in order to maximize your work hours and paycheck.

Pro Tip: for hourly employees working for companies that offer VTO, look for opportunities to pick up extra hours your colleagues leave on the table via VTO. An hour here or there can significantly increase your next paycheck.

Step 5: Take Advantage of Benefits

As an employee, your benefits are part of your compensation. Too many workers do not take full advantage of the benefits available to them which is tantamount to leaving money on the table. So be sure you’re doing the following:

-

Closely evaluate your healthcare plan options and make sure you choose the plan that is best for you. This is especially important if your health insurance premium, or a portion of it, is deducted from your paycheck.

-

Determine the cost to benefit payoff of each plan your employer offers. Make sure you select the one that meets your healthcare needs and is cost-effective.

For example, if you use contact lenses but do not require any of the other services included in your company’s vision insurance package, it may be cheaper to decline vision insurance and put the savings towards paying for contact lenses out of pocket.

Does your spouse’s employer offers better insurance coverage or cheaper costs? If so, enroll in their plan(s) instead of those offered by your employer. If you aren’t sure, look into it ASAP! And keep the following in mind: Small firm workers generally pay less for health insurance than those in large firms. In firms where a large percentage of workers make less than $23,000/year, premiums tend to be higher.

Employer Match

Take advantage of any and all employer-match programs. The most common of these are 401Ks. Many employers match, up to a certain amount, employee contributions to their 401k. This is essentially free money that, if taken advantage of, will significantly increasing your savings potential and retirement fund.

Paid Vacation and Sick Time

In general, employees are allocated, or earn, a certain number of paid vacation and sick days every year, or fraction thereof, they work. Some workers also receive additional vacation or sick days after working for a set number of years at one company. Some companies, however, cap the amount of vacation and sick days. Therefore, it is important you have a thorough understanding of your employer’s vacation and sick day policies.

Moreover, if you leave your job your company is, in most cases, obligated to pay you for your accrued but unused sick and vacation days.

Hire a financial adviser

The amount of benefits and savings options available to workers can become overwhelming. If you feel similarly, consider hiring a financial advisor to help you plan how to best put your money to use and take advantage of your benefits.

So there you have it. As you can see, there are numerous areas where workers often don’t take full advantage of the their employee benefits. Hopefully, this guide serves as an essential tool to help you identify where you could be getting more out of your paycheck and how to proceed to do so.

Download a PDF or Word Template

Pay Stub

A pay stub is an important document. The purpose of a pay stub is to provide you with proof of what was paid and any withholdings that were made on that payment. A pay stub will usually list the name of the person being paid as well as a date.

Read More

Read More

Employment Letter of Recommendation

A letter of recommendation for employment is written on behalf of a job applicant by someone who knows them either professionally or personally to lend support to the job applicant.

Read More

Read More

W-2 Form

If you have employees, you must be prepared to issue a W-2 at the end of each tax year to employees who made a certain amount of money for which you withheld taxes. A W-2 shows the total amount of money the employee was paid as well as the taxes that were withheld.

Read More

Read More

Employment Contract

An employment contract is entered into between an employer and an employee. The purpose of an employment contract is to explain the terms and conditions that must be upheld in order the employment opportunity to remain in effect.

Read More

Read More