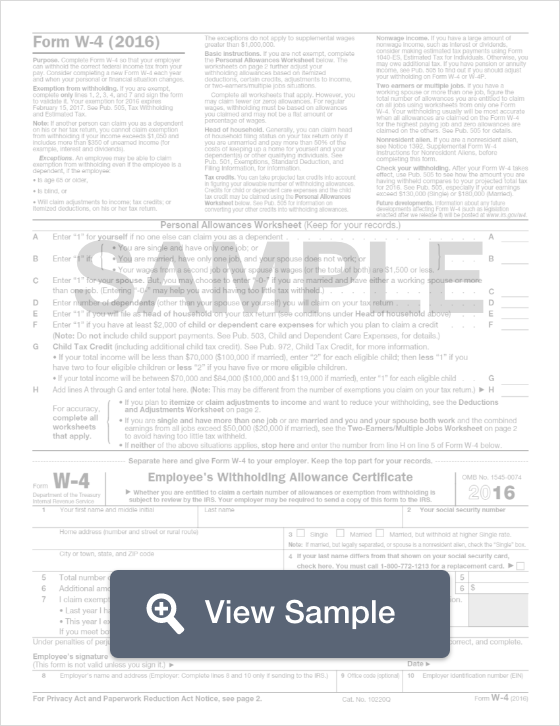

W-4 Form: What Is It?

A W-4 form is used for tax purposes. It is filled out by an employee when they first begin employment. This form provides the employer with information about the employee's tax withholdings from earnings. It is important for an employer to collect W-4 forms from their employees so that they can deduct the appropriate amount of taxes from their paycheck.

The employee who is filling out the W-4 form will need to provide some information, such as how many dependents they have, any tax credits, and their social security number. It is important to be accurate with this information, as it will determine how much taxes a person owes.

A W-4 form should be updated as needed. If there are any major life changes, such as getting married, divorced, or having a baby, the form should be changed to reflect this. This ensures you won't owe a lot of taxes when you file.

Click here to get started now!

W-4 Tax Document Information

Due to the Tax Cuts and Jobs Act of 2017, the W-4 has been updated by the IRS.

The updated W-4 form has eliminated personal allowances, because the Tax Cuts and Jobs Act doubled the standard deduction in order to eliminate personal and dependent exemptions. With the elimination of personal allowances, the W-4 form was shortened to five sections from its previous seven. Below are step-by-step instructions to filling out the new W-4.

Step-by-Step Instructions on How to Fill Out a W-4 Form

-

Step 1: Just list your name, address, filing status and social security number. If you are a single filer, do not have any dependents, have income from one job, and are just claiming the standard deduction, then you skip ahead to Step 5, where you sign and date the tax document. For filers who have a bit more complicated of a tax situation, follow the steps below as well.

-

Step 2: There are three options for this step. Option A is to utilize the IRS' tax withholding estimator and use the result in Step 4 later. Option B is to fill out the Multiple Jobs Worksheet and enter the final result in Step 4(c) later. Option C is if you have two jobs with similar pay for each and each W-4 will contain very similar information.

-

Step 3: Here is when you add if you have dependents in order to find out if you qualify for the Child Tax Credit and other dependent-related tax credits.

-

Step 4: This section for Other Adjustments. It was previously known as Employee Withholding. This is an optional step to complete. There are three options labeled a, b, and c. The first option is other income not from jobs. It is for your employer to withhold additional tax for other income that you expect and won’t withhold taxes from. The second option is for deductions you expect to claim other than the standard deduction. There is a deductions worksheet that you can use for this option. The third option is to list any extra withholding you would like your employer to take out of each pay period on your behalf.

-

Step 5: This concluding section is just to sign and date the document. Your employer will complete the Employers Only information.