What is a direct deposit form template?

A direct deposit form is a document that authorizes a third party to send money to a bank account using an ABA routing number and bank account number. This is typically used by employers for payroll purposes. Some parties will require you to submit a voided check with this form to ensure that the account is valid.

Many companies utilize direct deposit. Benefits for employees include: being paid on time, not having to visit a bank, and simpler money management. Employers benefit from: reduced labor costs to process payroll, less chance of check fraud, no need to print paper checks.

How to complete a direct deposit form

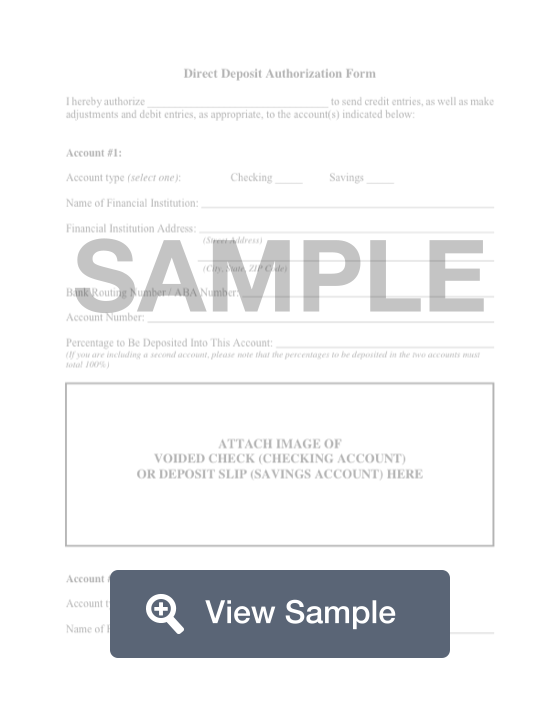

To complete a direct deposit form, you will need to provide the following information:

- Company Name (Company you are authorizing to make deposits to your account)

- Account Type (Checking or Savings)

- Bank Name

- Bank’s Address

- 9-Digit Routing Number (This information can be found on your checks, deposit slips, or on your financial institution’s website)

- Account Number

- Percentage to be Deposited Into This Account

- Any Additional Bank Information (If you would like the direct deposit to be divided between more than one account)

- Employee's Signature

- Date

- Printed Name

You will also need to attach an image of a voided personal check (checking account) or a deposit slip (savings account).