What is a Quitclaim deed?

A quitclaim deed, also written as “quitclaim deed,” is used to transfer interest, ownership, or rights to the property from one party to another in an extremely expeditious manner. The person giving away their claim on the real estate is known as the grantor. The person receiving the property is called the grantee. This form is most often used to transfer property between family members.

This legal form prevents the grantor from coming back and claiming an interest in the property after the quitclaim deed is finalized. This protects the grantee. This can be important in certain cases of transfer, such as during a divorce.

A quitclaim deed requires specific information about both the grantor and the grantee; sometimes, depending on the state, the marital status of the parties must be listed, as well as the name of a spouse (even if the property is not held jointly). Information about the real estate property must be included. For the best protection, a quitclaim deed should be notarized and filed with the county clerk's office. However, every state has its requirements for a quitclaim deed. Make sure that the required elements are included for the state in which the property is located.

Note: Quit Claims are sometimes referred to as a “Quick Claim Deed” or “Quickclaims.” Although this is a misnomer, it is nonetheless not uncommon.

Quitclaim Deed vs Warranty Deed

-

A quitclaim deed template is a fast way to provide ownership interest to the grantee, but it does not provide a warranty of any kind on the property.

-

A warranty deed transfers ownership of the property while also providing a guarantee that there is no lien or other financial claim associated with the property; and that if one is found, the grantor will do everything necessary to clear it up.

-

A quitclaim deed only transfers ownership interest, not actual ownership. That’s why it is used only in certain situations where a mortgage is non-existent.

-

A warranty deed transfers actual ownership of the property.

-

A quitclaim deed can be used to clear up minor issues on the existing chain of title, such as the misspelling of a name.

-

A quitclaim deed is often used to transfer the ownership interest of property from a person to trust.

-

A warranty deed would be used during the purchase of property by a trust.

What should you know about quitclaim deeds?

Transferring property can be tricky. There are various documents involved and they can be a source of confusion and frustration. A quitclaim deed can be very helpful because it simplifies the process. Let’s begin with a straightforward explanation of exactly what a quitclaim deed is and its various purposes.

-

A quitclaim deed certifies that the grantor "quits" or relinquishes any right or "claim" to the specified property.

-

It certifies that the property will be transferred to the grantee—something that most deeds do.

-

It does not guarantee that the grantor has any ownership interest in the property.

-

The only thing it attests is that if the grantor does have any ownership interest in the property, they agree to relinquish it and transfer it to the grantee—nothing more, nothing less.

-

-

As you may have determined, there is a measure of risk involved in a quitclaim deed, as the grantee has no real guarantee that the grantor owned the property free and clear of any liens, debts, disputes, or other ownership issues.

-

If you are going to be the grantee, you'd better be sure that the grantor did own the property outright and that ownership was free and clear of liens, debts, disputes, or other issues that could threaten your new claim to the property.

-

While a quitclaim deed has its drawbacks, it at least prevents the possibility that the grantor will claim ownership of the property later on.

-

Remember the following:

-

Depending on the state the property is located in, that the grantor and the grantee may need to list their marital status and the name of their spouse (if they’re married) even if the spouse doesn’t have a legal interest in the property.

-

One or two witnesses may be required to sign the form in the presence of a notary. Afterward, check with the local county clerk's office to find out if you need to file the document with them.

Top Five Warnings about a Quitclaim Deed

-

Quitclaim deeds do not provide any warranties. A quitclaim deed is known as a non-warranty deed. That is, the use of a quitclaim deed does not provide the grantee with any sort of warranty or guarantee that the property is without any kind of financial claim or lien against it. Quitclaim deeds expressly state that the grantor does not provide any sort of express or implied warranty related to the property or its title.

-

Quitclaim deeds work best for only very specific situations. A quitclaim deed should not be used in every situation where real estate is transferred. Generally, it is best used for situations including clearing up a cloudy title, transferring ownership interest between family members, and resolving a property line dispute. It is not a deed that should be used to buy property from someone you don’t personally know.

-

Quitclaim deeds are only as good as the title on the property. If the title on the property is cloudy, the quitclaim deed will be defective. A cloudy title means that there is an issue with property owners in some manner. One of the main reasons is a dispute related to the ownership of the property.

-

Quitclaim deeds do not transfer legal ownership. Quitclaim deeds transfer ownership interest. Ownership isn’t a guarantee. It is a document that essentially states the grantor is giving up their claim of interest. Hence the name, quitclaim deed.

-

Quitclaim deeds change the names on the deed, not the names associated with an outstanding mortgage. If the property has or will be affected by a mortgage, a quitclaim deed is not the proper deed to effect the change in ownership. While a quitclaim deed can be used to change the names on the deed, it does not affect an existing mortgage. Generally, someone transferring ownership of a mortgaged property must have the property refinanced into its name.

Filing a Quit Claim Deed

A quitclaim deed is a document used to transfer over the ownership interest in a home or piece of property from the current owner to a new owner. The current owner is referred to as the Grantor and the new owner is referred to as the Grantee.

Quitclaim deeds must follow the laws in the state where the property is located for both writing and filing the document. Writing the document includes the purchase price, an accurate description of the property, and executing the document as required by state law. After that, the quitclaim deed must be placed on file with the proper county office. In many states, this office is referred to as the County Recorder’s Office.

There are four steps involved in the creation and filing of a quitclaim deed.

Step 1: Negotiating the Sale or Transfer

A quitclaim deed is used to transfer the ownership of property. The process does not require a real estate agent, unlike more traditional methods. However, the parties may wish to have the transaction and the quitclaim deed reviewed by a lawyer to ensure that it abides by the laws in the state. The transfer most often takes place because the parties agree on a price for the property.

Step 2: Have the Required Information to Complete the Quit Claim Deed

County recorders need certain information to process quitclaim deeds. You’ll need:

-

The name of the person who prepares the quitclaim deed

-

The address where the deed should be returned after it is placed on file with the county

-

The Grantor’s full legal name and mailing address

-

The Grantee’s full legal name and mailing address

-

The purchase price (referred to as consideration).

It is important to note that some states require a quitclaim deed to include whether the Grantor or Grantee are single or married. Married individuals may be required to list the name of their spouse even if their spouse has no ownership interest in the property.

The deed also needs an accurate description of the property. Within the document, this is referred to as the legal description. The easiest way to get the legal description is to pull a previous deed on the property. This may be done through the County Recorder’s Office and sometimes through the tax assessor’s office. If you can locate the information, you should also include the tax map and lot or parcel ID.

Step 3: Executing the Quit Claim Deed

Every state will have its requirements for executing a quitclaim deed. At its most basic level, it requires the date, printed name, and signature of both the Grantor and the Grantee. Most states require these signatures to be notarized. Some states also require witnesses.

Step 4: Record the Deed

Take the deed to the proper county office to have it recorded. Before you go, contact that office to find out the amount charged for the filing fee. Take that amount with your, or take your checkbook, so that you’re fully prepared to complete the process.

A Sample Quit Claim Deed with Examples for Each Step

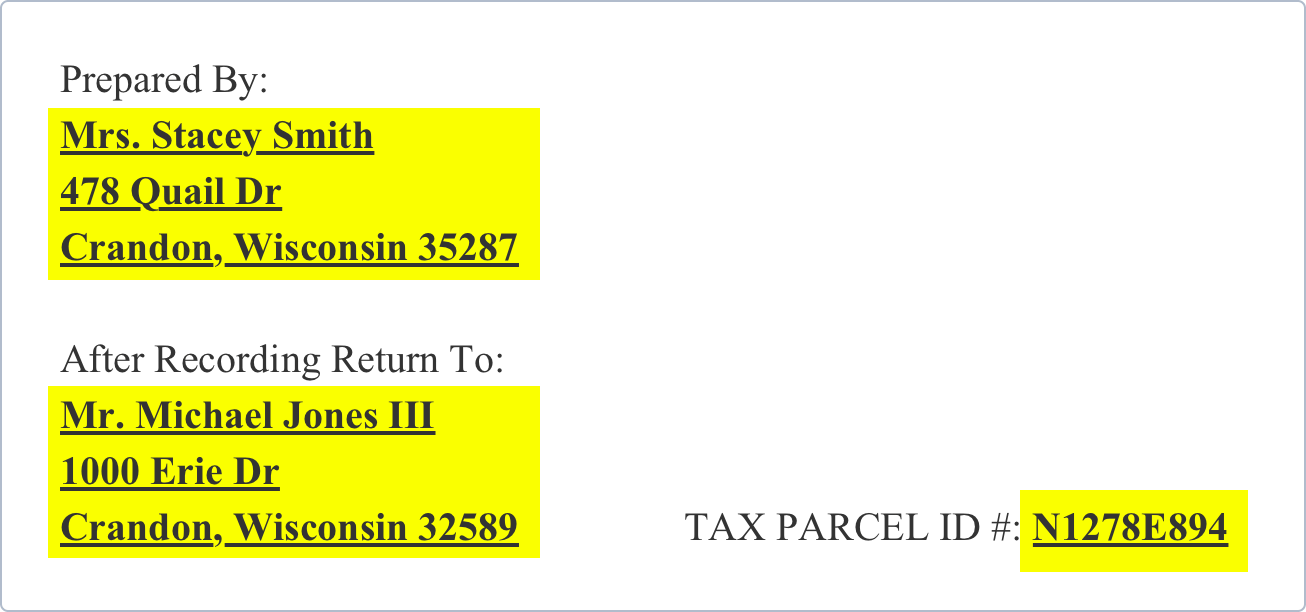

Step 1 - Individuals Involved:

First, enter the information of the individual preparing the Quit Claim Deed. Provide the following information of the person requesting the recording:

-

Full Name

-

Full Address (including city, state, and zip code)

Next, provide the information of the individual who the documents should be mailed to. This is typically the person who will be the Grantee or individual purchasing the property.

-

Full Name

-

Full Address (including city, state, and zip code)

Step 2 - Parcel Identification Number:

Provide the Tax Parcel Number for the property. This number can be obtained from the Assessor’s Office of the county where the property is located.

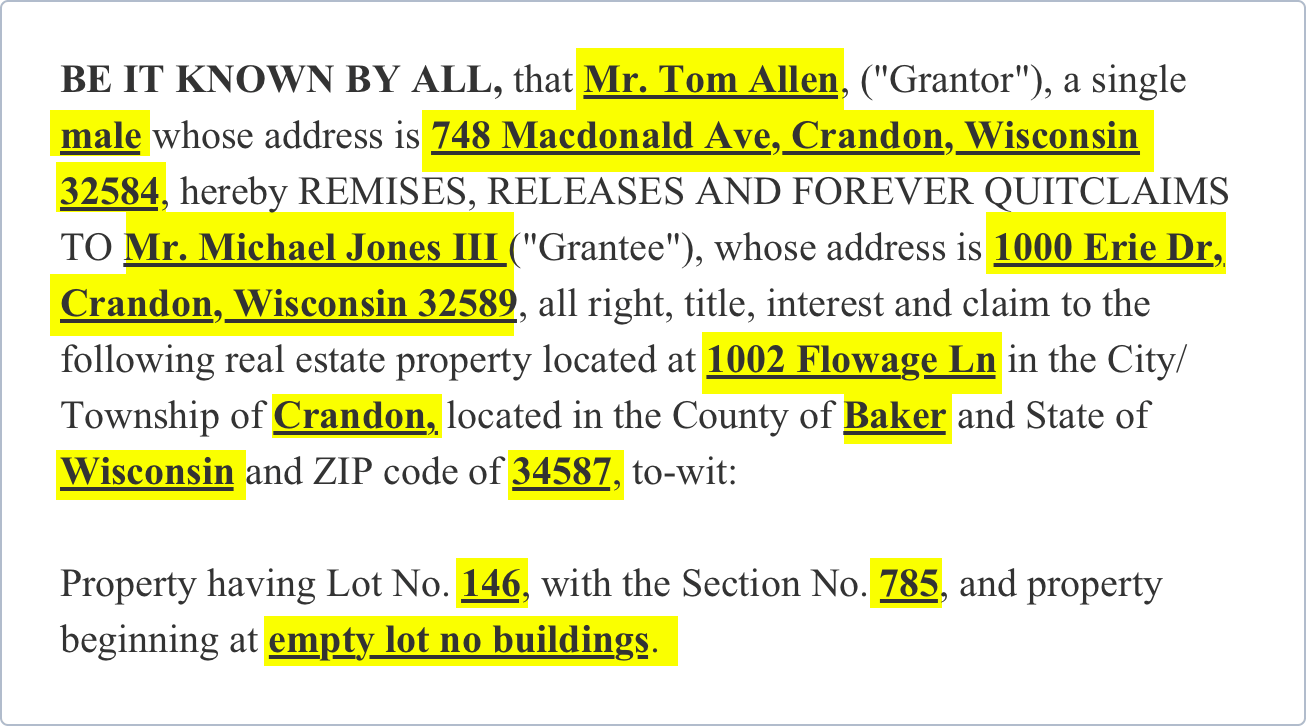

Step 3 - Grantor and Grantee Information:

Provide the names and addresses of both the Grantor or individual selling the property by listing the following:

-

Grantor’s Full Name

-

Grantor’s Gender

-

Grantor’s Full Address

Next, provide the information of the Grantee, or individual receiving the property:

-

Grantee’s Full Name

-

Grantee’s Current Address

Finally, provide information about the property. This information should include:

-

Full Address of the Property

-

Legal Description

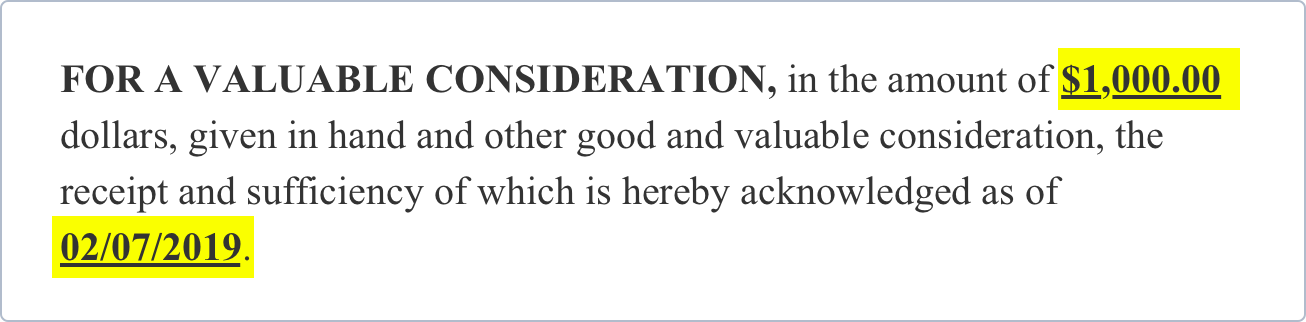

Step 4 - Valuable Consideration:

Provide the amount of money given for valuable consideration. Provide the figure in dollars and cents.

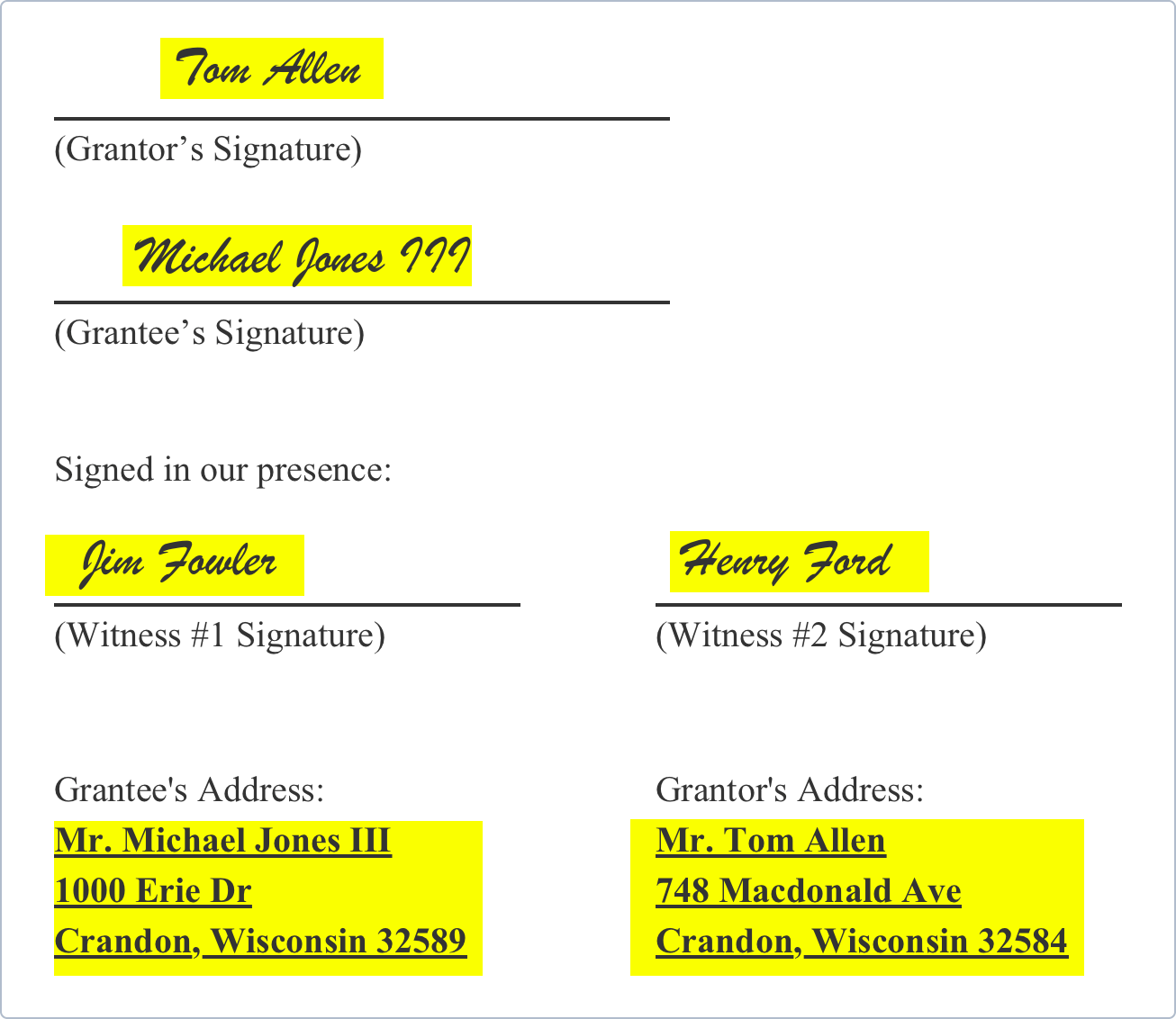

Step 5 - Signatures:

For the Quit Claim Deed to be finalized, it must be signed by all parties, including two witnesses. Besides, the document must be notarized by a certified Notary Public. Provide the following information for all parties involved:

-

Grantor’s Printed Name and Signature

-

Including Full Address

-

-

Grantee’s Printed Name and Signature

-

Including Full Address

-

Provide the following information of both attesting witnesses:

-

Witness’ Typed Name and Signature

Finally, have the document notarized by a Notary Public before filing it with the County Recorder.

FAQs about Quitclaims for Grantors & Grantees

What are the central components of a Quit Claim?

To transfer ownership of real property between parties, a deed of some sort is required. However, there isn’t one standard form of deed in use in the U.S. There are two main types of deeds: warranty deeds and quitclaim deeds (which are sometimes referred to as quick claim deeds or deeds of release). The former implies certain guarantees by the grantor to the grantee that their title to the property is good; the latter is simply a transference of the grantor’s interest in the property to the grantee.

Warranty deeds, also known as general warranty deeds, are the most commonly used form of deed because they provide a level of legal protection that the quitclaim deed does not provide. In situations where a piece of property is being bought and sold by parties who are unrelated, a warranty deed is necessary to prove that the title is clear.

A simple quitclaim deed has no warranty. It simply states a transference of the grantor’s interest in the property at the time. The grantor does not guarantee a good title or any title at all. This makes the quitclaim deed a somewhat precarious document.

While there are elements that must be included that vary from state to state, the quitclaim deed template consists of the same general components and must specify the method of transfer. There will also be a habendum clause, a “have and to hold” clause, meaning the grant of land is final, and the transaction is complete.

The quitclaim deed must also include a deed execution date. This is the date that the deed is signed by the parties and witnesses which is also the date it becomes effective. You must also include information about the person who prepared the quitclaim deed. The quitclaim deed template, of course, omits any statement of the grantor’s warranties. When the deed is signed and dated, witnessed, notarized, and (in some states) sealed, it becomes a legal document.

In short, a Quit Claim typically includes the following information:

-

Grantor: Who currently owns the property (i.e. the old owner), and their mailing address.

-

Grantee: Who is receiving the property (i.e. the new owner), and their mailing address.

-

Consideration: If the grantee is paying the grantor for the property, and if so, the amount.

-

Legal Description: A written description of the property, the land parcel, etc.

-

Land Parcel Number: Assigned by the tax assessor. Typically, the parcel number is listed on the property tax statement.

-

Preparer: The person who prepared the quitclaim.

-

Witnesses: Each state has its laws and regulations regarding witnesses to quitclaims. Some states do not require any, others as many as two. Be sure to consult your local County Records Office for information on your location.

-

Notary: quit claims require a notary public to verify the authenticity of the signatures in the deed.

Other information to consider:

-

Easements: Will the grantor continues, for example, using a portion of the property?

-

Encumbrances: Are there any outstanding liens, deed restrictions, or other encumbrances on the property?

-

Mineral Rights: If, for example, the property sits on oil, gas, or other mineral reserves, does the grantor retain any legal rights or ownership?

Types of ownership

A quitclaim deed details the terms of ownership the grantor has regarding the property in question. Those types of ownership include:

-

Fee Simple: Owned outright by the grantor.

-

Joint Tenancy: Owned equally by two or more people.

-

Tenancy by the Entirety: Joint ownership between spouses.

-

Tenancy in Common: Owned by two or more people who can sell their “stake” at their discretion.

When should I use a Quit Claim Deed?

Here are some common scenarios and relationships where quitclaims are common:

-

Divorce: One spouse releases their ownership stake in a property to their now former spouse as part of a divorce settlement.

-

Marriage: One spouse wishes to add their new spouse to the title of their property.

-

Family: A parent gifts property to a child.

-

Estate Planning: A person transfers property to a trust.

-

Business: Property is transferred from a company to a subsidiary.

-

Chain of Title Defect: A title insurance company uncovers parties with potential ownership claims to property and asks them to waive those potential claims.

-

Title Defect: Removing typos or other errors, often referred to as “clouds,” in an existing title.

-

Public Auction Sale: Property exchanges hands, but the buyer assumes all liability and risk of defective title.

What if I Don’t Have a Quit Claim Deed?

A quitclaim deed does not guarantee a perfect title. It does, however, provide a written public record of the change in ownership in property from the grantor to the grantee. Once a quitclaim is filed with the County Clerk, any title search of the property will include your quit claim.

If you do not file a quitclaim with the County, it may be difficult or impossible for a grantee to prove property ownership or for a grantor to prove they no longer own said property.

Tax Considerations of Quitclaim Deeds

Grantees should ensure that all property taxes are paid and that there are no back taxes before signing a quitclaim. Once the property is transferred to the grantee, they assume all property tax responsibilities. Tax bills will be mailed to the grantee's corresponding address listed on the deed after the quitclaim is filed.

While some states offer exemptions regarding real estate transfers that involve quitclaims, others impose real estate transfer taxes. Other taxes, including gift taxes and inheritance taxes, may also apply depending on your state. You should seek legal advice, specifically a tax lawyer or CPA to learn more about the tax obligations associated with your claim.

Legal Forms Related to a Quit Claim Deed

-

Warranty Deed: A warranty deed is used to transfer property between parties with the written guarantee of a valid title.

-

Contract for Deed/Land Contract: A land contract is a legal document that establishes the legal transfer of a property’s title from the seller to the buyer once the loan for the property is fully paid off.

Download a PDF or Word Template

Quit Claim Deed

Quit claim deeds are used for transfer of interests in a given piece of real estate.

Read More

Read More

Durable Power of Attorney

This legal document delegates the power to act on the Principal's behalf by a named Attorney in Fact. It prepares for the possibility of becoming incapacitated or unable to express their wishes and covers a variety of areas of life. It specifies their delegated areas of authority.

Read More

Read More

Contract for Deed

A contract for deed is a transaction whereby a seller of land finances the sale of their property. The buyer pays the purchase price of the property in monthly installments.

Read More

Read More

Commercial Lease Agreement

A Commercial Lease may be a legally binding agreement between a commercial landlord, and a business. It includes address of the property, business tenant and landlord contact details, inventory of fixtures and fittings, terms of the lease, and more.

Read More

Read More