What is a Property Deed?

A property deed is used to transfer property, such as a home or land, from the old owner to the new owner. The parties, the buyer and the seller, are identified by special terms. The buyer is referred to as the grantee. The seller is referred to as the grantor.

Because it is a legal document that transfers someone’s ownership interest in a home or piece of property to another person, it must contain certain information or ownership rights won't be legally transferred. While each state has its own laws that explains what information must be in the document, there are some specific items that you’ll see regardless of state.

Basics

First, you need the full legal name of both the grantor and the grantee. Additionally, each party with a should be designated with their title. For example, Jacob Jonathan Smith, Grantor. All parties involved must be legally competent to enter into a legal instrument and the legal capacity to own property. If the property is owned by more than one person, everyone with a property interest must be listed and they must also sign the document. In some states, the grantor and the grantee must list whether they are single or married. Even if the spouse of either party isn’t a legal party to the transaction, they may need to be listed. Make sure that you consult your state laws or seek out adequate legal advice from a law firm to learn more about property rights.

You must include the legal description of the property. This could include a lot, section, block, or plot number. You can get this information from the original deed which should be on file with both the county tax assessor and the county recorder’s office. You may be able to visit the websites for those government entities and perform the basic search using the street address to pull up the legal description. In addition to this, you can include the street address and the name of the housing development, if there is one, for easy identification.

Deeds for property transactions in the United States must be in writing otherwise the agreement is not legal. Deeds are put on file with the county where the property is located. The only way to do that (or to prove that you really do own the property) is to have written proof. The deed must include wording that shows conveyance, that is, the legal transfer of ownership from one person to another. That usually includes the words "deed conveys." However, some states have specific language that must be used. The best way to ensure that you have the right language is to find a sample property deed for your state and read it. Just make sure that the document is from a reputable source.

You may be required to list the current value of the premises as well as describe the type of dwelling on the land (if any). If the property is subject to a loan or mortgage, that should also be explained. If there are multiple owners and one grantor is deeding out their share, it should be mentioned whether there are unequal shares and the percentage of the share.

All grantors and grantees must sign the the grant deed before it is legally binding. In some states, this may require witnesses to the signatures or signing in front of a notary public. After it is signed, it must be legally delivered to the grantee or to someone who is legally appointed to act on behalf of the grantee (such as the grantee’s lawyer or realtor). The grantee must be willing to accept it. For the most part, grantees do accept upon delivery. There are times, such as a typographical error, where the grantee may reject it.

Other names

A property deed is commonly referred to as a house deed or grant deed. It can also be known as a general warranty deed.

Difference Between a Property Deed and a Title

A property deed is the actual legal instrument used to transfer the title of a home or land from the grantor to the grantee. When this is done, a new title for the property is generated. A title is a document that says that you own something. For example, you have a title to your car. There are even titles for homes. A title for a home works in the same way as a title for a car in that it is used to show that you own it.

The goal is to create a good title as opposed to a clouded or defective title. When a title is good, that means there are no other legal claims to the title (outside of perhaps a co-owner or joint tenant situation). A title company usually does research to determine whether the title is defective or not. If a title is defective or clouded, it may take a court proceeding to clear it up even if there is a title warranty.

Types of Property Deeds

Property deeds serve a purpose: transferring the legal interest of the grantor to the grantee. Yet, they are often named based on the type of warranty they provide or how they originate. Below, you’ll learn about the most common types of deed and what they mean.

General Warranty Deed

A general warranty deed gives the grantee the most legal protection during the the transfer title process. The grantor makes certain covenants (promises) and warranties to the grantee. They agree to protect the grantee, and grantee's heirs, from any prior claims or demands from third parties made regarding the property.

The covenants include:

- Covenant of seisin. This means that the grantor warrants that they’re the owner of the property and that they have a legal right to transfer their interest to another person.

- Covenant against encumbrances. This means that the grantor promises that the property is free of liens or encumbrances except any that were expressly mentioned in the deed.

- Covenant of quiet enjoyment. This means that the grantor promises that the grantee isn’t getting a defective title that will affect whether they can hold title to the property.

- Covenant of further assurance. With this, the grantor promises that they will complete and deliver any document that is necessary to create a clear and marketable title.

Special Warranty Deed

With a special warranty deed, the grantor warrants that they hold the title to the property and that they haven’t done anything to make the title defective. This creates a limitation that essentially means the grantee is only protected if a problem comes up with the title while it is in the possession of the grantor. Because it offers so little legal protection, grantees are less likely to approve this sort of deed.

Quitclaim Deed

A quitclaim deed offers no warranties at all for the grantee. In fact, it’s sometimes called a non-warranty deed. It offers practically no legal protection. It only transfers the interest the grantor has in the property. There is no promise that the title is clear. If the title is good, then there’s no problem. However, for a defective title, there are no legal remedies available to the grantee. This type of deed may be used in many circumstances. It is commonly used among family members. It is also used if a grantor isn’t sure whether their title is defective and when they do not want to hold any liability if it is. This could also involve a grantor that knows they have ownership interest, but they’re not sure just how much.

Special Purpose Deeds

Special purpose deeds are generally used when the court gets involved for some reason. The most common special purpose deeds are an administrator’s deed, an executor’s deed, a sheriff’s deed, a tax deed, a deed in lieu of foreclosure, and a deed of gift.

- Administrator’s Deed

- This deed is used if someone dies without a will. An administrator is appointed by the court. It is the job of the administrator to liquidate the assets of the deceased, including homes or property owned. It transfers the real property to the grantee.

- Executor’s Deed

- This deed is used when a person dies with a will. The will names the person, referred to as an executor or executrix, who is tasked with liquidating the assets of the deceased. So, an this deed works the same way as an administrator’s deed. The main difference is the title of the individual appointed to handle the assets and the presence of a will.

- Sheriff’s Deed

- This deed is issued after a sheriff’s sale takes place. The purpose of a sheriff’s sale is to sell the real property so that the proceeds can be used to satisfy a judgment issued by a court against the owner of the property. Sometimes, a sheriff’s sale is ran in an auction-like format. The person who purchases the property is the grantee who pays for the property and then receives a sheriff’s deed.

- Tax Deed

- This sort of deed is a deed issued by tax authorities. When federal or state taxes go unpaid for a certain amount of time, real property of the debtor may be seized and sold to satisfy the past due taxes. The person who buys the property is given a tax deed.

- Deed in Lieu of Foreclosure

- A deed in lieu of foreclosure means that the grantor who borrowed the loan for the mortgage is in danger of being foreclosed on by the lender. To prevent the foreclosure, the grantor is allowed to deed the property back to the lender. The loan is then satisfied. This is a preferable method for many lenders because it makes it easier to create a clean title. A clean title makes it easier to sell the property.

- Deed of Gift (Gift Deed)

- A deed of gift, also called a gift deed, is used when the grantor is giving their interest in the real property to another person. There’s generally no money exchanged, not even the nominal $1.00 that is often seen in other forms of deeds. It’s simply a gift. However, many states require that this sort of deed be recorded within a very short time period or it becomes invalid.

How to Fill out a Property Deed: Step by Step

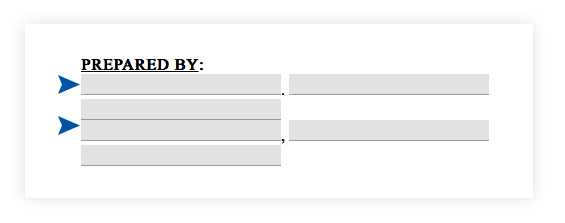

- Fill out the "Prepared By" section with your name and other applicable information (such as your title or address).

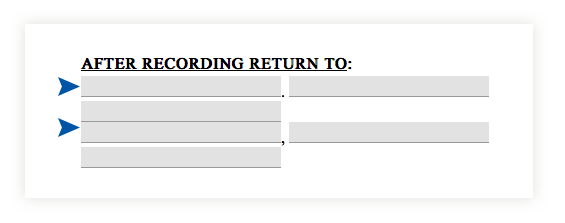

- Determine and fill out who the document should be returned to - you or another party.

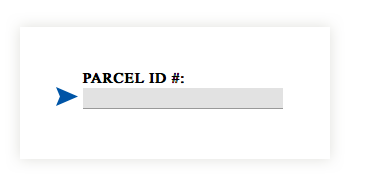

- Insert your parcel ID.

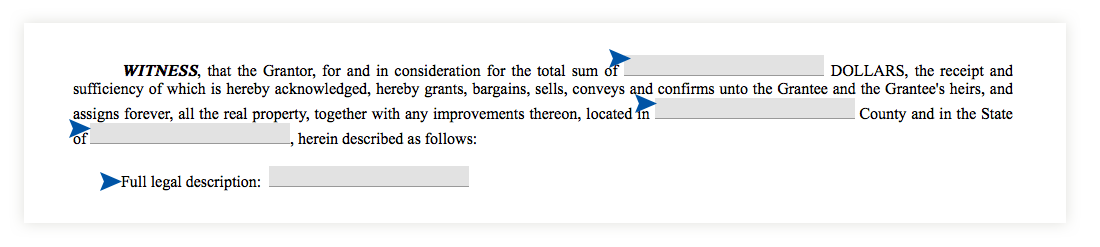

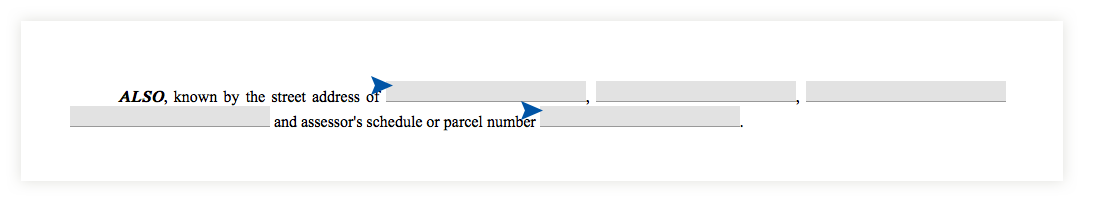

- Under the "Witness" section, include the total amount you are paying for the property in dollars, and include the location of the property (county and state). Below, include the specific street address of the property.

- Fill in your state.

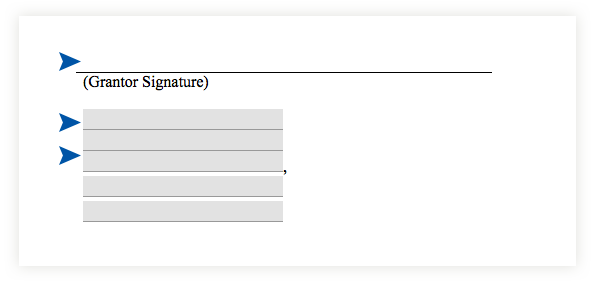

- The Grantor must sign the document and include their address or contact information. The Grantee must also sign and include the same.

- Witnesses must sign.

Legal Considerations of Property Deeds

Deeds are legal documents. Because of this, it’s important that you understand some important legal concepts associated with them.

Governmental process of finding your deed

Because a deed must contain specific information related to the property, there could come a time when you need to get a copy of it. First, determine the name of the office where deeds are recorded. In many states, they use the terminology “county recorder’s office.” If you’re not sure, you have a couple of options. You can call your county courthouse and ask them for the name of the office where deeds are recorded. You could call the tax assessor’s office. They, too, can tell you the name of the office where deeds are recorded.

After you have the name of the right office, call them and ask what the fee is for you to get a copy of the deed. You should ask if there is an extra charge to have the copy certified. You may be able to request copies over the phone and even pay for them at that time. Then, you can just go and pick them up.

However, some offices have a specific process that must be followed for a deed search. You may also be required to submit certain information such as the parcel identification number or the tax identification number. So, make sure you have that information. If you visit the office in person, you’ll likely find that the clerk is kind enough to walk you through the process of finding the deed.

You may also be able to find your deed online. Many counties have an online records search for deeds. The important thing to do if you opt to look online is to ensure that you’re on the official website for the county deed register. This won’t always end in .gov. However, it’s generally pretty easy to determine if you’re on the right site. Scroll down to the bottom of the website and look at the contact information or the copyright information. It might be for your city or town or list the actual deed recorder’s address and phone number. It will not list a private business, such as a records company or background check company. While those companies can sometimes return accurate records, there’s absolutely no way for you to guarantee that your record will even be listed. They may also charge you more than what you’d pay if you just contacted the county.

Do Property Deeds Need to be Notarized, Filed and Witnessed?

All states have their own laws that cover how deeds should be written and what steps to take after the document is signed. However, almost every state requires that it be signed in the presence of a notary public. Do not sign it until you know whether this is required in your state. If it is, do not sign it until you are in front of the notary. You’ll also have to take proof of your identity.

You should also do a little research to determine whether you need one or more witnesses. They will also need to wait and sign in front of the notary. You can look online for a sample or template of a property deed for your state. It should have a space for a notary and the correct number of witnesses.

Deeds must be filed with the land records office. Generally, this is known as the county recorder’s office. It may also be known as the land registry or the register of deeds. When you go to file the deed, they will record it and keep a copy. The original will be given back to you. Make sure that you keep it in a safe place.

What are trust deeds and contracts for deeds?

A trust deed and a contract for deed don’t actually permanently transfer the property into the name of a new grantee. A trust deed (also known as a deed of trust) is a mortgage that transfers the title to a trustee. The property is held as a security interest for a loan. When the loan is satisfied, the title is transferred back to the property owner. A contract for deed is a contract that gives the title to the property to someone until the owner pays off a loan. Like the trust deed, when the property owner pays off the loan, the title is transferred back to them. In short, both of these documents treat the property as collateral.

Guide to Racial and Restrictive Housing Covenants

By FormSwift Editorial Team

July 19, 2018

Dealing with Restrictive Covenants

Introduction

Property deeds often contain restrictive covenants that limit the use and sale of a property. Historically, covenants were used to maintain racially segregated neighborhoods. Today, they are used to restrict a wide range of far more benign elements of homeownership. This guide walks you through identifying any restrictive covenants in your own deed, how to ensure compliance with those restrictions, and how to challenge any you deem unfair.

What Is a Restrictive Housing Covenant?

A restrictive housing covenant is an agreement between the property owner and other parties (neighbors, potential buyers, etc.,) that limits how a property can be used and to whom a property can be sold. Typically, restrictive covenants are written into the deed directly or are referenced if the deed is held on file in the county or municipal government office or homeowner’s association (HOA).

Restrictive covenants apply to the property itself, rather than the owner who signs the agreement. Therefore, covenants remain legally binding in the event of the property’s sale.

Today, HOAs, developer, builders, etc., use covenants to protect property values in residential developments. For example, covenants may restrict or guide home additions, exterior paint color, whether you can add a pool, build a certain type of fence, etc.

Racial Housing Covenants: A Historical Overview

By the late-1800s, just about every city in the US utilized race-based zoning laws. The federal government institutionalized racial covenants in the mid-1930s with the establishment of the Home Owners’ Loan Corporation (HOLC) and the Federal Housing Authority (FHA).

While the Supreme Court banned racial housing covenants in 1948, it would take another two decades, and the passage of the Fair Housing Act (1968), before racial discrimination in housing was truly prohibited. In the years leading up to the Fair Housing Act, several states, including California, passed ballot initiatives protecting white homeowners’ rights to discriminate in the sale or lease of their home. Those initiatives, however, were typically thrown out by the Supreme Court.

Because they were written directly into deeds, racial and restrictive covenants still appear in property documents across the country, despite the fact that they are unenforceable and unconstitutional.

How to Handle Restrictive Covenants

It is important that homeowners read through their deed(s) and search for any language related to a restrictive covenant. If you find one, be sure you can comply with the existing covenants and that they are fair and constitutional. If they aren’t, you should consider consulting with a real estate attorney to learn about your potential legal remedies.

Circumventing Covenants

Begin by determining if any covenant in your deed is restrictive. Racial covenants, for example, are not enforceable. Additionally, many covenants have expiration dates. If your deed contains an expired covenant, it is no longer valid.

With that in mind, be careful about violating current legally binding covenants. If you choose to ignore a legal one, you risk a neighbor or your HOA taking legal action against you.

How to Remove Restrictive Covenants

If you have a restrictive covenant in your deed that you wish to remove, you could take your grievance to your HOA. However, they are unlikely to help you. It is the job of your HOA, after all, to enforce covenants.

Some HOAs may permit you to circumvent a restrictive covenant without having to go through the legal process of removing it. For example, they may grant you a waiver. If, on the other hand, you wish to deviate only slightly from a restriction, an HOA may grant a variance. For example, an HOA may grant a variance for a fence height slightly above the community limit, or for a color a shade darker (or lighter) than the allotted options.

If your HOA refuses to grant a waiver or restriction, you could consider legal action against the HOA. In this scenario, a judge would decide whether to amend the deed. For court, you will need the following:

- Identification of the land subject to the deed restrictions

- Identification of any known/potential beneficiaries

- Reasoning behind wanting to remove the covenant

There is one final option: indemnity insurance. Indemnity insurance protects homeowners if the owner violates the covenant and the beneficiary takes legal action to enforce it. Indemnity insurance can cover the following: alterations made to the landowners property, the reduction in value of the landowner’s property, general damages, or compensation.

Conclusion

The history of restrictive covenants is unsavory. While the Supreme Court outlawed the most discriminatory elements of covenants, deed restrictions remain commonplace for homeowners. We hope this guide provides a detailed overview on how to comply with, or challenge, covenants tied to your own property.

Segregation and Gun Violence in Top US Metropolitan Areas

July 19, 2018

Methodology

Our team at FormSwift wanted to determine the relationship between segregation and gun violence in top US metropolitan areas. To do this, we calculated a Segregation Score and a Gun Violence Score for each metropolitan area. Our segregation score was determined by evenly weighting the following factors into a total: black-white segregation index number (2005-2009 Census Bureau Data), percentage of black Americans living in predominantly white neighborhoods, segregation dissimilarity rate and segregation isolation rate (2010 data from the Manhattan Institute). Our gun violence score was calculated as the sum of the rate of firearm suicides and homicides in all age groups (2009-2010 Census Bureau Data). We charted these scores as well as created a ranking by metro area based on the combined totals.

Download a PDF or Word Template

Property Deed

A property deed enables a person to give or sell their interest in property to another person. A property deed must meet certain legal elements for your state. Then, the property deed should be placed on file with the county register.

Read More

Read More

Quit Claim Deed

A quit claim deed is a fast way for one person to give their interest in property to another person. Every state has legal elements that must be included in a quit claim deed in order for it to be valid.

Read More

Read More

Contract for Deed

A contract for deed is a real estate contract involving the purchase of a house. With a contract for deed, the buyer is able to take immediate possession, but they will not receive the deed until the loan is paid off.

Read More

Read More

Promissory Note

A promissory note is a promise to pay back a loan. Promissory notes generally list the amount of money that was loaned, a promise to pay, the amount of the payments, and when each payment is due. It is then signed and dated by the person who is obligated to pay back the loan.

Read More

Read More