What is this Promissory Note for?

Student Loan

A student loan is a loan made by a financial institution or private party to someone who wants to return to school. The promissory note lists the amount provided to the student and the terms of repayment. It is often signed by both the lender and the person receiving the funds.

Create My DocumentPersonal Loan

A personal loan is a loan made to someone by a financial institution or another person so that the recipient can use the money for a use that's not always specified to the lender. Generally, the loan is used for "personal" reasons which is how the loan name is derived. A promissory note outlines the amount provided to the recipient as a personal loan and the terms of repayment. Promissory notes for personal loans are signed by both the lender and the recipient.

Create My DocumentBusiness Loan

A business loan is money provided by a lender, venture capitalist, or even a private party to help someone grow their business. The money is earmarked specifically for business use. A promissory note explains the purpose of the money, the amount that was provided, and the terms of repayment. A promissory note is signed by both the lender and the recipient. Sometimes, a promissory note for a business loan will contain a personal guaranty that assures the lender that the recipient will repay the loan even if something happens to the business.

Create My DocumentReal Estate Purchase

A real estate purchase is often recorded in a promissory note. It will describe the property, the names of the parties involved in the purchase, the amount of the purchase, and the terms of repayment. Many promissory notes for real estate purchases are state specific. So, in addition to both parties signing the promissory note, you want to ensure you've met all the legal requirements in your state to document the real estate sale.

Create My DocumentVehicle Purchase

A vehicle purchase is one of the most well-known uses of promissory notes. It is used if a car will be financed by a lender, a private party, or from a "tote the note" car lot. The promissory note will describe the vehicle, the amount of the sale, and the terms of repayment. The promissory note is often signed by the person agreeing to pay for the vehicle.

Create My DocumentOther

Because a promissory note outlines the terms of a sale that is essentially being made because someone promises to pay for the item over time, it can be used for almost any sale. Regardless of what is sold, you should include a description of the item, the date the sale occurred, the price of the item, and the terms of repayment. Depending on the item sold, the promissory note may need to be signed by one or both parties.

Create My DocumentWhat is a Promissory Note?

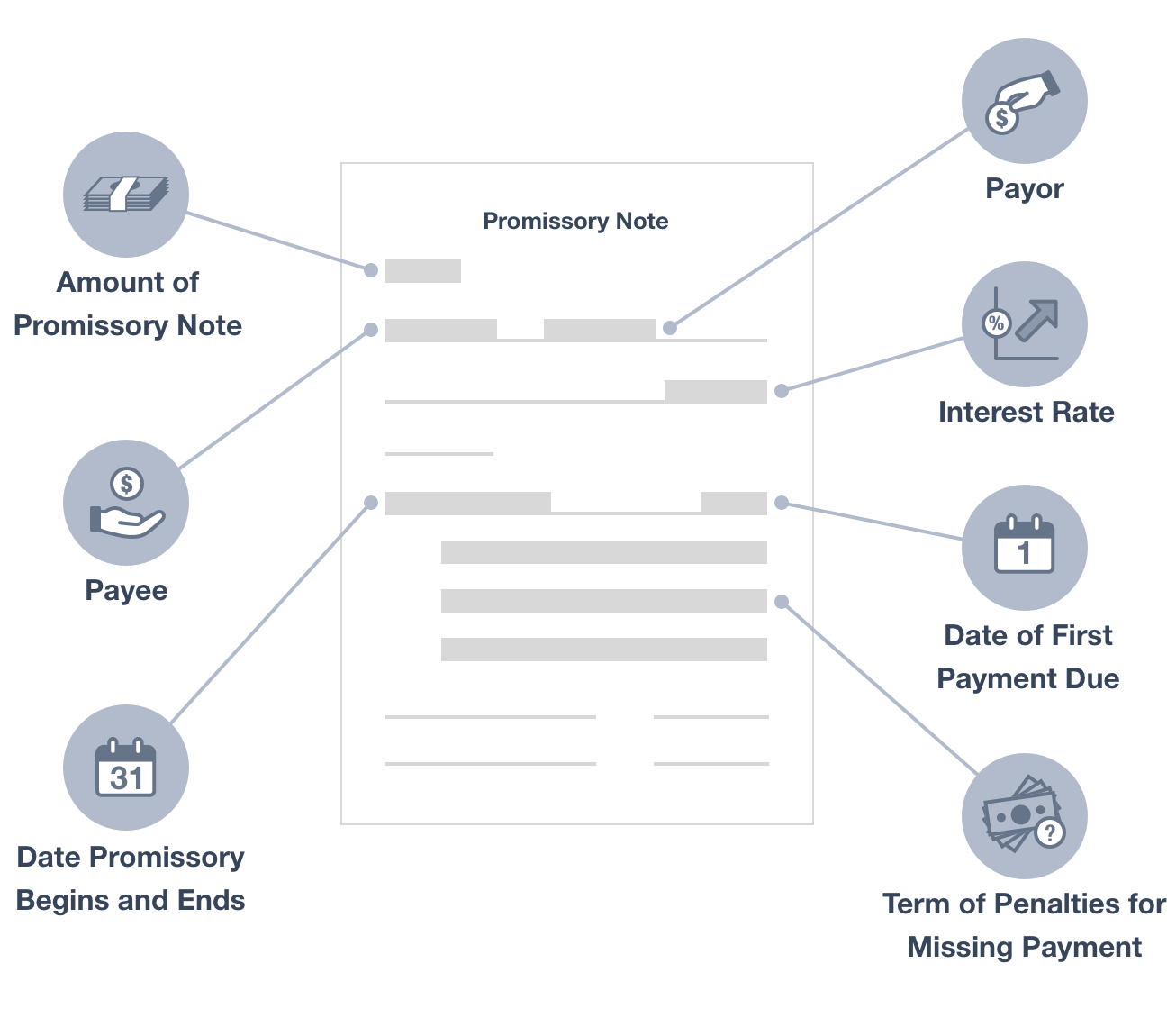

A promissory note, also known as an IOU, is a legal document that memorializes the terms of a loan, including interest and the repayment schedule.

The note should include the amount of money (the principal amount given to the person promising to pay it back), the interest rate, and the specific terms of repayment. The payee's rights in the event of a default are usually outlined.

The note should include the amount of money (the principal amount given to the person promising to pay it back), the interest rate, and the specific terms of repayment. The payee's rights in the event of a default are usually outlined.

What Are Promissory Notes Used For?

FormSwift’s promissory note template can be used for personal loans, business loans, and student loans. The proceeds of the loans can be used for many different purposes, including but not limited to:

-

Repayment of student loans

-

Refinancing credit card debt

-

Financing the purchase of a vehicle, boat, or physical property

-

To purchase real estate

What Do I Need To Write A Promissory Note?

A promissory note can be written by an individual or by a promissory note lawyer at a law firm. To construct a promissory note for your specific situation, you should have answers to the questions below:

-

The parties involved: Who is the borrower? Who is the lender? Only the borrower is legally required to sign the note, but it’s good practice to have all parties sign.

-

Repayment schedule: How will the principal sum be repaid? Weekly, monthly, annually, or at the borrower’s discretion? When must the entire loan be paid in full? When is the final payment due? If the payment structure requires a large payment or “balloon” payment, when is that due? Many promissory notes contain a clause stating the borrower waives presentment for payment notice and notice of protest. This means the lender does not have to demand payment when payment is due, so it's important that both parties clearly understand the repayment schedule to know when payments are expected.

-

Penalties for late payment or default: Hopefully, this is a non-issue, but a note needs to explain what happens for late payments or lack of payment. For example, is there a financial penalty for late payment? If so, how much? If the property is collected as collateral at the outset of the loan, does that property become the lenders? If so, after how long or how many missed payments?

-

Acceleration: Acceleration means that the loan becomes immediately due in full if a certain named trigger occurs. Can the borrower prepay any amounts owing under this note at any time? Is there a financial incentive to do it? What happens to the unpaid principal balance if one of the parties dies? What if the borrower enters bankruptcy?

-

Amendments: If revisions, additions, or adjustments are to be made, what is the process of doing so? For example, “Any amendment to this note must be made in writing and signed by both parties.”

-

Collateral: Frequently asked questions about collateral include the following. Is the borrower putting up collateral? If so, what? If there is security, consider adding a security agreement that describes the collateral.

-

Types of Repayment: The borrower should repay the note according to the terms of the note. There are four basic types of repayment:

-

Installment plan: Regular payments (e.g. monthly) of equal amounts, typically including principal and interest, are made until the loan is repaid.

-

Installment plan with balloon payment: The borrower agrees to make regular payments (e.g., monthly payments) at a typically low-interest rate for some time (e.g., two years). After that timeframe, the borrower has the option of re-paying the remainder of the loan in a single balloon payment or refinancing the remainder of the loan, typically at a higher interest rate.

-

Lump-sum payment by a specified date: Commonly used for smaller loan amounts, a lump-sum payment will require the borrower to repay the lender by a certain date (e.g., “The Borrower shall repay the lender $1,000 at 5% interest, or $1,050, within one year of the issue of the loan).

-

Due to demand: Most commonly used between family and close friends. Due to demand does not outline a timeline for repayment. The borrower is required to repay the lender at their discretion, in regular or irregular installments, a lump sum, etc.

-

If you have a particularly complex loan, you should consider a loan agreement. Loan agreements are similar to promissory notes, but offer significantly more customization to include complex terms and structures.

Types Of Promissory Notes

-

Secured and Unsecured Promissory Notes: Promissory notes are often categorized or classified as “secured” or “unsecured.” The difference is whether there is collateral. If the borrower offers collateral as security for loan repayment, the note is considered “secured”; if no collateral is required, the note is “unsecured.” A blank, printable promissory note template is available at the bottom of this page.

-

Master Promissory Note: Student loans require what’s called a Master Promissory Note (MPN). This is a legal document where a borrower (i.e. the student) agrees to repay a given loan, along with any interest and fees, to the U.S. Department of Education. The MPN also outlines the terms and conditions of the issued loan. Unless prohibited by the school, students can take out multiple federal loans under, or add additional loans to, one MPN for ten years. There are different MPNs for different categories of student loan borrowers:

-

Eligible undergraduate students and eligible graduate/professional students requesting unsubsidized loans should use the Subsidized/Unsubsidized Master Promissory Note.

-

Graduate/professional students who do not qualify for unsubsidized loans and wish to apply for a PLUS loan should use the Graduate/Professional PLUS Master Promissory Note.

-

Eligible parents of eligible dependent undergraduate students requesting a PLUS loan should use the PLUS Master Promissory Note for Parents.

-

If you need to submit financial aid appeals, you can start the process here.

Legal Forms Related to a Promissory Note:

-

Loan Agreement: A loan agreement is a financial contract between a lender and a borrower over an agreed sum of money and payment arrangements.

-

Bill of Sale: A bill of sale certifies the sale of an item, such as a car, for the seller and buyer.

-

Purchase Agreement: A purchase agreement specifies the terms and conditions of a sale for an item, setting out arrangements such as the payment schedule for the purchaser of the item.

-

Real Estate Purchase Agreement: Similar to the aforementioned purchase agreement, a real estate purchase agreement is used specifically to document the terms of sale for a piece of real estate.

Download a PDF or Word Template

Promissory Note

A Promissory Note is a signed document that establishes terms of a loan generally made informally between e.g. friends, family or colleagues. It sets out terms of repayment, period when outstanding balance must be paid and details of the parties. It must be signed by lender and borrower.

Read More

Read More

Bill of Sale

A bill of sale is used when someone is selling their personal property to another person. A common example is a car sale between two individuals.

Read More

Read More

Personal Finance Statement

A Personal Finance Statement sets out your personal net worth at any given time. It details the value of your accumulated assets, including stocks and shares, tangible assets, such as real estate, jewellery, bullion, cash, investments or other items which hold value. It also details liabilities.

Read More

Read More

Warranty Deed

A Warranty Deed is a legal document that clarifies ownership of property and right to sell to a buyer.

Read More

Read More