Form 1098-C

Form 1098-C is a special form used by individuals who donate a motor vehicle, boat, or airplane that is worth more than $500 to an organization of some kind or when the vehicle meets certain qualifications to sell it to someone in need at below the market value. When this form has the required information, the individual who donated the vehicle may be eligible to write off the item from their taxes. The type of information required will depend on the type of vehicle.

Table of Contents

What is a 1098 C?

A Form 1098-C is used by the Internal Revenue Service for tax filing purposes. It is also known as a Contribution of Motor Vehicles, Boats, and Airplanes form. It will be used for any contribution related to these vehicles that is worth more than $500. Only qualified vehicles will count towards this form; any vehicles held primarily for sale to customers does not qualify.

This form will require various information about the car and the contribution. The date the contribution is made and/or the date of the car’s sale will be needed. For the car, you will need to list how many miles are on the odometer, the vehicle identification number, and the vehicle’s monetary value. If the car has been involved in a sale, the details of the sale must be listed.

The more information you include, the more likely it is you will get a tax break. Be sure to list the conditions of the sale to ensure it was appropriate for this form. Remember that it must be a sale to a needy individual below market value or involved in an arms-length sale to qualify.

Most Common Uses

This form is commonly used when you donate a vehicle to charity and the vehicle’s fair market value is more than $500.

Components of a 1098 C

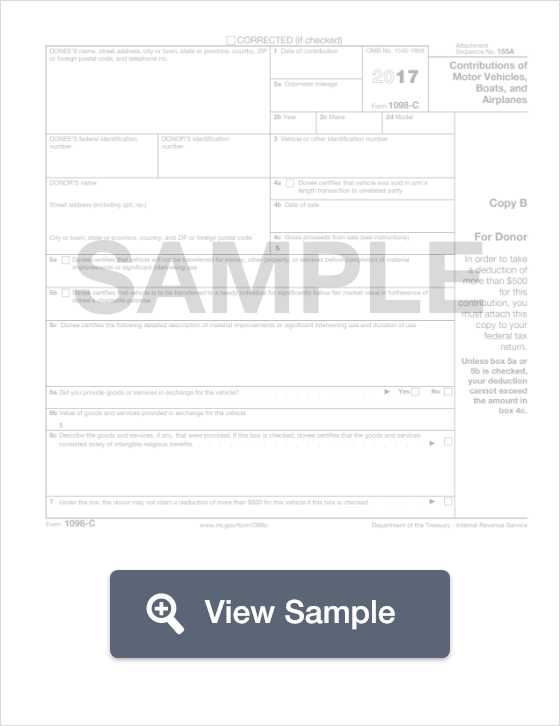

A Form 1098-C contains sections for:

- Donee’s information

- Donor’s information

- Details about donation

- Details about sale

- Details about goods or services provided in exchange for vehicle

How to complete a 1098 C (Step by Step)

To complete a 1098-C, you need to provide the following information:

- Donee’s name, address, phone number

- Donee’s TIN

- Donor’s TIN

- Donor’s name, address

- Date charity received vehicle

- Odometer mileage

- Year, make, model of vehicle

- Donee certifies vehicle was sold in an arm's length transaction to unrelated party

- Date of sale

- Gross proceeds from sale

- Donee certifies vehicle will not be transferred for money, other property, or service before completing of material improvements or significant intervening use

- Done certifies that vehicle is to be transferred to a needy individual for significantly below market value in furtherance of the donee's charitable purpose

- Donee certifies the following detailed description of material improvements or significant intervening use and duration of use

- Whether you provide goods and services in exchange for the vehicle

- Value of goods and services provided in exchange for the vehicle

- Description of goods and services provided, indicate if solely of intangible religious benefits

- Whether donor may not claim a deduction of more than $500 for this vehicle

Other Considerations

If you received any goods or services from the charity in exchange for your vehicle, you may need to reduce your deduction by the value assigned to those goods and services.