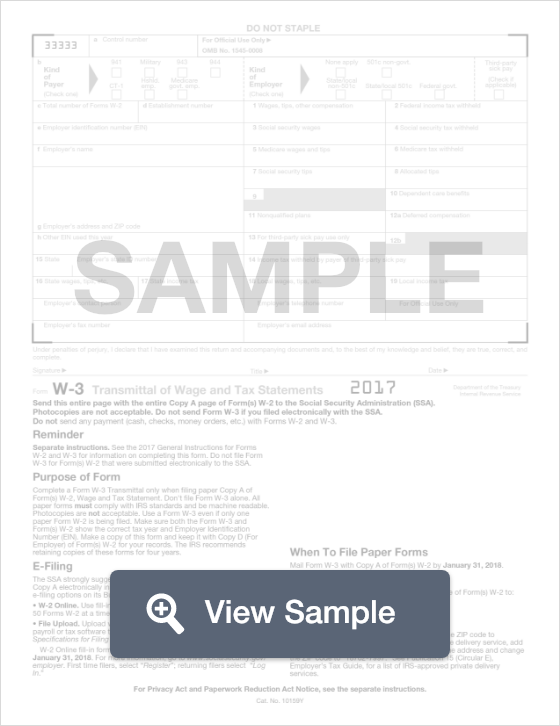

Form W-3

Form W-3, Transmittal of Wage and Tax Statements, is used by a business to send information about employees. It is filed with a W-2. The Form W-3 tells the IRS information about the individual taxpayer including what what they made during the tax year (including tips, social security wages, and Medicare wages). It also includes information about the employer.

What is a W-3 Form?

This form will be used by the Internal Revenue Service in the United States. The Form W-3 is known as a Transmittal of Wage and Tax Statements. This will be used for tax filing and reporting services. It is only filed in conjunction with a Form W-2, Wage and Tax Statement. This is a short form that only requires one page be filled out.

This form will require financial information about the taxpayer. This includes their wages and tips for the year, social security wages, and Medicare wages. The information about the employer will also need to be included. This information is often found on W-2 Forms as well. This information will be required for an income tax return.

This form is forwarded to the Social Security Administration. The form should be received by the SSA no later than the end of February.

Most Common Uses

The W-3 is commonly used to show total earnings, Social Security wages, Medicare wages, and withholding for all employees in the previous year.

Components of a W-3 Form

A Form W-3 contains:

- Information about the employer

- Kind of payer

- Kind of employer

- Establishment number

- Totals that you are submitting in the W-2

- Contact information

How to complete a W-3 Form (Step by Step)

To complete a W-3, you must provide the following information:

- Kind of payer: 941, military, 943, 944, CT-1, household emp., Medicare govt. emp.

- Kind of employer: none apply, 501c non-govt., state/local non-501c, state/local 501c, federal govt.

- Third-party sick pay indication

- Total number of forms W-2

- Establishment number

- Employer’s identification number

- Employer’s name

- Employer’s address and ZIP code

- Other EIN used this year

- Wages, tips, other compensation

- Federal income tax withheld

- Social security wages

- Social security tax withheld

- Medicare wages and tips

- Medicare tax withheld

- Social security tips allocated tips

- Dependent care benefits

- Nonqualified plans

- Deferred compensation

- For third-party sick pay use

- Income tax withheld by the payer of third-party sick pay

- State

- Employer’s state ID number

- State wages, tips, etc.

- State income tax

- Local wages, tips, etc.

- Local income tax

- Employer’s contact person

- Employer’s telephone number

- Employer’s fax number

- Employer’s email address

Legal Considerations

Do I have to attach W-2s to tax form W-3?

You are required to submit both tax forms at the same time. The totals on your tax form W-3 should equal the amounts on your W-2s.

Filing a W-3 Form

An employer must submit a W-3 Form along with all W-2 Forms for all employees before the end of January each tax year. The January 31 deadline is the same for both paper forms and electronic forms.

The W-3 Form must be sent to the SSA along with Copy A of the W-2 Forms for each employee. The totals for each item on the W-3 must equal the totals for all the same items on all employee W-2 Forms. The W-3 also contains total state wages and withholding for all employees.

If you file your employee W-2 Forms electronically, you will not have to compile all the W-2 information to submit a W-3 Form. The IRS strongly suggests that you provide W-2 Forms electronically. If you have 250 or more employees, you must file electronically.

Mistakes

If you make a mistake on your W-3 or if one or more of the W-2s is incorrect, you must file a W-2c and a W-3c Form with the Social Security Administration with the correct information.