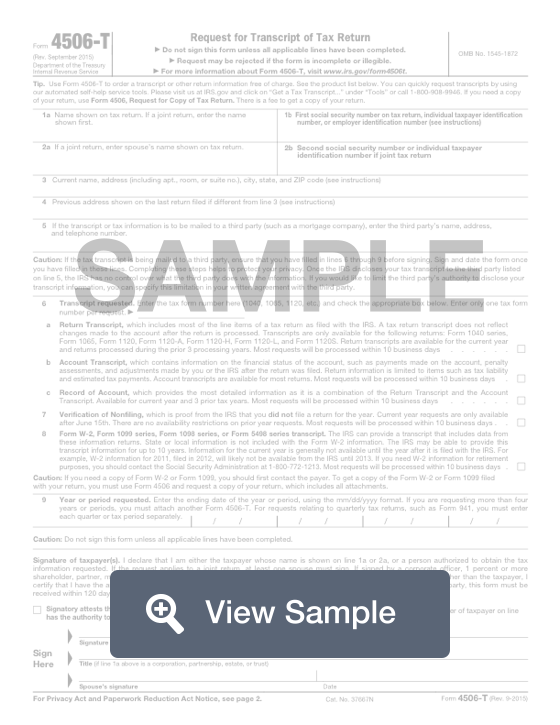

What is a 4506 T?

The IRS Form 4506-T is a Request for Transcript of Tax Return form. This form is used when people want to receive a tax return transcript, tax return, or other tax records. People can also use this form to request that a third-party receive a copy of your return as well.

In order for this form to be processed, it must have certain information. It needs the personal information of the person who is requesting the copy of tax return information in order to verify their identity. It also needs information about what type of tax transcript is requested and what tax year the tax information is from.

This tax form can be filled out online and printed out and mailed to the Internal Revenue Service (IRS). Before sending, ensure you have filled out all required fields and signed the document. Otherwise, your request may not be able to be processed.

If you only need a copy of the Form 1040 individual tax return, you can fill out Form 4506T-EZ instead.

How to complete a 4506 T (Step by Step)

To complete a Form 4506-T transcript request, you need to provide the following information:

- Name shown on income tax return

- First social security number (SSN) on tax return, ITIN, or EIN

- Spouse’s name

- Second social security number or individual taxpayer identification number if joint return

- Current name and current address

- Previous address shown on last return filed

- If transcript information or tax information is to be mailed to a third party, provide third party’s name, address, and phone number

- Customer file number

- Transcript requested (tax form number 1040, 1065, 1120, etc.)

- Return transcript - includes most of the line items of a tax return as filed with the IRS

- Account transcript - information on status of account, such as tax payments, adjustment made after return was filed

- Record of Account - most detailed information, a combination of Return Transcript and Account Transcript, available for current year and 3 prior years

- Verification of Nonfiling - proof from the IRS that you did not file a return for a tax period

- Form W-2, Form 1099, Form 1098 series, Form 5498 series transcript

- Year or period requested

- Signature

- Title

- Spouse’s signature

- Date