What is a Tax Exempt Form?

A tax exempt certificate is a document used by the Internal Revenue Service to grant a tax exempt status to certain non-profit or charitable organizations. The certificate must be presented to the organization or institution in order for them to be recognized as tax exempt.

Only certain individuals, organizations, and institutions will quality for a tax exempt certificate. Some of these parties include veterans, non-profit or charitable organizations, educational institutions, and some religious organizations. Someone seeking a tax exempt certificate must apply with the correct forms through the IRS. They will need to also provide extensive documentation outlining their organization. This allows the Internal Revenue Service to determine if they qualify for tax exemption.

Difference between a resale certificate and tax exempt certificate

A resale certificate and tax exempt certificate are different because of the reasons for the exemptions. Companies that qualify for a resale certificate are eligible to purchase items such as ingredients or component parts of the items that they sell. A resale certificate cannot be used to purchase items exempt from sales tax that do not qualify for this purpose. A tax exempt certificate is issued to an entity that qualifies for an exemption or because the purchased item qualifies for the exemption.

Most Common Uses

A tax exemption certificate is used to make tax-free purchases of some items and services that are taxable. The purchaser must provide the seller with the properly completed certificate within 90 days of the time the sale is made.

Purchasers who may use exemption certificates include: purchasers who intend to resell the property or service, purchasers who intend to use the property or service for a use that is exempt from sales tax; or purchases made as an agent or employee of a tax-exempt nonprofit organization or government entity.

Types of Exemption Certificates

For Resellers

The most common type of exemption is the resale exemption. If you purchase goods to be resold in the same form that they are purchased, they qualify for a resale exemption if the reseller is licensed and can provide a resale certificate. The reseller is required to collect sales tax when they later resell the goods.

For Drop Shipments

If a seller has a nexus in a state and has registered to collect sales tax, they are required to collect sales tax on all taxable sales delivered into that state. When a seller drop ships, the retailer is often not registered in the ship-to state. In these cases, the supplier/shipper is required to collect tax from the retailer on the drop ship transaction unless the retailer can provide valid exemption documentation that is considered acceptable by the ship-to state.

For Manufacturers or Purchasers of Raw Materials

If you purchase materials for incorporation into an end product to resell, you may be considered a manufacturer or processor instead of a reseller. In some states, machinery and equipment used in manufacturing is also exempt from tax. In this case, the manufacturer would issue an exemption certificate to their suppliers when they purchase qualifying items claiming the manufacturing exemption.

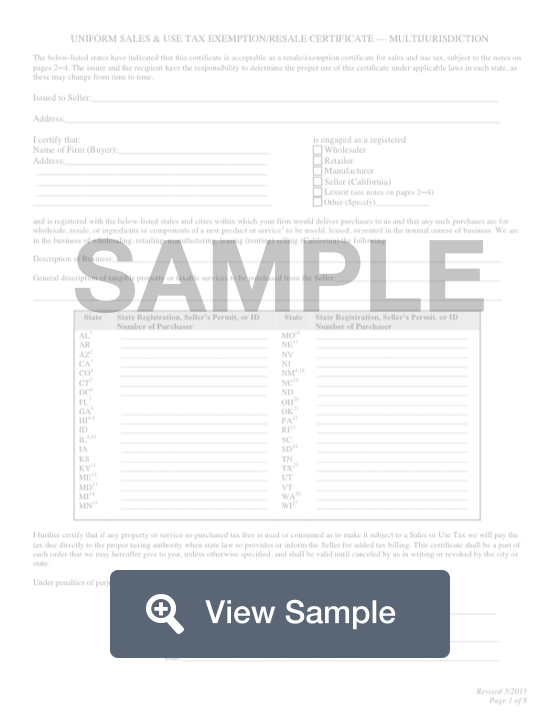

Components of a tax exempt form

A tax exempt form contains the following sections:

- Seller’s information

- Buyer’s information

- Description of business

- State registration, seller’s permit, or ID number of purchaser

- Signature

Requirements

A tax exempt certificate must contain the following information:

- Type of exemption claimed

- Names and addresses of the seller and purchaser

- Description of goods being purchased

- Purchaser’s tax registration number or business license

- Statement that if the purchaser uses the items in a taxable manner that they will be responsible for the use tax

- Signature of purchaser or agent

How to complete a Tax Exempt form (Step by Step)

To complete a tax exempt form, you will need to provide the following information:

- Seller’s name

- Seller’s address

- Buyer’s name

- Buyer’s address

- Classification of buyer: wholesaler, retailer, manufacturer, seller (California), lessor, other

- Description of business

- General description of tangible property or taxable services to be purchased from the seller

- State registration, seller’s permit, or ID number of purchaser

- Certification that if the purchaser uses the items in a taxable manner that they will be responsible for the use tax

- Authorized signature

- Title

- Date

Other Considerations

What a seller needs to know

If a purchaser gives you a properly completed tax exemption certificate within 90 days of the date of purchase, you do not have to charge the purchaser sales tax. A seller has a duty to exercise ordinary care in accepting a certificate. You could be held liable if you didn’t collect taxes if you knew that the purchase was not for an exempt purchase or knew that the certificate was false or fraudulent.

Proving an exemption

A purchaser is responsible to adequately prove that they meet the exemption requirements for that purchase. Proof is generally provided in the form of an exemption certificate that meets that state’s requirements. The seller is responsible to maintain and file a copy of the purchaser’s exemption documentation.

Exemption Expiration Dates

Each state has different rules and expiration dates can vary between types of certificates. It is advisable to update all of your exemption certificates every three to five years.