What is a UCC1?

A UCC Financing Statement is also known as a Form UCC-1. This form will be used by creditors in order to inform a debtor party that they have an interest in their personal property. This will allow the creditor to verify their interest in the property. This notice may be public in order to demonstrate the right of the creditor to take possession of certain properties in order to repay a debt.

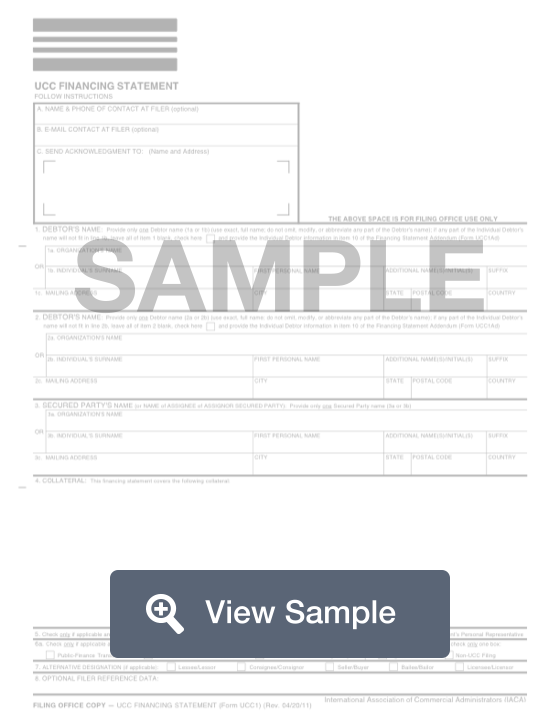

There are three major pieces of information that are required for this form. This includes the name and address for the debtor, the name and address for the creditor, and information about the collateral. This information does not need to be detailed. The form will only consist of one page, and it does not require a signature, witness, or notary.

This form is governed by the laws of the Uniform Commercial Code.

Most Common Uses of a UCC1 form

A UCC-1 Financing Statement is commonly used when parties engage in commercial transactions that incur debt. A party should file a UCC-1 to protect themselves in the event that a party is not able to pay his or her debt. A UCC-1 establishes a creditor as a secured party. In the event that a debtor goes bankrupt a secured creditor will have a place in line when the bankruptcy court divides that debtor’s assets among creditors.

Components of a UCC1 Financing Statement

A UCC-1 Financing Statement contains the following sections:

- Filer Information

- Debtor Information

- Secured Party Information

- Collateral Information

How to complete a UCC1 (Step by Step)

To complete a UCC-1, you need to provide the following information:\

- Filer Information

- Name and phone number of contact at filer

- Email contact at filer

- Name and address of where to send acknowledgment

- Debtor Information

- Organization or individual’s name

- Mailing address

- Secured Party Information

- Organization or individual’s name

- Mailing address

- Collateral Information

- Description of collateral

- Whether collateral is held in a trust (UCC1Ad, item 17) or administered by a decedent’s personal representative

- Indicate if: public-finance transaction, manufactured-home transaction, debtor is a transmitting utility

- Alternate designation: lessee/lessor, consignee/consignor, seller/buyer, bailee/bailor, licensee/licensor

Filing a UCC financing statement

You should file a UCC-1 Financing Statement with the secretary of state’s office in the state where the debtor is incorporated or located. If the collateral is real property, then you should also file a UCC-1 with the county recorder’s office in the county where the debtor’s real property is located.

Secretaries of state have websites where you can file your UCC-1 and instructions on how to complete all forms. Individual counties may not have websites and require you to file by mail or in person.

While there is a national UCC-1 form, some jurisdictions may have their own specific form. Be sure to use the correct form.

What service does a state or country UCC section provide?

A state or county UCC section will allow you to provide public notice that you have entered into a security agreement with a debtor. The UCC section can provide you with the forms that you need to file your Financing Statement, amend or extend the filing, make assignments, and search for other filings against a debtor.

How much does it cost to file?

The price to file a UCC-1 varies in each jurisdiction. Generally, the fee will range from between $10 to $25 per filing. Some states and counties will charge an additional fee for each debtor that is listed on a form.

How long does a filing last?

A UCC-1 Financing Statement is valid for 5 years. After 5 years, the filing is considered lapsed and is no longer valid. A lapsed filing will not protect you if the debtor remains in debt to you and encounters financial difficulties or files for bankruptcy.

You may extend a UCC-1 filing before the 5-year period elapses. To extend your filing, you need to file a continuation statement within six months before the initial filing’s expiration date.

How can I manage my UCC filings?

Keeping your UCC filings up to date is important to protect your security interest in a debtor’s property. You can assign this duty to a staff member or hire a third party to manage your UCC filings for you. There are many companies that offer this type of service.