What is a VA Form 21P 8416?

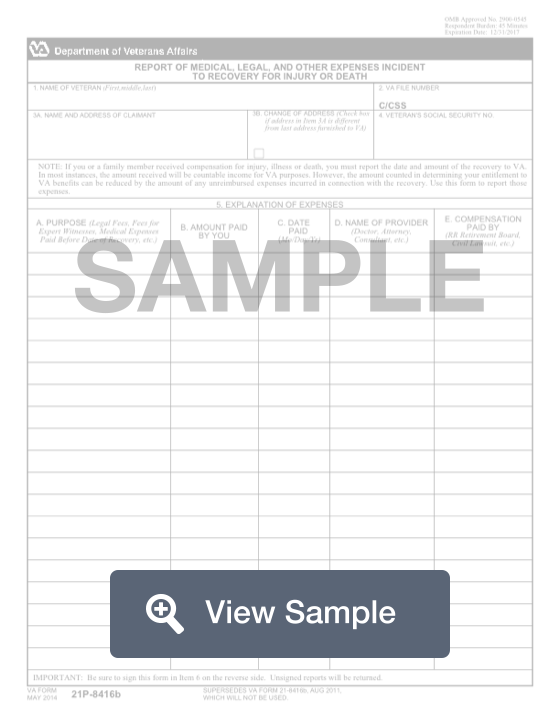

This form is known as a Medical Expense Report. The VA Form 21P-8146 is used by the United States Department of Veterans Affairs. This form will be used by a veteran in order to file a claim for the expenses related to medical care. This can be related to the cost of medical treatments or the transportation to and from medical appointments.

The first section of this form requires information about the claimant. This includes full name, social security number, VA file number, and address. After this, you can list the medical expenses. For transportation expenses, you’ll need to include the medical facility you went to and the amount of miles you traveled. List how much you paid for this visit. For medical expenses, list each individual expenses and how much you paid personally. The total will be calculated and the VA will use the form to determine how much may be covered.

Most Common Uses

This form is commonly used to report medical or dental expenses that you paid for yourself or a relative who is a member of your household. Common expenses include: hospital expenses, doctor's office fees, dental fees, prescription/non-prescription drug costs, vision care costs, medical insurance premiums, nursing home costs, hearing aid costs, home health service expenses, expenses related to transportation to a hospital, doctor, or other medical facility, monthly Medicare deduction.

Components of a VA Form 21P 8416

A VA Form 21P-8416 contains the following sections:

- Personal Information

- Mileage for Privately Owned Vehicle Travel for Medical Purposes

- In-home Attendant Expenses

- Itemization of Medical Expenses

- Worksheet for In-Home Attendant Expenses

- Worksheet for an Assisted Living, Adult Day Care, or a Similar Facility

How to complete a VA Form 21P 8416 (Step by Step)

- Personal Information

- First name of veteran

- Middle name of veteran

- Last name of veteran

- Suffix name of veteran

- Veteran’s social security number

- VA file number

- Claimant’s name

- Address

- Telephone number

- Change of address

- Email address of claimant

- Mileage for Privately Owned Vehicle Travel for Medical Purposes

- Mileage for travel to a hospital, doctor, or other medical facility

- Medical facility to which traveled

- Total roundtrip miles traveled

- Amount reimbursed from another source

- Date traveled

- Who needed the travel

- In-home Attendant Expenses

- Name of provider

- Hourly rate/numbers of hours

- Amount paid

- Date paid

- For whom paid

- Itemization of Medical Expenses

- Medical expense

- Amount paid

- Date paid

- Name of provider

- For whom paid

- Worksheet for In-Home Attendant Expenses

- Whether the claimant is the disabled person

- Whether the VA determined that you are eligible for special monthly pension (means pension at the aid and attendance or housebound rate or Parents' DIC at the aid and attendance level)

- Whether the primary responsibility of the in-home attendant is to provide you with health care services or custodial care

- Whether you are claiming special monthly pension

- Whether the primary responsibility of the in-home attendant is to provide you with health care or custodial care

- Whether the disabled person requires the health care services or custodial care that the in-home attendant provides to him or her because the disabled person’s mental or physical disability

- Whether it is the primary responsibility of the in-home attendant to provide the disabled person with health care and/or custodial care

- Activities that attendant assists the disabled person with: eating, bathing/showering, dressing, transferring, using the toilet, shopping, food preparation, housekeeping, laundering, managing finances, handling medications, handling medications, using the telephone, transportation for non-medical purposes

- Certification that the information is correct

- Worksheet for an Assisted Living, Adult Day Care, or a Similar Facility

- Whether the expenses are due to the disabled person’s treatment in the hospital, inpatient treatment center, nursing home, or VA approved medical foster home

- Whether the facility is licensed, the facility’s staff or facility’s contracted staff provides the disabled person with health care or custodial care or both, whether the facility is staffed 24 hours per day with caregivers

- Whether the claimant is the disabled person or a veteran, surviving spouse, or parents’ DIC claimant

- Whether VA has determined that you are eligible for special monthly pension

- Whether the facility’s providing of health or custodial care is the primary reason you live in the facility or attend day care in the facility

- Whether you are claiming special monthly pension

- Whether the disabled person requires the health care services or custodial care that the facility provides to him or her because of the disabled person’s mental or physical disability

- Whether the facility provides the disabled person with health care and/or custodial care and this is the primary reason the disabled person lives in the facility or attends day care in the facility

Privacy Act Notice

The VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 38, Code of Federal Regulations 1.576 for routine uses such as civil or criminal law enforcement, the collection of money owed to the United States, litigation in which the United States is a party or has an interest, the administration of VA programs and delivery of VA benefits, verification of identity and status, and personnel administration as identified in the VA system of records, 58VA21/22/28, Compensation, Pension, Education, and Vocational Rehabilitation and Employment Records - VA, published in the Federal Register.

Respondent Burden

The VA needs this information to determine whether medical expenses you paid may be used to reduce the amount of income we count in determining eligibility for veterans benefits (38 U.S.C. 1503). Title 38, United States Code, allows us to ask for this information. We estimate that you will need an average of 30 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. OMB Control No. 2900-0161.