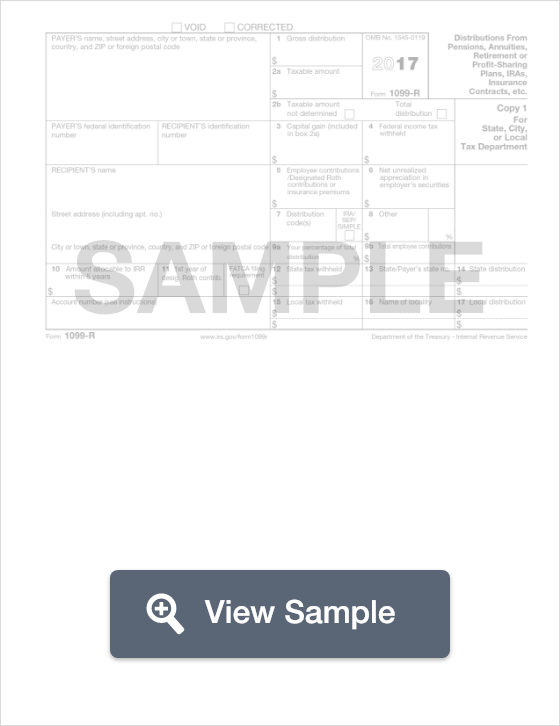

1099-R Form

A form 1099-R is used to report distributions made for both IRA and 401k accounts. It is also used for pensions, annuities, and profit-sharing plans. This form is mailed out by the company paying on the distribution. The tax payer who receives the form will pay taxes on the money the received. The amount of tax they pay depends on several factors, such as an early pay-out.

What is a 1099 R?

IRS Form 1099-R is related to tax filing. It is used to show any distributions from pensions, IRAs, profit-sharing plans, and annuities. It needs to be used anytime you receive over $10 from these accounts in a tax year. The report will include the financial information so you can include it on your state and federal tax returns.

This tax form should be sent by a bank or financial institution. The 1099-R form should list the gross income from these accounts for the year, and how much of that income is taxable. It will also list any state or federal tax deductions that have been made over the year. If the amount of taxable income is not included, it will need to be calculated manually by the person filing the taxes.

Most Common Uses

The most common types of distributions that will cause a 1099-R form to be issued are:

- An individual retirement account (traditional IRA or Roth IRA)

- Profit-sharing or retirement plans

- Annuities, pensions, insurance contracts, survivor income benefits plans

- Permanent and total disability payment sunder life insurance contracts

- Charitable gift annuities

Components of a 1099 R

A Form 1099-R include: gross distribution paid during the given tax year, the amount of the distribution that is taxable, the federal income tax that has been withheld, the contributions made to the investment or premiums paid, and a code that indicates the type of distribution that was made.

Distribution Codes

Code Explanation

1 Early distribution, usually under age 59.5

2 Early distribution, exception applies (under age 59.5)

3 Disability

4 Death

5 Prohibited Transaction – usually means the account is no longer an IRA.

6 Section 1035 exchange (a tax-free exchange of life insurance, annuity, qualified long-term care insurance, or endowment contracts)

7 Normal distribution

8 Excess contributions plus earnings/excess deferrals

9 Cost of current life insurance protection

A May be eligible for 10-year tax option

B Roth account distribution

D Annuity payments from nonqualified annuities, may be subject to taxation under § 1411

E Distributions from Employee Plan Compliance Resolution System (EPCRS)

F Charitable gift annuity

G Direct rollover of a distribution to a qualified plan, a section 403(b) plan, a governmental section 457(b) plan, or an IRA

H Direct rollover of a Roth account distribution to a Roth IRA

J Early distribution from a Roth IRA

L Loans treated as distributions

N Recharacterized IRA contribution made for current year and recharacterized in current year

P Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in past year

Q Qualified Roth IRA distribution, met 5 year holding period, reached age 59.5, died, disabled

R Recharacterized IRA contribution made for past year and recharacterized in current year.

S Early distribution from a SIMPLE IRA in first 2 years

T Roth IRA distribution, exception applies

U Dividend distribution from ESOP under sec. 404(k)

W Earmarked for purchasing qualified long-term care insurance contracts under combined arrangements.

Early distributions

Most benefits that are paid before someone turns 59.5 are considered to be early distributions. There is an additional 10 percent federal tax on early distributions that is intended to discourage the misuse of retirement funds. Some states also impose an additional state penalty on early distributions.

Common exceptions include: death, disability, an IRS levy, and medical expenses that exceed 7.5 percent of the taxpayer’s adjusted gross income.

Examples of distributions

Common types of distributions include:

- IRAs

- Profit-sharing retirement plans

- Annuities, pensions, insurance contracts

- Charitable gift annuities

Pension and Annuity Payments

Retirement benefits are essentially a deferred compensation arrangement. Taxes on this income are also deferred until the funds are withdrawn by the employee. If no after-tax contributions were made to the pension plan before distribution, the entire amount is included in taxable income. In cases where the after-tax contributions were made to an annuity or pension, only a portion of the distribution will be taxed.

Rollovers

A rollover means that retirement funds are moved from one custodian to another without paying money on the transferred money. Direct rollovers are identified by codes G or H. Indirect rollovers happen when the account owner takes possession of the retirement funds and redeposits them into another qualified retirement account. Typically, this must happen within 60 days.

Loans

Some companies allow employees to take loans against their pension plans. These loans are typically repaid with interest, so are no considered distributions. If the loan is not repaid on time, it is considered a distribution and a Form 1099 R is issued. These distributions may be subject to early distribution penalties.

How to complete a 1099 R (Step by Step)

To complete a 1099 R, you need to provide:

- Payer’s name address, phone number

- Payer’s TIN

- Recipient’s TIN

- Recipient’s name, address

- Account number

- Gross distribution

- Taxable amount

- Capital gain

- Federal income tax withheld

- Employee contributions/Designated Roth contributions or insurance premiums

- Net unrealized appreciation in employer’s securities

- Distribution code

- IRA/SEP/SIMPLE

- Percentage of total distribution

- Total employee contributions

- Amount applicable to IRR within 5 years

- 1st year of designated Roth contribution

- FATCA filing requirement

- State tax withheld

- State/Payer’s state number

- State distribution

- Date of payment

- Local tax withheld

- Name of locality

- Local distribution

Legal Considerations

When should I expect a 1099 R form?

Custodians are required to send a 1099 R to the owner of a plan if they have made distributions of $10 or more from the plan during the year. The form must be mailed to the recipients by January 31 of the year following the distribution.