1099-S Form

A form 1099-S is a tax document used to ensure that the full amount received for a real estate sale of some kind is accurately reported. When real estate is sold, the seller is often subject to a capital gains tax. A 1099-S can also be used to report income made on rental property or investment property. For selling real estate, the buyer must complete and file their own 1099-S. Buyers can ask for a 1099-S to be completed and included as part of their closing documents.

Table of Contents

What is a 1099 S?

IRS Form 1099-S form is used for tax reporting purposes to report proceeds from real estate transactions. It must be used whenever you make a real estate transaction in the tax year. This could include land, permanent structures, apartments or condominiums, and more. The form needs to be used any time the exchange of real estate takes place: for a sale or an exchange.

Because this is an Internal Revenue Service tax form, it requires a lot of information. The filer will need to include their personal information, such as full name and address. The address for the property involved in the transaction is also needed, as well as the gross amount of proceeds received from this real estate transaction. The 1099-S form should be submitted with the rest of the year's tax documents.

Most Common Uses

The purpose of the form 1099-S is to ensure that sellers are reporting the full amount of their capital gains on each year’s income tax return. Any organization involved in the sale of real estate and certain royalty payments must use Form 1099-S.

Personal Use

If you received a 1099-S because of the sale of your primary residence, then you should check the appropriate box on your Form 1099-S. The sale of your home will be reported on Form 8949 and Schedule D. Do not report the sale of your main home on your tax return unless your gain exceeds your exclusion amount.

If you received a 1099-S for the sale of a timeshare or vacation home, then the sale is a personal capital asset and is reportable on Form 8949 and Schedule D. A gain on this type of sale is reportable income. If you incurred a loss on the sale you cannot deduct the loss because it is a personal use property.

If the property was inherited and considered a personal capital asset, the same rules apply.

Investment Use

If you received your 1099-S for investment property or inherited property that is considered investment property, the sale is reportable on Schedule D.

Business or Rental Use

If you received your 1099-S for the sale of a business or rental property, this is reportable on IRS Form 4797 and Schedule D.

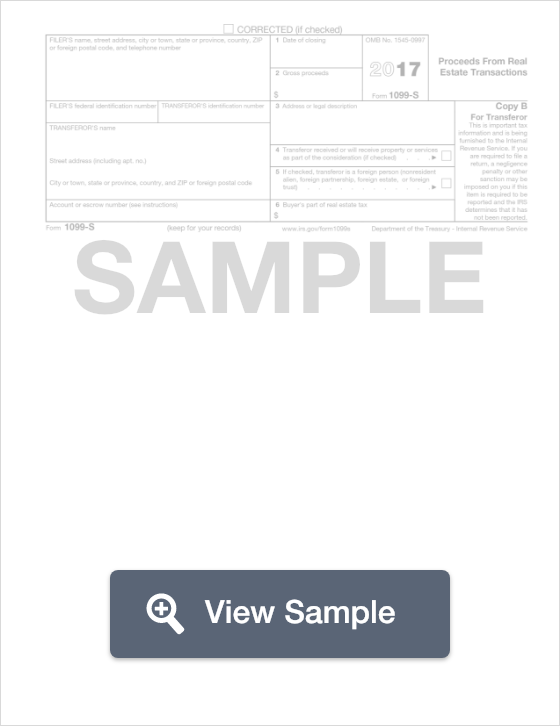

Components of a 1099 S

A 1099S form contains information about the Filer, the Transferor, the Date of Closing, Proceeds, and details of the property being transferred.

How to complete a 1099 s (Step by Step)

To complete a 1099 S, you need to provide:

- Filer’s name, address, telephone number

- Filer’s tax identification number or social security number

- Transferor’s TIN/SSN

- Transferor’s name, address

- Account number

- Date of closing

- Gross proceeds

- Address or legal description of transferred property

- Indication if transferor received property or services as part of the consideration

- Indication if transferor is a foreign person, partnership, estate or trust

- Buyer’s part of real estate tax

Legal Considerations

Buyer

If you are the buyer, you can include a clause in your purchase agreement that identifies the seller as the responsible party for any IRS reporting that is required as a result of their receipt of funds related to the transaction. You can also ask the seller to complete IRS Form W-9 as part of their closing package, which will include all the information that is needed to complete a 1099-S. If you fail to get a W-9 or include a designation clause in the purchase agreement, you can put together a letter of instruction and send it to the seller with all the forms they will need to complete and submit it to the IRS.

Seller

If you are a seller, you file your own 1099-S because you have all the necessary information to file one. In some cases, a closing may go through a title company, escrow company, or closing attorney who will have the responsibility to file the 1099-S. A seller will also have to complete one 1096 transmittal form with all of your information.

When do I file 1099-S?

This fiscal year, the 1099-S form must be mailed to the recipient by February 15, 2018 and e-filed with the IRS by April 2, 2018.