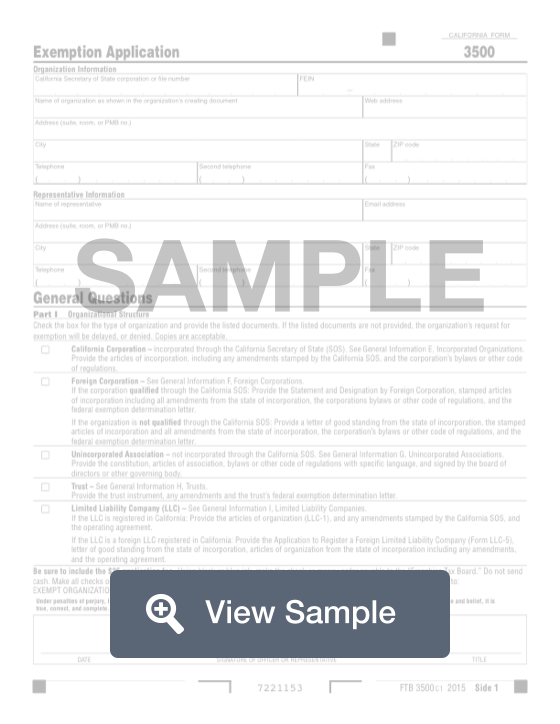

What is a California Form 3500?

A California Form 3500 will be used by an entity that wants to apply for California tax-exempt status. This could be a company or organization. Recognition as a tax-exempt entity requires that this form is approved by the State of California, so ensure you include all the requested information on this Exemption Application.

Information you’ll need includes details about the organization as well as its representative. Answer all the questions on the application honestly. In order for the application to be complete, a fee, a copy of the organization’s bylaws, and a copy of entity’s creating document will need to be included.

In order for the form to be accurate, you will need to know what type of entity the organization or company is. Otherwise, the application may be denied. If you have trouble understanding any of the information, contact a lawyer who is knowledgeable about taxes and state tax exemption status.

Most Common Uses of a Form 3500

The Form 3500 is used to apply for tax-exempt organization status in California under the California Revenue and Taxation Code (R&TC) Section 23701.

Components of a Form 3500

A Form 3500 requires you to submit:

- Creating documents

- California corporations - submit a copy of the endorsed articles of incorporation and all subsequent amendments

- Foreign corporations - submit a copy of the endorsed articles of incorporation and all subsequent endorsed amendments from the state or country in which incorporated and any Certificate of Qualification and/or Endorsed Statement and Designation by Foreign Corporation

- Trust - Submit a copy of the original trust document and any subsequent modifications

- California limited liability company - submit a copy of the endorsed articles of organization

- Foreign limited liability company qualified in California - submit a copy of the endorsed Application for Registration (LLC-5), a copy of the certificate of good standing from the home state, and a copy of the articles of organization from the home state

- Bylaws - submit copy of bylaws, proposed bylaws, operating agreement, and any other code of regulations

- Financial data - may use its own gross receipts and expense statements or Part III Financial worksheet provided in FTB 3500

How to complete a California Form 3500

To complete your California Form 3500, you will need to fill out:

- California Secretary of State corporation of file number

- FEIN

- Name of organization

- Website

- Address

- Email address

- Telephone numbers

- Fax number

- Representative information (name, address, phone, email, fax)

- Indication of organizational structure

- California corporation

- Foreign corporation - If corporation qualified through the California SOS, provide the Statement and Designation by Foreign Corporation, stamped articles of incorporation including all amendments from the state of incorporation, the corporations bylaws or other code of regulations, and the letter indicating federal tax-exempt status. If the organization is not qualified through the California SOS, you must provide a letter of good standing from the state of incorporation, the stamped articles of incorporation and all amendments from the state of incorporation, the corporation’s bylaws or other code of regulations, and the federal determination letter.

- Unincorporated association

- Trust

- Limited liability company

- Signature of officer of representative

- Date

- Whether the organization already has tax-exempt status under IRC Sections 501(c)(3), 501(c)(4), 501(c)(5), 501(c)(6), or 501(c)(7) - If yes, the organization may choose to file form FTB 3500A Submission of Exemption Request

- Indication of the California Revenue and Taxation Code section that best fits the organization

- Date of formation

- Whether the organization was formed in another state

- What is the organization’s annual accounting period ending

- Primary purpose of organization

- Whether the organization is currently conducting or planning to conduct activities

- Description of activities

- Full financial data - receipts, expenses, balance sheet

- Officers, Directors and Trustees - name, title, mailing address, compensation amount for all

- Whether any incorporator, founder, board member, or other person will share facilities with the organization; rent, sell, or transfer property to the organization; be compensated for services other than performing as a board member or employee

- Previous California entity ID numbers assigned to the organization

- Whether the organization was previously granted, dented, or revoked exemption by the Internal Revenue Service (IRS)

- Whether the organization was previously granted, dented, or revoked exemption by California

- Whether the organization has filed any federal returns

- Whether the organization will participate in any fundraising activities

- Whether the organization conducts any gaming activities

- Whether the organization leases any property

- Whether the organization publishes, sells or distributes any literature

- Whether the organization publishes, owns or has rights in music literature, tapes, artworks, choreography, scientific discoveries, or other intellectual property

- Whether the organization accepts contributions of real property, conservation easements, closely held securities, intellectual property such as patents, trademarks, and copyrights, works of music or art, licenses, royalties, automobiles, boats, places, or other vehicles, or collectibles of any type

- Whether the organization operates outside of the United States

- Specific questions depending on whether you fall under the exemptions for:

- Labor, agricultural, or horticultural organization

- Fraternal societies, orders, or associations

- Cemeteries, crematoria, and like corporations

- Religious, charitable, scientific, literary, or educational organization

- Business league, chamber or commerce, professional association, or society

- Civic league, social welfare organization, or local association of employees

- Social and recreational organization

- Title holding organization - organizations with members, incorporating as a nonprofit corporation under the California Corporations Code Sections 5410 and 7411 prohibit any distribution to member of nonprofit public benefit corporations or nonprofit mutual benefit corporations unless the organization dissolves.

- Voluntary employee’s beneficiary organization

- Fraternal beneficiary societies, orders, or associations

- Supplemental unemployment compensation trust

- Homeowners’ association

- Public facility financial corporation

- Mobile home park acquisition organization

- War veterans organization

- Title holding organization

- Credit union

- Self insurance pool for charitable organizations

- Schedule A - for Churches

- Schedule B - for Hospitals

- Schedule C - for Credit Counseling Organizations

You will need to complete the form in blue or black ink and submit it with a $25 check or money order payable to the "Franchise Tax Board." Mail form FTB 3500 to: EXEMPT ORGANIZATIONS UNIT MS F120, FRANCHISE TAX BOARD, PO BOX 1286, RANCHO CORDOVA, CA 95741-1286.

Legal Considerations

Date of tax exempt status

The effective date of an organization’s tax-exempt status for state income tax purposes shall be no earlier than the federal effective date.

Statement of Revoked tax exempt status

If an entity’s tax-exempt status is revoked for failure to file a return, failure to pay a balance due, or for being suspended, there is an abbreviated process to have the entity’s tax-exempt status reinstated. To qualify for relief from revocation, the entity must be incorporated after 1968 and File FTB 3500, Exemption Application Side 1 through 8, complete the appropriate item listed for the R&TC section that the organization qualifies for, pay the $25 application fee.

Rush exemption request

An organization qualifies a rush exemption request if it:

- Applies for tax-exempt status under R&TC Section 23701d to prevent loss of funding. The organization’s funding will be lost if the tax-exempt status is not granted within 15 days from the date the applicant enters the field office. The funding must be verifiable.

- Is a suspended entity in litigation

Entities that do not meet the above criteria may be considered for a rush by the Central Office Exempt Unit. Any applicant that is approved for a rush will be charged an additional fee of $40 if not suspended or $56 if suspended.