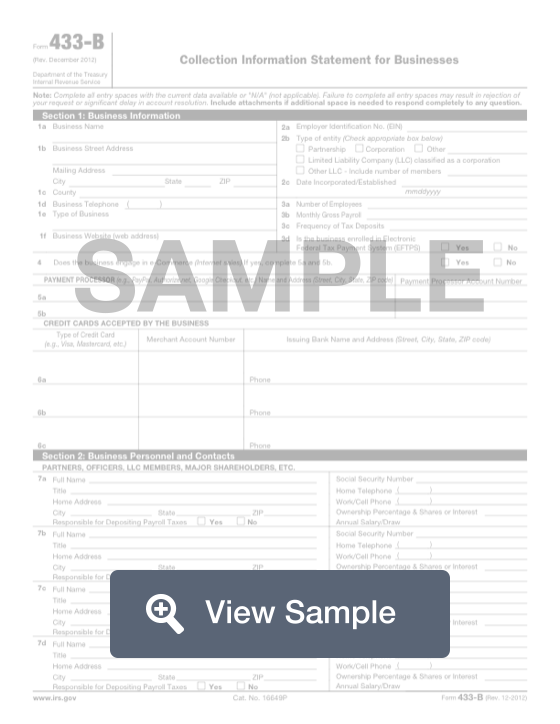

What is a Form 433 B?

This form will be used for tax filing purposes in the United States, and will be received by the Internal Revenue Service. The Form 433-B is known as a Collection Information Statement for Business. This form will be filled out by taxpayers who have their own business or are self-employed. It will provide the IRS with more information about their financial situation so that they can be taxed appropriately.

The form will often be used in conjunction with Form 433-A, or a Collection Information Statement for Wage Earners and Self-Employed Individuals. It can also be used separately if the party is not a sole proprietor. A Form 433-B will require more detailed information about the tax filers business. This includes very specific information about the assets, such as real estate and vehicles, and business expenses such as utilities and salaries. Have this information ready before you try to complete the form.

How to complete a Form 433 B (Step by Step)

To fill out a Form 433-B, you will need to provide the following information:

Section 1: Business Information

- Business name

- Address

- Telephone

- Type of business

- Website

- Employer identification number (EIN)

- Type of entity

- Date of incorporation

- Number of employees

- Monthly gross payroll

- Frequency of tax deposits

- Enrolled in the Electronic Federal Tax Payment System (EFTPS)

- Engaged in e-Commerce

- Payment processor

- Credit cards accepted by business

Section 2: Business Personnel and Contacts

- Partners, officers, LLC members, major shareholders

- Name, title, home address, SSN, phone, ownership percentage & shares or interest, annual salary/draw

Section 3: Other Financial Information

- Payroll service provider or reporting agent information

- Name and address

- Party to a lawsuit: plaintiff/defendant, location of filing, represented by, docket number, amount of suit, possible completion date, subject of suit

- Bankruptcy information: date filed, date dismissed, date discharged, petition number, district of filing

- Related parties owe money to the business

- Assets transferred in the past 10 years for less than full value

- Other business affiliations

- Increase/decrease in income anticipated

- Federal Government Contractor status

Section 4: Business Asset and Liability Information

- Cash on hand

- Safe on premises

- Business bank accounts

- Accounts/notes receivable

- Investments

- Available credit

- Real property

- Vehicles, leased and purchased

- Business equipment and intangible assets

- Business liabilities

Section 5: Monthly Income/Expenses Statement for Business

- Accounting method used

- Accounting period

- Total monthly business income: gross receipts from sales/services, gross rental income, interest income, dividends, cash receipts, other income

- Total monthly business expenses: materials purchased, inventory purchased, gross wages and salaries, rent, supplies, utilities/telephone, vehicle gasoline/oil, repairs, maintenance, insurance, current taxes, other expenses

Certification

- Signature

- Title

- Date

- Name of officer, partner, LLC member