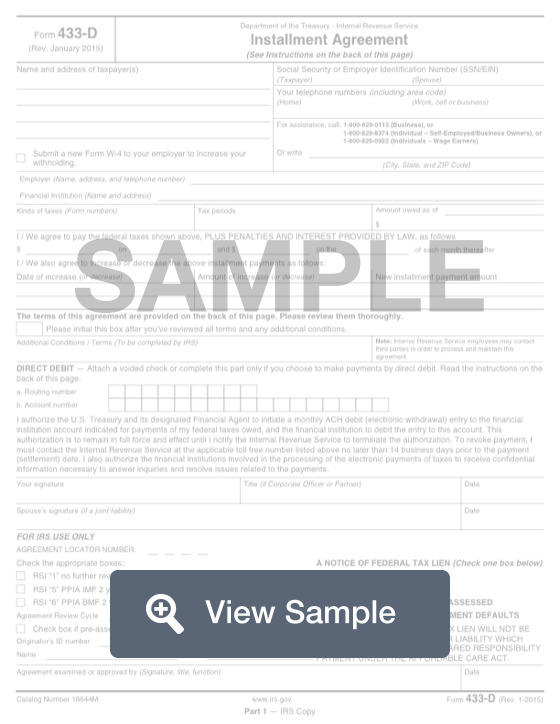

What is an IRS Form 433D?

This form is used by the United States Internal Revenue Service. A Form 433-D is known as an Installment Agreement, and it is used for taxpaying purposes. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. This is typically for people who owe a large amount of debt to the IRS or who are in a tough financial situation and can’t afford to make a lump payment.

In order to ensure the payments will go to the right place, personal identifying information is required. This is the same information that was included on the tax return forms. You will also need to include how the payments will be made, and how much taxes are owed. This information should be provided to you by the IRS before you fill out the form.

How to complete an IRS Form 433-D (Step by Step)

To complete a Form 433-D, you will need to provide the following information:

- Name and address of taxpayer

- Social security number or employer identification number (SSN/EIN)

- Telephone numbers

- Increased withholding (submit new W-4)

- Kinds of taxes

- Tax periods

- Amount owed

- Agreement to pay

- Amounts

- Dates

- Date of increase

- Date of decrease

- New installment payment amount

- Indication that you have reviewed terms and conditions

- Direct debit information

- Routing number

- Account number

- Signature

- Date

- Title

- Spouse’s signature

- Date