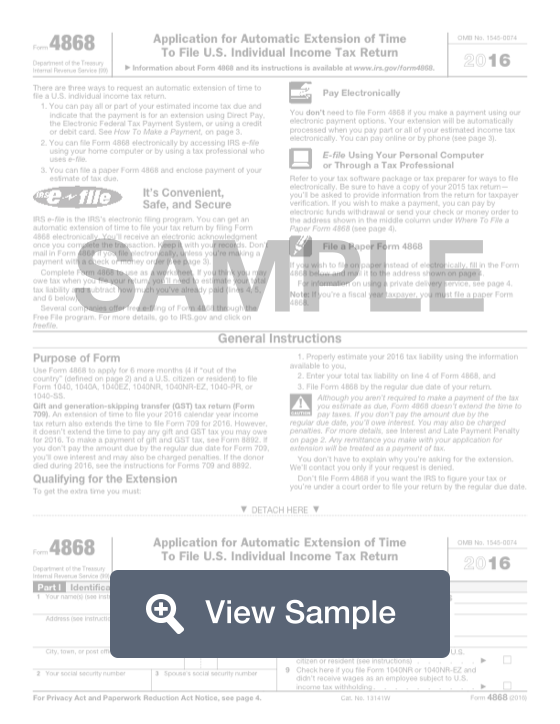

What is a Form 4868?

A Form 4868 is also known as an Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. It is used during the tax filing process and will be received by the Internal Revenue Service. Filing this form will give you an extension on the time you have to file your income tax return. This will be an extension for the filing of the tax return only – you will still need to pay your owed taxes by the due date.

To complete this form fully, you will need to include your identifying information. This includes your full name, address, and tax identification number or social security number. You will also need to have already calculated your owed taxes. This way, you can pay your taxes right away and not be penalized for a late payment.

How to complete a Form 4868 (Step by Step)

To complete a Form 4868, you will need to provide the following information:

- Part I - Identification

- Name

- Address

- Social security number

- Spouse’s social security number

- Part II - Individual Income Tax

- Estimate of total tax liability

- Total payments

- Balance due

- Indication if you are out of country and a U.S. citizen or resident

- Indication if you file Form 1040NR or 1040NR-EZ and didn’t receive wages as an employee subject to U.S. income tax withholding

You should file Form 4868 by the original due date of your tax return.

Generally, your due date cannot be extended for more than 6 months. There may be an exception if you live out of the country.

You will continue to owe interest on any tax not paid by the regular due date of your return.