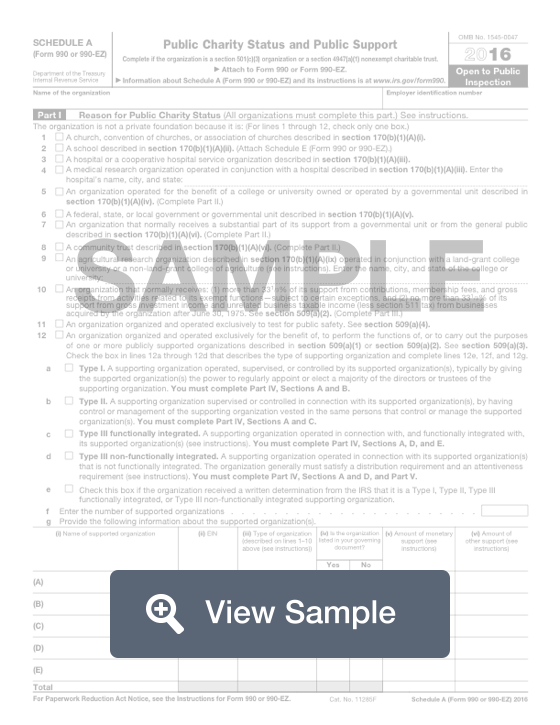

What is a Form 990 Schedule A?

A Schedule A Form 990 or 990-EZ is also known as a Public Charity Status and Public Support form. This form is used for tax filing purposes, and it will be sent to the United States Internal Revenue Service. Tax exempt organizations, non-exempt charitable trusts, and certain political organizations will need to include this form with their regular Form 990 or 990-EZ. It is a supplemental form.

This form will provide the Internal Revenue Service with the required information about their public charity status and public support. This form will allow the organization to list the reason why they are considered a public charity. They will also need to provide the IRS with detailed information about the organization, including the employer identification number and the type of organization they are classified as. This information will ensure that the organization is properly taxed.

How to complete a Form 990 Schedule A (Step by Step)

To complete a Form 990 Schedule A, you will need to provide the following information:

Part I - Reason for Public Charity Status

In the first part of Form 990-EZ, you need to indicate that the organization is not a private foundation because it is one of the following:

- Church, convention of churches or association of churches

- School

- Hospital

- Medical research organization that operates in conjunction with a hospital

- Organization that benefits a college or university

- Federal, state, or local governmental unit

- Organization that receives a substantial part of its support from the government or the general public

- Community trust

- Agricultural research organization operated in conjunction with a land-grant college or university or a non-land-grant college of agriculture

- Organization that normally receives more than 33â % of its support from contributions, membership fees, and gross receipts from activities related to its exempt functions and no more than 33â % of its support form gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired after June 30, 1975

- Organization organized and operated to test for public safety

- Organization organized exclusively for the benefit of, to perform the functions of, or carry out the purposes of a publicly supported organization

Part II - Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi)

This section must only be completed if the organization is: an organization operated for the benefit of a college or university, an organization that receives a substantial part of its support from the government or the general public, a community trust, or if it failed to qualify under one of the tests of Part III.

Section A. Public Support

The organization should indicate (for the past 5 years):

- Gifts, grants, contributions, and membership fees

- Tax revenues levied for the organization’s benefit and either paid to or expended on its behalf

- Value of services or facilities furnished by a governmental unit to the organization without charge

- Total of all of the above

- Portion of total contributions by each person (other than a governmental unit or publicly supported organization) from the gifts, grants, contributions, and membership fees that exceeds 2% of the amount of total support received in the last 5 years

- Section B. Total Support

The organization should indicate (for the past 5 years)

- Totals from the public support section

- Gross income from interest, dividends, payments received on securities loans, rents, royalties, and income from other sources

- Net income from unrelated business activities

- Other income

- Total support

- Gross receipts from related activities

- Whether it is the organization’s first five years

Section C. Computation of Public Support Percentage

The organization should indicate:

- Public support percentage for past year

- Public support percentage from one year ago

- 33â % support test for past year

- 10%-facts-and-circumstances test for the past year

- 10%-facts-and-circumstance test from one year ago

- Whether it is a private organization

Part III - Support Schedule for Organizations Described in Section 509(a)(2)

Organization should indicate the following information for the past 5 years

Section A. Public Support

Gifts, grants, contributions, and membership fees

Gross receipts from admissions, merchandise sold or services performed, or facilities furnished in any activity that is related to the organization’s tax-exempt purpose

Gross receipts from activities that are not an unrelated trade or business

Tax revenues levied for the organization’s benefit and paid to or expended on its behalf

Value of services or facilities furnished by the government without charge

Total of all above amounts

Amounts from the first three lines that were received from disqualified persons

Amounts included in the second or third lines from other than disqualified persons that exceed the greater of $5,000 or 1% of the amount of total support for the year

Total of the previous two lines

Total public support

Section B. Total Support

Total of public support minus the deductions

Gross income from interest, dividends, payments received on securities loans, rents, royalties, and income

Unrelated business taxable income

Total from previous two lines

Net income from unrelated business not previously included in two lines above

Other income

Total support

Whether it is the organization’s first five years

Section C. Computation of Public Support Percentage

Public support percentage from current year

Public support percentage from previous year

Section D. Computation of Investment Income Percentage

Investment income from current year

Investment income from previous year

33â

% support tests from current year

33â

% support tests from current year

Whether the organization is a private foundation

Part IV - Supporting Organizations

Section A. All Supporting Organizations

- Are all of the organization’s supported organizations listed by name in the governing documents?

- Does the organization have a supporting organization that does not have an IRS determination under section 509(a)(1) or (2)?

- Does the organization have a supported organization under section 501(c)(4), (5), or (6) and confirm that it satisfied the tests under 509(a)(2) and ensure the support was only for section 170(c)(2)(B) purposes?

- Was any supported organization not part of the United States? Did the organization have ultimate control over whether to make grants to the organization? Did the organization support any foreign supported organization that does not have an IRS determination under section 501(c)(3) and 509(a)(1) or (2)?

- Did the organization add, substitute, or remove any supported organizations during the tax year? Was any added or substituted organization part of a class already designated in the organizing documents? Was the substitution the result of events beyond the organization’s control?

- Did the organization provide a grant, loan, compensation, or similar payment to a family member of a substantial contributor or a 35% controlled entity?

- Did the organization make a loan to a disqualified person?

- Was the organization controlled at any time by a disqualified person?

- Was the organization subject to excess business holding rules of section 4943 because of section 4943(f)? Did the organization any excess business holdings?

- Has the organization accepted a gift or contribution from a person who controls the governing body or a supported organization, one of their family members, or a 35% controlled entity?

Section B. Type I Supporting Organizations

- Did the directors, trustees, or membership of one or more supported organizations have the power to appoint or elect at least a majority of the organization’s directors or trustees during the tax year?

- Did the organization operates for the benefit of any supported organization other than the supported organization(s) that were operated, supervised, or controlled the supporting organization?

Section C. Type II Supporting Organizations

- Were a majority of the organization’s directors or trustees during the tax year also a majority of the directors or trustees of each of the organization’s supported organizations?

Section D. All Type III Supporting Organizations

- Does the organization provide to each of its supported organizations, by the last day of the fifth month of the organization’s tax year, (i) a written notice describing the type and amount of support provided during the prior tax year, (ii) a copy of the Form 990 that was most recently filed as of the date of notification, and (iii) copies of the organization’s governing documents in effect on the date of notification, to the extent not previously provided?

- Were any of the organization’s officers, directors, or trustees either appointed or elected by the supported organization(s) or serving on the governing body of a supported organization?

- Did the organization’s supported organizations have a significant voice in the organization’s investment policies and in directing the use of the organization’s income or assets at all times during the tax year?

Section E. Type III Functionally Integrated Supporting Organizations

- Indicate how the organization satisfied the Integral Part Test during the year

- Activities Test

- Parent of each of its supported organizations

- Supported a governmental entity

- Activities Test

- Did substantially all of the organization’s activities during the tax year directly further the exempt purposes of the supported organization(s) to which the organization was responsive?

- Did the activities described in the previous line constitute activities that, but for the organization’s involvement, one or more of the organization’s supported organization(s) would have been engaged in?

- Parent of Supported Organizations

- Does the organization have the power to regularly appoint or elect a majority of the officers, directors, or trustees of each of the supported organizations?

- Did the organization exercise a substantial degree of direction over the policies, programs, and activities of each of its supported organizations?

Part V - Type III Non-Functionally Integrated 509(a)(3) Supporting Organizations

Indicate if the organization satisfied the Integral Part Test as a qualifying trust on Nov. 20, 1970 or fill out:

Section A - Adjusted Net Income

- Net short-term capital gain

- Recoveries of prior-year distributions

- Other gross income (see instructions)

- Add lines 1 through 3

- Depreciation and depletion

- Portion of operating expenses paid or incurred for the production or collection of gross income or for management, conservation, or maintenance of property held for production of income

- Other expenses

- Adjusted Net Income (subtract lines 5, 6, and 7 from line 4)

Section B - Minimum Asset Amount

- Aggregate fair market value of all non-exempt-use assets

- Average monthly value of securities

- Average monthly cash balances

- Fair market value of other non-exempt-use assets

- Total (add lines 1a, 1b, and 1c)

- Discount claimed for blockage or other factors

- Acquisition indebtedness applicable to non-exempt-use assets

- Subtract line 2 from line 1d

- Cash deemed held for exempt use. Enter 1-1/2% of line 3

- Net value of non-exempt-use assets (subtract line 4 from line 3)

- Multiply line 5 by .035

- Recoveries of prior-year distributions

- Minimum Asset Amount (add line 7 to line 6)

Section C—Distributable Amount Current Year

- Adjusted net income for the prior year (from Section A, line 8, Column A)

- Enter 85% of line 1

- Minimum asset amount for prior year (from Section B, line 8, Column A)

- Enter the greater of line 2 or line 3

- Income tax imposed in prior year

- Distributable Amount. Subtract line 5 from line 4

- Indicate if the current year is first as a non-functionally integrated Type III supporting organization

Section D—Distributions Current Year

- Amounts paid to supported organizations to accomplish exempt purposes

- Amounts paid to perform activity that directly furthers exempt purposes of supported organizations, in excess of income from activity

- Administrative expenses paid to accomplish the exempt purposes of supported organizations

- Amounts paid to acquire exempt-use assets

- Qualified set-aside amounts (prior IRS approval required)

- Other distributions

- Total annual distributions. Add lines 1 through 6.

- Distributions to attentive supported organizations to which the organization is responsive

- Distributable amount for current year from Section C, line 6

- Line 8 amount divided by line 9 amount

Section E—Distribution Allocations

- Distributable amount for past year from Section C, line 6

- Under Distributions, if any, for years prior to current year

- Excess distributions carryover, if any, to current year

- 5 years ago

- 4 years ago

- 3 years ago

- 2 years ago

- 1 year ago

- Total of past 5 years

- Applied to under distributions of prior years

- Applied to current year’s distributable amount

- Carryover from 5 years prior not applied

- Remainder. Subtract lines 3g, 3h, and 3i from 3f.

- Distributions for current year from Section D, line 7:

- Applied to under distributions of prior years

- Applied to current year’s distributable amount

- Remainder. Subtract lines 4a and 4b from 4.

- Remaining under distributions for years prior to current year, if any. Subtract lines 3g and 4a from line 2.

- Remaining under distributions for current year. Subtract lines 3h and 4b from line 1.

- Excess distributions carryover to next year. Add lines 3j and 4c.

- Breakdown of line 7 by past 5 years