What is a 941 Schedule B?

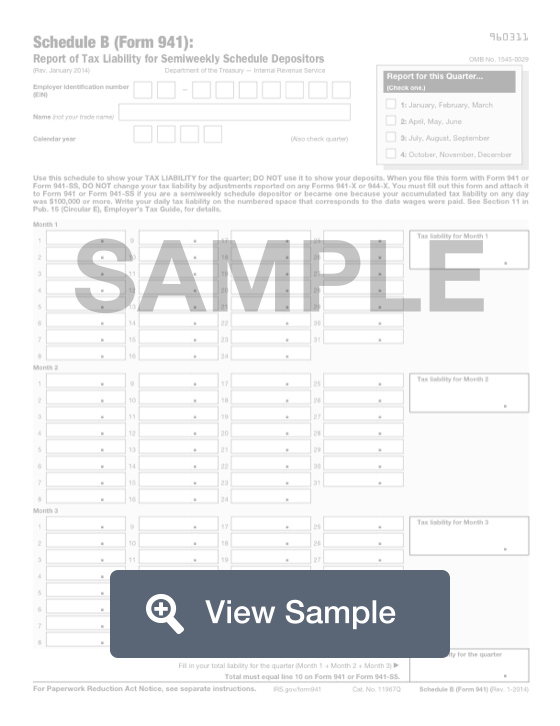

This is a supplemental form for the Form 941. It is known as a Report of Tax Liability for Semiweekly Schedule Depositors. A Schedule B Form 941 is used by the Internal Revenue Service for tax filing and reporting purposes. This form must be completed by a semiweekly schedule depositor who reported more than $50,000 in employment taxes or acquired more than $100,000 in liabilities in a single day in the tax year.

This form requires information that will show your tax liabilities for the tax quarter. List every individual liability for each month of the quarter, and then add them up to come up with the total quarterly liabilities. This information will be attached to the Form 941 so that the IRS can calculate your tax liabilities or refunds for the quarter or year.

How to complete a 941 Schedule B (Step by Step)

To complete a Schedule B for Form 941, you will need to provide the following information:

- Employer identification number (EIN)

- Name

- Calendar year

- Quarter

- For each month: break down tax liability by day and than by total amount

- Total liability for quarter