What is a statement of cash flows?

A statement of cash flow is a financial document used in conjunction with balance sheets and income statements. Companies will use these financial statements to create a complete financial report. The statement of cash flow will be used to demonstrate the cash generated by the company within a certain accounting period. It also shows the cash position of the company at the end of the time period. This information will be used by investors and shareholders to determine the company’s profit margin and risk.

The term “cash” refers to both cash and cash equivalents, or assets that are easily convertible into cash. A cash flow statement allows easy assessment of a business’ liquidity and solvency.

Cash flow comes from several different areas of income. Operating activities such as sales are typically the majority. The cash flow statement should also include income from investments, stocks, bond, dividends, and other activities. This information allows important parties such as investors, shareholders, and employees to see how well the company is performing. This allows them to make informed choices regarding stocks and investments.

Components of a cash flow statement template

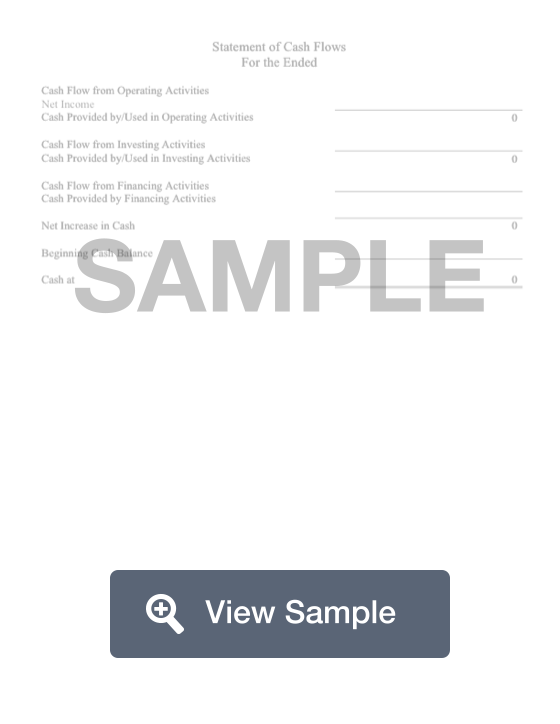

A cash flow template will typically break cash inflows and cash outflows into three different categories: Operating, Investing, and Financing.

- Operating activities are a company’s day-to-day business activities. This would include purchasing inventory, selling products, lawsuit settlements, payments to employees and suppliers, and fees and fines. This is the default classification (anything that is not classified into investing and financing activities)

- Investing activities are activities that involve the acquisition and disposal or long term assets. This would include buying and selling property and equipment or lending money to others.

- Financing activities involve changes in the size and compositions of equity and an entity’s borrowings. This would include borrowing from creditors, issuing or repurchasing stocks, and paying cash dividends.

Typically, a small business owner who needs to create a cash flow statement will look at templates that are available online or through Microsoft Excel.

A typical Cash Flow Statement Excel Template will include line items for:

- Operating cash flows

- Cash receipts from customers

- Cash paid for:

- Inventory purchases

- General operating expenses and administration

- Wages

- Interest

- Income Taxes

- Net cash flow from operations

- Cash flows from Investing Activities

- Cash receipts from:

- Sale of property and equipment

- Collection of principal on personal loans

- Sale of investment securities

- Cash paid for:

- Purchase of property and equipment

- Making loans to other entities

- Purchase of investment securities

- New cash flow from investing activities

- Cash receipts from:

- Cash flows from Financing Activities

- Cash receipts from:

- Issuance of stock

- Borrowing

- Cash paid for:

- Repurchase of stock

- Repayment of loans

- Dividends

- Net cash flow from financing activities

- Cash receipts from:

- Net Increase in Cash

- Cash Balance at End of Year