What is a T4A?

This form is used by the Canada Revenue Agency for tax filing and reporting purposes. The T4A form is known as a Statement of Pension, Retirement, Annuity, and Other Income. Some individuals or organizations will need to fill out this form if they are the payer for these types of income. This form must be filled out if you paid over $500 or if any tax was withheld from any payment.

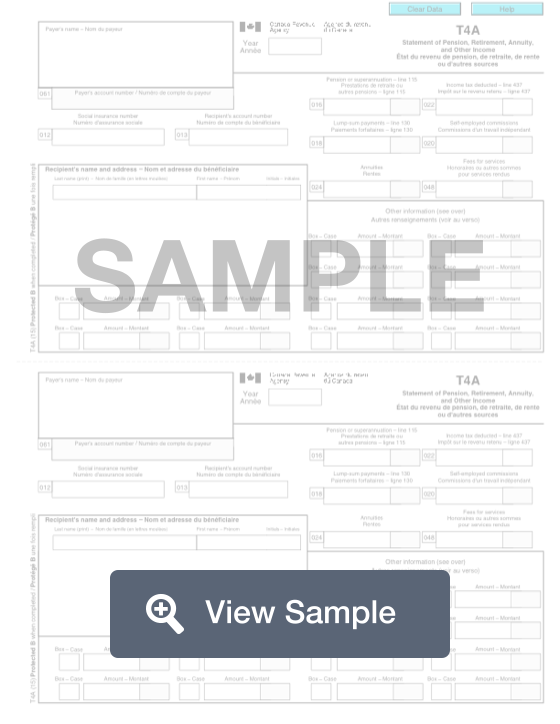

Like other tax forms, a T4A will require a lot of personal and financial information. This will include the payer’s name, account number, and social insurance number. It will also require the same information for the recipient. The amounts for each payment will then need to be listed. There are specific sections for lump sum payments, annuities, pensions, and more. If you need to include more payments from other forms of income, you can use another slip.

Difference between T4, T4A and T4A(P) forms

A T4 is a statement of remuneration paid. You were receive this form if you were employed during the year. A T4A is a statement of pension, retirement, annuity, and other income. You will receive this form if you received income from sources such as self-employed commissions, educational assistance payments, pension, and retirement income. A T4A(P) is a statement of Canada Pension Plan benefits. You will receive this form if you’ve received Canada Pension Plan (CPP) or Quebec Pension Plan benefits throughout the year.

Most Common Uses

A T4A is commonly used by employers, trustees, estate executors or liquidators, pension administrators or corporate directors to tell you and the Canada Revenue Agency how much of certain types of income you paid during a tax year and the amount of income tax that was deducted.

Components of a T4A

A T4A contains the following sections:

- Payer’s information

- Recipient’s information

- Income information

How to complete a T4A (Step by Step)

To complete a T4A, you need to provide the following information:

- Payer’s name

- Payer’s account number

- Social insurance number

- Recipient’s account number

- Recipient’s name and address

- Pension or superannuation

- Income tax deducted

- Lump-sum payments

- Self-employed commissions

- Annuities

- Fees for services

- Other information

Reporting your T4A

You are required to file your T4A information on or before the last day of February after the calendar year that the information return applies to. If the last day of February is a Saturday, Sunday, or holiday recognized by the CRA, your return is due on the next business day. If you fail to file your return on time, you may be assessed a penalty.