What is a T5?

A T5 form is used by the Canada Revenue Agency. This form is related to tax filing and reporting. It is known as a Statement of Investment Income slip. This form will serve as a record for any investment income payments made to a resident of Canada. This form is typically only used for amounts over $50 CAN, but they can be used for any amount.

On this form, financial information about any interest, dividends, or royalty payments will be listed. Two amounts should be included: the actual amount and the taxable amount. This information will be used to determine the amount of taxes either owed or due. The information for the payee and payer should also be listed on this form for identification purposes.

Most Common Uses

A T5 slip is commonly used when you have to make certain types of payments to a resident of Canada or receive payments as a nominee or agent for a resident of Canada. These payments include: eligible dividends and dividends other than eligible dividends; interest from a fully registered bond or debenture, money loaned to or on deposit with, or property of any kind placed with, a corporation, association, organization, or institution; an account with an investment dealer or broker; and insurance policy or annuity contract; an amount owing as compensation for expropriated property; certain amounts distributed from a funeral arrangement; amounts that have to be included in a policyholder’s income; royalties from use of work, an invention, or a right to take natural resources; blended payments of income and capital made by a corporation, association, organization, or institution; or interest that is deemed to accrue pursuant to subsection 20(14.2) of the Income Tax Act as a result of the assignment or transfer of linked noted.

You do not need to prepare a T5 slip for amounts paid to a recipient for the year is less than $50; the interest part of a blended payment is made by an individual; interest one individual pays to another, such as interest on a private mortgage; interest paid on loans from banks, financial houses, or other institutions whose usual business includes lending money; capital dividends; amounts paid to non-residents of Canada; interest on an investment account accrued or payable during the year to a corporation, partnership, trust, or unit trust where a corporation or partnership is a beneficiary; an amount distributed from an eligible funeral arrangement, if the amount is a return of contributions only; or interest paid to farmers under the AgriStability and AgriInvest programs, Fund 2.

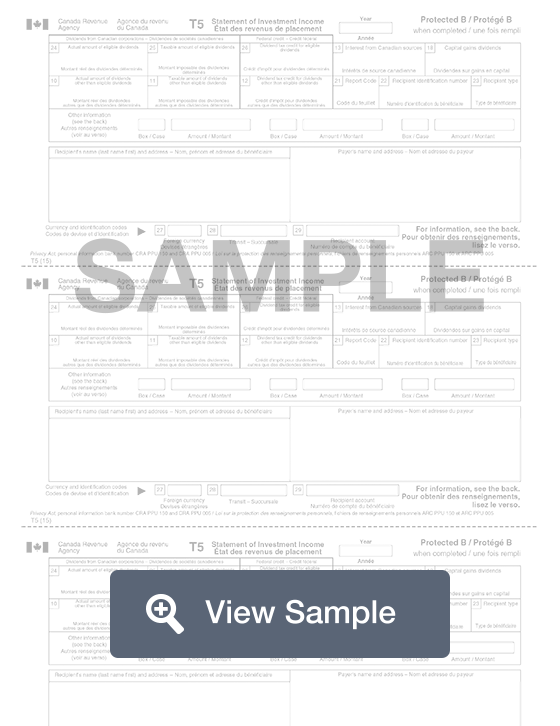

Components of a T5

A T5 contains the following sections:

- Recipient information

- Payer information

- Income information

- Currency and identification codes

How to complete a T5 (Step by Step)

To complete a T5, you need to provide the following information:

- Year

- Actual amount of eligible dividends

- Taxable amount of eligible dividends

- Dividend tax credit for eligible dividends

- Interest from Canadian sources

- Capital gains dividends

- Actual amount of dividends

- Taxable amount of dividends

- Dividend tax credit for dividends other than eligible dividends

- Report code

- Recipient identification number

- Recipient type

- Other information

- Recipient’s name and address

- Payer’s name and address

- Currency and identification code

Legal Considerations

Completing a T5

If you file more than 50 information returns a year, you must file your information returns electronically. If you file 1 to 50 T5 slips, you are encouraged to file over the internet using Web Forms or Internet file transfer. You can file up to 50 T5 slips on paper.

Distributing a T5

You can send recipients a copy of their T5 slips by the last day of February following the calendar year to which the information return applies. If you send recipients an electronic copy of their T5 slips, they must have consented in writing to receive their slips electronically.

If you are filing on paper, you should sent two copies of the T5 clip to the recipient by the last day of February following the calendar year to which the information return applies. You must also send each T5 slip and the T5 summary to:

Jonquière Tax Centre

T5 program

PO Box 1300 LCD Jonquière

Jonquière QC G7S 0L5

Amending/Cancelling/Adding/Replacing a T5

To amend your T5 slips by paper, you should write “AMENDED” at the top of each slip. Send two copies of the amended slip to the recipient and one copy of the amended slip with a letter explaining the reason for the amendment to your tax centre.

If you find out that you need to add T5 slips, you should identify the new slips by writing “ADDITIONAL” at the top. If you are filing the additional T5 slips after the due date, they may result in a late filing penalty.

If you need to cancel a T5 slip, you should identify the new slips by writing “CANCELLED” at the top of each slip. You should send one copy of the cancelled slips with a letter explaining the reason for your cancellation with your tax center.

If you issue copies to replace slips that were lost or destroyed, you should identify them as “DUPLICATE” at the top of the form and keep a copy for your records. You do not need to send replacement copies to the tax centre.

To amend or cancel slips online, you should include only the slips that need amending or cancelling and use either code “A” for an amended slip or “C” for a cancelled slip.