What is a W2c?

A W-2c form is used by the United States Internal Revenue Service for tax filing and reporting services. This form is known as a Corrected Wage and Tax Statement form. This form will be used by someone who has discovered an error when filing their tax return. This form should be filed as soon as possible after discovering the error on your original W2. This will allow the IRS to fix the error quickly.

The filer will need to have their personal information, as well as the information for their employer. They will also need to have the information for their taxes for the year when the error occurred. The filer will need to list the previously reported information as well as the corrected information. This will ensure the IRS can correct the W-2 form with the proper information. Depending on how you filed your taxes, you may need to mail this form or file it online.

When you file forms W-2c and W-3c, you should also refer to the penalties section of the current General Instructions for Forms W-2 and W-3 for more information. Providing false information on these tax forms may subject you to fines and prison.

Most Common Uses

The W-2c is used to correct any incorrect information that was previously given to the IRS. Form W-3c Transmittal of Corrected Wage and Tax Statement should be filed whenever a Form W-2c is submitted.

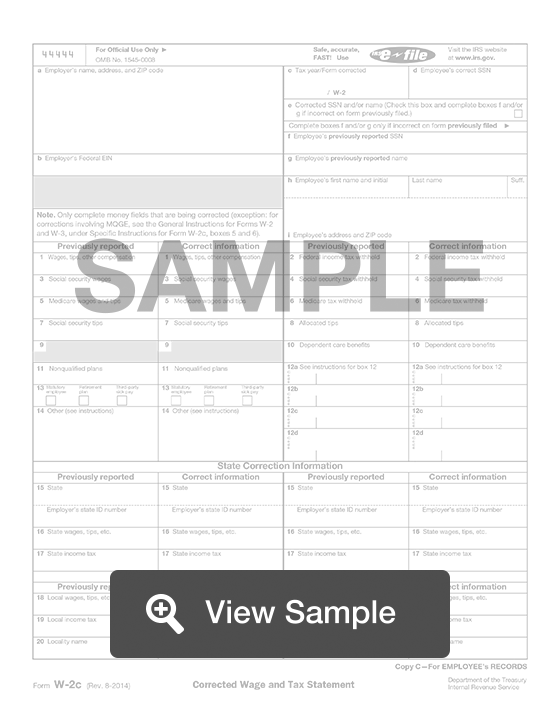

Components of a W2c

A W-2c contains the following sections:

- Personal Information

- Previously Reported Information

- Correct Information

- State Correction Information

- Locality Correction Information

How to complete a W2c (Step by Step)

When completing Forms W-2c, you will need to provide the following information:

- Personal Information

- Employer’s name, address, ZIP code

- Employer’s Employer Identification Number (EIN)

- Tax year, form corrected

- Correct social security number (SSN)

- Indicate if corrected SSN and/or name

- Employee’s previously reported SSN

- Employee’s previously reported name

- Employee’s name

- Employee’s address

- Previously Reported Information

- Wages, tips, other compensation

- Federal income tax withheld

- Social security wages

- Social security tax withheld

- Medicare wages and tips

- Medicare tax withheld

- Social security tips

- Allocated tips

- Dependent care benefits

- Nonqualified plans

- Statutory employee, retirement plan, third-party sick pay

- Correct Information

- Wages, tips, other compensation

- Federal income tax withheld

- Social security wages

- Social security tax withheld

- Medicare wages and tips

- Medicare tax withheld

- Social security tips

- Allocated tips

- Dependent care benefits

- Nonqualified plans

- Statutory employee, retirement plan, third-party sick pay

- State Correction Information

- State

- Employer’s state ID number

- State wages, tips, etc.

- State income tax

- Locality Correction Information

- Local wages, tips, etc

- Local income tax

- Locality name