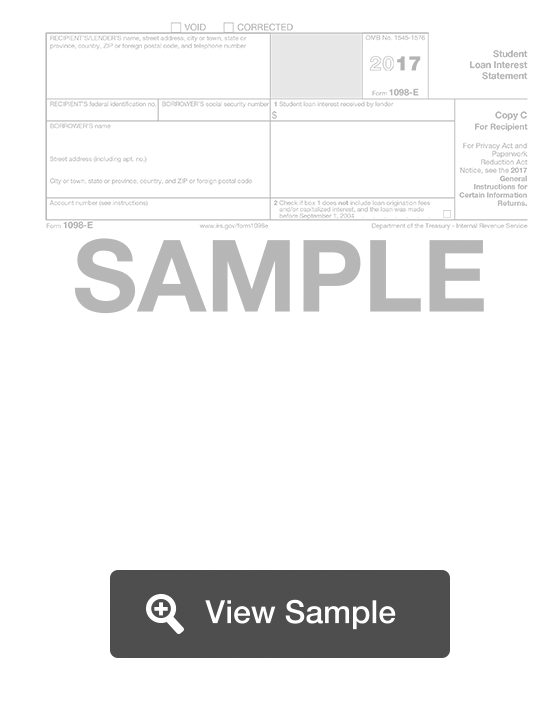

What is a 1098 E?

The 1098-E form or Student Loan Interest Statement is used for tax filing purposes. It will be used by people who are students or who have student loans. If you pay over $600 of interest on your student loan in the tax year, this form should be used. It can give student loan holders a break on the amount of taxes they owe.

The student loan servicer should send you the form with the appropriate information already filled out. A copy of your 1098-E form may also be available to you online through the provider's website. The form should include how much interest was paid over the course of the year, and it may also detail the amount of other fees that were paid.

The form can come from a government or private student loan lender. Ensure all the information on the form is accurate. If there are any issues, contact the student loan lender to change the information.

A student will use this tax form when calculating education tax credits, tax deductions, and adjusted gross income on his or her federal tax returns at the end of the year.

Eligibility

You qualify for a student loan interest deduction if you are making interest payments during the year on a student loan that you took out to put yourself, your dependents, or your spouse through school.

The maximum amount of interest that you can deduct is $2,500.

If you have questions about student loan interest deductions, you should speak to a tax advisor.