What is a 1098-T form?

A 1098-T form is used for tax filing purposes. It will be used by someone who is a student or who had been a student in the previous year. The form will be given to the student by the college or university they attended. They may be mailed automatically, or a student can request the information from their university online.

The form will detail the amount of tuition payments that were made in the tax year. The expenses should include tuition for classes, registration fees, and fees for course materials. This information will need to be transferred to the appropriate tax filing forms.

This tax form is important because it determines if a student is eligible for certain benefits, such as the Hope Credit or the Lifetime Learning Credit. These education tax credits can give an enrolled student a break on the costs of their education.

Who gets a 1098-T form?

A school must send Form 1098-T to any student who paid qualified educational expenses in the preceding tax year. Qualified expenses include tuition, fees, and required course materials. Schools must send the form to students before January 31 and file a copy with the IRS prior to February 28.

Most Common Uses

This IRS form is commonly used to provide information about educational expenses that may qualify a student or their parents or guardian for educational tax credits.

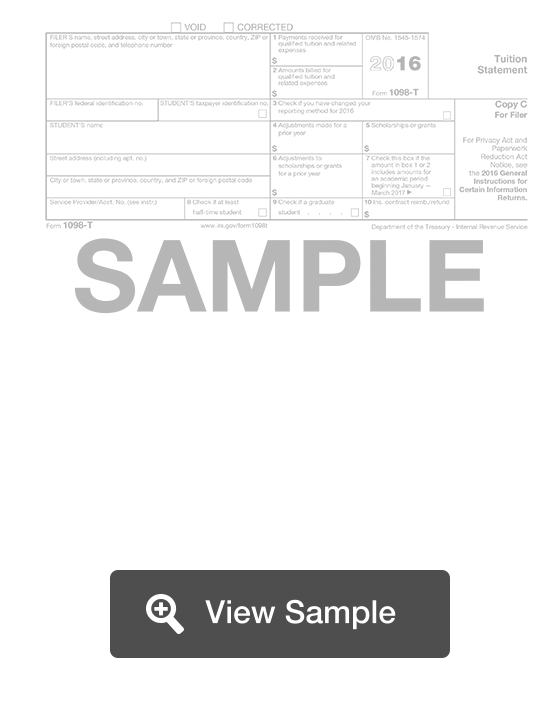

Components of a 1098-T form

A 1098-T Form contains sections for:

- Reporting qualified expenses - how much the student actually paid during that year or how much the student has billed that year, if they school changes its method of reporting, it must notify the IRS

- Adjustments and scholarships - any adjustments the school has made to qualified expenses reported on a previous 1098-T, any scholarships and grants that were paid directly to the school for the student’s expenses

- Other information - indicate if the form includes expenses for an academic term that begins in the first three months of the year following the current form, if the student is enrolled at least half time, and if the student is enrolled in a graduate program

- Box 10 - when students have had expenses reimbursed through a tuition insurance policy

Definitions

Eligible educational institution - A college, university, vocational school, or other post-secondary educational institution that only admits students with a certificate of graduation from a secondary school; is legally authorized by its state to provide postsecondary education; provides a bachelor’s, associate’s or other degree that is acceptable to admission to a graduate or professional degree program; is a public or nonprofit institution; and is accredited by a nationally recognized accrediting agency or association.

Qualified tuition and educational expenses - Tuition, school fees, the costs of materials that are required to enroll in the higher education classes. This does not include: application and processing fees; books and materials that are not required to enroll in a class; courses that involve sports, games, or hobbies if not part of a degree program or skills training; room and board, insurance, transportation, personal costs.

Exceptions - A 1098-T does not need to be filed if the student: takes courses where they do not receive academic credit, is a nonresident alien, has tuition that is completely waived or completely covered by scholarship, has tuition covered by a third party under a formal agreement (such as the Department of Defense)

Credits

The Lifetime Learning Credit - up to $2,000 per eligible student for qualified education expenses.

American Opportunity Credit - $2,500 for each qualifying student per tax return. Forty percent of the American Opportunity Credit is refundable, which means that if the refundable portion of your credit is more than your tax, any excess up to $1,000 will be refunded to you, even if you owe no tax.

How to complete a 1098-T (Step by Step)

- To complete a 1098-T, you will need to provide:

- Filer’s name, address, telephone number

- Filer’s federal identification number

- Student’s taxpayer identification number/social security number

- Student’s name

- Student’s contact information

- Service provider/account number

- Box 1: Payments received for qualified tuition and related expenses

- Indication if school has changed its reporting method this year

- Adjustments made for a prior year

- Adjustments to scholarships or grants for a prior year

- Indication if amount of payments received are for an academic period beginning January-March of the following calendar year

- Indication if student is at least a half-time student

- Indication if student is a graduate student

- Indication of any contract reimbursement or refund

- Indication if form is a VOID or CORRECTED form

Legal Considerations

Form Requirements

The form requires you to provide several pieces of tax information including: filer’s name address, phone number, tax ID number, student’s name, address, phone number federal identification number. The form also requires the institution to fill out various information about the amount of tuition paid by the student or billed to the student, adjustments, scholarships and grants, and the student’s part-time or graduate status.

If you have questions about this form, you should speak to an experienced tax advisor for tax advice