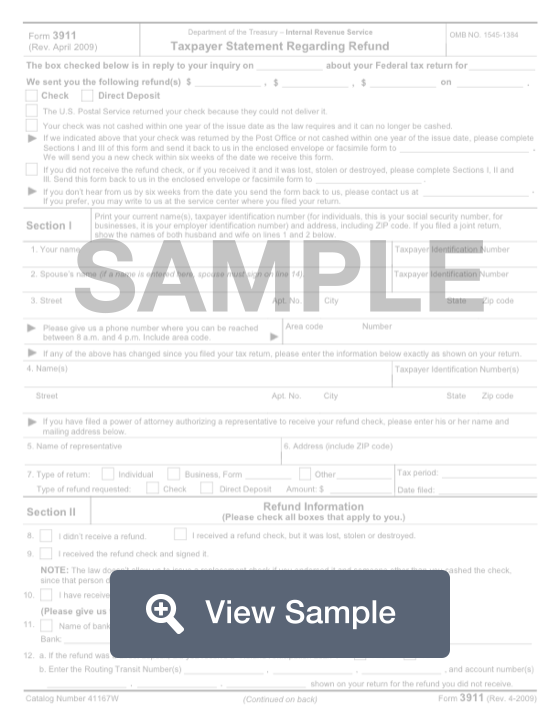

What is a Form 3911?

A Form 3911 is related to tax filing, and it is distributed by the United States Internal Revenue Service. This form is also called a Taxpayer Statement Regarding Refund. This form is used by a taxpayer who filed an income tax return but either never received their refund or lost the refund check that was issued to them.

This form will require information about the initial tax return that was filed. You will need to know the date that you filed your taxes, the amount of your tax return, and the form in which you requested the money be sent, whether it was a check or electronic transfer. You will also need to include the information you can on your tax return, such as account numbers and the name of your bank. This will ensure that the IRS is able to verify that you did not receive your tax return.

How to complete a Form 3911 (Step by Step)

To complete a Form 3911, you will need to provide the following information:

- Inquiry date

- Tax return year

- Refund amounts

- Refund dates

- Check or direct deposit

- Status:

- U.S. Postal Service returned check because they could not deliver it

- Check was not cashed within one year of issue date and law requires that it can no longer be cashed

- Lost, stolen, or destroyed

- Section I

- Name

- TIN

- Spouse’s name

- Spouse’s TIN

- Address

- Phone number

- Changed personal information

- Name of representative

- Type of return

- Type of refund requested

- Section II - Refund Information

- Status: didn’t receive a refund; lost, stolen, or destroyed; received and signed it

- Whether you received correspondence about tax return

- Bank and account number where you normally cash or deposit checks

- Whether you received a refund anticipation loan

- Routing transit numbers and account numbers shown on return for refund not received

- Section III - Certification

- Signature

- Date

- Spouse’s signature

- Date

- Section IV - Description of Check

- Schedule number

- Refund date

- Amount

- Other (DLN, check/symbol, etc.)