What is an IRS Form 3949-A?

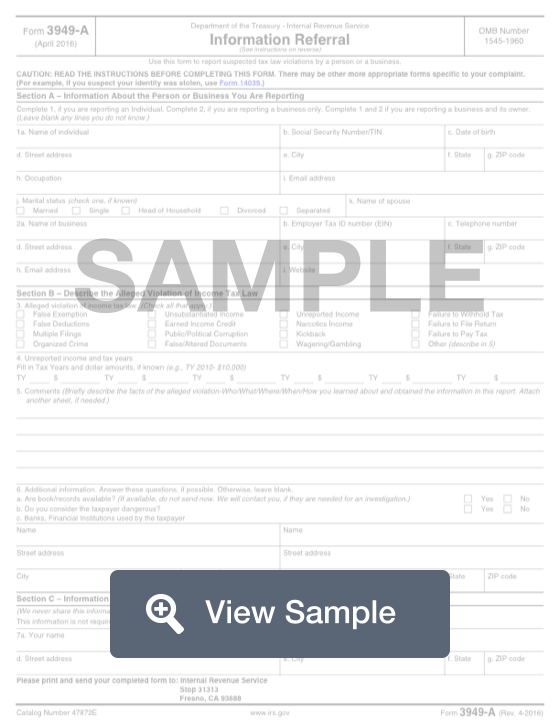

A Form 3949-A will be received by the United States Internal Revenue Service for issues related to taxes. The form is known as an Informational Referral, and it will be used by citizens to report any instances of suspected tax fraud in the country. These suspected tax violations could be performed by an individual or a business.

Make sure this is the right form for your report. Once you are sure, you can start filling a Form 3949-A out. This form will require all the information you have about the individual or the business you are reporting. If you don’t have a piece of information, just leave the spot blank. You will also need to identify the type of tax fraud you believe is occurring. If you have estimated financial amounts of unpaid taxes or the dates that the fraud occurred, you can include these. You can also include comments as needed.

After filing this form, you may be contacted in regards to the report. This will ensure that the IRS can get as much information as possible about the suspected tax fraud. Make sure you list your current contact information on the form.

How to complete an IRS Form 3949-A (Step by Step)

To complete a Form 3949-A, you will need to provide the following information:

- Section A - Information About the Person or Business You Are Reporting

- Individual report

- Name of individual

- Social security number/TIN

- Date of birth

- Address

- Occupation

- Email address

- Marital status

- Name of spouse

- Business report

- Name of business

- EIN

- Telephone number

- Street address

- Email address

- Website

- Individual report

- Section B - Describe the Alleged Violation of Income Tax Law

- Alleged violation:

- False exemption

- False deductions

- Multiple filings

- Organized crime

- Unsubstantiated income

- Earned income credit

- Public/political corruption

- False/altered documents

- Unreported income

- Narcotics income

- Kickback

- Wagering/gambling

- Failure to withhold tax

- Failure to file return

- Failure to pay tax

- Other

- Unreported income and tax years

- Briefly describe the facts of the alleged violation

- Additional information

- Books/records available

- Whether taxpayer is dangerous

- Banks, financial institutions used by the taxpayer

- Alleged violation:

- Section C - Information About Yourself

- Name

- Phone number

- Best time to call

- Address

Print and send your completed form to the Internal Revenue Service at:

Internal Revenue Service

Stop 31313

Fresno, CA 93888