What is a Form 843?

A Form 843 is known as a Claim for Refund and Request for Abatement form. This form is sent to and recorded by the Internal Revenue Service in the United States. Someone can file this claim form if they want to dispute a certain tax, interest, penalty, fee, or addition on their taxes from that tax year.

This form should not be used for income tax refunds, FICA tax, FUTA tax, or RRTA tax. These taxes will require a different form. This form can be used for any other tax problems due to an error on the IRS’ part, illegal taxation, or other disputes. These issues could be related to employment taxes, estates, gifts, fees, or excising issues.

Include your personal identifying information so the IRS can view the issue. You should also list the date for the tax error, as well as the type of error you believed occurred. Explain why you believe this is an error. Be sure to sign the form before you send it off to the IRS.

Most Common Uses

Form 843 is commonly used to ask the IRS to refund: tax other than income, estate, or gift tax; fees; penalties paid; taxes withheld in error and unadjusted by your employer; and Section 6715 penalties for misuse of dyed fuel. Form 843 is also used to ask the IRS to abate interest, penalties or additions to tax caused by IRS error or delay, incorrect written advice from the IRS; penalties for unreasonable cause; FUTA tax; and certain excise taxes.

Components of a Form 843

A Form 843 contains the following sections:

- Personal information

- Period

- Amount to be refunded or abated

- Type of tax or fee

- Type of penalty

- Interest, penalties, and additions to tax

- Original return

- Explanation

- Signature

- Paid preparer information

Limitations

Form 843 only applies to certain types of tax, interest, penalties, and fees. You cannot use Form 843 to:

- Claim a refund of a lien or offer-in-compromise fees

- Request an abatement of gift or estate taxes

- Amend a previously filed income or employment tax form

- Claim a refund of the FICA tax, Railroad Retirement Tax, or income tax withholding

Special Rules

The IRS requires that a set amount of interest and penalties apply to unreported and unpaid taxes. Interest can only be refunded or abated if it was assessed due to IRS error or delay. Penalties or additions to tax can be refunded or abated only if there is a showing of reasonable cause or a valid legal reason. One example is if you’ve received erroneous written advice from the IRS.

How to complete a Form 843 (Step by Step)

To complete a Form 843, you need to provide the following information:

- Name, address, social security number, spouses’ social security number, employer identification number (EIN), name and address on return, daytime telephone number

- Dates of period related to the request

- Amount to be refunded or abated

- Type of tax or fee: employment, estate, gift, excise, income, fee

- Type of penalty

- Interest, penalties, and additions to tax

- Date(s) of payment(s)

- Original return: 706, 709, 940, 941, 943, 945, 990-PF, 1040, 1120, 4720

- Explanation of why you believe the claim or request should be allowed

- Signature

- Spouse’s signature

- Paid preparer’s name, signature, date, PTIN, firm name, address

Filing the Form

Excessive Claims

If the IRS believes that you claimed an excessive refund amount, if can fine you an amount equal to 20% of the amount that it determined to be excessive. If you can show that you had a reasonable basis to claim that amount, you can request the IRS waive the penalty.

Claim Denial and Protective Claims

If the IRS denies your claim by sending a statutory notice of claim disallowance or if 6 months pass without action, you can file a refund suit in the U.S. District Court or Federal Claims Court. You can also file a protective claim before the expiration of the statute of limitations to preserve your right to make a claim for refund.

Submitting the Form

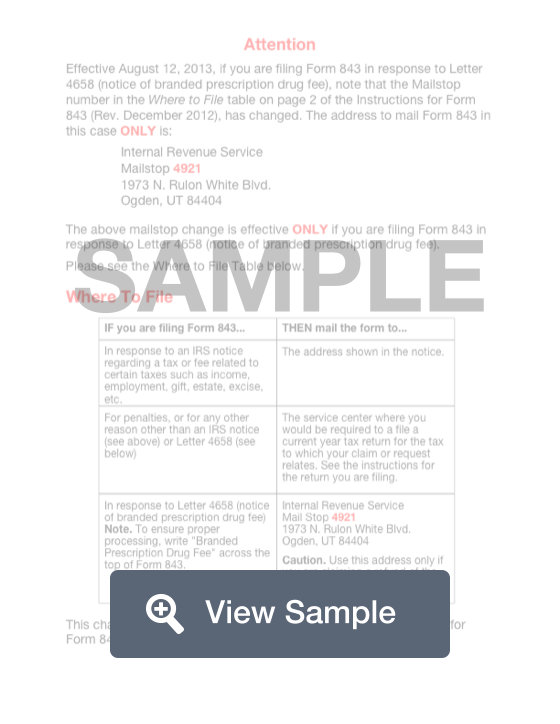

If you have received a notice, you should send Form 843 and the required supporting documents to the address on the notice. If you have not received a notice, you should send the form to the IRS center that is closest to you. You should file Form 843 within 2 years of the date that you paid the taxes or 3 years from the date that the return was filed.

Legal Considerations

Other forms you might need

When filing your IRS Form 843, you may also need to supply supporting documents such as: hospital records, court records, a note from your physician, documentation of natural disasters or other events that prevented compliance.

Where to mail the 843

If you received a notice from the IRS, you should mail your request to the address listed on the notice that you received. For any other purpose, mail the request to the IRS service center that you would normally file your tax returns. If you are not sure where your IRS service center is, you can locate the closest one by visiting the IRS.gov website.