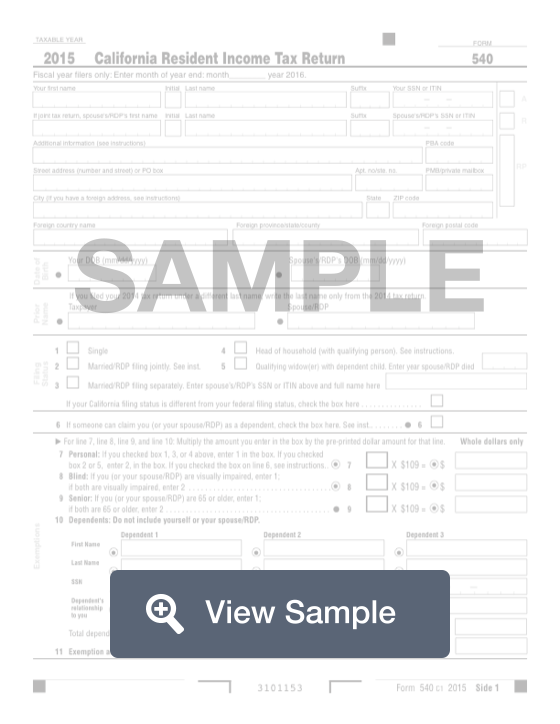

What is a Form 540?

A Form 540 is also known as a California Resident Income Tax Return. This form will be used for tax filing purposes by citizens living and working in the state of California. This form is used each year to file taxes and determine if the filer owes taxes or is entitled to a tax refund. The form will be sent to the state organization that processes and records the tax information.

This form will require personal identifying information, similar to what you put on a federal tax return form. If you are filed as married filing jointly, you’ll also need the information for your spouse. Below this section, you’ll need to calculate your taxes using your financial information from the tax year. This will include your stage wages, federal gross income, and any adjustments. You will then use these numbers to calculate your taxes, whether you owe the state or are getting a refund.

Most Common Uses

This form is commonly used to file income taxes in the state of California.

How to complete a Form 540 (Step by Step)

To complete a Form 540, you need to provide the following information:

- Personal information

- First name, middle initial, last name, suffix

- SSN or ITIN

- Spouse’s name and SSN or ITIN

- Additional information

- PBA code

- Street address

- Date of birth

- Spouse’s date of birth

- Prior name

- Spouse’s prior name

- Filing status

- Single, married/RDP filing jointly, married RDP filing separately, head of household, qualifying widow(er) with dependent child

- Exemptions

- Personal

- Blind

- Senior

- Dependents

- Exemption amount

- Taxable income

- State wages from Form W-2

- Federal adjusted gross income from Form 1040, 1040A, or 1040EZ

- California adjustments

- California adjusted gross income

- Taxable income

- Tax

- Tax table/tax rate schedule, FTB 3800, FTB 3803

- Exemption credits

- Tax

- Special credits

- Nonrefundable child and dependent care expenses credit

- Credit name, code, amount

- Schedule P if more than 2 credits

- Nonrefundable renter’s credit

- Total credits

- Other taxes

- Alternative minimum tax

- Mental health services tax

- Other taxes and credit recapture

- Total tax

- Payments

- California income tax withheld

- 2017 CA estimated tax and other payments

- Withholding

- Excess SDI or VPDI withheld

- Earned income tax credit (EITC)

- Total payments

- Use tax

- Use tax

- Indication if no use tax is owed or you paid use tax obligation directly to CDTFA

- Overpaid tax/tax due

- Payments balance

- Use tax balance

- Overpaid tax

- Amount over overpaid tax you want applied to next year’s estimated tax

- Overpaid tax available this year

- Tax due

- Contributions

- Amount you wish to contribute to any of the special funds

- Amount you owe

- Total amount owed

- Interest and penalties

- Interest, later return penalties, late payment penalties

- Underpayment of estimated tax (attach FTB 5805 or FTB 5805F)

- Total amount due

- Refund and direct deposit

- Refund due

- Account information for deposit

- Direct deposit amount

- Signature

- Signature

- Date

- Spouse’s signature

- Email address

- Preferred phone number

- Firm’s name

- Firm’s address

- Third party designee’s name

- Phone number